The Private Credit Hiring Boom: 5 Do's & Don'ts To Secure Your Position

Table of Contents

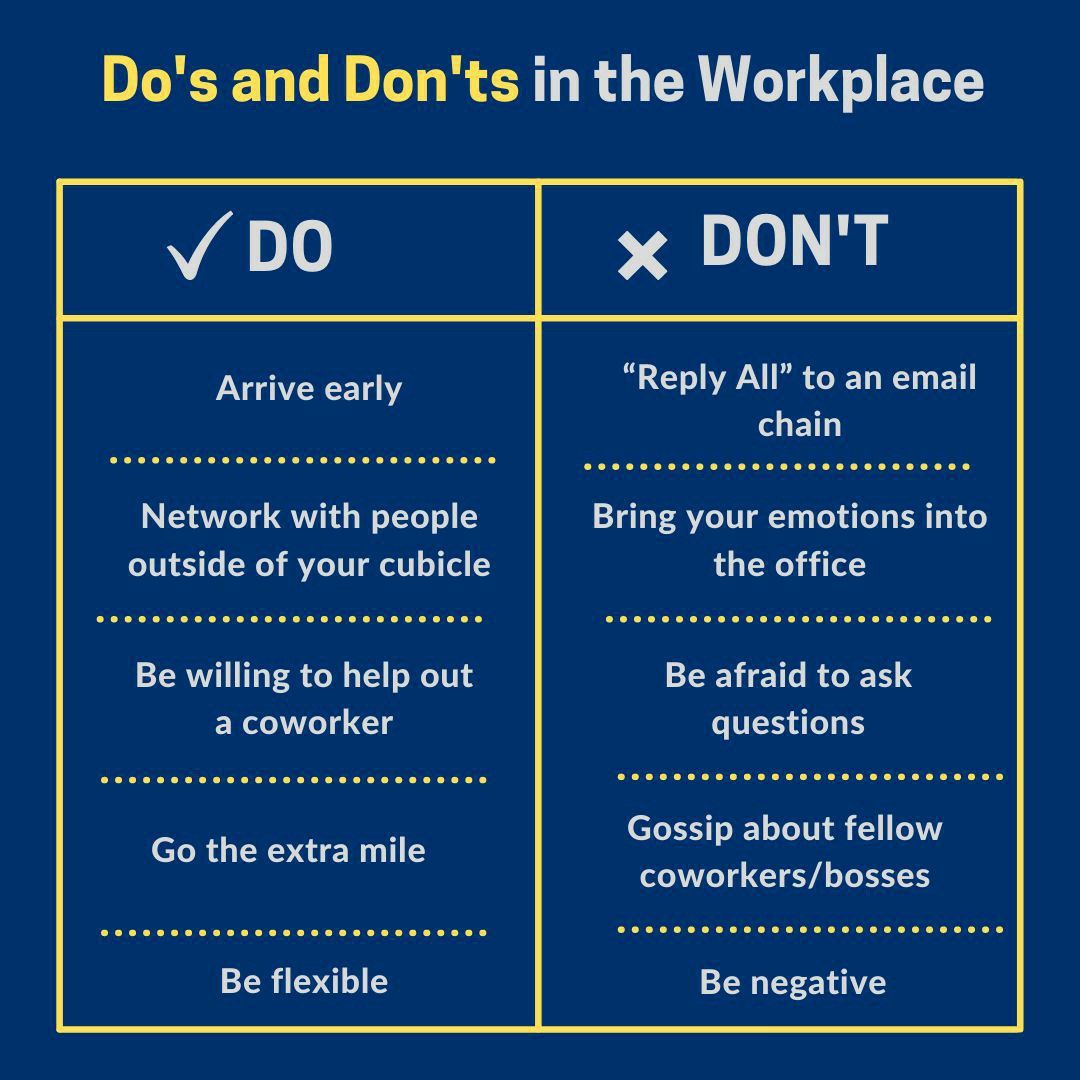

Do's to Land Your Dream Private Credit Job

1. Network Strategically

Building a strong professional network is paramount in the competitive world of private credit jobs. Don't underestimate the power of connections.

- LinkedIn Optimization: Create a compelling LinkedIn profile highlighting your experience in finance, specifically mentioning skills relevant to private credit such as credit analysis, financial modeling, and portfolio management. Actively engage with industry professionals and join relevant groups.

