The Dax Index: How Bundestag Elections Shape Market Trends

Table of Contents

Pre-Election Volatility and Investor Uncertainty

The period leading up to Bundestag elections often witnesses increased volatility in the Dax Index. This heightened uncertainty stems from several factors, creating a challenging environment for investors.

-

Uncertainty surrounding potential policy changes: The election campaigns bring forth a plethora of proposed policies, many of which have significant implications for different sectors of the German economy. This uncertainty makes it difficult for investors to predict future market conditions and profits.

-

Impact of pre-election polls and campaigning on investor sentiment: Public opinion polls and the tone of political campaigning directly influence investor confidence. Negative news or a perceived lack of consensus among major parties can lead to selling pressure and a drop in the Dax. Conversely, positive messaging and strong polling numbers can boost investor optimism.

-

Increased speculation and hedging activity by investors: As the election approaches, investors engage in increased speculation and hedging strategies to protect their portfolios against potential negative market shocks. This increased trading activity can amplify volatility.

-

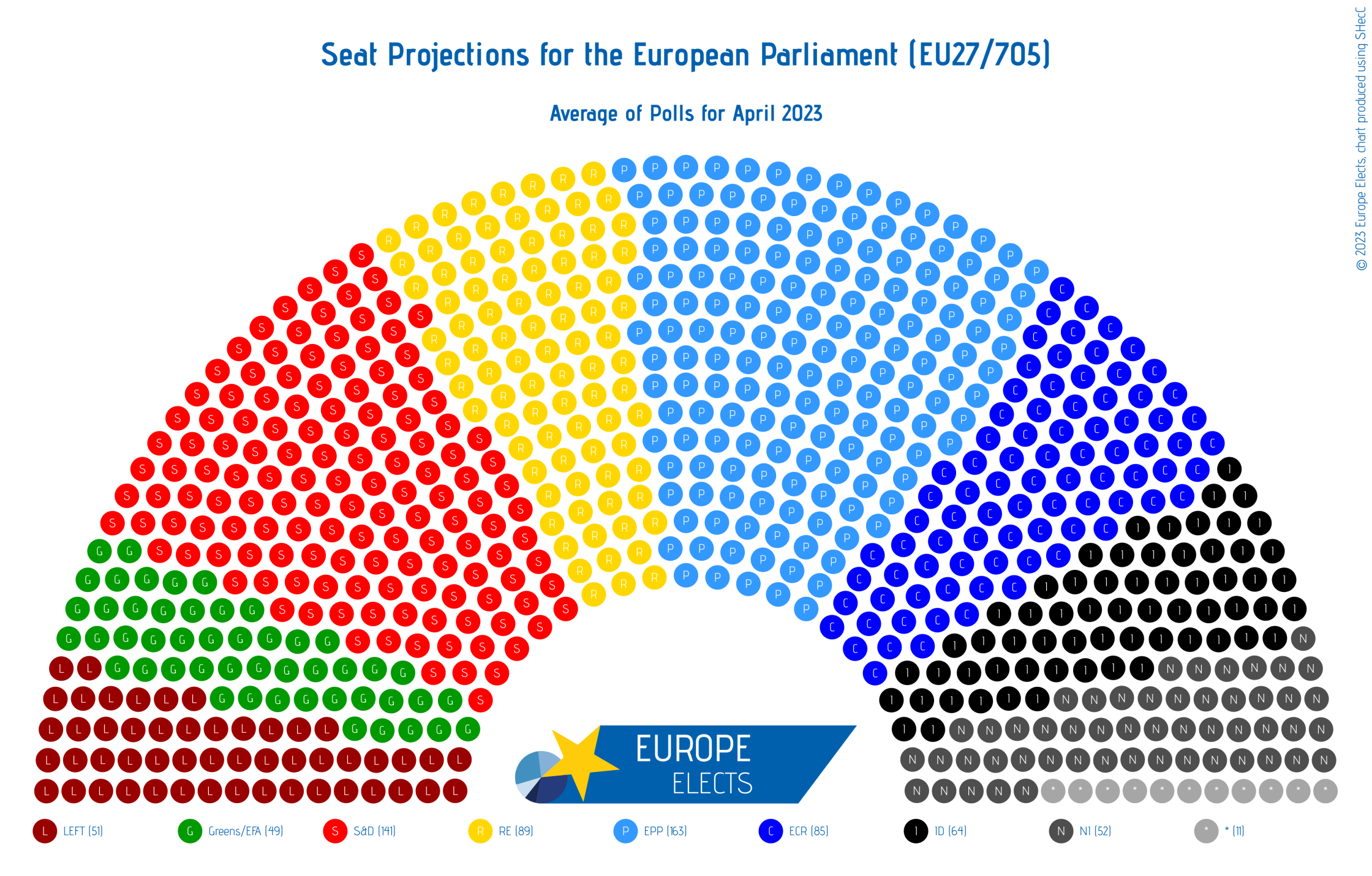

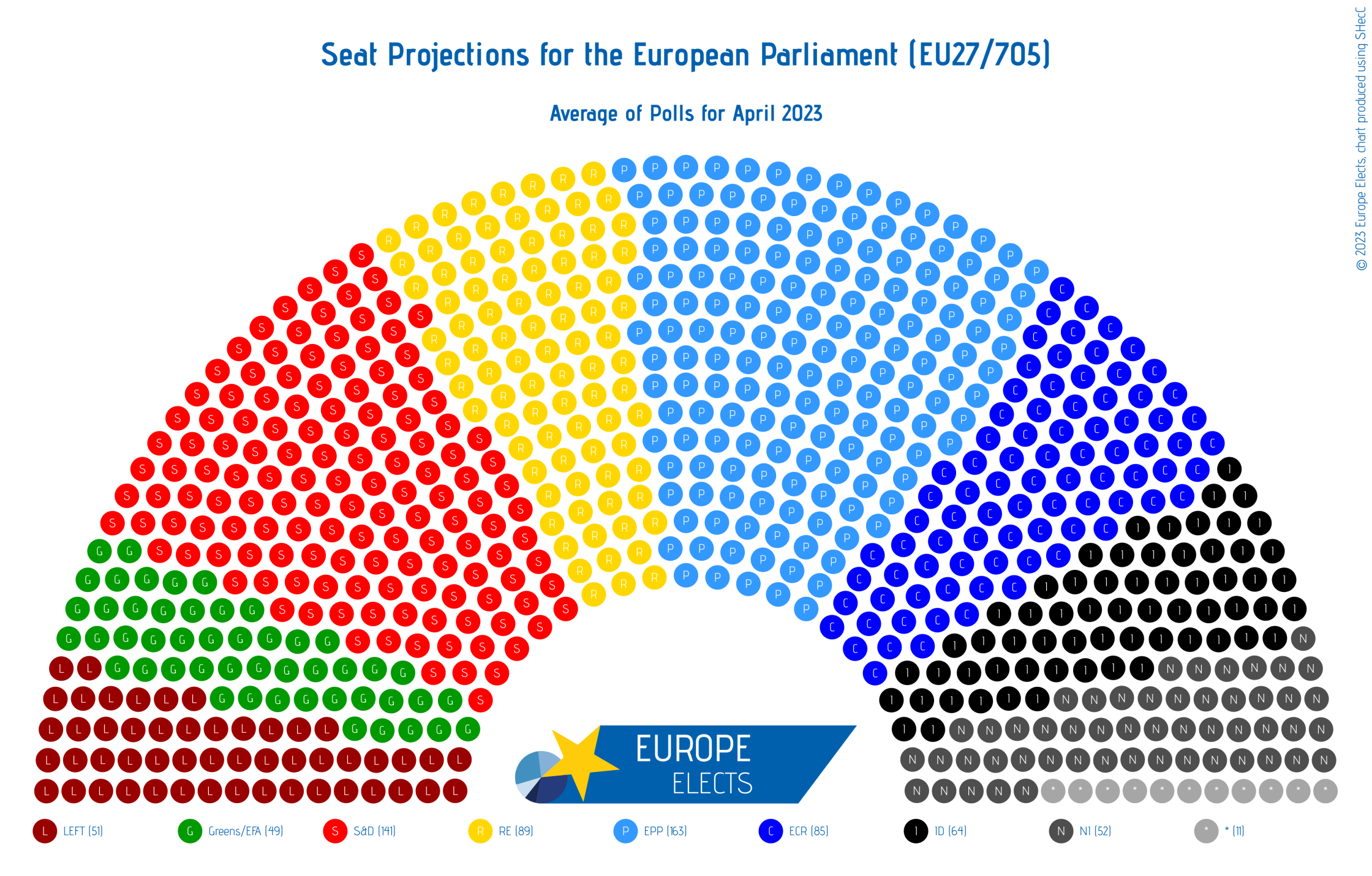

Examples of historical Dax Index fluctuations during pre-election periods: Examining past Bundestag elections reveals consistent patterns of increased Dax volatility in the months leading up to the vote. For example, the run-up to the 2017 election saw significant fluctuations as coalition possibilities and policy debates unfolded. [Insert chart or graph illustrating historical Dax volatility around election periods here].

Post-Election Market Reactions

The Dax Index's reaction to election results is often swift and significant, depending on the winning party and the subsequent coalition formation.

-

Positive market responses to pro-business or stable government outcomes: Elections resulting in a clear pro-business majority or a stable coalition government generally lead to positive market reactions. Investors tend to favor predictable policy environments and the assurance of continuity.

