Steady Start For Frankfurt Stock Market: DAX Maintains Position Post-Record

Table of Contents

DAX Performance and Key Indicators

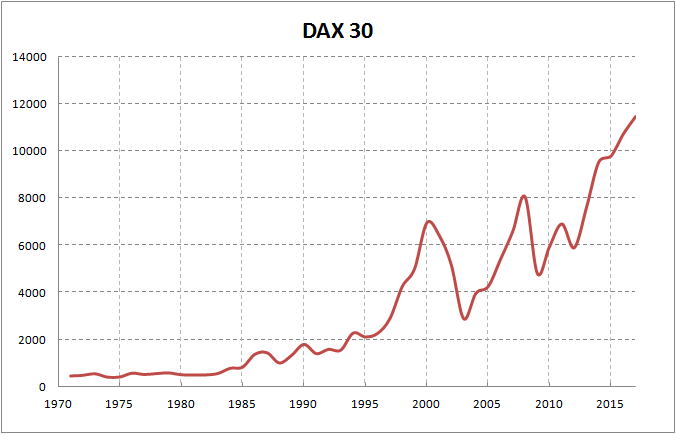

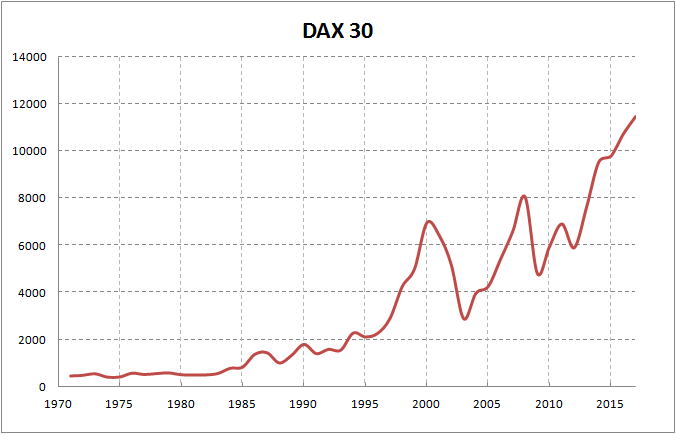

The DAX, Germany's leading stock market index, has shown remarkable resilience in the period immediately following its record-breaking surge. While initial exuberance might have subsided slightly, the index remains remarkably stable, indicating a healthy underlying market sentiment. Let's examine the key indicators:

Trading Volume and Volatility

Analyzing trading volume and volatility offers a crucial perspective on the market's current health.

-

Comparison of trading volume to the previous week/month: While initial post-record highs saw a surge in trading volume, it has since normalized to levels comparable to the previous month, suggesting a less speculative and more balanced market. This contrasts sharply with the heightened volatility seen during the initial record-breaking period.

-

Analysis of volatility using the VIX or similar index: The VIX, a widely used measure of market volatility, has remained relatively low following the record, implying investor confidence and a decreased likelihood of significant short-term corrections. This suggests a more stable and predictable market environment for investors in the Frankfurt Stock Market.

-

Mention any significant price fluctuations or corrections: Minor corrections have been observed, but these have been contained and short-lived, further supporting the notion of a steady and healthy market. The DAX has shown a remarkable capacity to absorb these small dips, maintaining its overall upward trajectory.

Sectoral Performance

Examining sector-specific performance provides further granularity into the DAX's stability.

-

Performance of key sectors (e.g., automotive, technology, financials): The technology sector has continued to show robust performance, driven by innovation and strong global demand. The automotive sector, while facing some headwinds from supply chain issues, has also demonstrated resilience. The financial sector has shown a more moderate growth, reflective of the overall cautious optimism in the market.

-

Highlight any significant gains or losses in specific sectors: While some sectors have experienced temporary setbacks, these have been largely offset by gains in other areas, indicating a balanced and diversified market. This diversification is a key factor contributing to the DAX's stability.

-

Discuss potential reasons for sectoral performance differences: Global economic trends, government policies, and individual company performance all contribute to the varying degrees of success among sectors. Understanding these factors is crucial for informed investment decisions in the Frankfurt Stock Market.

Impact of Global Economic Factors

The Frankfurt Stock Market, like all major global markets, is heavily influenced by global economic and geopolitical factors.

Inflation and Interest Rate Hikes

Inflation and interest rate decisions are two of the most significant factors impacting investor sentiment.

-

Correlation between interest rate changes and DAX movement: Interest rate hikes, while potentially dampening economic growth, can also stabilize inflation, creating a positive long-term outlook for investors. The DAX's reaction to recent interest rate decisions has been relatively muted, suggesting that investors have factored these changes into their assessments.

-

Impact of inflation on corporate earnings and investor confidence: High inflation can erode corporate earnings and reduce investor confidence. However, the recent stability of the DAX suggests that investors are confident in the ability of German companies to navigate the inflationary environment.

