Stock Market Reaction: Analyzing Trump's China Tariff Proposal And UK Trade Implications

Table of Contents

Immediate Stock Market Reaction to Trump's China Tariffs

The imposition of tariffs on Chinese goods resulted in a swift and noticeable stock market reaction. The impact wasn't uniform across all sectors; some were hit harder than others.

Sharp Decline in Specific Sectors

Specific sectors heavily reliant on trade with China experienced sharp declines. The technology and manufacturing sectors were particularly vulnerable.

- Technology: Companies like Apple, heavily reliant on Chinese manufacturing and consumers, saw their stock prices dip significantly following tariff announcements. The increased cost of production and potential reduced consumer demand in China directly impacted their bottom line.

- Manufacturing: Boeing, a major exporter of aircraft, faced challenges due to disruptions in supply chains and reduced Chinese demand. The imposition of tariffs increased the cost of components sourced from China, impacting profitability.

- Market Indices: The Dow Jones Industrial Average, S&P 500, and Nasdaq all experienced notable drops reflecting the broader market uncertainty and negative investor sentiment following the tariff announcements. The correlation between tariff escalation and stock price drops was clear, demonstrating the immediate impact of trade policy on market confidence.

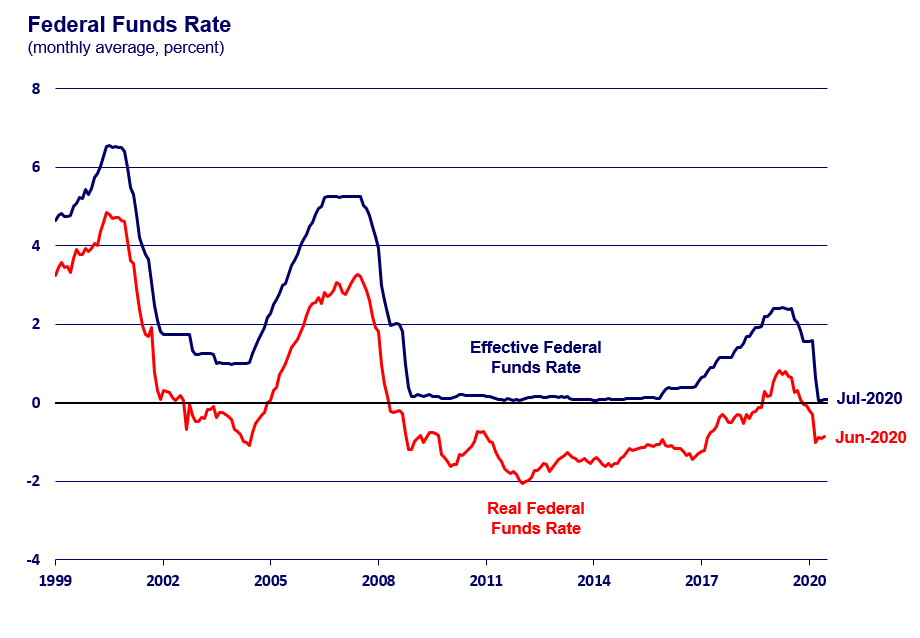

Increased Market Volatility and Uncertainty

The uncertainty surrounding the escalating trade war fueled increased market volatility. This volatility significantly impacted investor confidence and decision-making.

- Investor Confidence: The unpredictable nature of tariff announcements and potential retaliatory measures from China eroded investor confidence, leading to increased risk aversion. Investors became hesitant to commit capital in the face of such uncertainty.

- Market Sentiment: Market sentiment shifted dramatically, with a prevailing sense of pessimism and fear dominating the investment landscape. Speculation about the potential duration and intensity of the trade war further amplified market volatility.

- VIX Index: The Chicago Board Options Exchange Volatility Index (VIX), a key indicator of market fear, spiked considerably during periods of heightened trade tensions, reflecting the increased uncertainty and risk aversion among investors.

UK Trade Implications and Stock Market Response

The Trump administration's China tariffs had a ripple effect, significantly impacting UK trade and subsequently the UK stock market.

Impact on UK-China Trade

UK companies engaged in significant trade with China experienced considerable challenges. Disruptions to supply chains and increased costs became major concerns.

- Supply Chain Disruptions: UK businesses reliant on Chinese components or goods faced delays and disruptions in their supply chains, leading to production bottlenecks and increased costs.