-

Negative market reactions to unexpected results or coalition uncertainties: Unexpected election results or difficulties in forming a stable coalition government often create uncertainty and can trigger negative market reactions. Prolonged periods of political instability can significantly impact investor confidence and lead to a decline in the Dax.

-

Case studies of past elections and their impact on the Dax: Analyzing past elections provides valuable insights. For example, [cite specific examples of elections and their immediate impact on the Dax]. These case studies highlight the importance of understanding the potential political outcomes and their economic ramifications.

-

The influence of the new government's economic policies on long-term Dax trends: The long-term trajectory of the Dax is heavily influenced by the economic policies implemented by the new government. Pro-growth policies tend to boost the Dax, while austerity measures or protectionist policies can negatively impact market performance.

Key Policy Areas Affecting the Dax Index

Several key policy areas significantly influence the Dax Index, with differing viewpoints among major political parties.

-

Fiscal policy (taxation, government spending): Changes in tax rates, government spending on infrastructure projects, and social welfare programs directly impact corporate profitability and investor sentiment.

-

Regulatory policy (environmental regulations, financial regulations): Stringent environmental regulations can impact the profitability of certain industries, while financial regulations can affect the banking sector and overall market stability.

-

Industrial policy (support for specific sectors, trade agreements): Government support for specific sectors (e.g., renewable energy, automotive) can boost their performance, while trade agreements can impact export-oriented businesses.

-

Eurozone policy (if relevant): Germany's role in the Eurozone means its domestic policies have implications for the broader European economy, indirectly impacting the Dax.

