The Elon Musk Fortune: Strategies And Investments Of The World's Richest Man

Table of Contents

Early Investments and Entrepreneurial Beginnings

Elon Musk's path to becoming a billionaire wasn't a straight line; it was paved with calculated risks and a keen eye for emerging technologies. His early ventures laid the foundation for his future successes, demonstrating his ability to identify market trends and capitalize on them.

-

Zip2's Acquisition by Compaq: Musk's first major success came with Zip2, a software company providing online city guides to newspapers. Its acquisition by Compaq for $307 million in 1999 provided Musk with the crucial initial capital to fuel his future endeavors. This early success highlighted his ability to build a company from the ground up and recognize opportune exit strategies.

-

PayPal's Triumph and eBay Acquisition: Musk co-founded X.com, which later merged with Confinity to form PayPal. The online payment system revolutionized the way people conducted transactions online, making it a highly sought-after asset. Its sale to eBay for $1.5 billion in 2002 provided Musk with a massive influx of capital, further solidifying his financial base and proving his acumen in the burgeoning internet space.

-

Strategic Exit Strategies and Reinvestment: Crucially, Musk didn’t simply hoard his profits. He strategically reinvested his earnings from Zip2 and PayPal into his next big ventures: Tesla and SpaceX. This reinvestment strategy exemplifies his long-term vision and commitment to building disruptive companies.

Key takeaway: Musk's early career emphasizes the importance of identifying and capitalizing on market trends, developing strong exit strategies, and intelligently reinvesting profits to fuel future growth.

The Tesla Revolution: Disrupting the Automotive Industry

Tesla's rise isn't just a story of technological innovation; it's a testament to Musk's vision and perseverance in disrupting a deeply entrenched industry. His commitment to electric vehicles (EVs) when they were largely considered niche products was a bold, high-stakes gamble that ultimately paid off spectacularly.

-

Early Investment and Leadership: Musk's early investment and leadership in Tesla were vital to the company's survival and eventual success. He provided not only financial capital but also the strategic vision necessary to guide the company through challenging times.

-

Innovative Marketing and Branding: Tesla's marketing strategy focused on creating a premium brand image, associating EVs with cutting-edge technology, luxury, and sustainability. This approach helped elevate EVs beyond their perception as environmentally conscious but less desirable alternatives to gasoline-powered cars.

-

Government Incentives and Subsidies: While innovation played a crucial role, government incentives and subsidies for electric vehicles played a significant part in accelerating Tesla's growth and market penetration, particularly in the early stages.

Key takeaway: Tesla’s success showcases the power of disruptive innovation and the importance of a long-term vision, even when faced with significant challenges and skepticism. Musk's leadership and innovative marketing contributed to making EVs mainstream.

SpaceX and the Conquest of Space

SpaceX, Musk's aerospace manufacturer and space transportation services company, represents an even bolder gamble than Tesla. It aimed to revolutionize the space industry, drastically reducing launch costs and making space exploration more accessible.

-

Reusable Rocket Technology: SpaceX’s development of reusable rocket technology was a game-changer, drastically reducing the cost of space travel, a feat previously considered impossible by many. This innovation was central to the company's ability to secure lucrative contracts.

-

Securing Government and Private Contracts: SpaceX has secured numerous contracts with NASA and private entities, furthering its technological advancements and securing its financial stability through revenue generation.

-

Colonizing Mars: A Long-Term Vision: Musk's ambitious goal of colonizing Mars is a long-term vision that drives SpaceX's innovation and attracts significant investment. While a distant goal, this vision fuels the company's value and attracts talented individuals.

Key takeaway: SpaceX demonstrates the potential of ambitious, high-risk ventures with significant long-term payoffs. Its success hinges on technological breakthroughs, securing partnerships, and maintaining a compelling, futuristic vision.

Diversification and Other Investments

Elon Musk's investment portfolio extends beyond Tesla and SpaceX. His diversification strategy includes ventures like The Boring Company and Neuralink, showcasing his diverse interests and his understanding of the importance of spreading risk.

-

The Boring Company: This infrastructure and tunnel construction company tackles urban transportation challenges with innovative solutions. While still relatively nascent, it highlights Musk's interest in solving real-world problems through unconventional approaches.

-

Neuralink: This neurotechnology company aims to develop implantable brain-machine interfaces, an ambitious project with far-reaching potential implications for medicine and technology. Its high risk aligns with Musk's penchant for pushing technological boundaries.

