Suncor Energy: Record Production Despite Slowing Sales And Inventory Increase

Table of Contents

Suncor Energy, a leading force in the Canadian energy sector, has announced record-breaking oil production figures. This significant achievement, however, is counterbalanced by concurrently slowing sales and a substantial increase in inventory levels. This article dissects the intricacies of Suncor's current performance, exploring the contributing factors to this seemingly paradoxical situation and analyzing its implications for investors and the broader energy market.

Record-Breaking Oil Production at Suncor Energy

Operational Efficiency and Technological Advancements

Suncor's remarkable increase in oil production stems from significant improvements in operational efficiency and the strategic implementation of technological advancements. The company has invested heavily in optimizing its existing assets and integrating cutting-edge technologies across its operations.

- Increased Automation: Suncor has implemented advanced automation systems across its oil sands operations, leading to improved production rates and reduced downtime.

- Enhanced Drilling Techniques: The adoption of improved drilling techniques and horizontal drilling has increased the efficiency of oil extraction from existing wells.

- Production Numbers: Suncor's Q[Insert Quarter] 2024 oil production reached [Insert specific number] barrels per day, a [percentage]% increase compared to the same period last year and exceeding previous records.

This substantial increase is a testament to Suncor's commitment to technological innovation and operational excellence within the oil production industry.

Impact of High Crude Oil Prices (Potential Factor)

The sustained period of relatively high crude oil prices has undoubtedly played a role in incentivizing increased production at Suncor. Higher prices make increased production economically viable and potentially more profitable, encouraging companies like Suncor to maximize output.

- Global Demand Influence: Strong global demand for crude oil, even amidst economic uncertainties, has supported elevated prices, further bolstering Suncor's decision to ramp up production.

- Price Correlation: A clear correlation can be observed between the increase in crude oil prices and the significant rise in Suncor's production volume. As prices rose, so did the company's output. However, this relationship is not necessarily linear, and other factors also contribute to the production numbers.

Slowing Sales and Rising Inventory Levels

Weakening Global Demand

Despite record production, Suncor is experiencing slower sales, a trend partly attributed to weakening global demand for oil and refined products. Several macroeconomic factors are at play:

