Analysis: Chinese Stocks' Strong Performance In Hong Kong's Market

Table of Contents

Economic Factors Fueling Growth

Several significant economic forces are contributing to the booming performance of Chinese stocks in Hong Kong.

China's Economic Reopening

China's post-pandemic economic recovery has been a major catalyst. The easing of Covid-19 restrictions unleashed pent-up consumer demand, leading to increased spending across various sectors. This surge in consumer activity, coupled with robust infrastructure projects fueled by government stimulus packages, has significantly boosted the profits of many companies listed in Hong Kong.

- Increased Consumer Spending: Retail sales have shown strong growth, indicating a healthy recovery in consumer confidence.

- Robust Infrastructure Projects: Massive investments in infrastructure development are creating numerous opportunities for related companies.

- Government Stimulus Packages: Targeted fiscal policies have injected liquidity into the economy, stimulating business activity.

- Easing of Covid-19 Restrictions: The relaxation of pandemic-related restrictions has enabled businesses to operate more freely, boosting productivity and profitability.

For instance, the recent data from the National Bureau of Statistics of China shows a significant increase in retail sales, corroborating the positive impact of the economic reopening on Chinese companies listed in Hong Kong. (Link to relevant news article/report).

Government Policies and Regulations

Supportive government policies in both mainland China and Hong Kong have played a crucial role in bolstering investor confidence. Targeted initiatives designed to stimulate economic growth and encourage investment have had a tangible impact on listed companies.

- Examples of Supportive Policies: These include tax incentives for specific industries, streamlined regulatory processes, and initiatives promoting innovation and technology.

- Changes in Regulations Impacting Listed Companies: Recent regulatory reforms have aimed to create a more favorable environment for businesses, reducing bureaucratic hurdles and enhancing transparency.

- Impact on Specific Sectors (e.g., Tech, Real Estate): Specific policies tailored to particular sectors have influenced the performance of related companies listed on the HKEX. For example, supportive measures for the tech sector have led to a surge in the share prices of many tech giants.

Attractiveness of the Hong Kong Market

The Hong Kong market itself offers several advantages that contribute to the strong performance of Chinese stocks.

International Investment Hub

Hong Kong's status as a leading global financial center makes it an attractive destination for international investors seeking exposure to the Chinese market.

- Access to International Capital: The HKEX provides access to a vast pool of international capital, facilitating easier fund-raising for listed companies.

- Strong Legal Framework: Hong Kong's robust legal system and transparent regulatory environment enhance investor confidence.

- Liquid Market: The high trading volume and liquidity in the HKEX ensure efficient execution of trades.

- Ease of Trading: The market's accessibility and ease of trading attract both individual and institutional investors.

Data on foreign investment flows into Hong Kong underscores its appeal as a gateway to the Chinese market. (Link to relevant data source).

Competitive Advantages of the HKEX

Listing on the HKEX offers several advantages compared to other exchanges.

- Lower Listing Requirements (in some cases): Compared to some international exchanges, the HKEX may have more lenient listing requirements, making it easier for companies to go public.

- Access to a Wider Investor Base: The HKEX provides access to a diverse pool of investors from across Asia and globally.

- Strong Regulatory Oversight: The HKEX maintains strict regulatory oversight, ensuring market integrity and investor protection.

A comparison of the HKEX with other Asian exchanges highlights its competitive strengths. (Link to comparative analysis).

Sector-Specific Performance Analysis

While the overall market is performing strongly, certain sectors stand out.

High-Growth Sectors

Technology, healthcare, and renewable energy are among the high-growth sectors driving the strong performance of Chinese stocks in Hong Kong.

- Specific Examples of Leading Companies: Mention specific examples of leading companies in each sector and their contributions to overall market growth. (e.g., Tencent, Alibaba, etc.)

- Reasons for Their Strong Performance: Analyze the factors contributing to their success, such as innovation, strong demand, and supportive government policies.

- Future Growth Prospects: Discuss the future growth potential of these sectors and their impact on the overall performance of Chinese stocks in Hong Kong. Include charts or graphs showcasing sector performance.

