Stock Market Today: Trump's Tariff Threat & UK Trade Deal Impact

Table of Contents

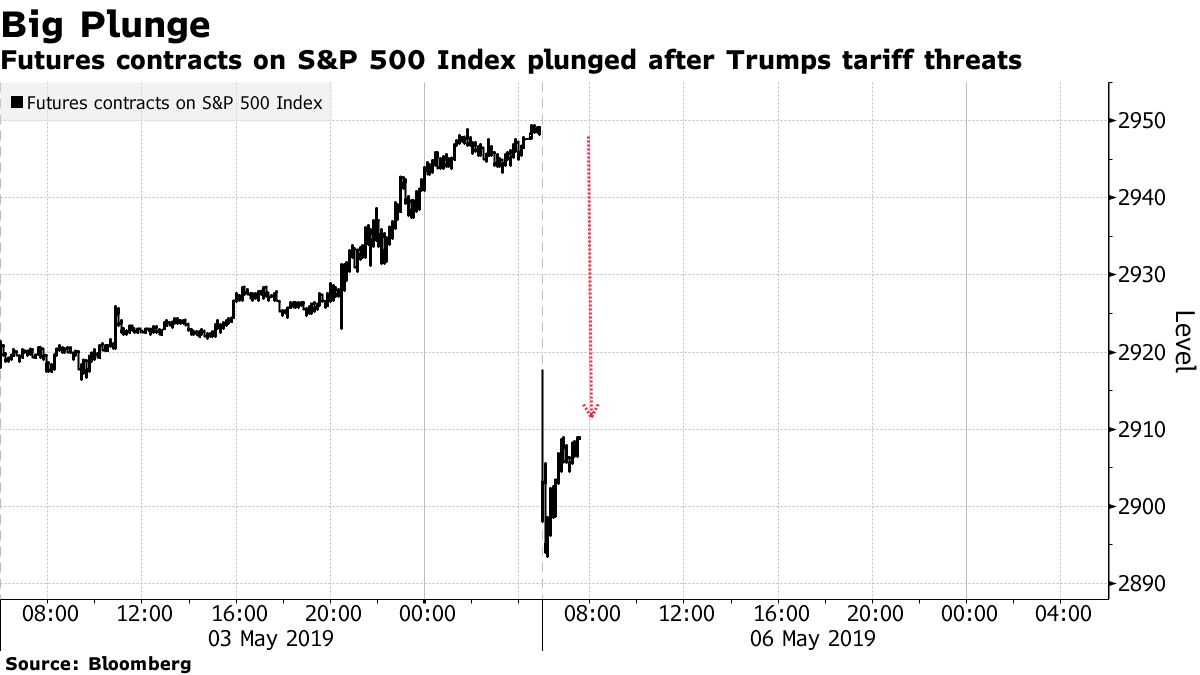

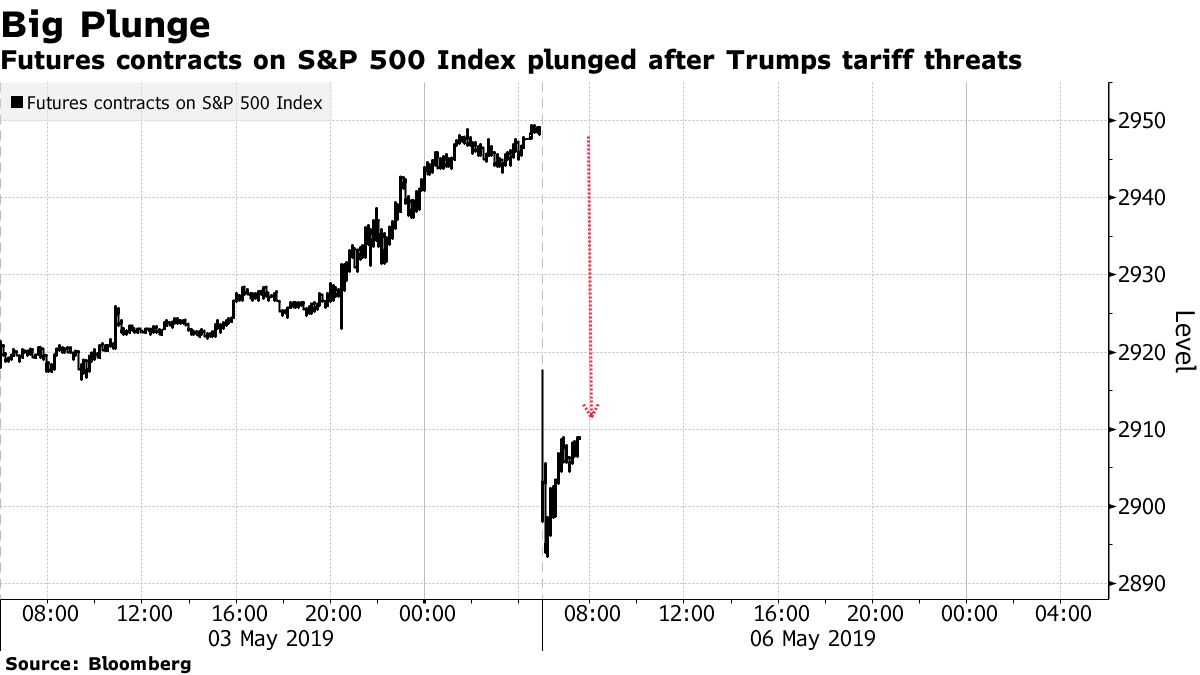

Trump's Tariff Threats: A Looming Shadow Over the Stock Market

The threat of new tariffs, a hallmark of the Trump administration's trade policy, continues to cast a long shadow over the stock market. This uncertainty creates ripples throughout the global economy, impacting investor sentiment and market performance.

Impact on Specific Sectors

Tariffs disproportionately affect certain sectors. A sectoral analysis reveals vulnerabilities across various industries.

- Manufacturing: Companies heavily reliant on imported components or exporting finished goods are particularly vulnerable. For example, the automotive industry, with its complex global supply chains, faces significant challenges. Companies like Ford and General Motors have already voiced concerns about increased costs.

- Agriculture: Farmers exporting goods face reduced competitiveness in international markets due to tariffs imposed by trading partners. This impacts crop prices and farm profitability, potentially leading to job losses in rural communities.

- Technology: The tech sector, with its intricate global supply chains and dependence on international markets, could also experience disruptions and increased costs. Companies relying on components sourced from tariff-affected countries will likely see their profit margins squeezed.

