Tariffs And The Canadian Beauty Industry: A "Buy Canadian" Challenge

Table of Contents

H2: The Impact of Tariffs on Imported Beauty Products

Tariffs, essentially taxes on imported goods, significantly impact the Canadian beauty industry. These added costs ripple throughout the supply chain, affecting both businesses and consumers.

H3: Increased Costs for Consumers

Tariffs directly translate to higher prices for consumers. This is particularly noticeable with popular imported beauty products.

- Examples: Imported fragrances, high-end skincare lines from Europe, and certain makeup brands often see significant price increases due to tariffs.

- Percentage Increases: Depending on the product and origin, tariff increases can range from a few percentage points to over 20%, significantly impacting consumer purchasing power. This can lead to consumers seeking cheaper alternatives, potentially impacting brand loyalty.

- Impact on Consumer Purchasing Power: Higher prices mean consumers may buy less, switch to cheaper brands (potentially impacting Canadian brands negatively), or forgo purchases altogether, thus reducing overall market spending.

H3: Reduced Competitiveness for Canadian Businesses

The impact of tariffs extends beyond the consumer level. Canadian beauty brands also feel the pinch. Tariffs on imported ingredients (like specific oils, extracts, and pigments) and packaging materials raise their production costs, making them less competitive both domestically and internationally.

- Examples: Smaller Canadian beauty companies relying on imported ingredients face disproportionately large cost increases, potentially jeopardizing their profitability and growth.

- Difficulty in Exporting: Increased production costs make it harder for Canadian businesses to compete on price in global markets, hindering their ability to export and expand internationally.

- Potential for Job Losses: If Canadian companies cannot compete effectively due to increased costs, this could lead to job losses within the industry.

H2: The "Buy Canadian" Movement: Opportunities and Challenges

The "Buy Canadian" movement presents both significant opportunities and considerable challenges for the Canadian beauty industry.

H3: Supporting Domestic Brands and Jobs

Choosing Canadian-made beauty products offers substantial benefits. It directly supports local economies, fosters job creation, and promotes sustainable business practices.

- Prominent Canadian Brands: Many successful Canadian beauty brands offer high-quality products with unique selling propositions. Examples include (insert examples of Canadian beauty brands here – this needs to be researched and added).

- Unique Selling Propositions: Many Canadian brands focus on sustainable practices, ethically sourced ingredients, and unique formulations, offering a compelling alternative to imported products.

- Success Stories: Highlighting the success stories of thriving Canadian beauty brands can inspire consumer confidence and encourage support for domestic products.

H3: The Price Factor: Is "Buy Canadian" Affordable?

While supporting Canadian brands is crucial, the price difference between domestic and imported products is a significant factor for consumers.

- Price Comparisons: A direct comparison of similar products (e.g., a Canadian-made moisturizer versus an imported equivalent) will reveal price discrepancies. This needs further research to be included.

- Government Incentives: Government subsidies or tax breaks for Canadian beauty companies could help make domestic products more price-competitive.

- Accessibility Strategies: Exploring strategies like bulk discounts, loyalty programs, or targeted marketing campaigns can enhance the accessibility and affordability of Canadian beauty products.

H2: Government Policies and Support for the Canadian Beauty Industry

Government policies play a vital role in shaping the landscape of the Canadian beauty industry.

H3: Current Tariff Policies and Their Impact

Analyzing current Canadian government tariff policies reveals their direct impact on the beauty industry's competitiveness. This requires detailed research into current tariff rates on specific imported beauty products and ingredients.

- Specific Tariff Rates: (Insert research-based data on specific tariff rates here).

- Government Initiatives: Existing government initiatives aimed at supporting domestic manufacturing should be discussed.

- Potential Policy Changes: Analysis of potential future policy adjustments and their likely effects on the industry is needed.

H3: Potential for Future Government Intervention

The Canadian government could play a more active role in supporting the "Buy Canadian" movement through targeted interventions.

- Potential Policy Solutions: Subsidies, tax breaks, or investment in research and development for Canadian beauty brands could level the playing field and make them more competitive.

- Investment in Innovation: Government support for innovation and technology within the Canadian beauty industry could lead to the development of unique, high-quality products that can compete globally.

3. Conclusion

Tariffs significantly impact the Canadian beauty industry, increasing costs for consumers and reducing the competitiveness of Canadian brands. The "Buy Canadian" movement presents an opportunity to support domestic businesses, create jobs, and promote sustainable practices. However, price competitiveness remains a challenge. Government intervention through targeted policies and incentives could significantly boost the Canadian beauty industry and encourage consumer adoption of a "Buy Canadian" approach. Embrace the "Buy Canadian" movement and help strengthen our domestic beauty industry by choosing Canadian brands. Your support makes a difference!

