SSE's £3 Billion Spending Cut: A Response To Economic Slowdown

Table of Contents

Keywords: SSE, spending cut, £3 billion, economic slowdown, energy investment, energy sector, cost reduction, financial impact, consumer impact, future of energy, renewable energy, energy prices, energy supply, inflation, interest rates.

SSE, a major player in the UK energy sector, recently announced a significant £3 billion reduction in its planned spending. This drastic measure, reflecting the current economic climate, sends ripples throughout the energy market and raises crucial questions about the future of energy investment and its impact on consumers. This article delves into the reasons behind this decision, its potential consequences, and its implications for the UK's energy landscape.

H2: The Economic Context: Why the Spending Cut?

The decision to slash £3 billion from its investment plans wasn't taken lightly. SSE's move is a direct response to the challenging economic headwinds currently facing the UK and the global energy sector.

H3: Inflation and Rising Interest Rates:

The current inflationary environment and subsequent rise in interest rates have significantly impacted SSE's ability to invest. These factors directly affect the company's financial capacity and the cost of borrowing.

- Increased borrowing costs: Securing funding for large-scale energy projects becomes exponentially more expensive with higher interest rates.

- Reduced consumer spending: Economic uncertainty leads to decreased consumer spending, potentially impacting energy demand forecasts and the viability of certain projects.

- Impact on project financing: The increased risk associated with higher inflation and interest rates makes it harder to secure project financing from investors and lenders.

These factors collectively constrain SSE's ability to undertake ambitious energy projects, forcing a reassessment of its spending priorities. The cost of capital for large-scale renewable energy projects, for example, is significantly affected by these macroeconomic trends.

H3: Energy Market Volatility:

The energy market's inherent volatility further complicates investment decisions. Uncertainty stemming from geopolitical instability and fluctuating energy prices adds another layer of risk.

- Fluctuating energy prices: The unpredictable nature of energy prices makes long-term investment planning extremely challenging, increasing the risk of unforeseen losses.

- Geopolitical instability: Global events, such as the ongoing war in Ukraine, create significant uncertainty and price volatility in the energy market, affecting investment confidence.

- Regulatory changes: Changes in government regulations and policies can impact the profitability and viability of energy projects, making long-term investment planning even riskier.

This inherent volatility makes it difficult for SSE to justify large-scale investments with a clear return on investment, especially given the current economic uncertainty. Long-term investment strategies require stable and predictable market conditions, which are currently absent.

H2: Impact of the Spending Cut on SSE's Operations:

The £3 billion spending cut will undoubtedly have far-reaching consequences for SSE's operations.

H3: Delayed Renewable Energy Projects:

The most immediate impact will likely be the delay or cancellation of several renewable energy projects. While SSE hasn't publicly named specific projects, the delay will undoubtedly affect the UK's progress towards its renewable energy targets.

- Timeline delays: Several wind farm developments and other renewable energy initiatives are likely to be postponed, impacting the timeline for achieving carbon reduction goals.

- Impact on carbon emission reduction goals: Delays in renewable energy projects will directly impede the UK's progress toward its commitment to reduce carbon emissions.

- Broader implications for the UK's renewable energy transition: The SSE spending cut highlights the challenges in delivering large-scale renewable energy projects in the current economic climate, posing a significant threat to the UK's green energy ambitions.

This delay throws a significant spanner in the works for the UK's ambitious renewable energy targets.

H3: Job Security and Employment:

While SSE hasn't announced widespread job losses, the spending cut could lead to restructuring and potential redundancies within various departments.

- Potential impact on workforce: Reduced investment will likely lead to a slowdown in hiring and potential staff reductions across different departments.

- Any announced redundancies: Further information regarding potential job losses is expected to emerge as the company adapts to the reduced budget.

- Strategies for mitigating job losses: SSE will likely implement strategies to mitigate job losses, such as redeployment and retraining programs, but some redundancies remain a possibility.

The impact on employment will depend heavily on how effectively SSE manages its restructuring and resource allocation.

H3: Impact on Innovation and R&D:

The spending cut will inevitably affect SSE's investment in research and development.

