The Angry Elon Effect: How It Impacts Tesla

Table of Contents

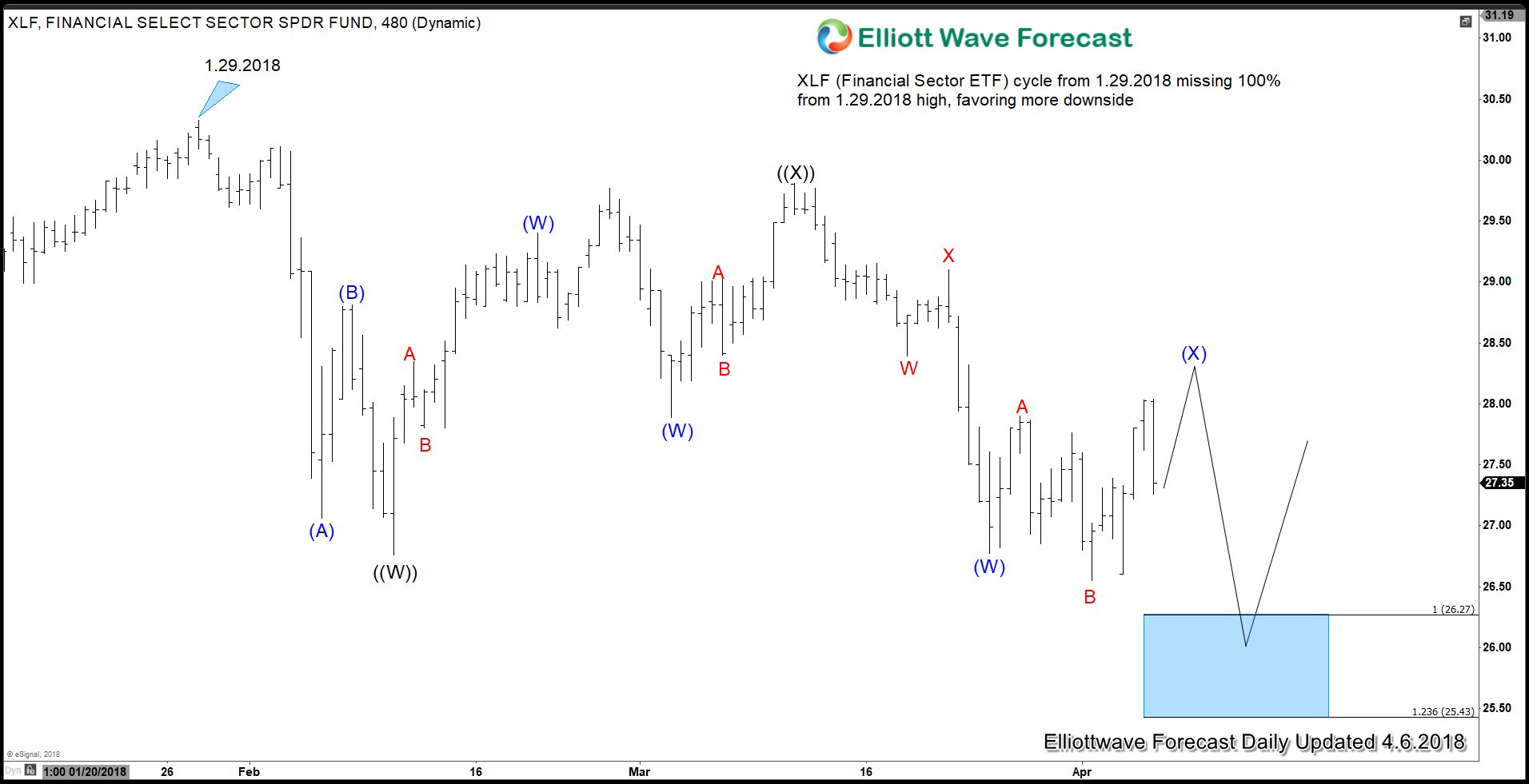

Impact on Tesla's Stock Price

Elon Musk's public pronouncements have a profound and often immediate effect on Tesla's stock price. This volatility presents both opportunities and significant risks for investors.

