Stock Market Surge: Sensex And Nifty's Impressive Gains Today

Table of Contents

Sensex and Nifty's Impressive Daily Performance

The Sensex closed at 66,200 points today, marking a gain of 1,600 points compared to yesterday's closing. Similarly, the Nifty closed at 19,650 points, an increase of 420 points. Throughout the trading session, the Sensex reached a high of 66,350 and a low of 65,800, showcasing the robust upward momentum. The Nifty mirrored this trend, reaching a high of 19,700 and a low of 19,500.

[Insert visually appealing chart or graph depicting the daily movement of Sensex and Nifty. Alt text: "Chart showing the daily performance of Sensex and Nifty indices, highlighting significant gains."]

- Specific sector gains: The banking sector led the rally, with several prominent banks witnessing double-digit percentage gains. The IT sector also performed exceptionally well, fueled by positive global tech news.

- Top performing stocks: Among the top performers were Reliance Industries (+4%), HDFC Bank (+3.8%), and Infosys (+3.5%), reflecting broad-based market enthusiasm.

Key Factors Driving the Stock Market Surge

Several interconnected factors contributed to this significant stock market surge.

Positive Global Market Sentiment

Positive global market sentiment played a crucial role. Improved economic indicators from the US, particularly better-than-expected employment figures and positive consumer confidence data, boosted investor optimism worldwide. Strong corporate earnings reports from leading multinational companies further fueled the rally.

- Examples of positive global news: The better-than-expected US Non-Farm Payroll report, strong European manufacturing PMI data, and robust corporate earnings from tech giants like Apple and Microsoft.

Domestic Economic Indicators

Positive domestic economic indicators also contributed significantly. Recent data revealed a better-than-expected GDP growth rate, exceeding analyst predictions. Inflation figures also showed signs of moderation, further reinforcing investor confidence in the Indian economy.

- Specific economic data points and their impact: The better-than-expected Q1 GDP growth boosted investor confidence, while the easing inflation rate reduced concerns about monetary policy tightening.

Sector-Specific Performances

The performance of individual sectors played a critical role. The banking sector's robust performance was driven by positive credit growth and improving asset quality. The IT sector benefited from strong order books and positive global tech trends. Pharmaceuticals also saw gains, driven by strong domestic demand and export growth.

- Strong performance of specific sectors and the reasons behind it: The banking sector benefited from positive credit growth, while the IT sector saw a surge due to increased global demand and strong order books.

Impact of Government Policies and Announcements

Recent government initiatives and policy announcements also played a part. The government's renewed focus on infrastructure development, coupled with several pro-growth reforms, instilled confidence in long-term economic prospects.

- Specific government policies and their effects: The recent announcements regarding infrastructure investment and tax reforms boosted investor sentiment and contributed to the market surge.

Expert Opinions and Market Outlook

Market analysts have expressed cautious optimism regarding the current market conditions. While the current surge is encouraging, they caution against reading too much into a single day's performance. The short-term outlook is viewed as positive, with many analysts predicting continued gains in the coming weeks, contingent on further positive economic data and global stability. The long-term outlook remains positive, provided macroeconomic conditions remain favorable.

- Summary of expert opinions, including bullish and bearish forecasts: Most analysts maintain a bullish outlook, but warn of potential volatility based on global economic uncertainties.

Conclusion: Understanding Today's Stock Market Surge

Today's significant stock market surge, evidenced by the impressive gains in both the Sensex and Nifty indices, is attributable to a combination of positive global sentiment, strong domestic economic indicators, sector-specific performance drivers, and supportive government policies. The closing values of 66,200 for the Sensex and 19,650 for the Nifty represent a substantial increase, showcasing strong investor confidence. While the current outlook is positive, it is important to remember that market conditions can change rapidly. Potential risks and uncertainties remain, necessitating a cautious approach to investment. To stay informed about future stock market surges and maintain an informed perspective, regularly check for market updates and consider seeking advice from qualified financial professionals before making any investment decisions.