Key takeaway: Musk's diversification emphasizes the importance of managing risk and maximizing potential returns by investing in various sectors with potentially high future growth.

Elon Musk's Investment Philosophy

Throughout his entrepreneurial journey, several common threads emerge in Musk's investment decisions.

-

Focus on Disruptive Technologies: Musk consistently invests in companies and technologies poised to disrupt existing industries, focusing on the future rather than incremental improvements.

-

High-Risk, High-Reward Tolerance: Musk is not afraid to take significant risks, accepting the possibility of failure for the chance of exceptional rewards.

-

Long-Term Vision and Commitment: His investments showcase a dedication to long-term goals, even when faced with considerable setbacks and short-term losses.

Key takeaway: Elon Musk's success is underpinned by a unique investment philosophy that blends a bold, future-oriented technological vision with shrewd business acumen and a high tolerance for risk.

Conclusion: Understanding the Elon Musk Fortune – A Masterclass in Strategic Investment

Elon Musk's extraordinary wealth is a result of a unique combination of factors: a keen eye for disruptive technologies, a willingness to take on significant risks, a commitment to long-term vision, and astute business strategies. His journey from early ventures like Zip2 and PayPal to the revolutionary innovations of Tesla and SpaceX serves as a compelling case study in strategic investment and entrepreneurial leadership. The diversification into ventures like The Boring Company and Neuralink further demonstrates his adaptability and understanding of risk management. Learning from the successes and challenges encountered in building the Elon Musk fortune offers valuable insights for aspiring entrepreneurs and investors alike. Explore how to build your own wealth through strategic investment by further analyzing the Elon Musk fortune and the methodologies of other successful entrepreneurs.