Short-Term Volatility

Controversial tweets, sudden announcements, and even seemingly innocuous social media posts can cause immediate and dramatic swings in Tesla's stock.

- Example 1: Musk's April 2022 tweet about potentially taking Tesla private caused a significant spike and then subsequent correction in the stock price.

- Example 2: Announcements regarding new product releases or production targets frequently result in short-term market fluctuations, sometimes exceeding 10% in a single day. The inherent unpredictability makes accurate short-term forecasting exceptionally difficult.

- Example 3: Musk's involvement in meme stocks and cryptocurrency markets has also indirectly impacted Tesla's stock, creating ripple effects across investor sentiment.

These rapid fluctuations in Tesla stock exemplify the high degree of "Tesla stock market volatility" directly linked to Musk's public persona. The unpredictability affects investor sentiment and creates a high-risk, high-reward environment for short-term traders. This "Elon Musk tweets" effect is a defining characteristic of Tesla's market behavior.

Long-Term Investor Confidence

While short-term traders might capitalize on the volatility, the consistent unpredictability linked to Musk's behavior erodes long-term investor confidence.

- Institutional Investors: Many institutional investors, who prefer stability and predictable returns, are hesitant to invest heavily in Tesla due to the inherent risk associated with Musk's leadership style.

- Risk Assessment: The "risk assessment" for Tesla is inherently higher than for companies with more predictable leadership. This elevated risk deters long-term investors seeking steady growth and reduces the potential for substantial institutional investment.

- Brand Stability: The lack of consistent messaging and occasional erratic behavior from Musk casts a shadow over Tesla's brand stability, influencing investor perception of long-term prospects and potential returns on "Tesla investment."

Damage to Tesla's Brand Reputation

Musk's actions directly impact the public perception of Tesla, potentially damaging its carefully cultivated brand image.

Public Perception of Tesla

Negative publicity surrounding Musk's behavior can directly translate into a negative "customer perception" of Tesla as a brand.

- Brand Association: Consumers increasingly associate Tesla with the often controversial public image of its CEO, leading some potential customers to reconsider purchasing its vehicles.

- Loss of Customers: Negative news coverage can directly result in a "loss of customers," particularly among those sensitive to ethical and social responsibility concerns. This erodes the company's market share and potential for future growth.

- Brand Image: The overall "brand image" of Tesla is constantly in flux due to the unpredictable nature of Musk's pronouncements and actions. This impacts marketing and branding strategies and necessitates constant damage control.

Impact on Employee Morale and Talent Acquisition

The turbulent environment created by Musk's leadership style presents challenges in attracting and retaining top talent.

- Recruitment: The negative press surrounding Musk's behavior makes recruiting top engineers, designers, and other skilled professionals more difficult. The perception of a high-pressure, unpredictable workplace deters potential applicants.

- Retention: Existing "Tesla employees" may also be affected, with some potentially seeking employment in more stable corporate environments. High employee turnover rates can negatively impact productivity and innovation.

- Workplace Culture: A toxic or unpredictable "workplace culture" can significantly impact morale and create a challenging work environment.

Regulatory and Legal Ramifications

Musk's actions and statements have also exposed Tesla to considerable regulatory and legal risks.

SEC Investigations and Fines

Tesla faces ongoing regulatory scrutiny, partly due to Musk's past actions and statements.

- SEC Investigation: Past "SEC investigations" and subsequent fines have demonstrated the potential consequences of Musk's public behavior. These fines impose significant financial burdens on the company.

- Regulatory Compliance: Maintaining regulatory "compliance" is essential for any publicly traded company. Musk's actions raise concerns about Tesla's ability to consistently adhere to regulatory standards.

- Legal Risks: The "legal risks" associated with Musk's behavior are substantial, potentially resulting in further fines, settlements, and reputational damage.

Impact on Partnerships and Collaborations

Musk's controversial behavior can also negatively impact Tesla's partnerships and collaborations.