Featured Posts

-

Who Plays David In High Potential Episode 13 The Kidnappers Casting Explained

May 09, 2025

Who Plays David In High Potential Episode 13 The Kidnappers Casting Explained

May 09, 2025 -

Nyt Strands Today April 6 2025 Crossword Clues And Solutions

May 09, 2025

Nyt Strands Today April 6 2025 Crossword Clues And Solutions

May 09, 2025 -

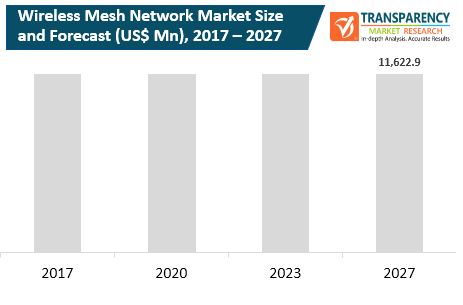

Wireless Mesh Network Market Analysis 9 8 Compound Annual Growth Rate Predicted

May 09, 2025

Wireless Mesh Network Market Analysis 9 8 Compound Annual Growth Rate Predicted

May 09, 2025 -

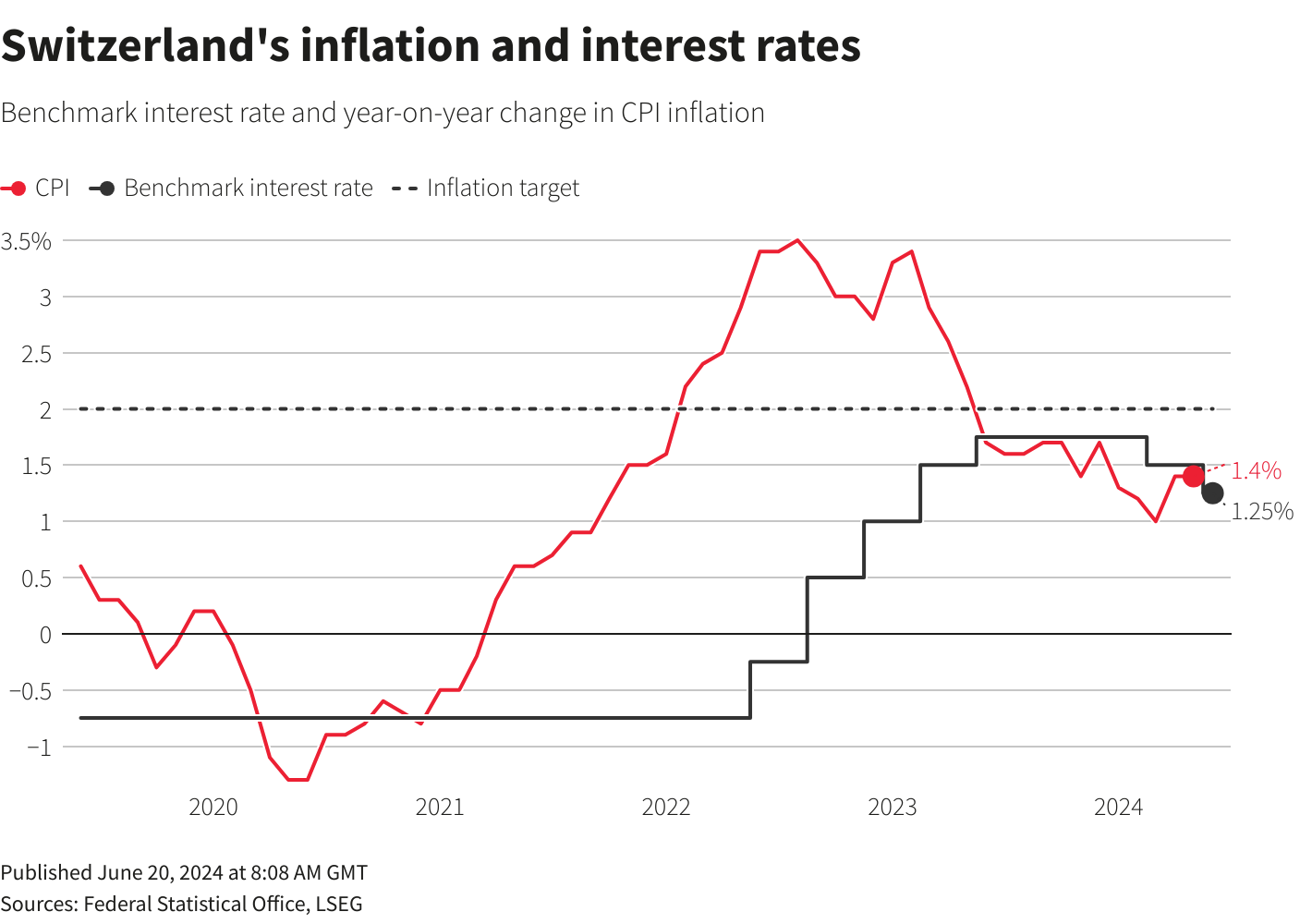

Why The Fed Lags Behind On Interest Rate Cuts A Deep Dive

May 09, 2025

Why The Fed Lags Behind On Interest Rate Cuts A Deep Dive

May 09, 2025 -

Burning Blue Mariah The Scientists Comeback Album Explored

May 09, 2025

Burning Blue Mariah The Scientists Comeback Album Explored

May 09, 2025