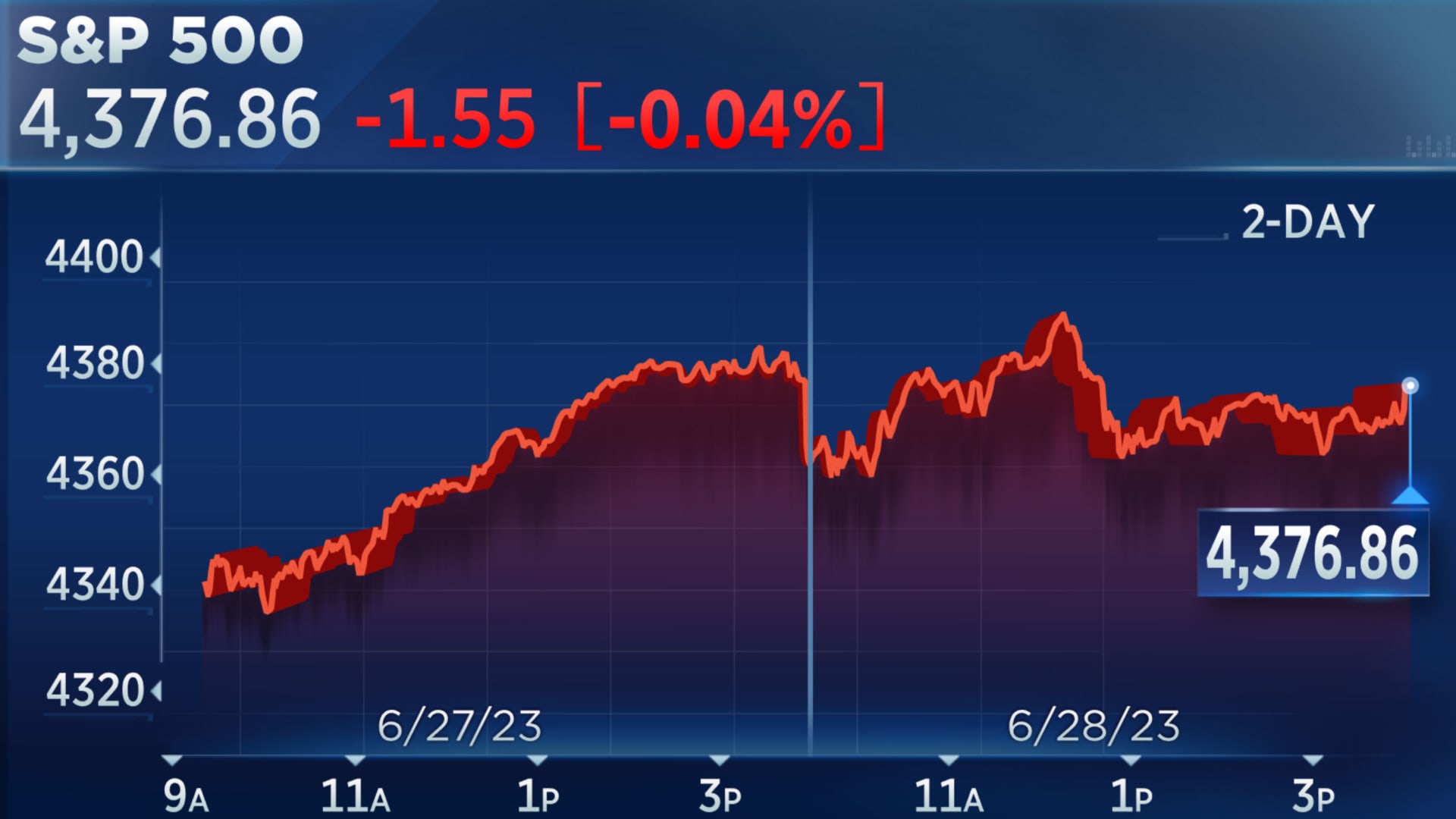

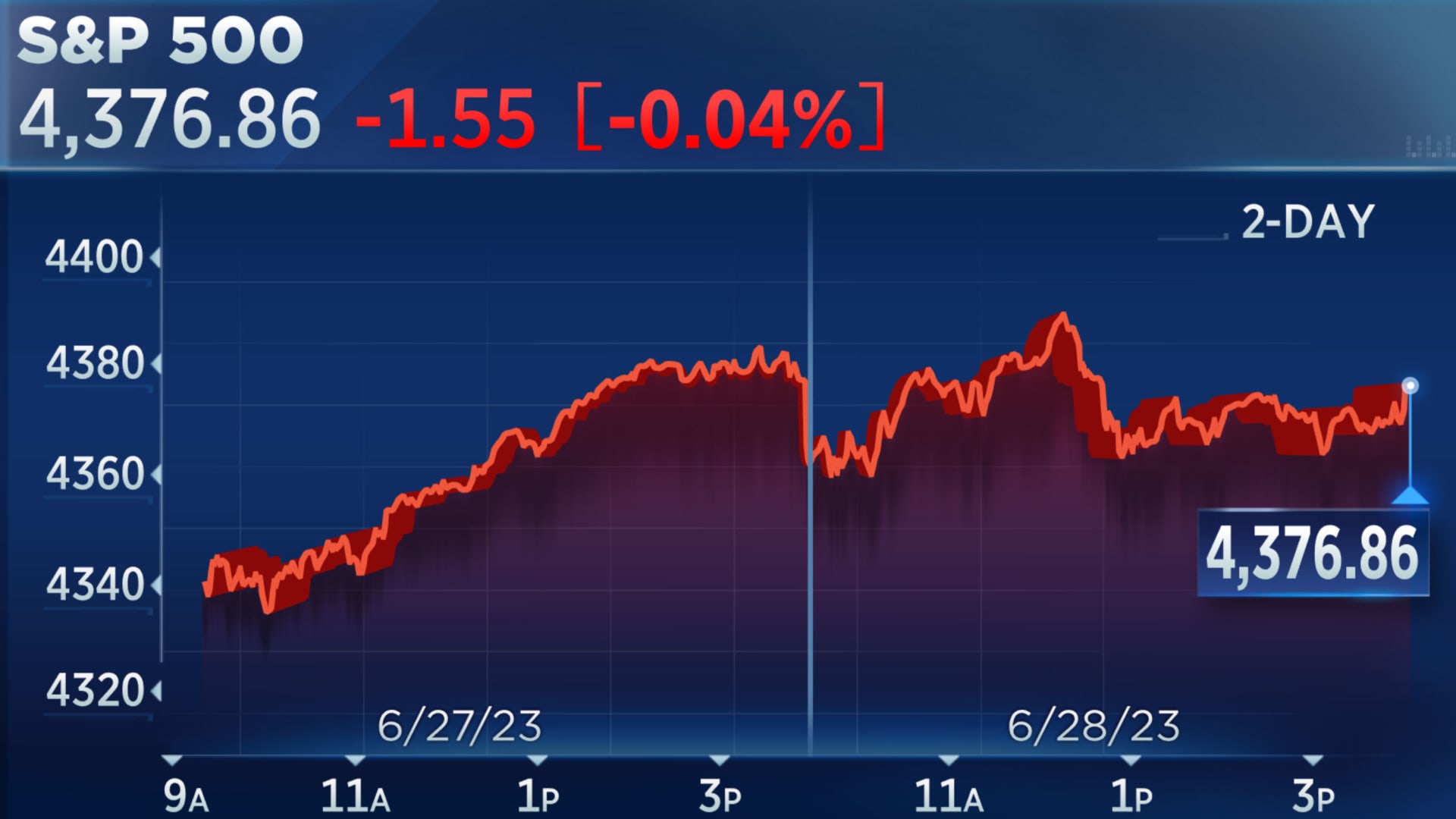

Stock Market Live: 1000-Point Dow Jump On Tariff Hopes

Table of Contents

Tariff Hopes Fuel Market Rally

The current state of global trade, particularly the US-China trade war, has been a major source of volatility in the stock market. Recent months have seen significant ups and downs driven by fluctuating tariff threats and negotiations. However, today's surge suggests a shift in investor sentiment. The market reacted strongly to positive developments indicating a potential breakthrough in trade talks. This market rally was fueled by a combination of factors, including:

- Specific tariff reduction announcements or agreements: While details may still be emerging, reports suggest potential agreements to reduce or remove tariffs on certain goods, easing concerns about escalating trade tensions.

- Statements from key political figures influencing investor sentiment: Positive statements from both US and Chinese officials regarding a willingness to compromise and find a mutually beneficial agreement significantly boosted investor confidence. These statements signaled a potential de-escalation of the trade war.

- Changes in trade policies impacting market confidence: The market seems to be responding positively to subtle but significant shifts in rhetoric and policy signals, suggesting a potential path towards a more stable trade environment.