- Business Partnerships: Potential partners may be hesitant to collaborate with Tesla, given the inherent risks associated with Musk's unpredictable nature. This limits opportunities for growth and expansion.

- Strategic Collaborations: "Strategic collaborations" are often essential for technological innovation and market penetration. Musk's actions could jeopardize these crucial partnerships.

- Brand Synergy: Companies are careful to maintain a positive "brand synergy" in their partnerships. The volatile nature of the "Tesla partnerships" due to Musk's behavior can significantly reduce the appeal of collaborative ventures.

Conclusion

The "Angry Elon Effect" significantly impacts Tesla on multiple fronts, from its stock price volatility and brand reputation to the company's legal and regulatory standing and ability to attract and retain top talent. The link between Musk's public persona and Tesla's success is undeniable, but the long-term implications remain uncertain. While the short-term excitement and volatility can benefit some investors, the overall impact on long-term stability and growth remains a significant concern.

Call to Action: Understanding the "Elon Musk effect" on Tesla's performance requires diligent monitoring of both the company's activities and Musk's public pronouncements. We encourage readers to conduct further research into "Tesla stock analysis" and carefully consider the implications of the "Angry Elon Effect" before making any investment decisions. Stay informed about the latest news and developments to better understand the ongoing "impact of leadership" on Tesla's future trajectory.

Featured Posts

-

7 Plunge For Amsterdam Stocks Trade War Uncertainty Creates Market Volatility

May 25, 2025

7 Plunge For Amsterdam Stocks Trade War Uncertainty Creates Market Volatility

May 25, 2025 -

Guccis Supply Chain Future Uncertain After Vians Departure

May 25, 2025

Guccis Supply Chain Future Uncertain After Vians Departure

May 25, 2025 -

Les Acteurs Du Brest Urban Trail Portrait Des Benevoles Artistes Et Partenaires

May 25, 2025

Les Acteurs Du Brest Urban Trail Portrait Des Benevoles Artistes Et Partenaires

May 25, 2025 -

Investigation Into 2002 Submarine Deal Implicates Malaysias Ex Pm

May 25, 2025

Investigation Into 2002 Submarine Deal Implicates Malaysias Ex Pm

May 25, 2025 -

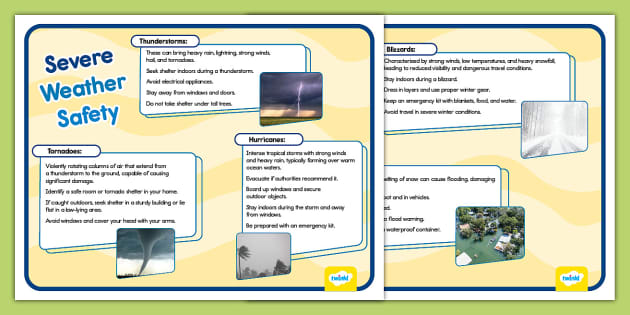

Day 5 Staying Safe During Severe Weather Focus On Flood Prevention And Response

May 25, 2025

Day 5 Staying Safe During Severe Weather Focus On Flood Prevention And Response

May 25, 2025

Latest Posts

-

Urgent Flash Flood Warning Extended For Cayuga County Through Tuesday

May 25, 2025

Urgent Flash Flood Warning Extended For Cayuga County Through Tuesday

May 25, 2025 -

Flash Flood Warning Cayuga County Under Alert Until Tuesday Night

May 25, 2025

Flash Flood Warning Cayuga County Under Alert Until Tuesday Night

May 25, 2025 -

Flash Flood Emergency Prevention Response And Recovery

May 25, 2025

Flash Flood Emergency Prevention Response And Recovery

May 25, 2025 -

How To Recognize And React To A Flash Flood Emergency

May 25, 2025

How To Recognize And React To A Flash Flood Emergency

May 25, 2025 -

Responding To A Flash Flood Emergency A Survival Guide

May 25, 2025

Responding To A Flash Flood Emergency A Survival Guide

May 25, 2025