Challenges and Risks

Despite the positive trends, it's crucial to acknowledge potential risks and challenges.

- Geopolitical Uncertainties: Geopolitical tensions between China and other countries can impact market sentiment and investor confidence.

- Regulatory Changes: Changes in regulations, both in mainland China and Hong Kong, can affect the performance of specific companies and sectors.

- Economic Slowdown Risks: A potential slowdown in the Chinese economy could negatively impact the performance of listed companies.

- Valuation Concerns: Overvaluation of certain stocks presents a risk to investors.

A balanced perspective acknowledging these challenges is crucial for informed investment decisions.

Conclusion

The strong performance of Chinese stocks in Hong Kong is a result of several converging factors: a robust economic recovery in mainland China, supportive government policies, Hong Kong's attractiveness as an international investment hub, and impressive growth in key sectors. The trends discussed highlight the significant potential of this market. However, investors should carefully consider the inherent risks before making investment decisions.

Learn more about the exciting opportunities and potential risks associated with investing in Chinese stocks in Hong Kong. Conduct your own thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Oil Price Analysis Market News For April 23 2024

Apr 24, 2025

Oil Price Analysis Market News For April 23 2024

Apr 24, 2025 -

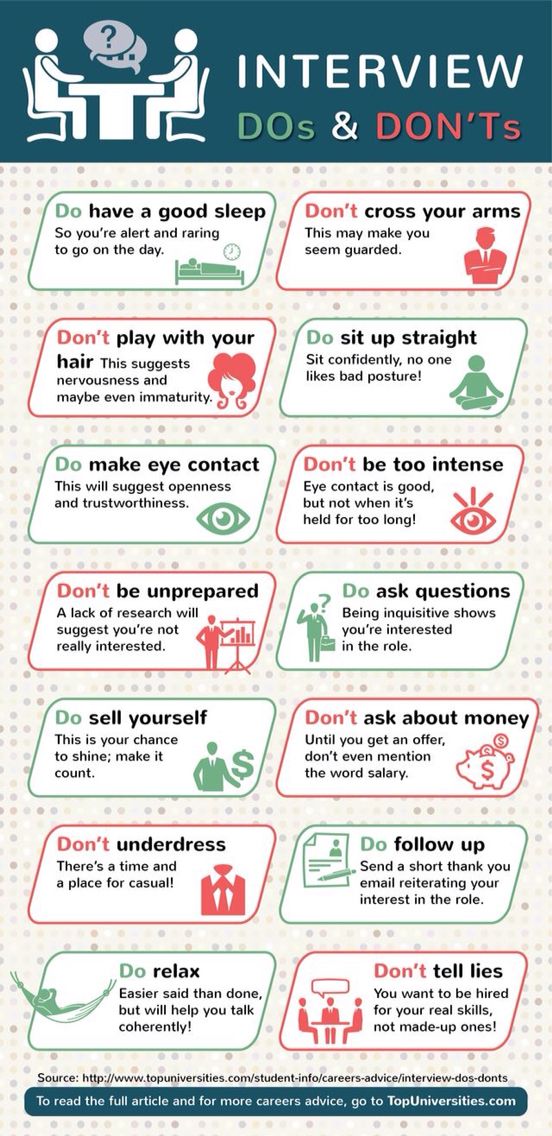

Navigate The Private Credit Boom 5 Dos And Don Ts For Job Seekers

Apr 24, 2025

Navigate The Private Credit Boom 5 Dos And Don Ts For Job Seekers

Apr 24, 2025 -

Office365 Security Failure Millions Lost In Executive Email Breach

Apr 24, 2025

Office365 Security Failure Millions Lost In Executive Email Breach

Apr 24, 2025 -

La Fires Price Gouging Allegations Surface Amidst Housing Crisis

Apr 24, 2025

La Fires Price Gouging Allegations Surface Amidst Housing Crisis

Apr 24, 2025 -

Los Angeles Wildfires And The Perils Of Disaster Betting

Apr 24, 2025

Los Angeles Wildfires And The Perils Of Disaster Betting

Apr 24, 2025