The Economic Fallout: Trump's Trade Actions And America's Global Financial Standing

Table of Contents

The Tariffs and Their Ripple Effects

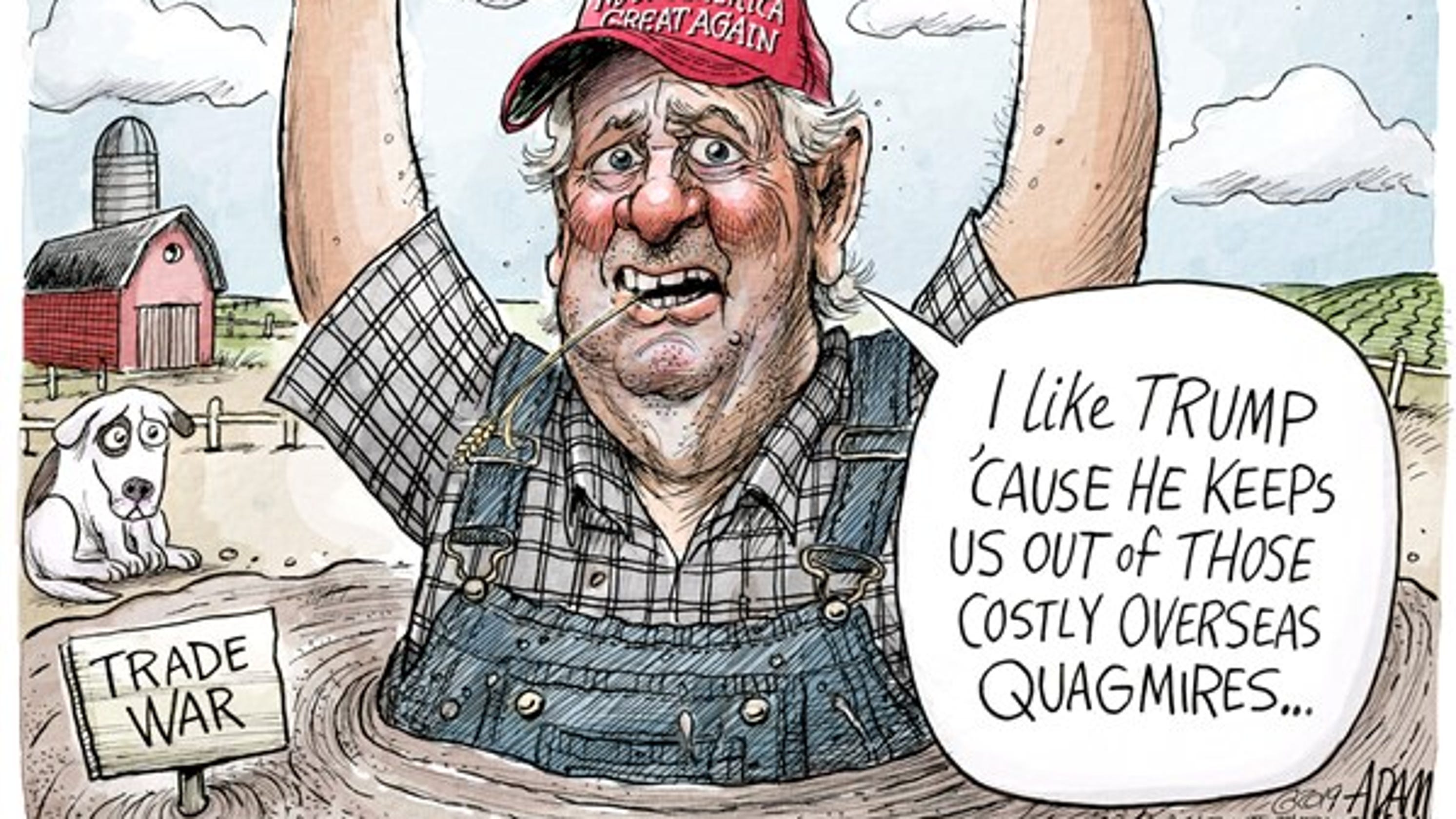

Trump's administration implemented significant tariffs on various imported goods, aiming to protect domestic industries and reduce the trade deficit. However, these actions had far-reaching and often unforeseen consequences.

Impact on Specific Industries

The impact of these tariffs varied widely across different sectors.

- Agriculture: Soybean farmers, heavily reliant on exports to China, faced significant losses when China imposed retaliatory tariffs. Exports plummeted, leading to farm bankruptcies and widespread economic hardship in rural communities.

- Manufacturing: While some sectors like steel experienced short-term gains from increased domestic demand, others faced higher input costs due to tariffs on raw materials, impacting competitiveness and profitability.

- Technology: The tech sector, heavily reliant on global supply chains, faced disruptions and increased costs due to tariffs on components and finished goods. This impacted innovation and slowed technological advancement.

The imposition of tariffs resulted in job losses in some sectors, while creating limited job growth in others – a net effect that remains a subject of ongoing debate and economic analysis. Specific examples include the struggles of Harley-Davidson, whose motorcycle exports to the EU were affected by retaliatory tariffs, and the challenges faced by US aluminum producers who saw a reduction in export markets.

Inflationary Pressures

Tariffs directly increased the cost of imported goods, leading to inflationary pressures. This mechanism is straightforward: tariffs increase the price of imports, which then translates into higher prices for consumers either directly or indirectly (as input costs increase for businesses). Examples include higher prices for consumer electronics, clothing, and automobiles. This increased inflation impacted consumer spending, potentially slowing economic growth and eroding purchasing power.