Supply chain disruptions are a major concern. Tariffs can lead to delays, increased transportation costs, and shortages of essential materials, negatively impacting production and profitability across multiple sectors. Additionally, increased import costs contribute to inflationary pressures, further impacting consumer spending and economic growth. Recent market reactions to tariff announcements have generally been negative, with stock prices of affected companies experiencing declines.

Geopolitical Uncertainty and Investor Sentiment

The threat of tariffs contributes significantly to broader geopolitical uncertainty. Investors are hesitant to commit capital in an environment marked by unpredictable trade policies and escalating trade wars. This uncertainty directly impacts investor confidence and risk appetite. Many investors become more risk-averse, leading to reduced investment in equities and a shift towards safer assets like government bonds.

Market speculation and media coverage play a significant role in driving investor behavior. Negative news about potential tariffs can trigger sell-offs, while positive developments can lead to market rallies. Understanding the interplay between news cycles, investor sentiment, and market movements is crucial for effective investment decision-making. (Keywords: Geopolitical Risk, Investor Sentiment, Market Speculation)

The UK Trade Deal: A Mixed Bag for the Stock Market

The recently negotiated UK trade deal, while heralded by some, presents a mixed bag for the stock market. The long-term impacts remain uncertain, creating both opportunities and challenges for investors.

Potential Benefits for UK and Global Businesses

The deal holds potential benefits for specific sectors.