Analyzing the Impact of Specific Parties

Examining the historical performance of the Dax under different governing coalitions reveals the distinct influence of major parties: CDU/CSU, SPD, FDP, Greens, and AfD.

-

Historical data comparing Dax performance under different governments: Analyzing data from previous periods under different governments reveals correlations between political ideology and market performance. [Insert charts or graphs comparing Dax performance under different governments].

-

Specific policy initiatives and their effect on market sentiment: Specific policy initiatives undertaken by different governments have demonstrable effects on investor sentiment and Dax performance. Examples could include tax cuts, infrastructure spending, or regulatory changes.

-

Analysis of investor perceptions of different parties' economic platforms: Investors actively assess the potential economic implications of the different parties' platforms. Analyzing these perceptions provides crucial insights into market reactions to election outcomes.

Conclusion

The Dax Index is intrinsically linked to Bundestag elections. Pre-election uncertainty often leads to volatility, while post-election results significantly shape investor confidence and subsequent market trends. Understanding the specific policy positions of different parties and their potential impact on key sectors is crucial for predicting the Dax Index's trajectory. By analyzing the political landscape and understanding the economic implications of different party platforms, investors can better anticipate market fluctuations.

Call to Action: Stay informed about upcoming Bundestag elections and their potential effects on the Dax Index. By carefully analyzing the political landscape and understanding the economic implications of different party platforms, you can make better-informed decisions regarding your investments in the German stock market and effectively navigate the fluctuations of the Dax Index. Understanding the Dax Index's sensitivity to Bundestag elections is key to successful investing in the German market.