-

Mention any forecasts from economic analysts: Many analysts anticipate inflation to cool down gradually, leading to a more favorable environment for stock market growth in the coming months. This forecast further contributes to the positive outlook for the Frankfurt Stock Market.

Geopolitical Risks and their Influence

Geopolitical events can significantly impact market sentiment and investment decisions.

-

Specific geopolitical events and their effect on market sentiment: The ongoing war in Ukraine and the complex relationship between the US and China present significant geopolitical uncertainties. While these events create some level of risk, the DAX's steady performance indicates that investors are not unduly alarmed.

-

Risk assessment and its impact on investor behavior: Investors are factoring these geopolitical risks into their investment strategies, leading to a more cautious approach. However, the continued strength of the DAX suggests that the level of risk is deemed manageable by a significant portion of the investment community.

-

Mention any safe-haven assets gaining traction: While some investors may be seeking refuge in safe-haven assets, the overall strength of the DAX implies that the Frankfurt Stock Market is considered a relatively safe investment destination, compared to other global markets currently exhibiting more volatility.

Investor Sentiment and Future Outlook

The prevailing investor sentiment towards the Frankfurt Stock Market and the DAX appears to be one of cautious optimism.

Analyst Predictions and Forecasts

Financial analysts offer varied but generally positive outlooks for the DAX.

-

Short-term and long-term predictions: Short-term predictions are mostly positive, with some analysts predicting modest growth. Long-term forecasts are more optimistic, anticipating sustained growth fueled by economic recovery and innovation.

-

Potential catalysts for further growth or decline: Further interest rate hikes, unexpected geopolitical developments, and the overall global economic climate could impact the DAX's trajectory.

-

Consensus view and differing opinions among analysts: While there is a generally positive consensus, differing opinions exist regarding the pace and extent of future growth. This reflects the inherent uncertainty in any market prediction.

Investment Strategies for the Frankfurt Stock Market

Given the current market conditions, several investment strategies can be considered:

-

Strategies for mitigating risk (e.g., diversification): Diversification across sectors and asset classes remains a crucial risk-mitigation strategy.

-

Opportunities for growth in specific sectors: Sectors like technology and renewable energy offer strong growth potential.

-

Recommendations for long-term vs. short-term investors: Long-term investors are generally well-positioned to benefit from the anticipated growth, while short-term investors should closely monitor market fluctuations.

Conclusion

The DAX has demonstrated remarkable resilience in the period following its record highs. While global economic factors and geopolitical risks remain significant considerations, the overall outlook for the Frankfurt Stock Market remains relatively positive. Maintaining a diversified portfolio and closely monitoring key economic indicators is crucial for successful navigation of this dynamic market. Stay updated on the Frankfurt Stock Market and monitor the DAX for future trends to make informed investment decisions. Invest wisely in the Frankfurt Stock Market by staying informed and adapting your strategies to changing market conditions.

Featured Posts

-

Your Guide To Bbc Radio 1 Big Weekend 2025 Tickets Sefton Park

May 25, 2025

Your Guide To Bbc Radio 1 Big Weekend 2025 Tickets Sefton Park

May 25, 2025 -

Crisi Dazi Mercati Azionari In Ribasso La Risposta Dell Ue

May 25, 2025

Crisi Dazi Mercati Azionari In Ribasso La Risposta Dell Ue

May 25, 2025 -

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Piyasalarinda Duesues

May 25, 2025

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Piyasalarinda Duesues

May 25, 2025 -

Jordan Bardella A Profile Of A Rising French Politician

May 25, 2025

Jordan Bardella A Profile Of A Rising French Politician

May 25, 2025 -

Joy Crookes Carmen A New Single For Your Playlist

May 25, 2025

Joy Crookes Carmen A New Single For Your Playlist

May 25, 2025

Latest Posts

-

Significant Stock Market Gains On Euronext Amsterdam After Trumps Tariff Action

May 25, 2025

Significant Stock Market Gains On Euronext Amsterdam After Trumps Tariff Action

May 25, 2025 -

Euronext Amsterdam Experiences 8 Stock Market Increase After Trumps Tariff Announcement

May 25, 2025

Euronext Amsterdam Experiences 8 Stock Market Increase After Trumps Tariff Announcement

May 25, 2025 -

Amsterdam Stock Exchange Plunges Third Consecutive Day Of Heavy Losses

May 25, 2025

Amsterdam Stock Exchange Plunges Third Consecutive Day Of Heavy Losses

May 25, 2025 -

8 Stock Market Jump On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 25, 2025

8 Stock Market Jump On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 25, 2025 -

Amsterdam Snack Bar Overcrowding Residents File Lawsuit Against Citys Handling Of Tik Tok Trend

May 25, 2025

Amsterdam Snack Bar Overcrowding Residents File Lawsuit Against Citys Handling Of Tik Tok Trend

May 25, 2025