- Financial Services: While access isn't fully unrestricted, some progress has been made, offering limited opportunities for UK financial institutions.

- Pharmaceuticals: The deal could streamline the movement of pharmaceutical products, potentially reducing costs and improving access to medicines.

Increased trade and economic growth are potential long-term outcomes of a successful trade agreement. The deal aims to reduce trade barriers and facilitate smoother commerce between the UK and other participating countries. Specific provisions within the deal relating to customs procedures and regulatory cooperation could streamline trade processes and boost efficiency for businesses. (Keywords: UK Trade Deal, Brexit Impact, Economic Growth, Trade Agreements)

Challenges and Uncertainties

Despite the potential benefits, the UK trade deal also presents challenges and uncertainties.

- Trade Barriers: Significant trade barriers remain, particularly for certain sectors. The deal doesn't eliminate all tariffs or regulatory hurdles.

- Regulatory Uncertainty: Ongoing regulatory divergence between the UK and the EU continues to create uncertainty for businesses operating across both markets. This uncertainty makes long-term planning difficult.

These lingering uncertainties could negatively affect investor confidence and hinder the potential for significant economic growth. Businesses will need to navigate complex regulations and potential trade barriers, adding to their operational costs and potentially slowing down growth. (Keywords: Trade Barriers, Regulatory Uncertainty, Economic Uncertainty)

Strategic Investment Considerations in the Current Climate

Navigating the current market volatility requires a strategic approach to investment.

Diversification and Risk Management

Diversification is paramount. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and geographic regions helps mitigate risk. In a volatile market, diversification is key to reducing the impact of negative events on your portfolio. Risk management strategies, such as stop-loss orders and hedging techniques, can further protect your investments.

Monitoring Key Economic Indicators

Closely monitoring key economic indicators is vital for making informed investment decisions.

- Inflation: Rising inflation erodes purchasing power and can impact interest rates and market valuations.

- Unemployment: High unemployment suggests weak consumer demand and potential economic slowdown.

- Consumer Confidence: Consumer spending is a significant driver of economic growth. Low consumer confidence indicates potential weakness in the economy.

Reliable sources for economic data include government agencies (like the Bureau of Economic Analysis in the US or the Office for National Statistics in the UK), central banks, and reputable financial news outlets. Analyzing these indicators can help in predicting future market movements and adjusting your investment strategy accordingly. (Keywords: Economic Indicators, Market Forecasting, Investment Analysis)

Conclusion

The stock market today is navigating a complex landscape shaped by Trump's tariff threats and the implications of the UK trade deal. Understanding the potential impacts of these factors on various sectors and employing sound investment strategies, such as diversification and careful monitoring of economic indicators, is crucial for navigating this volatility. Stay informed about the latest developments regarding the Stock Market Today and adjust your investment strategy accordingly. Regularly monitor news and analysis related to Trump Tariffs and the UK Trade Deal to make informed investment decisions.

Featured Posts

-

Barys San Jyrman Rhlt Nhw Alfwz Bdwry Abtal Awrwba

May 10, 2025

Barys San Jyrman Rhlt Nhw Alfwz Bdwry Abtal Awrwba

May 10, 2025 -

Wall Streets Resurgence A Look At The Failed Bear Market Predictions

May 10, 2025

Wall Streets Resurgence A Look At The Failed Bear Market Predictions

May 10, 2025 -

2 000 Guest Capacity Unveiling The New Queen Elizabeth 2 Cruise Ship

May 10, 2025

2 000 Guest Capacity Unveiling The New Queen Elizabeth 2 Cruise Ship

May 10, 2025 -

Pre May 5th Palantir Stock Analysis Is It A Wise Investment

May 10, 2025

Pre May 5th Palantir Stock Analysis Is It A Wise Investment

May 10, 2025 -

Transgender Experiences Under Trump Administration Executive Orders

May 10, 2025

Transgender Experiences Under Trump Administration Executive Orders

May 10, 2025