- Industry Events: Attend conferences, workshops, and seminars focused on private credit, alternative lending, and related financial areas. These events provide excellent networking opportunities and allow you to learn about the latest trends.

- Informational Interviews: Reach out to professionals working in private credit firms for informational interviews. These conversations provide invaluable insights into the industry and can lead to unexpected opportunities. Prepare thoughtful questions beforehand.

- Targeted Networking: Identify specific firms and individuals whose work aligns with your career aspirations. Research their investment strategies and tailor your networking approach accordingly.

- Leverage Existing Networks: Don't forget your alumni network and professional organizations. These resources often provide access to hidden job opportunities and valuable connections within the private credit industry.

2. Highlight Relevant Skills and Experience

Your resume and cover letter are your first impression. Make them count. Highlighting the right skills and experiences is crucial for securing a private credit job.

- Targeted Resumes & Cover Letters: Tailor your resume and cover letter to each specific application. Don't use generic templates. Emphasize the skills and experiences most relevant to the job description. Use keywords from the job posting.

- Quantifiable Achievements: Quantify your achievements whenever possible. Instead of saying "Improved efficiency," say "Increased efficiency by 15% resulting in X cost savings."

- Showcase Private Credit Expertise: Demonstrate a strong understanding of private credit strategies, including direct lending, mezzanine financing, distressed debt, and other relevant investment approaches.

- Technical Proficiency: Showcase your proficiency in essential software like Excel (including advanced functions like VBA), Bloomberg Terminal, and other relevant financial modeling tools.

3. Master the Interview Process

The interview is your chance to shine. Preparation is key to securing your dream private credit job.

- STAR Method: Prepare for behavioral questions using the STAR method (Situation, Task, Action, Result). This structured approach allows you to concisely and effectively communicate your experiences.

- Thorough Research: Research the firm and the interviewer thoroughly. Understand their investment strategies, recent transactions, and the interviewer's background and expertise.

- Practice Common Questions: Practice answering common private credit interview questions such as "Walk me through your financial modeling experience," "How do you assess credit risk?", and "Describe a challenging situation you overcame."

- Ask Insightful Questions: Prepare insightful questions to demonstrate your genuine interest and understanding of the firm and the role. This shows initiative and engagement.

- Follow Up: Always send a thank-you note after each interview, reiterating your interest and highlighting key points from the conversation.

Don'ts That Could Cost You a Private Credit Position

Avoiding these pitfalls can significantly increase your chances of success.

1. Neglecting Due Diligence

Failing to conduct thorough research is a common mistake.

- Insufficient Firm Research: Don't apply for private credit jobs without researching the firm and understanding their investment strategies, portfolio composition, and recent activities.

- Generic Applications: Don't submit generic resumes and cover letters. Each application should be tailored to the specific requirements of the job and the firm.

- Poor Interview Preparation: Don't fail to prepare for common interview questions specific to the private credit industry and the firm you are interviewing with.

- Ignoring Networking: Don't underestimate the importance of networking. Building relationships can significantly increase your chances of getting hired.

2. Underestimating the Importance of Soft Skills

Technical skills are important, but soft skills are equally crucial in the collaborative environment of private credit.

- Communication Gaps: Don't overlook the importance of clear and concise communication, both written and verbal. Private credit roles require effective interaction with various stakeholders.

- Teamwork Deficiencies: Don't underestimate the value of teamwork and collaboration. Private credit teams often work closely together on complex transactions.

- Problem-Solving Skills: Don't shy away from demonstrating your ability to analyze problems, develop solutions, and think critically.

- Poor Presentation: Don't ignore the impact of your body language and overall presentation during interviews. Project confidence and professionalism.

3. Failing to Follow Up

Following up demonstrates your initiative and interest.

- No Thank You Notes: Don't neglect to send thank-you notes after interviews. This reinforces your interest and provides an opportunity to reiterate your qualifications.

- Passive Approach: Don't be afraid to follow up on your application status after a reasonable timeframe (typically one to two weeks).

- Assuming Rejection: Don't assume silence means rejection. Proactive follow-up can sometimes make the difference.

- Networking Lapse: Don't forget to maintain your professional network even after securing a position.