- Reduced investment in new technologies: Reduced R&D budgets will likely lead to slower development of new technologies, potentially hindering innovation within the energy sector.

- Potential slowdown in innovation: Less funding for cutting-edge research could result in a slowdown in the development of crucial energy solutions.

- Long-term implications for competitiveness: Reduced investment in innovation could put SSE at a competitive disadvantage in the long run, hindering its ability to adapt to future energy market demands.

This decrease in R&D spending could have long-term consequences for SSE's ability to remain competitive in a rapidly evolving energy landscape.

H2: Consequences for Consumers:

The ramifications of SSE's cost-cutting measures extend beyond the company's operations, potentially impacting consumers.

H3: Potential Impact on Energy Prices:

While it's difficult to predict definitively, the delay of renewable energy projects could indirectly influence energy prices.

- Potential increase in energy costs: Delays in renewable energy capacity could potentially increase reliance on more expensive energy sources, indirectly contributing to higher energy bills.

- Factors affecting price changes: Several factors influence energy prices beyond investment decisions, including global energy markets and regulatory frameworks.

- Alternative scenarios: The impact on energy prices is uncertain and depends on various interconnected factors.

The relationship between investment and energy prices is complex, and a direct link isn't always clear-cut.

H3: Reliability of Energy Supply:

Delayed renewable energy projects could potentially affect the reliability of energy supply in the long term.

- Potential energy shortages: Delays in adding new renewable capacity to the grid could potentially exacerbate existing energy supply challenges, particularly during peak demand periods.

- Impact on grid stability: Insufficient renewable energy capacity could pose challenges to the stability of the national grid.

- Measures taken to maintain reliability: SSE and the national grid operator will need to implement strategies to mitigate the risk of energy shortages and ensure grid stability.

The issue of energy security in the face of these delays is crucial and requires careful management.

3. Conclusion:

SSE's £3 billion spending cut is a significant event with far-reaching implications for the UK energy sector. The economic slowdown, high inflation, rising interest rates, and energy market volatility have forced the company to reassess its investment plans. This decision will likely lead to delays in renewable energy projects, potential impacts on employment, and possible indirect effects on energy prices and supply reliability for consumers. The long-term consequences for SSE's competitiveness and the UK's energy transition remain to be seen. Stay informed about the evolving situation and the potential long-term effects of SSE's £3 billion spending cut by following our updates on energy market trends and subscribing to our newsletter.