Featured Posts

-

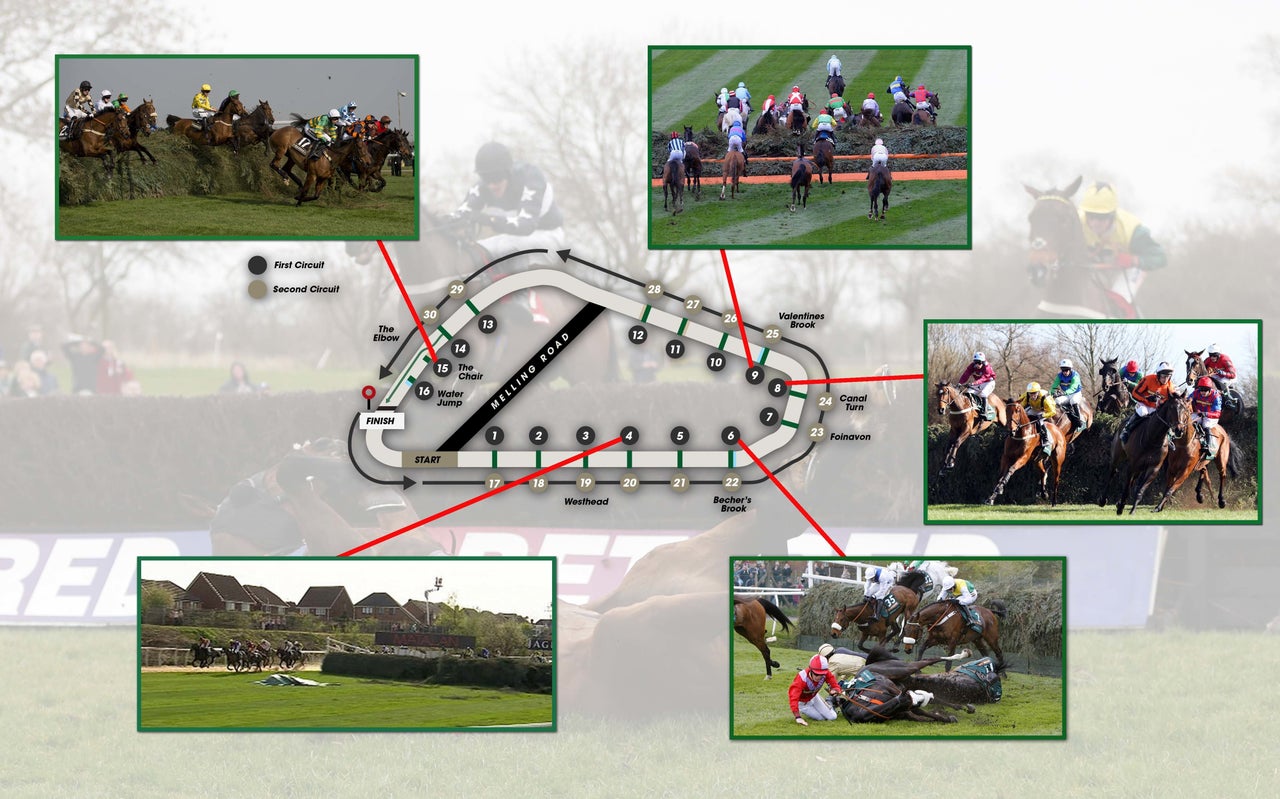

The Toll Of The Grand National Horse Deaths Before The 2025 Race

Apr 27, 2025

The Toll Of The Grand National Horse Deaths Before The 2025 Race

Apr 27, 2025 -

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025 -

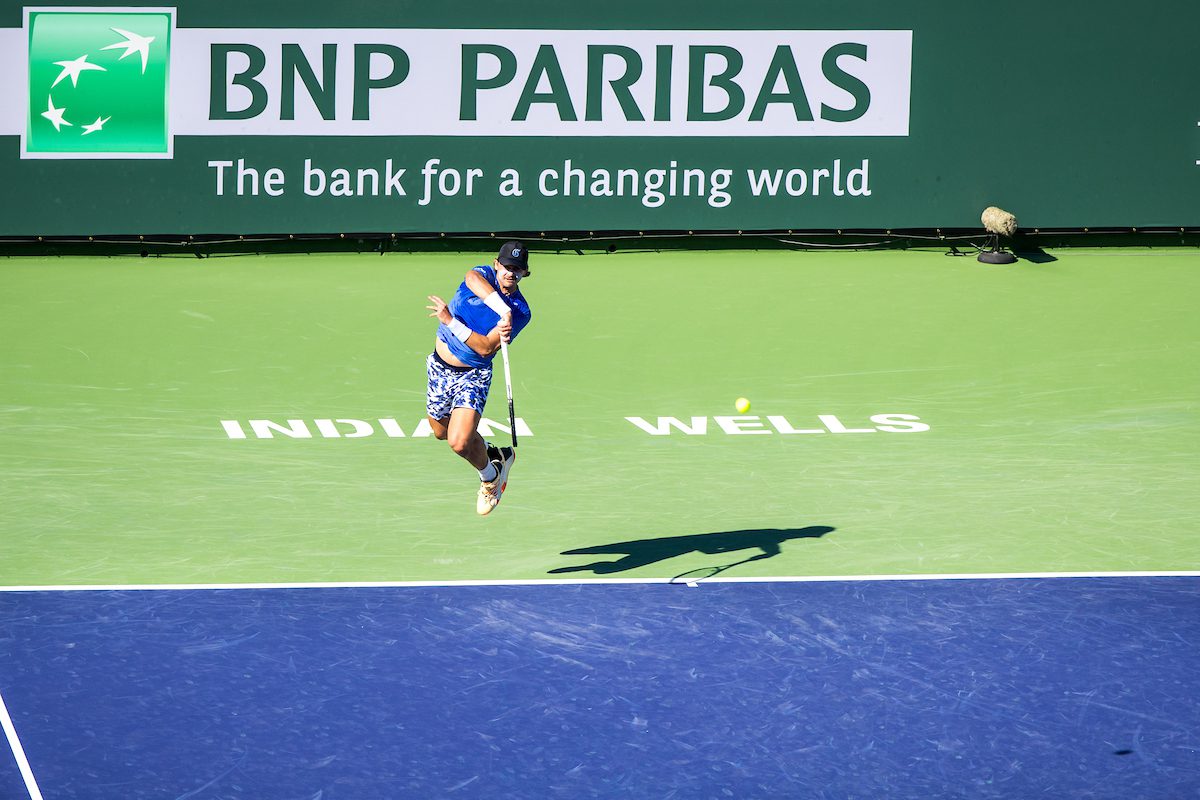

Indian Wells 2024 Eliminacion De Favorita Genera Conmocion

Apr 27, 2025

Indian Wells 2024 Eliminacion De Favorita Genera Conmocion

Apr 27, 2025 -

Free Film And Tv Streaming On Kanopy A Comprehensive List

Apr 27, 2025

Free Film And Tv Streaming On Kanopy A Comprehensive List

Apr 27, 2025 -

The Dax Index How Bundestag Elections Shape Market Trends

Apr 27, 2025

The Dax Index How Bundestag Elections Shape Market Trends

Apr 27, 2025

Latest Posts

-

From Hair To Tattoos Ariana Grandes Evolution And The Power Of Professional Support

Apr 27, 2025

From Hair To Tattoos Ariana Grandes Evolution And The Power Of Professional Support

Apr 27, 2025 -

Hair And Tattoo Transformations Lessons From Ariana Grandes Journey And The Need For Professional Guidance

Apr 27, 2025

Hair And Tattoo Transformations Lessons From Ariana Grandes Journey And The Need For Professional Guidance

Apr 27, 2025 -

Ariana Grandes Transformation A Look At Hair Tattoos And The Value Of Professional Expertise

Apr 27, 2025

Ariana Grandes Transformation A Look At Hair Tattoos And The Value Of Professional Expertise

Apr 27, 2025 -

The Psychology Behind Ariana Grandes Style Changes Professional Help And Self Discovery

Apr 27, 2025

The Psychology Behind Ariana Grandes Style Changes Professional Help And Self Discovery

Apr 27, 2025 -

Understanding Ariana Grandes Artistic Choices Hair Tattoos And Professional Assistance

Apr 27, 2025

Understanding Ariana Grandes Artistic Choices Hair Tattoos And Professional Assistance

Apr 27, 2025