Featured Posts

-

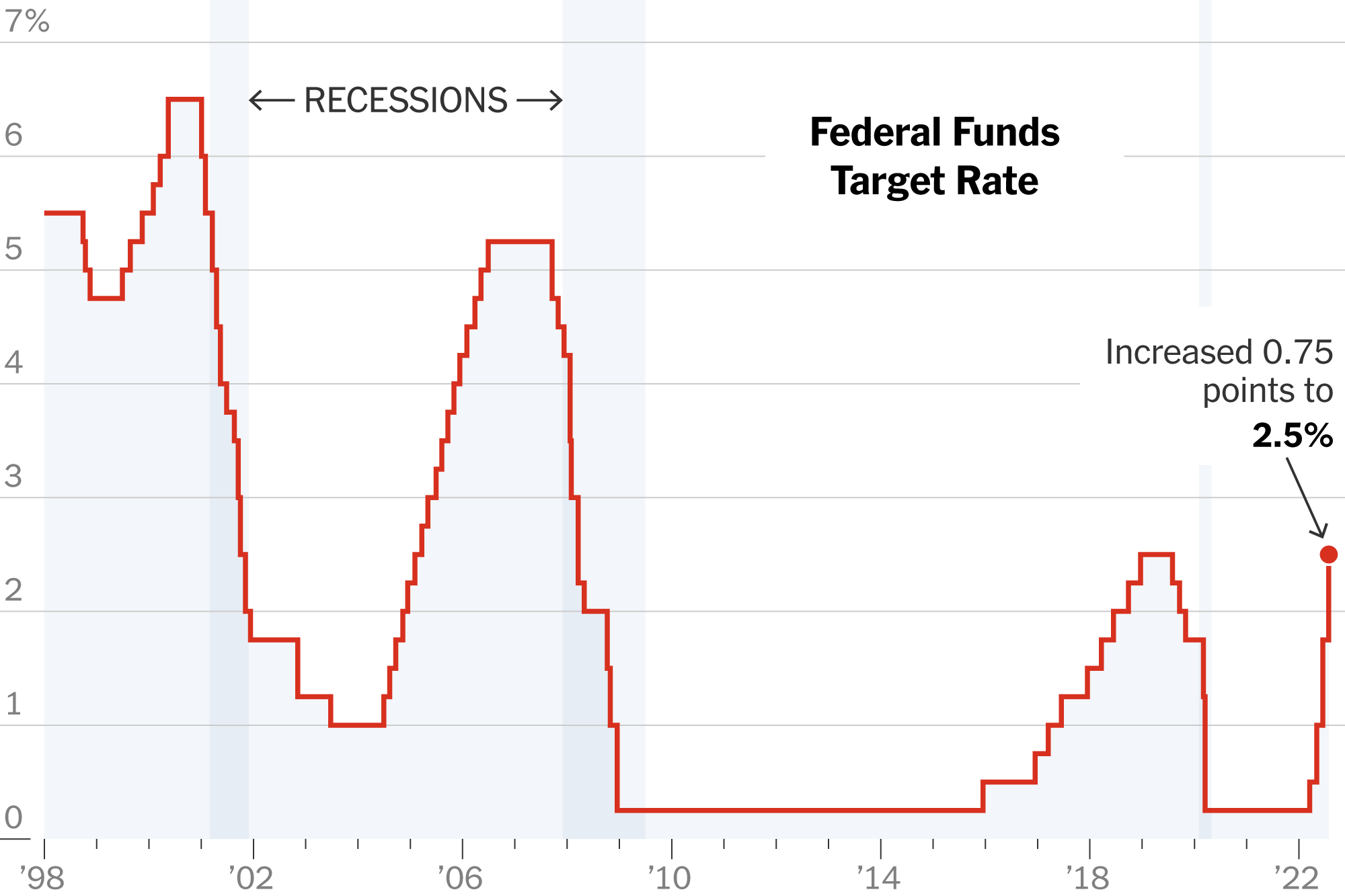

Federal Reserve Rate Decision Holding Steady Amidst Economic Uncertainty

May 10, 2025

Federal Reserve Rate Decision Holding Steady Amidst Economic Uncertainty

May 10, 2025 -

Charlz Iii I Stiven Fray Istoriya Rytsarskogo Posvyascheniya

May 10, 2025

Charlz Iii I Stiven Fray Istoriya Rytsarskogo Posvyascheniya

May 10, 2025 -

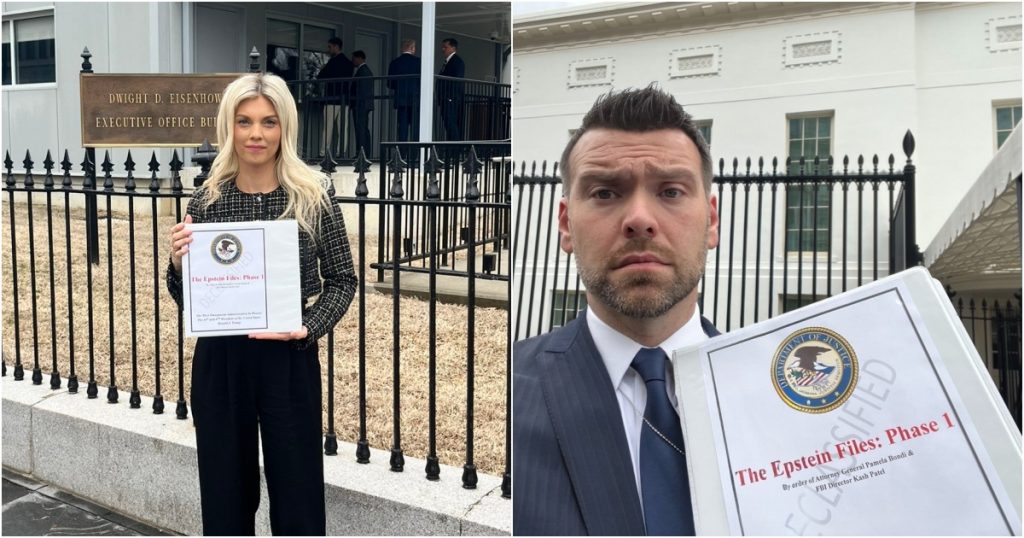

Upcoming Release Of Epstein Files Pam Bondis Statement And Timeline

May 10, 2025

Upcoming Release Of Epstein Files Pam Bondis Statement And Timeline

May 10, 2025 -

King Povernuvsya Ta Prokomentuvav Trampa I Maska

May 10, 2025

King Povernuvsya Ta Prokomentuvav Trampa I Maska

May 10, 2025 -

Toxic Chemical Residue From Ohio Train Derailment A Building Contamination Investigation

May 10, 2025

Toxic Chemical Residue From Ohio Train Derailment A Building Contamination Investigation

May 10, 2025