The Bitcoin Rebound: Opportunities And Risks

Table of Contents

Understanding the Bitcoin Rebound: Market Analysis

The current Bitcoin rebound isn't a random event; several converging factors are fueling its resurgence. Macroeconomic instability, coupled with increasing institutional adoption and technological advancements, is creating a favorable environment for Bitcoin's price appreciation.

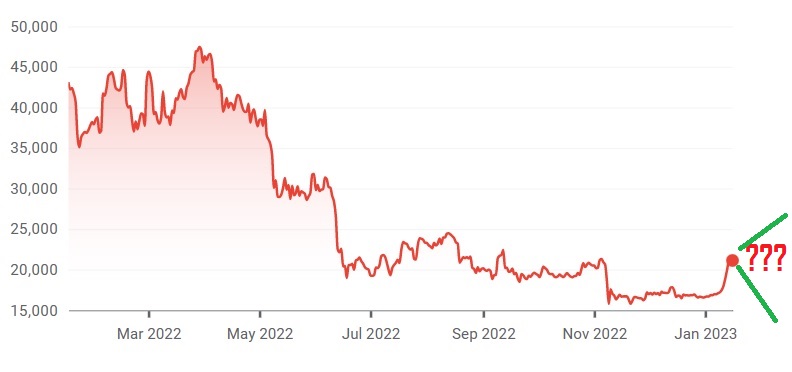

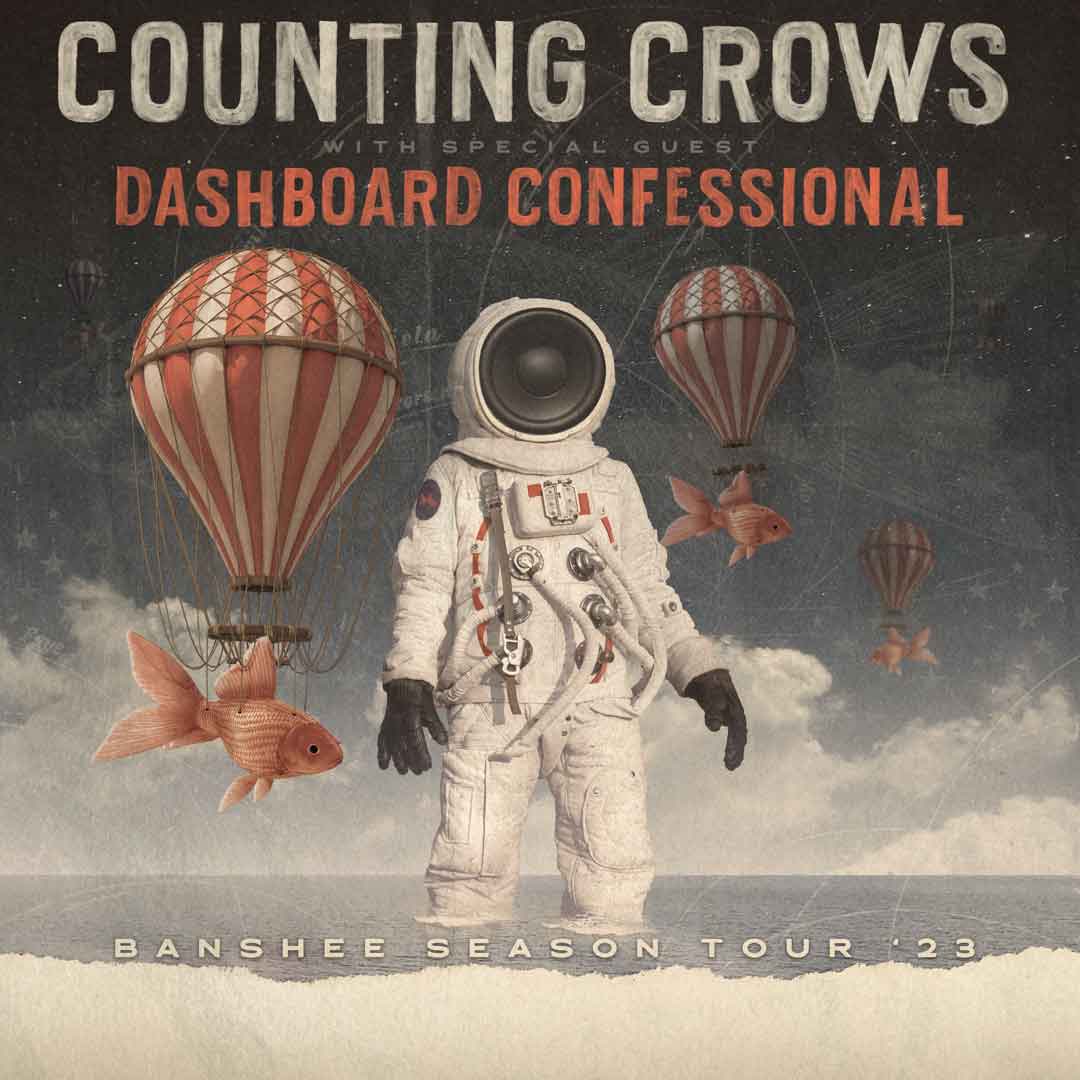

Recent price charts show a clear upward trend, accompanied by increased trading volume, suggesting a renewed interest in Bitcoin. Technical indicators like the Relative Strength Index (RSI) and moving averages also point towards a bullish momentum, although it's crucial to remember that technical analysis is not foolproof.

