Thames Water Executive Bonuses: A Case Study In Corporate Governance Failures

Table of Contents

H2: The Performance Paradox: Poor Service and Lucrative Bonuses

The core issue lies in the glaring contradiction between Thames Water's abysmal performance and the lucrative bonuses awarded to its executives. This performance paradox is a key element of the Thames Water executive bonuses debate.

H3: Analysis of Thames Water's Performance Metrics

Thames Water's performance has been consistently criticized across several key metrics:

- High Leakage Rates: Millions of liters of treated water are lost daily due to aging pipes, a significant waste of resources and a costly inefficiency. [Link to Ofwat report on leakage].

- Customer Complaints: A consistently high number of customer complaints regarding water quality, billing inaccuracies, and slow response times to service issues plague the company. [Link to customer complaint statistics].

- Pollution Incidents: Repeated instances of sewage discharges into rivers and waterways highlight the company’s failure to maintain its infrastructure adequately. [Link to news articles on pollution incidents].

This poor performance stands in stark contrast to the substantial executive compensation packages, creating a justifiable public outcry. The discrepancy between the reality of poor service delivery and the rewarding of executives fuels the debate surrounding Thames Water executive bonuses.

H3: The Structure of Executive Bonus Schemes

The details of Thames Water's executive bonus schemes remain largely opaque, fueling suspicion and accusations of flawed incentives. However, reports suggest that bonuses were likely tied to targets that did not adequately reflect the company's overall performance or its environmental impact.

- Performance Indicators: The specific performance indicators used to determine bonuses are unclear, raising questions about their relevance to the company's actual operational success. A transparent and publicly accessible breakdown of these metrics is needed for full scrutiny.

- Potential Loopholes: The scheme may have contained loopholes allowing for bonuses even in the face of poor performance, indicating a fundamental flaw in the design and oversight of the system.

- Conflicts of Interest: The possibility of conflicts of interest within the bonus structure cannot be discounted, especially given the lack of transparency. An independent review is necessary to assess any potential conflicts.

H2: Regulatory Failures and Lack of Accountability

The Thames Water executive bonuses controversy also exposes significant failures in regulatory oversight and accountability.

H3: The Role of Ofwat (the water regulator)

Ofwat, the water regulator, has faced considerable criticism for its apparent failure to effectively address Thames Water's persistent performance issues.

- Ineffective Oversight: Critics argue that Ofwat's regulatory framework failed to sufficiently incentivize improved performance and to penalize consistent underperformance.

- Lack of Transparency: A lack of transparency surrounding Ofwat's interactions and decisions regarding Thames Water has fueled public distrust.

- Regulatory Capture: Concerns have been raised about the potential for regulatory capture, whereby the regulator becomes too closely aligned with the interests of the companies it is supposed to regulate.

H3: Governmental Responsibility and Intervention

The government also bears responsibility for the situation, given its oversight of the water industry and its role in setting regulatory frameworks.

- Political Pressure: Potential political pressure on Ofwat to avoid overly stringent regulation might have inadvertently contributed to the current situation.

- Lack of Sufficient Intervention: The government's response to the deteriorating performance of Thames Water has been criticized for its slowness and lack of decisive intervention.

H2: Shareholder Responsibility and Corporate Governance

While regulatory oversight failed, shareholder responsibility also needs examination in the context of Thames Water executive bonuses.

- Shareholder Activism: The level of shareholder activism in challenging the executive compensation packages remains unclear, but a more assertive approach could have held the company more accountable.

- Corporate Governance Weaknesses: The corporate governance structure of Thames Water requires scrutiny to identify potential weaknesses that allowed for such a disconnect between performance and reward.

- Best Practices: A thorough review of corporate governance best practices and compliance with relevant codes of conduct is essential.

H2: The Public Backlash and the Wider Implications

The public reaction to the Thames Water executive bonuses has been swift and intense.

H3: Public Outrage and Media Coverage

Social media and news outlets have been flooded with criticism, highlighting the profound damage done to public trust in corporations and the water industry. [Link to social media discussions and news articles].

H3: Calls for Reform and Potential Future Changes

The scandal has sparked widespread calls for significant reform within the water industry.

- Increased Transparency: Demand for increased transparency in executive compensation and performance metrics is paramount.

- Reform of Bonus Schemes: Significant changes to executive compensation structures are needed to ensure that bonuses accurately reflect company performance and environmental responsibility.

