SPAC Stock Surge: Should You Invest In This MicroStrategy Competitor?

Table of Contents

Understanding the SPAC Market and its Risks

What are SPACs?

SPACs are shell companies that raise capital through an initial public offering (IPO) to acquire a private company. The process involves a merger between the SPAC and the target company, taking the latter public without undergoing a traditional IPO. SPACs offer faster access to capital for target companies and can bypass some of the regulatory hurdles associated with traditional IPOs. However, this speed comes at a cost.

The Risks of Investing in SPACs:

SPAC stocks are notoriously volatile. The price can fluctuate wildly based on speculation and the eventual target company announcement. Significant losses are possible, especially if the merger fails or the target company underperforms. Furthermore, evaluating a SPAC's target company before the merger can be challenging due to limited publicly available information. Investors rely heavily on the SPAC's management team and their due diligence, which isn't always foolproof.

- Dilution: Existing SPAC shareholders may experience dilution as new shares are issued during the merger.

- Redemption Rights: SPAC investors often have the right to redeem their shares before the merger, potentially impacting the SPAC's post-merger value.

- Uncertainty of Post-Merger Performance: The success of the merged company is uncertain, depending on various factors including market conditions and integration challenges.

- Conflicts of Interest: Potential conflicts of interest can arise between the SPAC's sponsors and investors.

Analyzing the MicroStrategy Competitor's Potential

Let's assume the SPAC in question is targeting "Company X" as a MicroStrategy competitor in the business intelligence software market.

Identifying the Competitor:

