The Canadian Dollar And The Minority Government: A Potential Downturn?

Table of Contents

Political Instability and Investor Confidence

A minority government inherently introduces a higher degree of political instability compared to a majority government. The need for constant compromise and the potential for snap elections create an environment of uncertainty that can significantly impact investor confidence. This uncertainty is a major factor affecting the Canadian economy and consequently, the CAD. Investors are inherently risk-averse; prolonged political gridlock can lead to:

- Increased volatility in the stock market: Uncertainty surrounding government policy and potential legislative changes creates a climate of speculation, leading to increased market fluctuations and potentially lower returns for investors.

- Potential for decreased foreign investment: Foreign investors are less likely to commit capital to a country with a volatile political landscape, hindering economic growth and impacting the Canadian dollar.

- Impact on long-term economic planning: Businesses hesitate to make long-term investments under uncertain political conditions, negatively impacting job creation and economic expansion.

- Examples of past instances where political instability affected the CAD: Historical examples, such as periods of minority government in the past, can be analyzed to see the correlation between political instability and CAD performance, providing valuable insight.

Government Spending and the CAD

Government spending policies play a crucial role in influencing the Canadian dollar. A minority government, often reliant on support from other parties, may face challenges in implementing cohesive fiscal policies. Increased government debt and deficits, often associated with minority governments needing to negotiate for budget passage, can lead to:

- Relationship between government debt and currency valuation: High levels of government debt can weaken a currency, as it suggests a higher risk for the country.

- Potential inflationary pressures from increased spending: Increased government spending without corresponding economic growth can lead to inflation, eroding the purchasing power of the CAD.

- Impact of government spending on interest rates: To manage debt, the government might increase interest rates, impacting borrowing costs for businesses and consumers and potentially attracting foreign investment seeking higher returns.

- Analysis of the current government's fiscal policies: A detailed analysis of the current government's budget and spending plans is needed to assess the potential impact on the Canadian dollar.

Global Economic Factors and the Canadian Dollar

The Canadian economy, and therefore the CAD, is significantly impacted by global economic factors. These external forces interact with the domestic political landscape to create a complex economic environment. A minority government might find it more challenging to respond effectively to these external pressures:

- Impact of fluctuating oil prices on the CAD: As a major oil exporter, Canada's economy is highly sensitive to oil price fluctuations, which directly influence the CAD.

- The relationship between the US dollar and the Canadian dollar: The USD is a major trading partner for the CAD; fluctuations in the USD's value significantly impact the Canadian dollar.

- Effects of global trade wars on Canadian exports: Trade disputes and protectionist measures can negatively impact Canadian exports and thus affect the CAD.

- The role of the Bank of Canada in managing these external pressures: The Bank of Canada plays a vital role in mitigating the impact of global economic shocks on the CAD through monetary policy adjustments.

Mitigating the Risks: Strategies for Navigating Uncertainty

While the potential risks are considerable, individuals and businesses can implement strategies to mitigate the impact of a minority government on their finances. These include:

- Hedging strategies against CAD fluctuations: Employing hedging techniques, such as forward contracts or options, can reduce the risk associated with CAD volatility.

- Diversification of investment portfolios: Diversifying investments across different asset classes and geographies can reduce overall portfolio risk.

- Monitoring economic indicators closely: Closely tracking key economic indicators, such as inflation, interest rates, and GDP growth, can help anticipate potential changes in the CAD.

- Seeking professional financial advice: Consulting a financial advisor can provide tailored strategies based on individual circumstances and risk tolerance.

The Canadian Dollar's Future Under a Minority Government – A Cautious Outlook

The current minority government in Canada presents a degree of uncertainty that can impact the Canadian dollar. Political instability, potential fiscal challenges, and the interplay with global economic factors all contribute to a potentially volatile environment for the CAD. Close monitoring of both political and economic developments is crucial for navigating this period.

Stay informed about the Canadian dollar and minority government impacts. Monitor the CAD exchange rate closely and understand the risks and opportunities for the Canadian dollar in this political climate. Subscribe to reputable financial news sources, engage with financial experts, and utilize online tools to track the CAD exchange rate. Making informed decisions is key to mitigating potential risks and capitalizing on opportunities in this uncertain environment. The outlook for the Canadian dollar requires a cautious approach, emphasizing the need for informed decision-making and proactive risk management.