- Legislative Changes: Policy recommendations and legislative changes are likely to be pursued to prevent similar situations from recurring.

3. Conclusion: Learning from the Thames Water Executive Bonus Scandal

The Thames Water executive bonuses controversy serves as a stark reminder of the critical need for robust corporate governance and effective regulatory oversight in essential service sectors. The scandal highlights failures in accountability, transparency, and the alignment of executive incentives with genuine performance. The damage to public trust extends beyond Thames Water, impacting confidence in the entire water industry. We must demand greater transparency and accountability from both corporations and regulators. This requires ongoing engagement in discussions about corporate governance, executive compensation, and the regulation of essential services like water. Further research into the specifics of the bonus schemes and a thorough review of Ofwat’s regulatory practices are urgently needed. Demand action – let's reform the system to prevent future occurrences of Thames Water executive bonuses style scandals.

Featured Posts

-

Analyst Sees Apple Reaching 254 Investment Implications At 200

May 24, 2025

Analyst Sees Apple Reaching 254 Investment Implications At 200

May 24, 2025 -

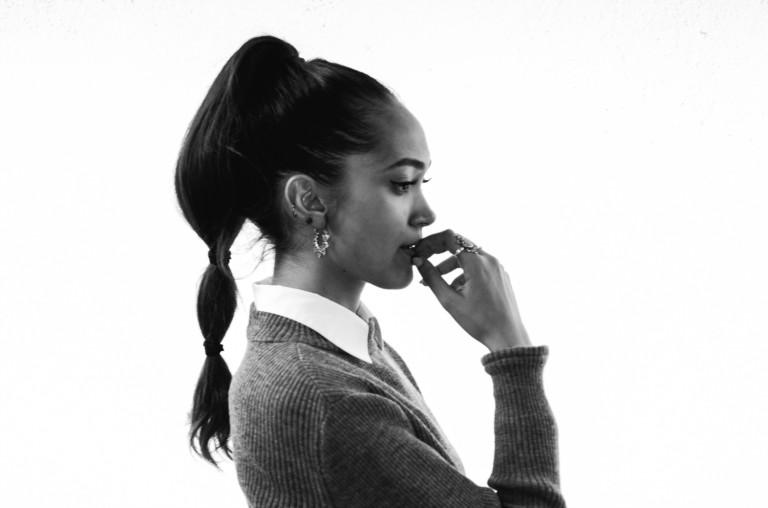

Joy Crookes Carmen A New Single To Listen To

May 24, 2025

Joy Crookes Carmen A New Single To Listen To

May 24, 2025 -

Stocks Surge 8 On Euronext Amsterdam Trumps Tariff Pause Fuels Rally

May 24, 2025

Stocks Surge 8 On Euronext Amsterdam Trumps Tariff Pause Fuels Rally

May 24, 2025 -

T Mobile Data Breaches Result In 16 Million Fine After Three Year Period

May 24, 2025

T Mobile Data Breaches Result In 16 Million Fine After Three Year Period

May 24, 2025 -

Aex Stijgt Markt Herstelt Na Trumps Uitstel

May 24, 2025

Aex Stijgt Markt Herstelt Na Trumps Uitstel

May 24, 2025

Latest Posts

-

Billie Jean King Cup Rybakina Propels Kazakhstan To Finals

May 24, 2025

Billie Jean King Cup Rybakina Propels Kazakhstan To Finals

May 24, 2025 -

Rybakinas Dominant Performance Secures Kazakhstans Billie Jean King Cup Final Spot

May 24, 2025

Rybakinas Dominant Performance Secures Kazakhstans Billie Jean King Cup Final Spot

May 24, 2025 -

Kazakhstans Billie Jean King Cup Finals Berth Rybakinas Power

May 24, 2025

Kazakhstans Billie Jean King Cup Finals Berth Rybakinas Power

May 24, 2025 -

Rybakina Kommentariy O Tekuschey Fizicheskoy Forme

May 24, 2025

Rybakina Kommentariy O Tekuschey Fizicheskoy Forme

May 24, 2025 -

Podderzhka Eleny Rybakinoy Dlya Devushek Tennisistok Kazakhstana

May 24, 2025

Podderzhka Eleny Rybakinoy Dlya Devushek Tennisistok Kazakhstana

May 24, 2025