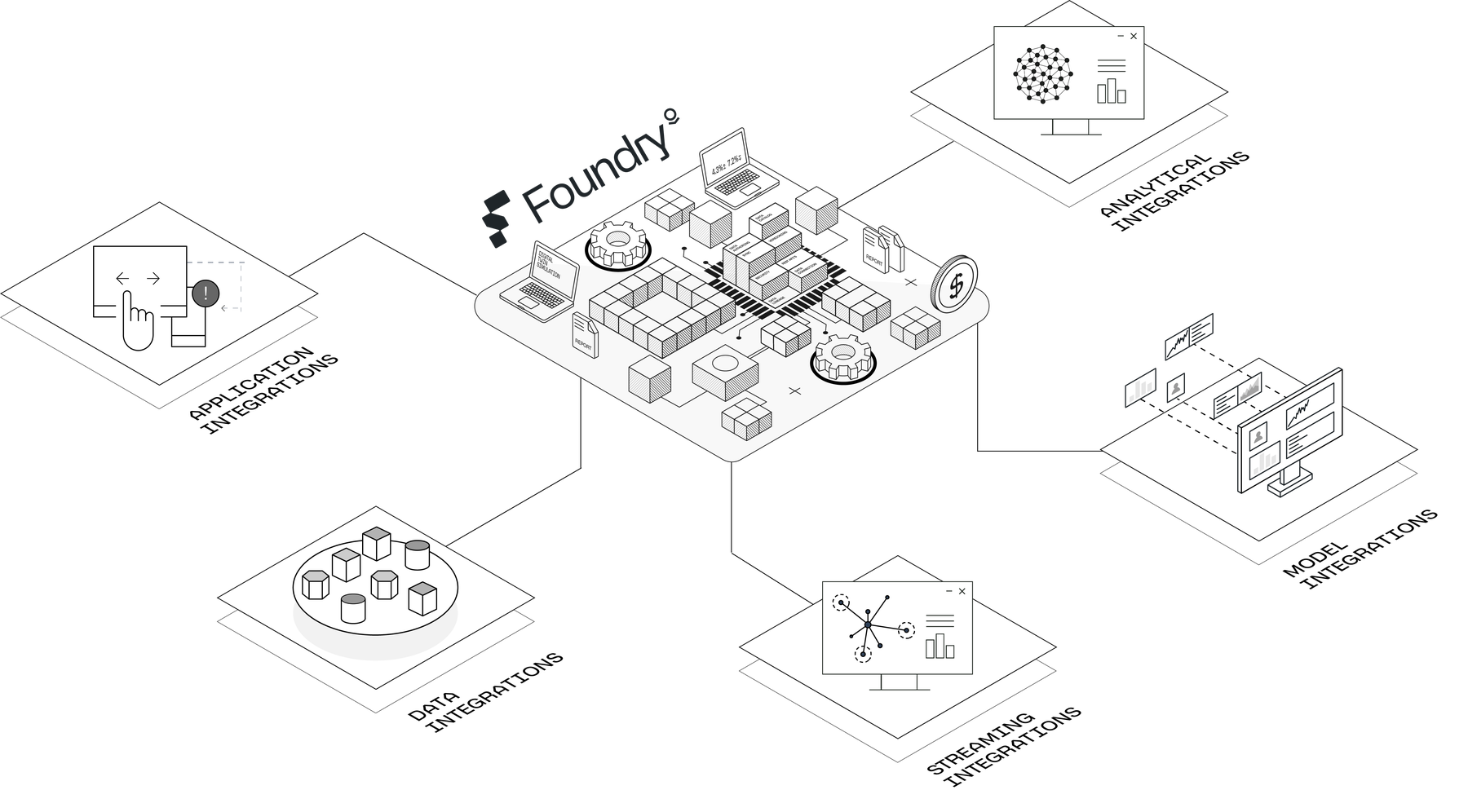

Company X offers a cloud-based business intelligence platform with advanced analytics capabilities, targeting a slightly different customer segment than MicroStrategy. Their competitive advantages lie in their innovative use of AI-powered insights and a more user-friendly interface. Company X could potentially outperform MicroStrategy by capitalizing on the growing demand for accessible, AI-driven analytics in smaller and medium-sized businesses.

Evaluating the Competitor's Financials:

(Replace with actual data for Company X if available) While precise figures are unavailable before the merger, initial projections suggest Company X boasts a strong revenue growth rate (e.g., 30% year-over-year), healthy profit margins (e.g., 25%), and manageable debt levels. Comparing this projected performance with MicroStrategy's current financials demonstrates Company X's potential for rapid growth and market disruption.

Market Analysis and Future Outlook:

The business intelligence market is expanding rapidly, fueled by the increasing adoption of cloud-based solutions and the need for data-driven decision-making. Company X's focus on a specific niche within this market could allow them to capture significant market share. Positive industry trends, such as the growing demand for AI-powered analytics, further bolster Company X’s future prospects.

Should You Invest? Weighing the Risks and Rewards

Investment Considerations:

Investing in this SPAC presents a high-risk, high-reward opportunity. While Company X's potential is significant, the inherent risks of SPAC investments cannot be ignored. The success of the merger and the post-merger integration are crucial factors. A diversified investment portfolio and a high-risk tolerance are essential for considering this opportunity.

Due Diligence and Research:

Before investing, thorough due diligence is paramount. Review the SPAC's filings with the Securities and Exchange Commission (SEC), analyze financial news reports and industry analyses, and assess the management team's track record. Understand the terms of the merger agreement and the potential dilution of your investment.

Conclusion: SPAC Stock Surge – Make an Informed Decision

Investing in SPACs targeting MicroStrategy competitors offers substantial potential returns but comes with significant risks. The volatility of the SPAC market, the challenges in evaluating pre-merger companies, and the uncertainty surrounding post-merger performance demand careful consideration. By conducting thorough due diligence and understanding your risk tolerance, you can make an informed investment decision regarding this SPAC stock surge and the potential of companies challenging MicroStrategy's dominance. Learn more about SPAC investment strategies and risk management by visiting [link to a reputable financial resource]. Remember, before investing in any SPAC, including those targeting MicroStrategy competitors, make sure to conduct your own thorough research.

Featured Posts

-

Ftc To Challenge Activision Blizzard Acquisition Approval

May 09, 2025

Ftc To Challenge Activision Blizzard Acquisition Approval

May 09, 2025 -

Trump Appoints Jeanine Pirro As Dc Top Prosecutor Fox News Role And Implications

May 09, 2025

Trump Appoints Jeanine Pirro As Dc Top Prosecutor Fox News Role And Implications

May 09, 2025 -

Palantir Stock Down 30 Is This A Buying Opportunity

May 09, 2025

Palantir Stock Down 30 Is This A Buying Opportunity

May 09, 2025 -

Technical Skills Development Program For Transgender Individuals In Punjab

May 09, 2025

Technical Skills Development Program For Transgender Individuals In Punjab

May 09, 2025 -

Harry Styles Reacts To A Hilariously Bad Snl Impression

May 09, 2025

Harry Styles Reacts To A Hilariously Bad Snl Impression

May 09, 2025