Tax Credits And Film Production In Minnesota: A Comprehensive Look

Table of Contents

Minnesota Film Tax Credit Program: A Deep Dive

Understanding the Basics

The Minnesota Film Tax Credit program offers substantial financial assistance to qualifying film productions shot within the state. This incentive aims to attract both large-scale and independent projects, boosting the local economy and creating jobs. Let's break down the essentials:

- Eligibility Requirements: To qualify, productions must meet specific spending thresholds and adhere to guidelines regarding the percentage of production spent in Minnesota. This includes both principal photography and post-production.

- Eligible Expenditures: The credit applies to a range of production costs, including labor costs (cast and crew), equipment rentals, location fees, and post-production expenses. Specific details on eligible and ineligible expenses are available through the Minnesota Department of Employment and Economic Development (DEED).

- Credit Percentage: The credit percentage offered varies depending on the type of production and may be subject to change, so it's vital to check the most up-to-date information from official sources.

- Application Process and Deadlines: The application process involves submitting a detailed budget, production schedule, and other supporting documentation before principal photography begins. Strict deadlines are in place, so careful planning and early application are crucial.

Qualifying Productions

A wide variety of film and television productions are eligible for Minnesota's film tax credits, making it an attractive location for diverse projects:

- Feature Films: Both independent and studio films are eligible, boosting the state's profile as a filming destination.

- Television Series: Television shows, including pilots and ongoing series, can benefit significantly from these incentives.

- Commercials: Advertising productions can also leverage the tax credit program, further stimulating the local economy.

- Documentaries: Non-fiction productions focusing on Minnesota themes or filmed within the state are also eligible.

- Other Eligible Productions: The program also covers other qualifying productions, including animation and digital media projects. It is always advisable to consult the DEED guidelines for the most up-to-date information.

Maximizing Your Tax Credit

To maximize the benefits of the Minnesota Film Tax Credit, consider these strategies:

- Strategic Budgeting and Expense Allocation: Carefully plan your budget, allocating expenses strategically to maximize the credit's impact. Consult with tax professionals experienced in film production.

- Working with Experienced Tax Professionals: Engage experienced film tax credit consultants to navigate the complexities of the application process and ensure compliance. Their expertise can significantly increase your chances of securing the maximum credit.

- Collaboration with Minnesota-Based Businesses: Prioritize using Minnesota-based vendors for services like equipment rentals, catering, and transportation. This not only helps maximize your credit but also supports the local economy.

The Economic Impact of Film Tax Credits in Minnesota

Job Creation and Local Employment

The Minnesota Film Tax Credit program significantly impacts employment in the state:

- Direct Employment: It creates numerous direct jobs for actors, crew members, and other production personnel.

- Indirect Employment: The ripple effect extends to indirect employment in sectors like hospitality, transportation, and catering, further boosting the local economy.

Revenue Generation and Business Development

Film production stimulates economic growth in various ways:

- Increased Spending in Local Businesses: Productions inject significant capital into local businesses, from hotels and restaurants to equipment rental companies and production supply stores.

- Support for Local Infrastructure: Film production can also improve and utilize existing infrastructure, boosting its overall value.

- Attracting Tourism: Successful productions filmed in Minnesota can draw tourists who want to visit locations showcased in those films.

Case Studies

Several successful film and television productions have already benefited from Minnesota's film tax credits, demonstrating their positive impact. These case studies showcase increased employment, revenue generation, and positive media exposure for the state.

Navigating the Application Process: A Step-by-Step Guide

Preparing Your Application

The application process requires meticulous preparation. Key elements include:

- Detailed Budget Breakdown: A comprehensive and transparent budget is crucial for demonstrating compliance and eligibility.

- Proof of Minnesota Spending: Provide clear documentation to demonstrate that the required percentage of your production budget was spent within the state.

- Casting and Crew Lists: Submit detailed lists of cast and crew members, highlighting Minnesota-based personnel.

Common Mistakes to Avoid

Common pitfalls include inaccurate budget projections, insufficient documentation, and missed deadlines. Careful planning and professional assistance can help avoid these issues.

Seeking Professional Assistance

Engaging a qualified film tax credit consultant can prove invaluable. Their expertise streamlines the process, maximizes your chances of success, and helps you avoid costly mistakes.

Comparing Minnesota's Film Tax Credits to Other States

Minnesota's film tax credit program is competitive compared to neighboring states like Wisconsin and Iowa, making it an attractive location for film production. A detailed comparison of incentive programs across the region is highly recommended to fully understand this competitive advantage.

Conclusion

Utilizing Minnesota's film tax credits offers significant financial advantages for film productions, stimulating job creation, boosting local economies, and fostering the growth of the state's film industry. By understanding the program's details and following best practices, filmmakers can maximize these incentives and contribute to Minnesota's vibrant film scene. To learn more and access the application process, visit the official Minnesota Department of Employment and Economic Development (DEED) website and seek guidance from experienced film tax credit consultants. The future of film production in Minnesota looks bright, and the tax credit program plays a crucial role in its continued success. Take advantage of this exceptional opportunity – start planning your Minnesota film project today!

Featured Posts

-

Willie Nelsons Wife Denies Inaccurate Media Claims

Apr 29, 2025

Willie Nelsons Wife Denies Inaccurate Media Claims

Apr 29, 2025 -

Trumps Next 100 Days A Deep Dive Into Trade Deregulation And Executive Actions

Apr 29, 2025

Trumps Next 100 Days A Deep Dive Into Trade Deregulation And Executive Actions

Apr 29, 2025 -

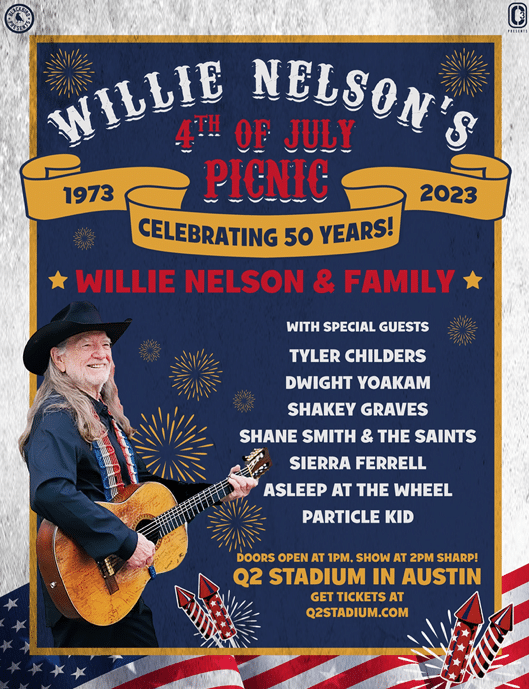

Willie Nelsons 4th Of July Picnic Returns To Texas What To Expect

Apr 29, 2025

Willie Nelsons 4th Of July Picnic Returns To Texas What To Expect

Apr 29, 2025 -

Securing Your Capital Summertime Ball 2025 Tickets

Apr 29, 2025

Securing Your Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

Willie Nelsons New Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelsons New Album Oh What A Beautiful World

Apr 29, 2025