Strong Retail Sales Data Pushes Back Against Bank Of Canada Rate Cut Speculation

Table of Contents

Robust Retail Sales Figures Exceed Expectations

Retail sales surged by 1.5% in July, significantly outperforming the anticipated 0.5% growth predicted by most analysts. This robust growth marks a considerable upward revision from the previous month's figures and signals a surprisingly resilient consumer spending environment.

- Strong performance in key sectors: Strong performance across various sectors fuelled this impressive growth. Automotive sales saw a substantial increase, alongside notable gains in furniture, electronics, and clothing. This broad-based growth suggests a healthy consumer confidence level.

- Implications for consumer spending and economic health: This unexpectedly strong retail sales data suggests a more resilient consumer base than previously thought, pointing to a healthier-than-expected economy. It indicates that Canadians are continuing to spend despite inflationary pressures and rising interest rates, a positive sign for overall economic growth.

- Data Source: This data is sourced from Statistics Canada's latest retail trade report. [Link to Statistics Canada Report].

Impact on Bank of Canada Monetary Policy

The strong retail sales figures significantly impact the Bank of Canada's decision-making process concerning interest rates. The robust consumer spending data suggests a less urgent need for immediate monetary stimulus.

- Reduced pressure for a rate cut: The strong sales figures reduce the pressure on the Bank of Canada to implement a rate cut to stimulate economic activity. The central bank may now feel more comfortable maintaining its current interest rate policy.

- Potential for a hold or future rate hike: Depending on upcoming economic indicators and inflation data, the Bank of Canada could even consider holding the interest rate steady or potentially even implementing a future rate hike to manage inflationary pressures.

- Inflationary implications: Sustained strong consumer spending could contribute to increased inflationary pressures, further complicating the Bank of Canada's monetary policy decisions. The central bank will carefully monitor inflation alongside other key economic indicators before making its next move.

- Expert Opinion: "The robust retail sales data significantly reduces the probability of a near-term interest rate cut by the Bank of Canada," stated Dr. Anya Sharma, a leading economist at the Canadian Economic Forecasting Institute. "The data suggests a more resilient economy than previously anticipated, providing the central bank with more room to manoeuvre."

Market Reactions and Investor Sentiment

The release of the strong retail sales data triggered positive reactions in the market, reflecting renewed investor confidence in the Canadian economy.

- Positive market response: Stock markets responded positively to the news, with the TSX Composite Index experiencing a slight increase following the release of the report. This indicates increased investor optimism about the Canadian economy's trajectory.

- Impact on the Canadian dollar and bond yields: The Canadian dollar strengthened slightly against major currencies like the US dollar, while bond yields rose marginally, reflecting increased investor confidence and expectation of less need for stimulus.

- Shift in interest rate speculation: Speculation regarding an imminent Bank of Canada rate cut has significantly diminished following this positive economic data. The market now appears to anticipate a period of rate stability or even a potential future increase.

Strong Retail Sales Data and the Future of Bank of Canada Interest Rates

In summary, the unexpectedly strong retail sales data presents a compelling case against a near-term Bank of Canada rate cut. The robust consumer spending, positive market reactions, and reduced pressure for stimulus all contribute to a more optimistic outlook for the Canadian economy.

While the future trajectory of interest rates remains uncertain, the strong retail sales figures represent a significant development. The Bank of Canada will likely continue to monitor key economic indicators, including inflation and employment data, before making any adjustments to its monetary policy.

Stay tuned for further updates on strong retail sales data and its impact on Bank of Canada rate decisions. Follow us for the latest analysis on Canadian economic indicators and interest rate predictions.