- Increased Institutional Investment: Large financial institutions are increasingly allocating assets to Bitcoin, viewing it as a potential diversification tool and a hedge against inflation.

- Positive Regulatory Developments: Several jurisdictions are adopting more favorable regulatory frameworks for cryptocurrencies, reducing uncertainty and attracting further investment.

- Growing Adoption as Inflation Hedge: With persistent inflation in many global economies, Bitcoin's limited supply and decentralized nature are making it increasingly attractive as a store of value.

- Technological Upgrades: Upgrades to the Bitcoin network, such as the Lightning Network, improve scalability and transaction efficiency, enhancing its usability and appeal.

Opportunities Presented by the Bitcoin Rebound

The Bitcoin rebound presents several potential opportunities for savvy investors. However, a well-defined strategy is crucial to maximize profits while mitigating risks.

- Long-Term Holding: A buy-and-hold strategy can be highly rewarding during a sustained rebound, benefiting from compounding returns.

- Short-Term Trading: Skilled traders can capitalize on short-term price fluctuations during the rebound, employing techniques like day trading or swing trading.

- Growth in Related Sectors: The Bitcoin ecosystem is expanding rapidly, offering investment opportunities in Bitcoin mining, DeFi projects built on the Bitcoin blockchain, and related services.

Here are some strategies to consider:

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals, mitigating the risk of investing a lump sum at a market peak.

- Support and Resistance Levels: Short-term traders can identify key support and resistance levels on price charts to optimize entry and exit points.

- Market Diversification: Don't put all your eggs in one basket. Diversifying your investments across different cryptocurrencies and asset classes is essential for managing risk.

- Bitcoin-Related Investment Products: Explore regulated investment products like Bitcoin ETFs and trusts, which offer exposure to Bitcoin with added regulatory oversight.

Risks Associated with the Bitcoin Rebound

While the Bitcoin rebound offers significant potential, it’s crucial to acknowledge the inherent risks. Bitcoin's price remains highly volatile, prone to dramatic swings.

- Market Volatility: Rapid price corrections are a common occurrence in the cryptocurrency market, potentially leading to substantial losses for investors.

- Speculative Bubbles: The Bitcoin market is susceptible to speculative bubbles, where prices rise rapidly based on hype rather than fundamentals.

- Regulatory Uncertainty: Government regulations concerning cryptocurrencies remain fluid, creating uncertainty and potential for future restrictions.

- Security Risks: Holding and trading Bitcoin involves security risks, including hacking, scams, and the loss of private keys.

Consider these risks carefully:

- Significant Losses: The volatile nature of Bitcoin means substantial losses are possible, even during a rebound.

- Scams and Fraud: Be wary of fraudulent schemes and scams that often proliferate during periods of market excitement.

- Stricter Regulations: Governments worldwide are increasingly scrutinizing cryptocurrencies, leading to potential stricter regulations.

- Exchange and Wallet Security: Choose reputable cryptocurrency exchanges and wallets, and implement strong security measures to protect your assets.

Navigating the Bitcoin Rebound: A Strategic Approach

Participating in the Bitcoin rebound requires a strategic and informed approach. Thorough due diligence, risk management, and a balanced perspective are crucial.

- Thorough Research: Understand the technology behind Bitcoin, its limitations, and its potential.

- Defined Investment Strategy: Develop a clear investment strategy aligned with your risk tolerance and financial goals.

- Portfolio Diversification: Spread your investments across different assets to reduce overall risk.

- Secure Storage: Use reputable wallets and exchanges, and implement robust security measures to protect your Bitcoin holdings.

Remember to:

- Understand the technology behind Bitcoin before investing.

- Only invest what you can afford to lose.

- Seek professional financial advice if needed.

- Stay updated on market trends and regulatory changes.

Conclusion: Making Informed Decisions on the Bitcoin Rebound

The Bitcoin rebound presents both significant opportunities and considerable risks. While the potential for profit is substantial, the volatile nature of the market necessitates a cautious and informed approach. By carefully considering the factors driving this rebound, understanding the inherent risks, and implementing sound risk management strategies, you can navigate this dynamic market effectively. Stay informed about the latest developments in the Bitcoin market to effectively navigate the Bitcoin rebound and capitalize on potential opportunities while managing the inherent risks. Conduct thorough research and make informed decisions to successfully participate in this exciting but volatile market.

Featured Posts

-

Am I Due A Universal Credit Refund From The Dwp

May 08, 2025

Am I Due A Universal Credit Refund From The Dwp

May 08, 2025 -

Lyon Sufre Derrota Local Frente Al Psg

May 08, 2025

Lyon Sufre Derrota Local Frente Al Psg

May 08, 2025 -

Greenland And The Us China Rivalry A Detailed Examination

May 08, 2025

Greenland And The Us China Rivalry A Detailed Examination

May 08, 2025 -

Counting Crows Announce Las Vegas Show

May 08, 2025

Counting Crows Announce Las Vegas Show

May 08, 2025 -

Arsenal V Psg Champions League Semi Final Key Players And Predictions

May 08, 2025

Arsenal V Psg Champions League Semi Final Key Players And Predictions

May 08, 2025