Stocks Fall: US Fiscal Concerns Fuel Market Uncertainty

Table of Contents

The Looming Debt Ceiling Crisis

The ongoing political debate surrounding raising the debt ceiling is a major source of market anxiety. Failure to reach an agreement could lead to a US government default, triggering a global financial crisis and sending shockwaves through the global economy. This is a critical juncture, and the uncertainty surrounding the negotiations is creating significant volatility in the stock market.

- Uncertainty surrounding the debt ceiling negotiations creates volatility. The lack of a clear timeline and the conflicting statements from politicians are fueling investor unease. Daily news updates on the debt ceiling negotiations directly impact stock prices, creating a highly volatile market environment.

- Potential government shutdown adds to economic uncertainty. A government shutdown would disrupt numerous government services, further impacting economic activity and investor confidence. This disruption could cascade throughout the economy, leading to job losses and decreased consumer spending.

- Failure to raise the debt ceiling could negatively impact US credit rating. A US default would severely damage the nation's credit rating, increasing borrowing costs for the government and businesses alike. This would have far-reaching consequences, impacting everything from mortgage rates to corporate investment decisions.

- Rising bond yields reflect investor concerns. Investors are increasingly demanding higher yields on US Treasury bonds, reflecting their apprehension about the potential for a default. This rise in bond yields indicates a flight to safety, as investors seek lower-risk investments during this period of uncertainty.

Inflationary Pressures and Rising Interest Rates

Persistent inflation is forcing the Federal Reserve to maintain higher interest rates, impacting borrowing costs for businesses and consumers. This monetary policy, aimed at cooling down inflation, is dampening economic growth and putting downward pressure on stock prices. The interplay between inflation and interest rates is a crucial factor in understanding the current market decline.

- High inflation erodes purchasing power and impacts consumer spending. Rising prices for essential goods and services reduce consumer spending, slowing economic growth and creating a negative feedback loop. This decreased consumer demand further impacts corporate profits and stock valuations.

- Increased interest rates increase borrowing costs for businesses. Higher interest rates make it more expensive for companies to borrow money for investments and expansion, impacting corporate growth and profitability. This can lead to reduced hiring and decreased capital expenditures.

- Higher interest rates reduce corporate profitability. The increased cost of borrowing directly reduces profit margins for many businesses, particularly those with high levels of debt. This negative impact on profitability translates to lower stock valuations.

- The Fed's monetary policy response impacts investor sentiment. The Federal Reserve’s actions directly influence investor sentiment, and its commitment to controlling inflation is a key factor investors are watching closely. Any shift in monetary policy can trigger significant market reactions.

Political Gridlock and Government Spending

Political divisions are hindering the implementation of effective fiscal policies, further contributing to market uncertainty. Disagreements over government spending and tax policies add to investor apprehension, creating an environment of uncertainty that discourages investment and fuels market volatility.

- Political polarization hampers efficient policymaking. The lack of bipartisan cooperation slows down the decision-making process, leaving crucial economic policies stalled and creating uncertainty about the future direction of the economy.

- Uncertainty over future government spending impacts business investment. Businesses hesitate to invest in expansion or new projects when the future direction of government spending is unclear. This uncertainty makes it difficult to plan for the long term and hampers economic growth.

- Debates on tax policies influence corporate profitability. Changes in tax policies can significantly impact corporate profitability. The uncertainty surrounding future tax policies adds to the overall market uncertainty, creating volatility.

- Lack of bipartisan cooperation increases market volatility. Political gridlock and the absence of cohesive economic policy create an unstable environment, leading to increased market volatility and making it difficult to predict future market trends.

Impact on Investor Sentiment and Market Volatility

The combined effect of these factors has significantly impacted investor sentiment, leading to increased risk aversion and heightened market volatility. This creates a challenging environment for investors, requiring careful consideration of investment strategies.

- Investors are moving towards safer assets like government bonds. In times of uncertainty, investors often move towards safer investments, like government bonds, reducing their exposure to riskier assets like stocks.

- Increased market volatility leads to higher trading costs. The increased price swings make it more expensive to trade stocks, adding another layer of complexity for investors.

- Uncertainty makes it challenging for investors to make informed decisions. The confluence of factors makes it difficult for investors to predict future market movements, making informed investment decisions more challenging.