Featured Posts

-

Charles Leclerc Ferraris Pre Imola Gp Update

May 20, 2025

Charles Leclerc Ferraris Pre Imola Gp Update

May 20, 2025 -

Hmrc Child Benefit Crucial Information And Important Notifications

May 20, 2025

Hmrc Child Benefit Crucial Information And Important Notifications

May 20, 2025 -

Ferrari Podrobnosti Diskvalifikatsii Leklera I Khemiltona

May 20, 2025

Ferrari Podrobnosti Diskvalifikatsii Leklera I Khemiltona

May 20, 2025 -

New Drone Truck Technology Could Revolutionize Usmc Tomahawk Launch

May 20, 2025

New Drone Truck Technology Could Revolutionize Usmc Tomahawk Launch

May 20, 2025 -

62 5m Transfer Battle Man Utd Makes Move For Arsenal And Chelsea Target

May 20, 2025

62 5m Transfer Battle Man Utd Makes Move For Arsenal And Chelsea Target

May 20, 2025

Latest Posts

-

Kaellmanin Nousu Kentaeltae Ja Sen Ulkopuolelta

May 20, 2025

Kaellmanin Nousu Kentaeltae Ja Sen Ulkopuolelta

May 20, 2025 -

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan

May 20, 2025

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan

May 20, 2025 -

Benjamin Kaellman Huuhkajien Uusi Maalintekijae

May 20, 2025

Benjamin Kaellman Huuhkajien Uusi Maalintekijae

May 20, 2025 -

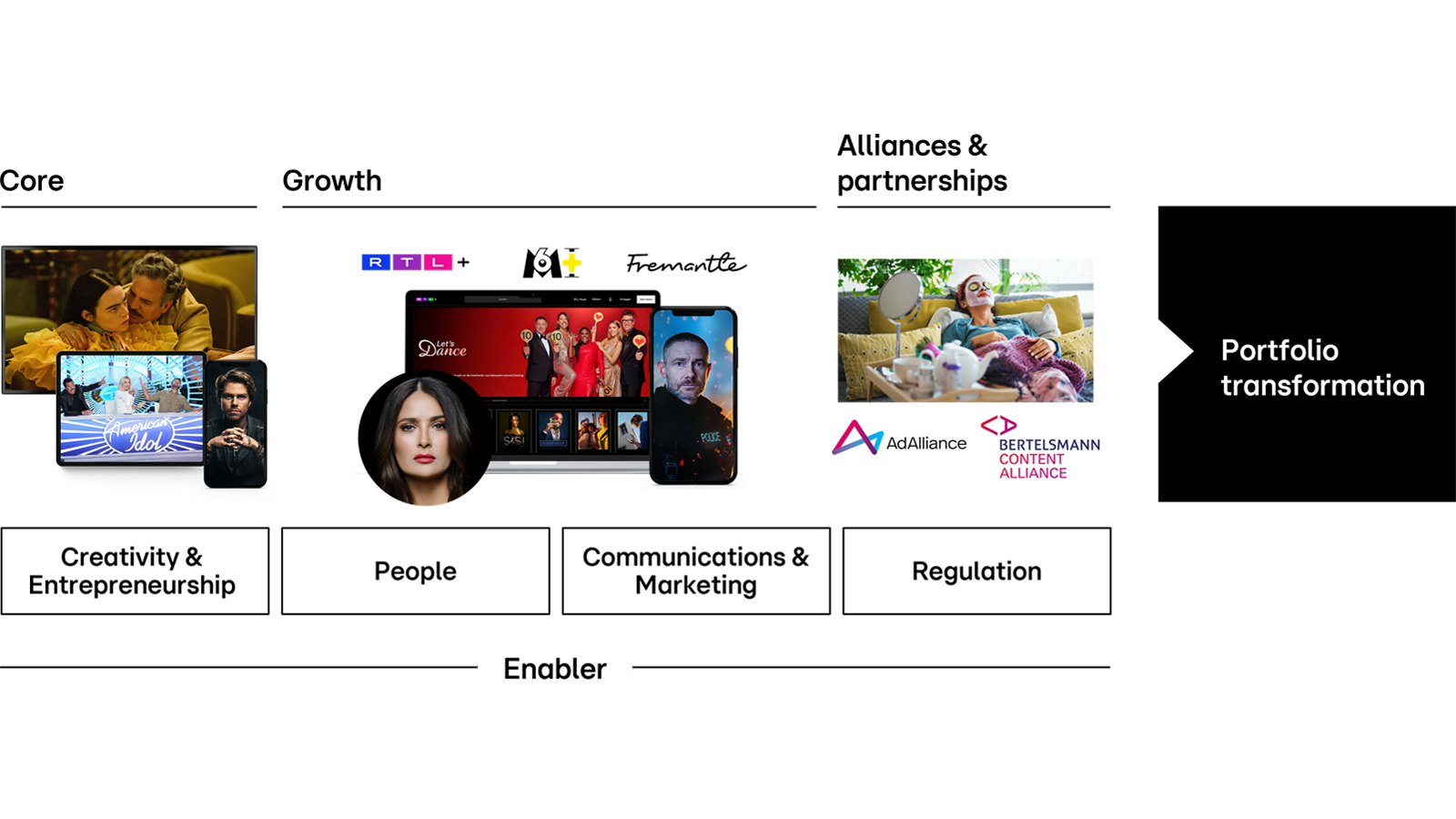

Fremantle Q1 Revenue 5 6 Decrease Due To Reduced Buyer Spending

May 20, 2025

Fremantle Q1 Revenue 5 6 Decrease Due To Reduced Buyer Spending

May 20, 2025 -

Rtl Groups Streaming Strategy A Path To Profitability

May 20, 2025

Rtl Groups Streaming Strategy A Path To Profitability

May 20, 2025