Retaliatory Tariffs and Trade Wars

Trump's tariffs triggered retaliatory measures from key trading partners like China and the European Union. These retaliatory tariffs targeted US exports, leading to a decline in US exports and exacerbating the trade war. The economic cost of these trade wars included reduced global trade, disrupted supply chains, and increased uncertainty for businesses. This uncertainty hampered investment and economic growth both domestically and internationally.

Impact on Global Supply Chains

Trump's trade actions significantly disrupted established global supply chains.

Disruptions and Relocation

Companies faced increased costs and complexities associated with navigating the fluctuating tariff landscape. This led some companies to relocate manufacturing facilities outside the US to avoid tariffs, further impacting American jobs and economic growth. The process of reshoring (bringing manufacturing back to the US) or nearshoring (relocating to nearby countries) proved to be costly and complex, slowing down the adaptation process. Examples include companies moving production to Mexico or Vietnam to avoid tariffs on goods destined for the US market.

Impact on Global Trade and Investment

The uncertainty created by unpredictable trade policies significantly decreased global trade and foreign direct investment (FDI). Statistical data from organizations like the WTO illustrate a decline in global trade volume during this period. This decline had a ripple effect, dampening global economic growth and creating a more risk-averse investment climate.

Long-Term Implications for America's Global Financial Standing

Trump's trade actions had long-lasting consequences for America's role in the global economy.

Damage to International Relations

The trade disputes strained relationships with key allies and trading partners, damaging trust and hindering international cooperation on other crucial issues. This damaged the US's reputation as a reliable and predictable trading partner, complicating future trade negotiations and undermining its soft power.

Weakening of the US Dollar?

The impact on the US dollar is a complex issue. While some argued that protectionist policies could weaken the dollar, others maintained that the overall effect was relatively muted. The relationship between trade policies and currency valuation is intricate and dependent on numerous factors. Further economic research is needed to definitively assess the long-term impact.

Loss of Global Economic Leadership?

Trump's trade actions raised concerns about a potential shift in global economic leadership. The rise of China and other economic powers, coupled with the uncertainty caused by the US's trade policies, potentially lessened America's influence on the world economic stage.

Conclusion

Trump's trade actions had a significant and multifaceted impact on America's global financial standing. The tariffs and resulting trade wars disrupted global supply chains, led to inflationary pressures, and strained relationships with key trading partners. While some sectors experienced short-term gains, the overall long-term consequences included reduced global trade, decreased investment, and potential damage to America's role in the global economy. Understanding the complexities of Trump's trade actions and America's global financial standing is crucial for navigating the future of the global economy. Continue your research and participate in the conversation to promote sound economic policy.

Featured Posts

-

Ftc Appeals Activision Blizzard Acquisition Ruling Whats Next

Apr 22, 2025

Ftc Appeals Activision Blizzard Acquisition Ruling Whats Next

Apr 22, 2025 -

China Indonesia Security Dialogue A Closer Partnership

Apr 22, 2025

China Indonesia Security Dialogue A Closer Partnership

Apr 22, 2025 -

Ftc Launches Investigation Into Open Ai And Chat Gpt

Apr 22, 2025

Ftc Launches Investigation Into Open Ai And Chat Gpt

Apr 22, 2025 -

Pope Francis Passes Away At Age 88 After Pneumonia Illness

Apr 22, 2025

Pope Francis Passes Away At Age 88 After Pneumonia Illness

Apr 22, 2025 -

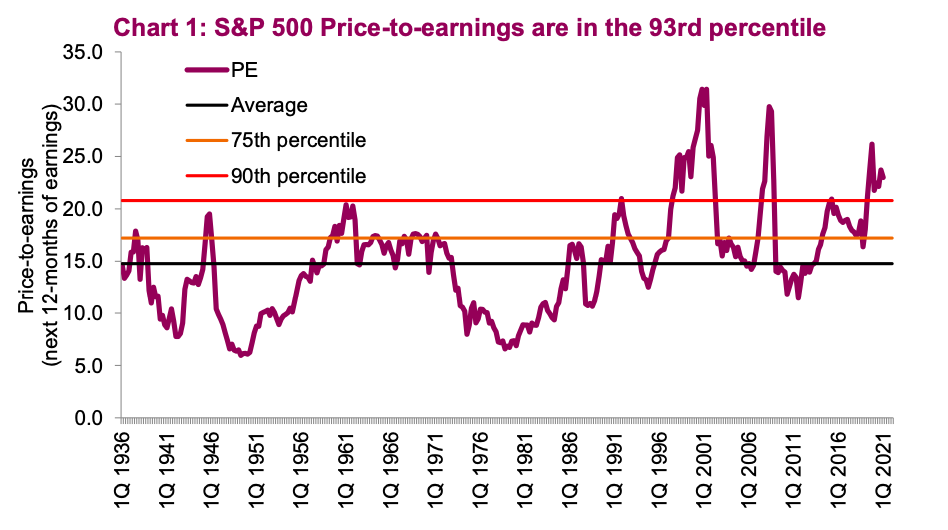

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025

Latest Posts

-

The Fate Of Trumps Tariffs Rests With This New York Court

May 12, 2025

The Fate Of Trumps Tariffs Rests With This New York Court

May 12, 2025 -

Sean Diddy Combs Trial 2016 Videos Central Role

May 12, 2025

Sean Diddy Combs Trial 2016 Videos Central Role

May 12, 2025 -

The Silent Struggle Small Businesses And The Impact Of Trumps Tariffs

May 12, 2025

The Silent Struggle Small Businesses And The Impact Of Trumps Tariffs

May 12, 2025 -

Trumps Tariffs The Impact Of A New York Court Decision

May 12, 2025

Trumps Tariffs The Impact Of A New York Court Decision

May 12, 2025 -

Trumps Tariffs A Threat To The American Small Business Landscape

May 12, 2025

Trumps Tariffs A Threat To The American Small Business Landscape

May 12, 2025