Featured Posts

-

Is Now The Right Time To Buy Xrp Ripple A Sub 3 Evaluation

May 01, 2025

Is Now The Right Time To Buy Xrp Ripple A Sub 3 Evaluation

May 01, 2025 -

Eurovision 2025 Betting Tips Latest Odds And Predictions

May 01, 2025

Eurovision 2025 Betting Tips Latest Odds And Predictions

May 01, 2025 -

Carrie Actress Priscilla Pointer Dead At 100 A Legacy Remembered

May 01, 2025

Carrie Actress Priscilla Pointer Dead At 100 A Legacy Remembered

May 01, 2025 -

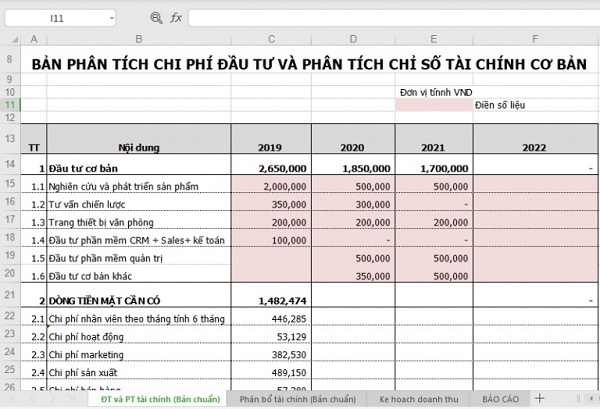

Bao Ve Von Dau Tu Cach Thuc Danh Gia Rui Ro Khi Gop Von Vao Doanh Nghiep

May 01, 2025

Bao Ve Von Dau Tu Cach Thuc Danh Gia Rui Ro Khi Gop Von Vao Doanh Nghiep

May 01, 2025 -

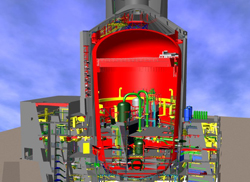

Reactor Power Uprate Your Guide To Nrc Approval

May 01, 2025

Reactor Power Uprate Your Guide To Nrc Approval

May 01, 2025

Latest Posts

-

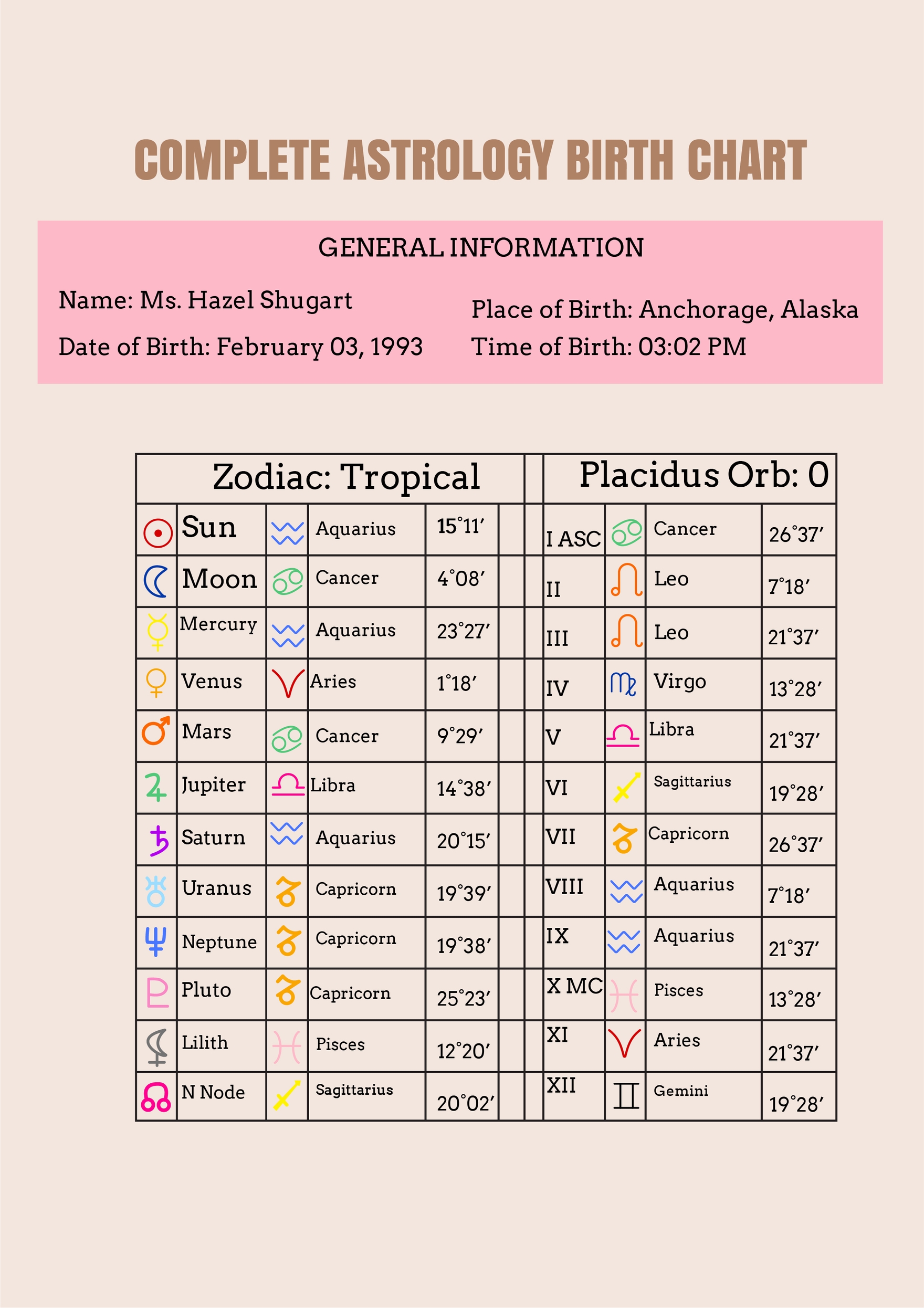

Aaj Ka Love Rashifal 14 March 2025

May 01, 2025

Aaj Ka Love Rashifal 14 March 2025

May 01, 2025 -

April 17 2025 Horoscope Astrological Readings For Every Sign

May 01, 2025

April 17 2025 Horoscope Astrological Readings For Every Sign

May 01, 2025 -

The X Files Director Ryan Coogler On A Potential Reboot

May 01, 2025

The X Files Director Ryan Coogler On A Potential Reboot

May 01, 2025 -

X Files Reboot Cooglers Conversation With Anderson

May 01, 2025

X Files Reboot Cooglers Conversation With Anderson

May 01, 2025 -

Gillian Anderson And Ryan Coogler Discuss Future Of X Files

May 01, 2025

Gillian Anderson And Ryan Coogler Discuss Future Of X Files

May 01, 2025