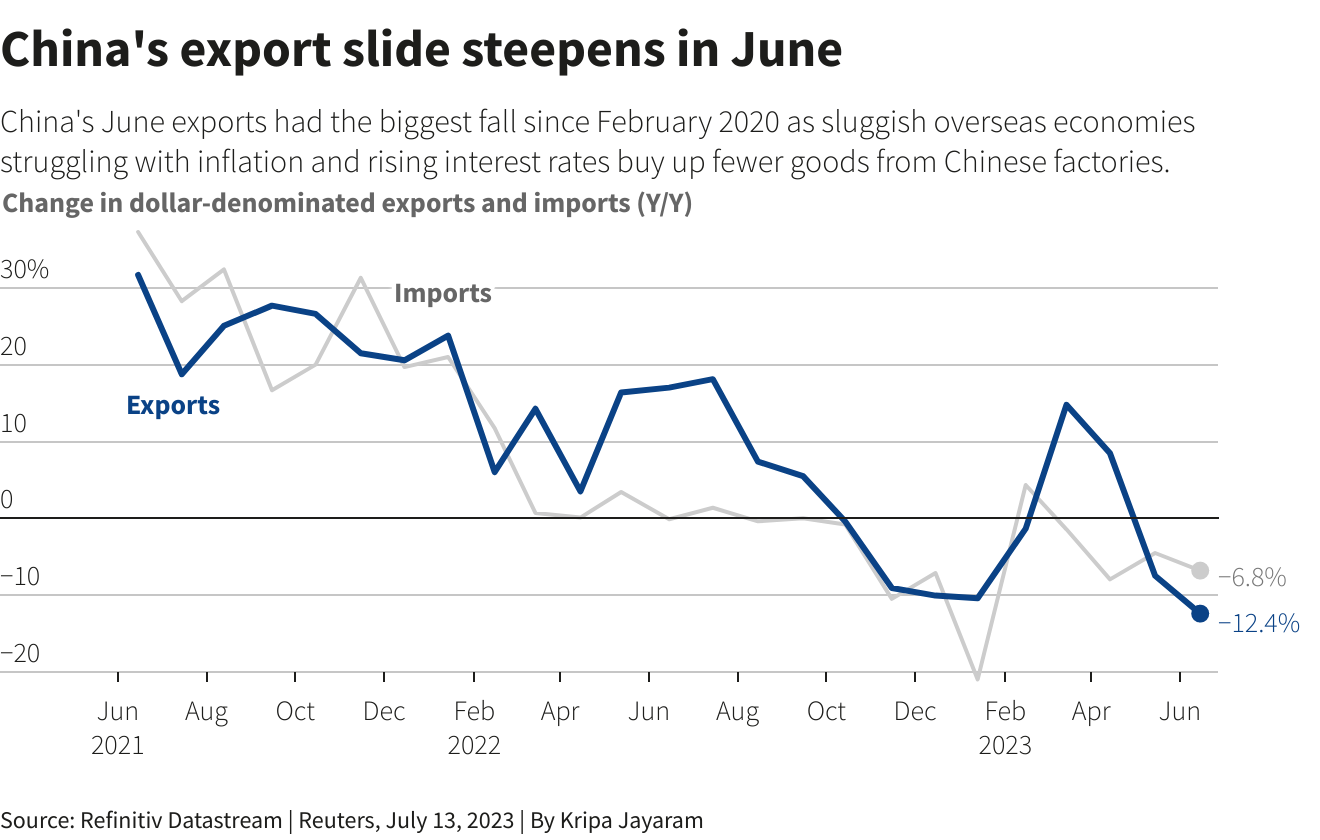

- Economic Slowdown: Concerns about a global economic slowdown have dampened demand for energy, impacting sales across the industry, including Suncor.

- Global Oil Consumption Statistics: Global oil consumption data show a recent moderation in growth compared to previous years, contributing to the oversupply and reduced demand experienced by Suncor.

- Shifting Energy Landscape: The increasing adoption of renewable energy sources is also impacting overall oil demand, creating headwinds for traditional oil producers like Suncor.

Supply Chain Disruptions (Potential Factor)

Supply chain disruptions, though less impactful than demand fluctuations, may also have contributed to slower sales for Suncor.

- Logistical Bottlenecks: Potential logistical bottlenecks in the transportation and distribution of oil products could have temporarily restricted sales volumes.

- Transportation Costs: Increased transportation costs associated with fuel prices and logistical challenges could impact the profitability of sales and influence distribution strategies.

Increased Inventory Costs

The combination of record production and slower sales has resulted in a significant increase in Suncor's inventory levels. This surplus inventory comes with considerable financial implications:

- Storage Costs: Storing large volumes of oil incurs substantial costs, impacting profitability margins.

- Price Volatility Risk: Holding large inventories exposes Suncor to the risk of price fluctuations in the oil market, potentially resulting in losses if prices decline.

- Inventory Management Strategies: Suncor needs to implement proactive inventory management strategies to mitigate these risks, potentially including adjustments to production levels and exploring new marketing avenues.

Financial Implications and Future Outlook for Suncor Energy

Impact on Profitability

While record production is positive, the impact on Suncor's overall profitability remains a concern. The increased inventory costs and slower sales could offset some of the gains from higher production volumes.

- Net Profit Analysis: A detailed analysis of Suncor's financial statements is crucial to determine the net impact of these competing forces on the company's bottom line.

- Shareholder Returns: The impact on profitability directly affects shareholder returns, with potential implications for investor confidence.

Investor Sentiment and Stock Performance

The market's reaction to Suncor's recent performance is mixed. While record production is positive news, the slowing sales and inventory buildup are concerns for investors.

- Stock Price Analysis: Careful observation of Suncor's stock price movements provides insight into investor sentiment.

- Analyst Forecasts: Analyst forecasts and market predictions for Suncor's future performance offer valuable perspective on the company's prospects.

Suncor's Strategic Response

Suncor is likely to adopt several strategic responses to address the challenges presented by slowing sales and rising inventory levels.

- Production Adjustments: The company might adjust its production targets to better align with actual market demand.

- Marketing Strategies: Enhanced marketing strategies could be implemented to stimulate demand for Suncor's products.

- Diversification: Suncor may explore diversification into renewable energy sources to reduce its reliance on traditional oil production and mitigate future market risks.

Conclusion

Suncor Energy's achievement of record oil production is impressive. However, the simultaneous slowdown in sales and inventory increase presents a complex picture requiring careful analysis. Understanding the interaction between operational successes and market dynamics is crucial for evaluating Suncor's long-term prospects. While record production showcases operational strength, effectively addressing the sales and inventory challenges is paramount for maintaining profitability and sustaining investor confidence. To stay abreast of Suncor Energy's performance and strategic adjustments within the ever-changing energy landscape, continue following our updates on Suncor Energy production, sales, and market analysis.

Featured Posts

-

The Delicate Years Why Daycare Might Not Be Right For Your Young Child

May 09, 2025

The Delicate Years Why Daycare Might Not Be Right For Your Young Child

May 09, 2025 -

Incendie A La Mediatheque Champollion De Dijon Premieres Informations

May 09, 2025

Incendie A La Mediatheque Champollion De Dijon Premieres Informations

May 09, 2025 -

Trade Disruptions How The Bubble Blaster Crisis Affects Chinese Exports

May 09, 2025

Trade Disruptions How The Bubble Blaster Crisis Affects Chinese Exports

May 09, 2025 -

Azalan Karlilik Bitcoin Madenciliginin Gelecegi Icin Oenemli Sorular

May 09, 2025

Azalan Karlilik Bitcoin Madenciliginin Gelecegi Icin Oenemli Sorular

May 09, 2025 -

Phan No Vu Bao Mau Tat Tre Em Tien Giang Phai Bao Ve Tre Em

May 09, 2025

Phan No Vu Bao Mau Tat Tre Em Tien Giang Phai Bao Ve Tre Em

May 09, 2025