- Portfolio diversification becomes crucial in times of market uncertainty. Diversifying investments across different asset classes helps mitigate risk and protect portfolios during periods of market volatility.

Conclusion

The recent stock market decline is a direct result of escalating US fiscal concerns, encompassing the debt ceiling crisis, inflationary pressures, and political gridlock. These factors have created significant market uncertainty and impacted investor sentiment. Understanding these contributing factors is crucial for navigating the current market conditions. To stay informed on the evolving situation and its impact on your investments, continue monitoring news related to stocks fall and US fiscal concerns. Consider diversifying your portfolio and consulting a financial advisor to manage risk effectively in this period of market uncertainty.

Featured Posts

-

Big Rig Rock Report 3 12 Your Guide To The Big 100 Trucking Companies

May 23, 2025

Big Rig Rock Report 3 12 Your Guide To The Big 100 Trucking Companies

May 23, 2025 -

Acquisition Of Johnson Mattheys Catalyst Technologies Honeywells Strategic Move To Enhance Its Portfolio

May 23, 2025

Acquisition Of Johnson Mattheys Catalyst Technologies Honeywells Strategic Move To Enhance Its Portfolio

May 23, 2025 -

Dan Lawrence Future England Cricketer Analyzing His Career Trajectory

May 23, 2025

Dan Lawrence Future England Cricketer Analyzing His Career Trajectory

May 23, 2025 -

Freddie Flintoffs Disney Documentary The Full Story Of His Horror Crash

May 23, 2025

Freddie Flintoffs Disney Documentary The Full Story Of His Horror Crash

May 23, 2025 -

Swiss Alps Landslide Emergency Livestock Evacuation Underway

May 23, 2025

Swiss Alps Landslide Emergency Livestock Evacuation Underway

May 23, 2025

Latest Posts

-

The First Amendment And Ai Chatbots Character Ai Faces Legal Scrutiny

May 23, 2025

The First Amendment And Ai Chatbots Character Ai Faces Legal Scrutiny

May 23, 2025 -

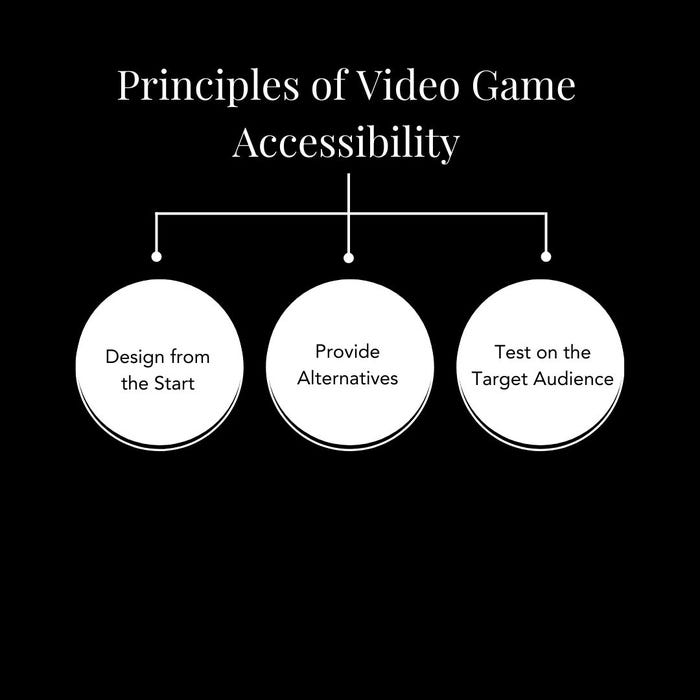

Gaming Accessibility In A Time Of Industry Cuts

May 23, 2025

Gaming Accessibility In A Time Of Industry Cuts

May 23, 2025 -

Character Ai Chatbots And Free Speech A Legal Gray Area

May 23, 2025

Character Ai Chatbots And Free Speech A Legal Gray Area

May 23, 2025 -

Accessibility Concerns Rise As Game Industry Contracts

May 23, 2025

Accessibility Concerns Rise As Game Industry Contracts

May 23, 2025 -

Are Character Ais Chatbots Protected Speech One Courts Uncertainty

May 23, 2025

Are Character Ais Chatbots Protected Speech One Courts Uncertainty

May 23, 2025