Conclusion

The private credit hiring boom presents a fantastic opportunity for ambitious professionals. By following these do's and don'ts, and focusing on developing the right skills and experience, you can significantly improve your chances of securing a rewarding career in private credit. Remember to network strategically, showcase your relevant expertise, and master the interview process. Don't let these opportunities pass you by – start your job search for your dream private credit job today!

Featured Posts

-

Arsenal And Newcastle Target Promising Ligue 1 Youngster

May 28, 2025

Arsenal And Newcastle Target Promising Ligue 1 Youngster

May 28, 2025 -

New Rent Regulations A Blow To Tenant Protections

May 28, 2025

New Rent Regulations A Blow To Tenant Protections

May 28, 2025 -

Tyrese Haliburton Picks Pacers Vs Knicks Game 1 Predictions And Best Bets

May 28, 2025

Tyrese Haliburton Picks Pacers Vs Knicks Game 1 Predictions And Best Bets

May 28, 2025 -

Brewers Vs Diamondbacks Mlb Game Prediction Picks And Odds

May 28, 2025

Brewers Vs Diamondbacks Mlb Game Prediction Picks And Odds

May 28, 2025 -

Ukraines Offensive Germanys Merz Approves Strikes Within Russia

May 28, 2025

Ukraines Offensive Germanys Merz Approves Strikes Within Russia

May 28, 2025

Latest Posts

-

Pccs Downtown Corner Market Reimagined And Reopened

May 29, 2025

Pccs Downtown Corner Market Reimagined And Reopened

May 29, 2025 -

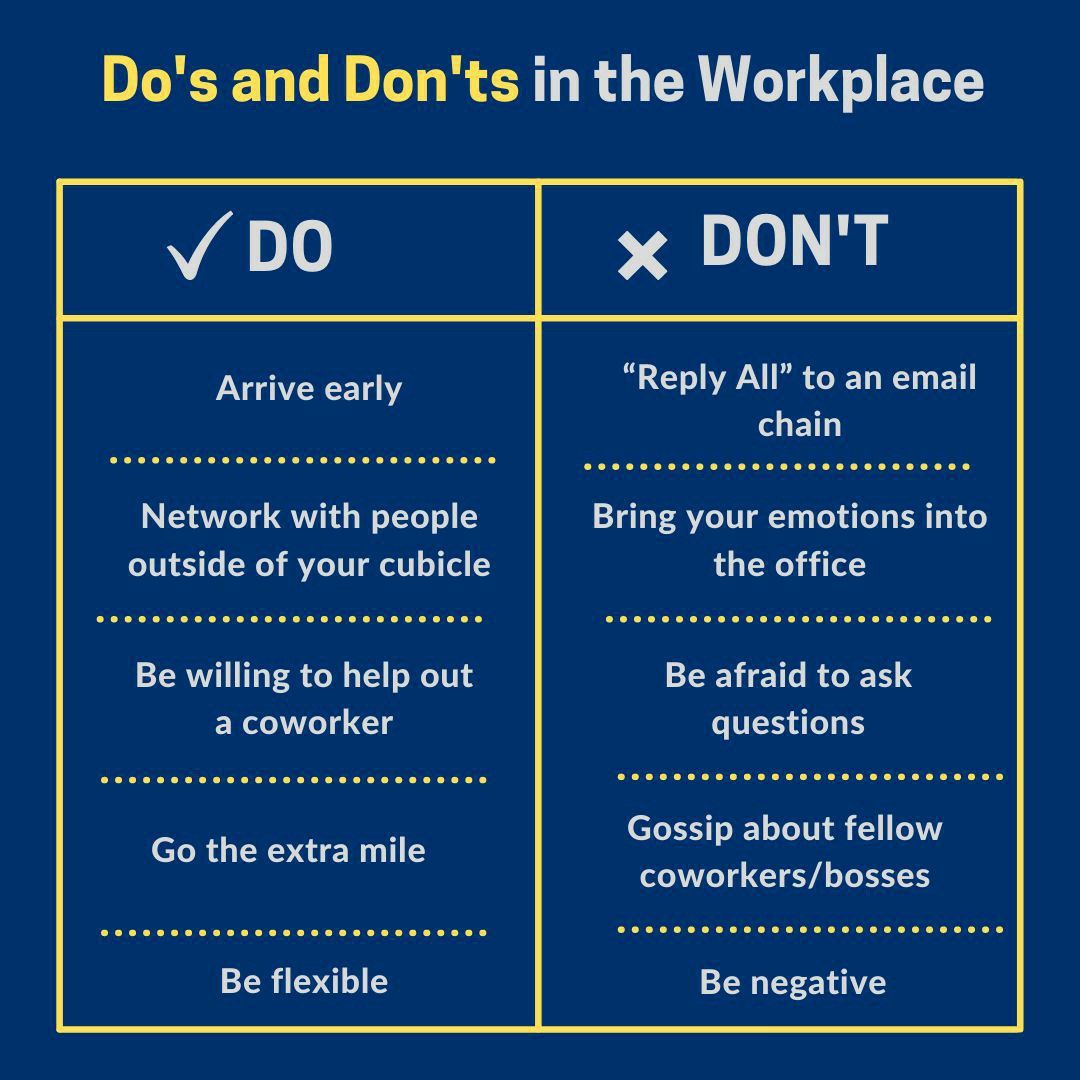

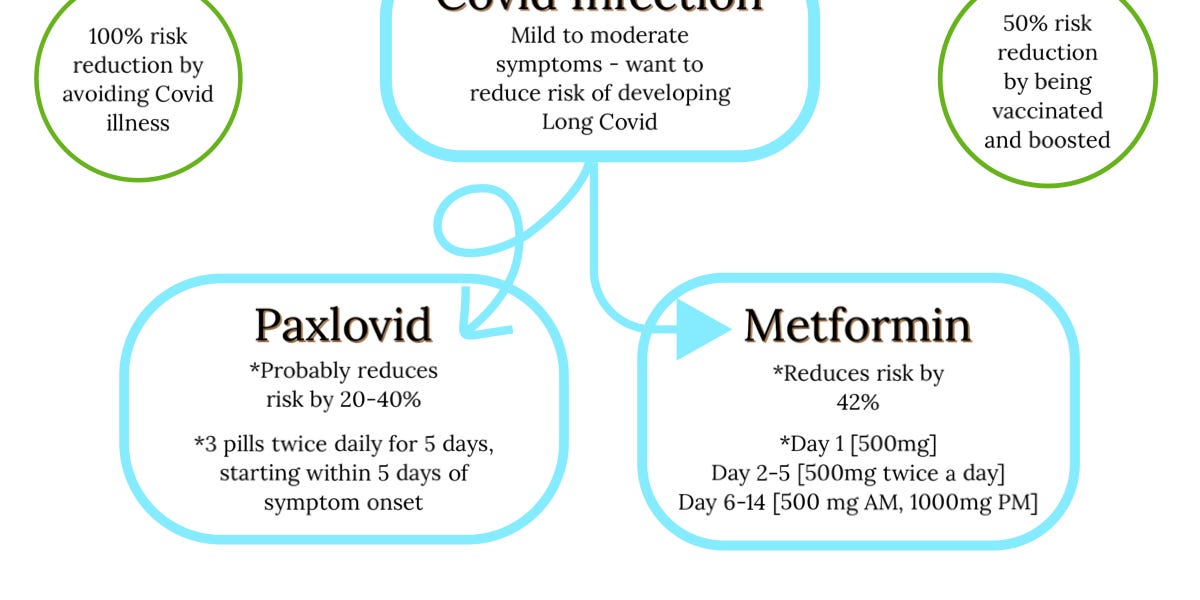

Long Covid Prevention The Role Of Covid 19 Vaccines

May 29, 2025

Long Covid Prevention The Role Of Covid 19 Vaccines

May 29, 2025 -

Lw Ansf Alqwmu Amnyat Wttleat Fy Dhkra Alastqlal

May 29, 2025

Lw Ansf Alqwmu Amnyat Wttleat Fy Dhkra Alastqlal

May 29, 2025 -

Alastqlal Mktsbat Wtnyt Wdwr Almwatn Fy Swnha

May 29, 2025

Alastqlal Mktsbat Wtnyt Wdwr Almwatn Fy Swnha

May 29, 2025 -

First Ever Canadian Guidelines On The Diagnosis And Management Of Long Covid

May 29, 2025

First Ever Canadian Guidelines On The Diagnosis And Management Of Long Covid

May 29, 2025