Featured Posts

-

Discover The Unique Taste Of Cassis Blackcurrant

May 22, 2025

Discover The Unique Taste Of Cassis Blackcurrant

May 22, 2025 -

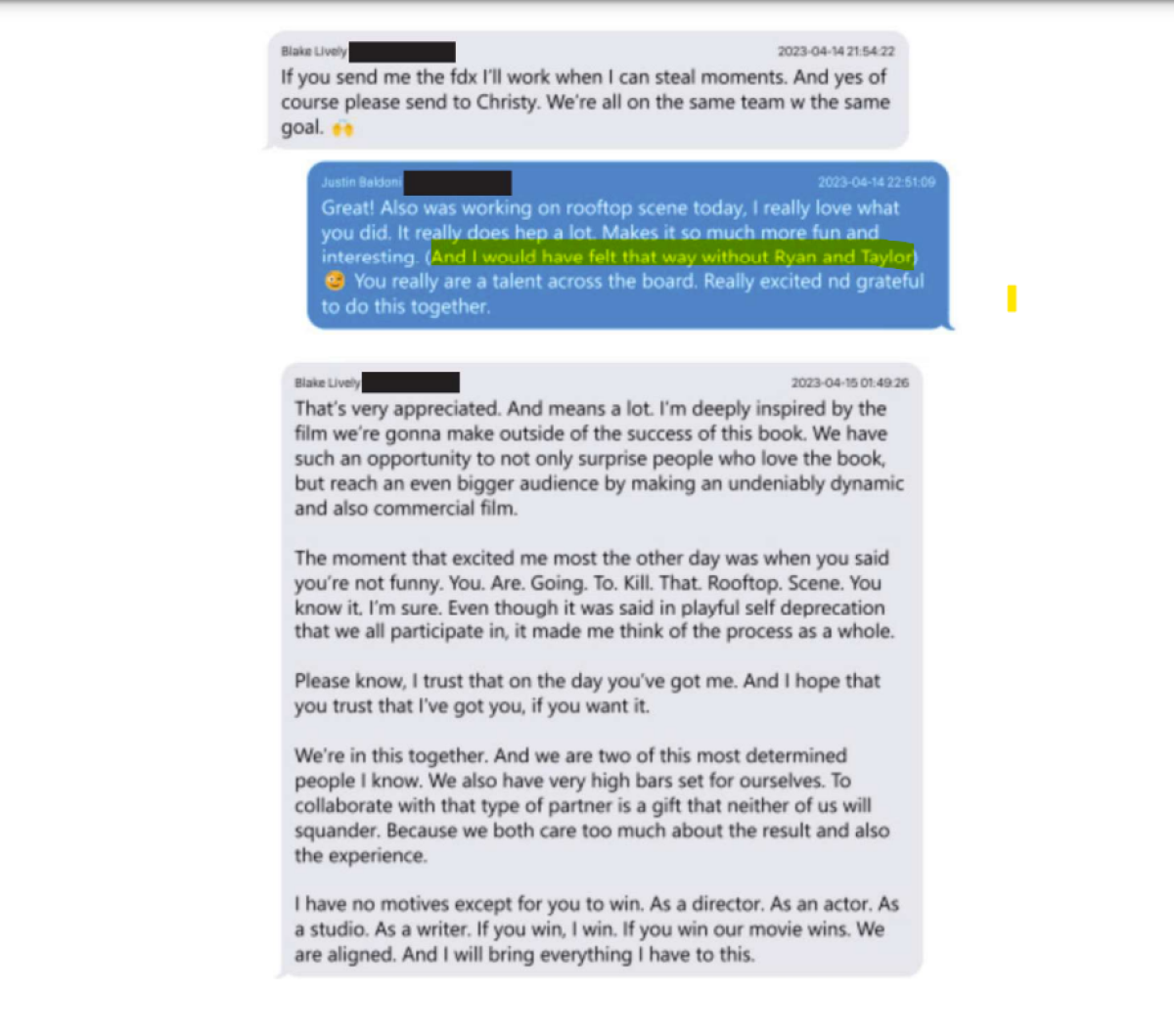

Blake Livelys Alleged Blackmail Of Taylor Swift Explored The Baldoni Dispute And Leaked Texts

May 22, 2025

Blake Livelys Alleged Blackmail Of Taylor Swift Explored The Baldoni Dispute And Leaked Texts

May 22, 2025 -

Barry Ward An Interview About His Career And Cop Roles

May 22, 2025

Barry Ward An Interview About His Career And Cop Roles

May 22, 2025 -

Selena Gomez And Taylor Swift A Wake Up Call Over The Justin Baldoni Lawsuit

May 22, 2025

Selena Gomez And Taylor Swift A Wake Up Call Over The Justin Baldoni Lawsuit

May 22, 2025 -

Abn Amro Analyse Van De Toename In Occasionverkoop

May 22, 2025

Abn Amro Analyse Van De Toename In Occasionverkoop

May 22, 2025

Latest Posts

-

Core Weave Crwv Stock Market Performance Explaining Todays Surge

May 22, 2025

Core Weave Crwv Stock Market Performance Explaining Todays Surge

May 22, 2025 -

Understanding Core Weaves Crwv Significant Stock Increase Last Week

May 22, 2025

Understanding Core Weaves Crwv Significant Stock Increase Last Week

May 22, 2025 -

Understanding Core Weave Inc S Crwv Tuesday Stock Price Increase

May 22, 2025

Understanding Core Weave Inc S Crwv Tuesday Stock Price Increase

May 22, 2025 -

Core Weave Crwv Stock Jump Understanding Wednesdays Market Movement

May 22, 2025

Core Weave Crwv Stock Jump Understanding Wednesdays Market Movement

May 22, 2025 -

Analyzing The Reasons For Core Weave Crwv S Strong Stock Performance Last Week

May 22, 2025

Analyzing The Reasons For Core Weave Crwv S Strong Stock Performance Last Week

May 22, 2025