Featured Posts

-

Futbol Kuluebue Sokta Doert Oyuncuya Yoenelik Sorusturma Baslatildi

May 26, 2025

Futbol Kuluebue Sokta Doert Oyuncuya Yoenelik Sorusturma Baslatildi

May 26, 2025 -

Funeral For Respected South Shields Biker Attracts Hundreds

May 26, 2025

Funeral For Respected South Shields Biker Attracts Hundreds

May 26, 2025 -

Tirreno Adriatico 2024 Mathieu Van Der Poels New Canyon Aeroad

May 26, 2025

Tirreno Adriatico 2024 Mathieu Van Der Poels New Canyon Aeroad

May 26, 2025 -

Analyzing The F1 Drivers Press Conference Insights And Predictions

May 26, 2025

Analyzing The F1 Drivers Press Conference Insights And Predictions

May 26, 2025 -

Elon Musks Recent Outbursts A Positive For Tesla Investors

May 26, 2025

Elon Musks Recent Outbursts A Positive For Tesla Investors

May 26, 2025

Latest Posts

-

The Trump Administrations Proposal To Shift Harvard Funding

May 28, 2025

The Trump Administrations Proposal To Shift Harvard Funding

May 28, 2025 -

Harvard And The Trump Administration A Funding Showdown

May 28, 2025

Harvard And The Trump Administration A Funding Showdown

May 28, 2025 -

Understanding Stock Market Valuations Why Bof A Remains Optimistic

May 28, 2025

Understanding Stock Market Valuations Why Bof A Remains Optimistic

May 28, 2025 -

Analysis Trumps Threat To Redirect Harvard Grant Money

May 28, 2025

Analysis Trumps Threat To Redirect Harvard Grant Money

May 28, 2025 -

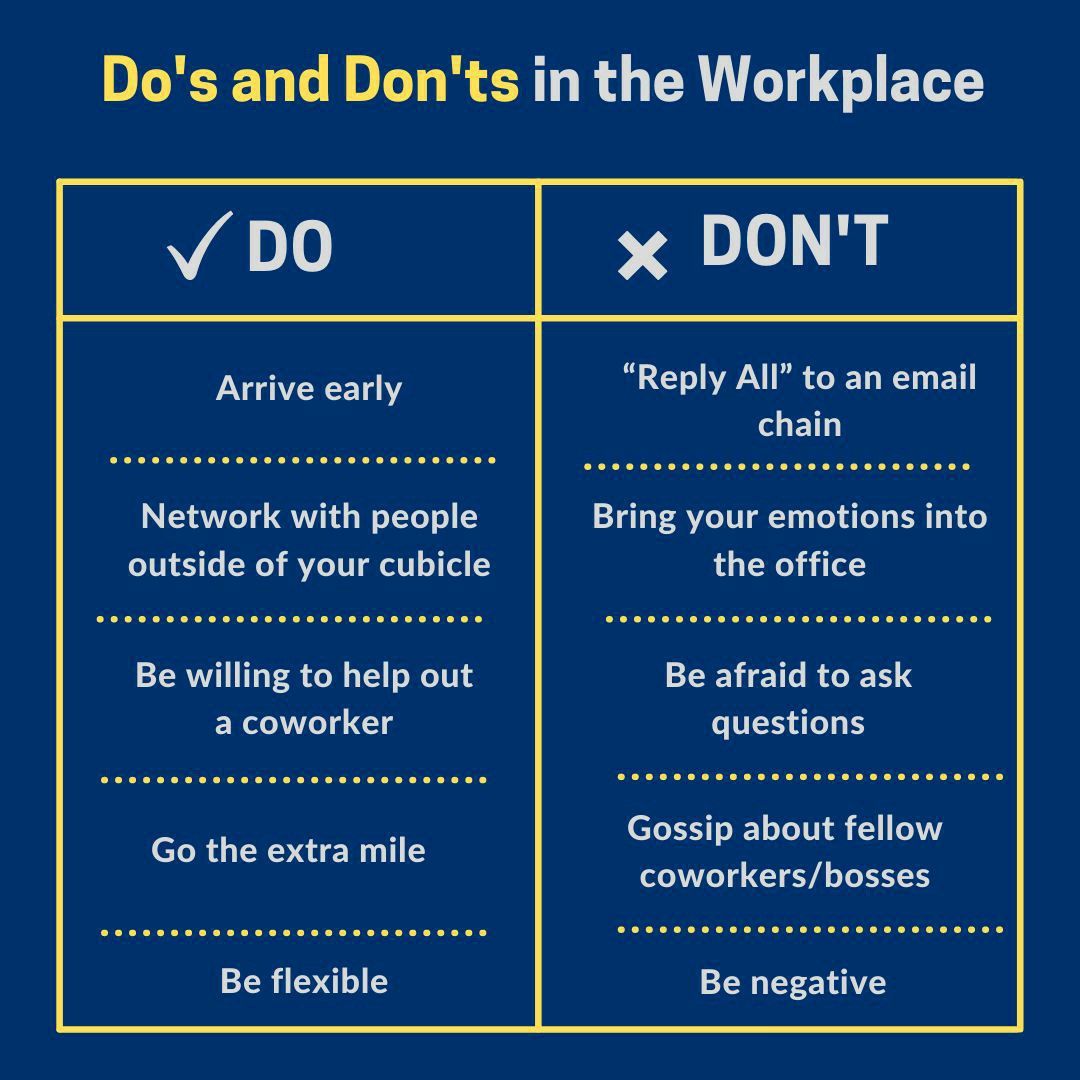

The Private Credit Hiring Boom 5 Dos And Don Ts To Secure Your Position

May 28, 2025

The Private Credit Hiring Boom 5 Dos And Don Ts To Secure Your Position

May 28, 2025