- Increased Costs: Tariffs imposed by the US on Chinese goods indirectly affected UK businesses, as the increased cost of importing Chinese goods impacted their competitiveness. This particularly affected sectors like automotive manufacturing and textiles, reliant on Chinese-sourced materials.

- Listed UK Companies: Several publicly listed UK companies with substantial exposure to Chinese markets saw their stock valuations decline as a result of the trade disputes, reflecting the direct impact of these trade tensions on their profitability and future prospects.

The Ripple Effect on UK-US Trade Relations

The US-China trade tensions had indirect consequences for UK-US trade relations, adding another layer of complexity for UK businesses.

- Trade Deal Complexities: Negotiating trade deals amidst global trade disputes proved challenging for the UK. The uncertainty surrounding the US's trade policy created complexities in securing favorable trade agreements.

- Investment Strategies: UK investment strategies were impacted by the heightened trade uncertainty. Investors were cautious about committing capital to ventures with significant exposure to either US or Chinese markets.

- Brexit Factor: Brexit further complicated the UK's ability to respond effectively to these trade challenges. The ongoing uncertainties surrounding Brexit added another layer of vulnerability to the UK economy's exposure to global trade tensions.

Long-Term Economic and Investment Implications

The long-term consequences of the trade war between the US and China extend beyond immediate market reactions, potentially impacting global economic growth and investment strategies.

Potential for Economic Slowdown

The prolonged trade war between the US and China raised concerns about a potential global economic slowdown.

- Global GDP Growth: International organizations like the IMF warned of reduced global GDP growth as a result of the trade disputes, highlighting the potential for decreased consumer confidence and investment.

- Consumer Confidence: The uncertainty and increased prices resulting from the tariffs negatively affected consumer confidence, potentially leading to reduced spending and economic contraction.

- Inflationary Pressures: Trade wars can contribute to inflationary pressures as tariffs increase the cost of goods, impacting consumer purchasing power and potentially leading to economic instability.

Strategies for Navigating Market Volatility

Navigating the market volatility resulting from trade tensions requires a well-defined investment strategy.

- Diversification: Diversifying investment portfolios across different asset classes and geographic regions can help mitigate risks associated with trade wars.

- Reduced Trade Exposure: Focusing on companies less reliant on international trade or those with a diversified customer base can reduce the negative impacts of trade disputes.

- Professional Advice: Seeking professional financial advice is crucial to develop a robust investment strategy that can withstand market fluctuations and navigate the complexities of global trade disputes.

Conclusion

The stock market reaction to Trump's China tariff proposals was significant, impacting various sectors globally and particularly affecting UK trade. Increased market volatility, sector-specific declines (especially in technology and manufacturing), and the complex interplay with Brexit highlighted the far-reaching consequences of these trade disputes. Understanding the potential for long-term economic slowdown and adapting investment strategies accordingly are crucial for navigating this turbulent environment.

Understanding the stock market reaction to Trump's China tariffs and their UK trade implications is crucial for informed investment decisions. Stay informed about further developments to effectively manage your investment portfolio and mitigate potential risks. Continue to monitor the stock market reaction and adjust your investment strategy accordingly.

Featured Posts

-

U S Federal Reserve Holds Steady Inflation Pressures And Rate Decisions

May 10, 2025

U S Federal Reserve Holds Steady Inflation Pressures And Rate Decisions

May 10, 2025 -

100 Days Of Trump Examining The Impact On Elon Musks Net Worth

May 10, 2025

100 Days Of Trump Examining The Impact On Elon Musks Net Worth

May 10, 2025 -

Lynk Lee Sau Chuyen Gioi Cuoc Song Hanh Phuc Ben Nguoi Yeu

May 10, 2025

Lynk Lee Sau Chuyen Gioi Cuoc Song Hanh Phuc Ben Nguoi Yeu

May 10, 2025 -

Uk Visa Restrictions Impact On Nigerian And Pakistani Applications

May 10, 2025

Uk Visa Restrictions Impact On Nigerian And Pakistani Applications

May 10, 2025 -

Romantiki Komodia Materialists Treiler Me Ntakota Tzonson Pedro Paskal Kai Kris Evans

May 10, 2025

Romantiki Komodia Materialists Treiler Me Ntakota Tzonson Pedro Paskal Kai Kris Evans

May 10, 2025