The Canadian Dollar's Vulnerability: A Minority Government Scenario

Table of Contents

Political Instability and its Impact on the CAD

A minority government, by its very nature, introduces a level of instability that can directly affect the Canadian dollar. This instability manifests in two primary ways: increased policy uncertainty and difficulty in passing key legislation.

Increased Policy Uncertainty

Frequent elections, potential coalition collapses, and the constant threat of a snap election create an environment of significant policy uncertainty. Investors, both domestic and foreign, dislike uncertainty. It makes long-term planning difficult and increases the perceived risk associated with investing in the Canadian economy.

- Fiscal Policy: Changes in government spending and taxation can dramatically impact the CAD. Uncertainty surrounding these policies makes it challenging for businesses to plan investments and hiring.

- Trade Agreements: Negotiating and implementing new trade deals becomes more complex under a minority government, potentially leading to delays or disruptions in international trade, which heavily influences the CAD.

- Resource Extraction Policies: Canada's resource-rich economy is sensitive to policy changes affecting the energy and mining sectors. Minority governments may find it harder to establish clear and consistent policies, impacting investor confidence in these crucial industries.

This uncertainty directly impacts foreign investment and capital flows. If investors perceive increased risk, they're likely to move their capital to more stable markets, weakening demand for the CAD and pushing its value down. History provides ample examples: past periods of political instability in Canada have demonstrably correlated with periods of CAD depreciation.

Difficulty in Passing Key Legislation

Minority governments often face challenges in passing crucial economic legislation, leading to legislative gridlock. This inability to swiftly enact essential economic policies creates further uncertainty and dampens investor confidence.

- Budget Bills: Failure to pass a budget on time can disrupt government spending and investment plans, sending negative signals to the market.

- Tax Reforms: Uncertainty surrounding tax policies discourages investment and hinders economic growth, negatively affecting the CAD.

- Infrastructure Projects: Delays in approving and funding critical infrastructure projects can slow down economic activity and hurt the CAD's value.

Examples of past legislative battles faced by Canadian minority governments demonstrate the real-world impact of this gridlock on economic confidence and, consequently, on the Canadian dollar. The inability to swiftly enact necessary economic reforms can lead to a loss of investor confidence and a subsequent decrease in the CAD's value.

Economic Volatility and the Canadian Dollar

The political instability inherent in a minority government translates directly into economic volatility, which further weakens the Canadian dollar. This manifests through decreased investor confidence and an increased risk premium.

Impact on Investor Confidence

Political instability directly impacts investor confidence in the Canadian economy. This confidence is a significant determinant of the CAD's value. When investors lose confidence, they withdraw capital, leading to a decrease in demand for the CAD and a subsequent decline in its value.

- Reduced foreign direct investment (FDI): Uncertain political landscapes deter foreign companies from investing in Canadian businesses.

- Lower portfolio investment: International investors are less inclined to invest in Canadian stocks and bonds.

- Decreased capital inflows: A lack of confidence leads to a reduction in the flow of capital into Canada, further weakening the CAD.

Data consistently shows a strong correlation between political stability and the performance of the Canadian dollar. Periods of political uncertainty tend to coincide with CAD depreciation, while periods of stable government are often associated with CAD appreciation.

Increased Risk Premium

In foreign exchange markets, a risk premium is the extra return investors demand to compensate for the perceived risk of investing in a particular currency. A minority government increases the perceived risk associated with the CAD. Investors will demand a higher return to hold CAD, effectively lowering its value compared to other currencies.

This higher risk premium reflects the increased uncertainty surrounding economic policies and the potential for disruptive political events. The implications are straightforward: a higher risk premium means a lower CAD value. This aligns with established economic theories like the portfolio balance model, which links currency values directly to risk perceptions.

Understanding the Risks and Navigating the Future of the Canadian Dollar Under Minority Government

In summary, a minority government in Canada increases the vulnerability of the Canadian dollar due to heightened political instability, amplified policy uncertainty, and the subsequent impact on investor confidence and economic volatility. This leads to decreased capital inflows, a higher risk premium for the CAD, and ultimately, depreciation of the currency's value against other major currencies.

To mitigate these risks, investors might consider diversification strategies, hedging techniques using derivatives, and closely monitoring the political landscape and economic indicators. Understanding the intricacies of Canadian politics and the potential implications for the CAD is crucial for effective financial planning. Monitor the Canadian dollar's performance closely and stay informed about the impact of minority government policies on the CAD to navigate this complex economic environment. Understanding the interplay between politics and the Canadian dollar is key to making informed financial decisions in the face of potential minority government scenarios.

Featured Posts

-

Louisville Postal Service Delays Expected To End Soon

Apr 30, 2025

Louisville Postal Service Delays Expected To End Soon

Apr 30, 2025 -

Extra Inning Magic Guardians Defeat Royals In Season Opener

Apr 30, 2025

Extra Inning Magic Guardians Defeat Royals In Season Opener

Apr 30, 2025 -

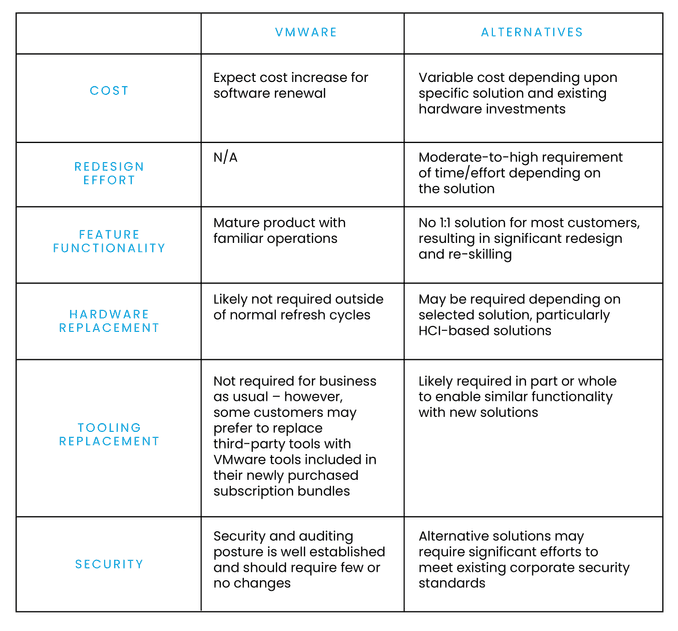

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Hike Concerns

Apr 30, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Hike Concerns

Apr 30, 2025 -

Air Ambulance Response Near Yate Recycling Centre

Apr 30, 2025

Air Ambulance Response Near Yate Recycling Centre

Apr 30, 2025 -

Nothing Phone 2 Modular Design And Its Implications

Apr 30, 2025

Nothing Phone 2 Modular Design And Its Implications

Apr 30, 2025