Sector-Specific Performance

The 1000-point jump wasn't uniform across all sectors. While many benefited, some showed more muted responses. The overall market rally saw significant gains in various sectors, demonstrating the widespread positive impact of the tariff-related news. Here's a sector-by-sector breakdown:

- Technology sector gains: Tech stocks, which are often sensitive to global trade dynamics, experienced substantial gains, reflecting investor optimism about reduced trade barriers and increased global demand. Companies heavily reliant on international trade saw particularly strong gains.

- Energy sector response: The energy sector showed a mixed reaction, with some components performing strongly while others remained relatively stable. This is likely linked to the complexities of how tariff changes impact energy prices and trade flows.

- Performance of other key sectors: Financials and consumer discretionary sectors also experienced significant gains, reflecting broader optimism about the overall economic outlook fueled by decreased trade uncertainty.

Several individual stocks experienced exceptional gains, highlighting the sector-specific nuances of this market response. Analyzing these individual performances offers deeper insights into specific market dynamics.

Investor Sentiment and Market Volatility

The dramatic 1000-point increase indicates a significant shift in investor sentiment. Leading up to the news, there was considerable uncertainty and volatility. However, following the positive tariff developments, investor confidence surged dramatically. This can be seen through:

- Increased buying volume indicating bullish sentiment: A massive increase in trading volume confirmed the strong buying pressure as investors reacted enthusiastically to the positive news.

- Short-term volatility and its implications for day traders: While the overall trend was upward, there was still some short-term volatility, which presents opportunities and risks for day traders accustomed to quick market shifts.

- Long-term investor outlook in the context of the tariff situation: Despite the positive day, many investors remain cautious, acknowledging that the long-term effects of the trade situation are still unfolding. The market's reaction is viewed as short-term optimism.

This volatility underscores the importance of careful risk management in any market environment.

Expert Opinions and Predictions

Financial experts have offered diverse perspectives on the significance of this Dow jump. While many view it as a positive sign, caution prevails:

- Predictions from leading financial analysts: Many analysts believe this surge reflects a temporary relief based on tariff hopes. Sustained growth depends on the actual implementation and impact of any trade agreements.

- Potential risks and opportunities in the current market climate: The market presents both opportunities and risks. While some sectors might see continued growth, others could face challenges.

- Cautions regarding sustained growth based on tariff hopes alone: Experts warn against over-interpreting this single day's performance. Further developments in trade negotiations and broader economic factors will determine the long-term market trajectory.

Conclusion

The 1000-point surge in the Dow is primarily attributed to renewed optimism regarding trade tariffs and the potential for a resolution to the US-China trade war. However, it's crucial to maintain a balanced perspective. While this Stock Market Live update highlights the significant positive shift in investor sentiment, the long-term effects remain uncertain. The impact of these developments on various sectors is varied, requiring continued monitoring and analysis. Stay tuned to our Stock Market Live updates for the latest news and analysis on market fluctuations and the ongoing trade situation. Follow us for continuous Stock Market Live coverage!

Featured Posts

-

Canada Election Conservatives Pledge Lower Taxes Smaller Budget Deficits

Apr 24, 2025

Canada Election Conservatives Pledge Lower Taxes Smaller Budget Deficits

Apr 24, 2025 -

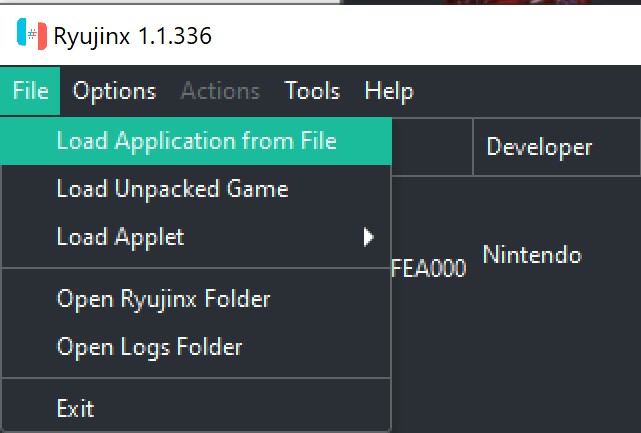

Ryujinx Emulator Development Halted Nintendos Involvement Investigated

Apr 24, 2025

Ryujinx Emulator Development Halted Nintendos Involvement Investigated

Apr 24, 2025 -

Chinas Shift To Middle Eastern Lpg A Response To Us Tariff Hikes

Apr 24, 2025

Chinas Shift To Middle Eastern Lpg A Response To Us Tariff Hikes

Apr 24, 2025 -

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025 -

South Carolina Voters Confrontation With Rep Nancy Mace The Full Story

Apr 24, 2025

South Carolina Voters Confrontation With Rep Nancy Mace The Full Story

Apr 24, 2025