The GOP Tax Plan And The Deficit: Fact Vs. Fiction

Table of Contents

The 2017 Tax Cuts and Jobs Act, the centerpiece of the GOP tax plan, aimed to stimulate economic growth through significant tax cuts for corporations and individuals. Proponents argued that these cuts would spur investment, job creation, and ultimately, increased tax revenue, offsetting the initial revenue loss. However, the reality has been far more complex, leading to a contentious debate about its long-term fiscal consequences.

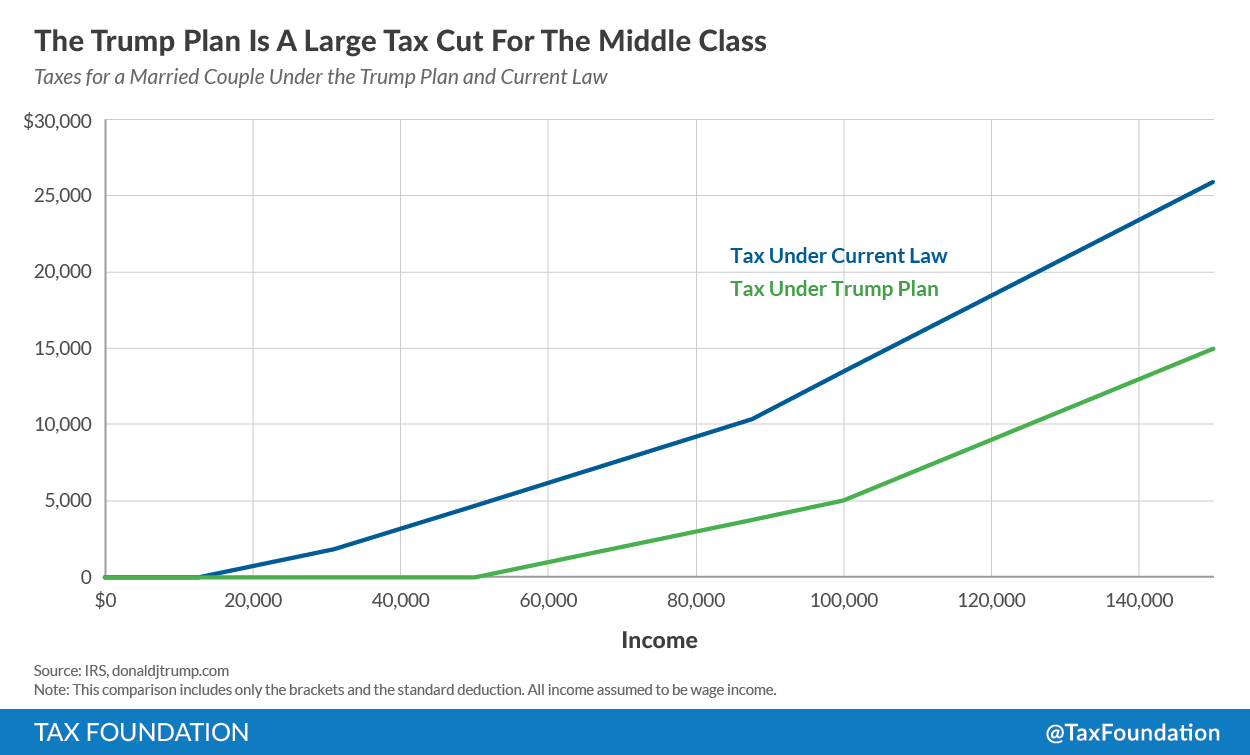

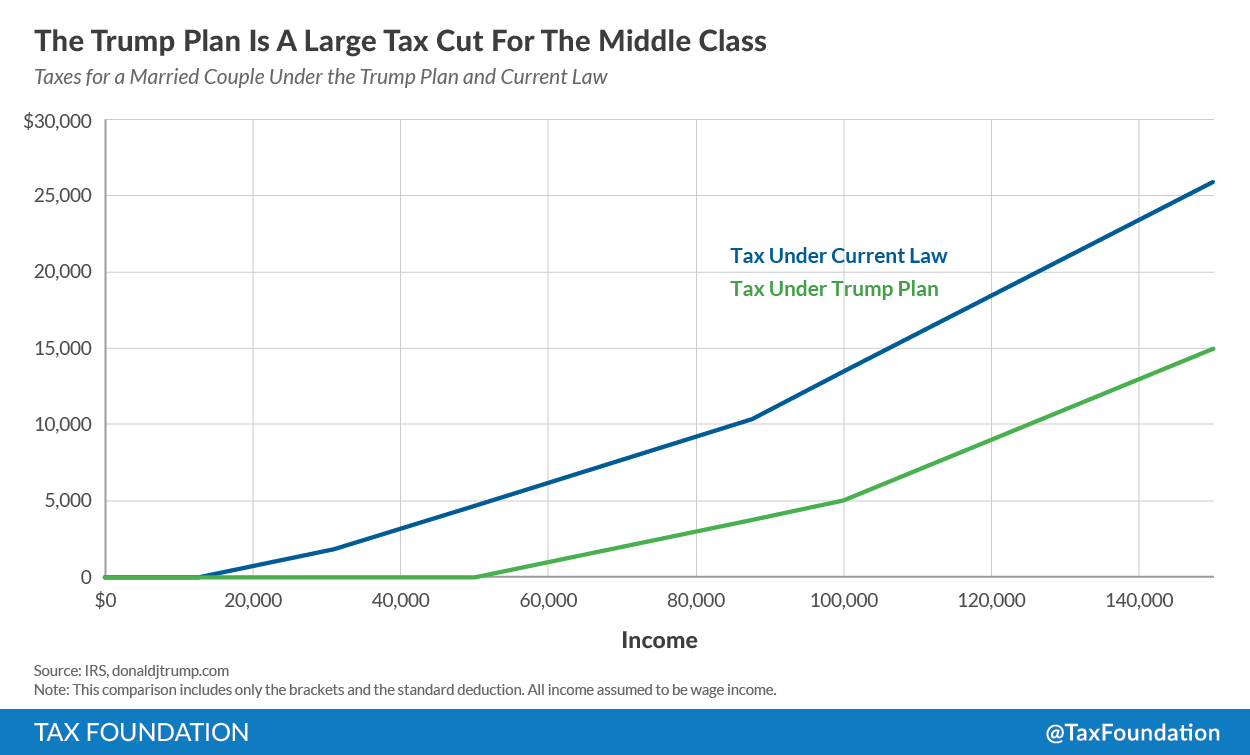

Projected Revenue Impacts of the GOP Tax Plan

Initial Projections vs. Reality

Initial projections from the Trump administration and Republican lawmakers predicted that the tax cuts would lead to a surge in economic activity, generating sufficient revenue to offset the cost of the cuts. These optimistic forecasts, however, contrasted sharply with the actual revenue collected. The Congressional Budget Office (CBO), for example, offered a more conservative estimate, anticipating a significant increase in the national debt. The difference between these initial projections and the CBO's predictions highlights the inherent uncertainties in forecasting the impact of such sweeping tax reforms.

- Impact of corporate tax cuts on revenue: The reduction in the corporate tax rate from 35% to 21% was a cornerstone of the plan. While proponents argued this would incentivize investment and boost profits, leading to higher tax revenues, the actual increase in corporate tax revenue fell short of expectations.

- Effect of individual tax cuts on revenue: Individual tax cuts, particularly the standard deduction increase and changes to tax brackets, also contributed to a reduction in overall tax revenue. While some argued this would boost consumer spending, the effect on overall revenue collection was negative.

- Unexpected economic consequences affecting revenue: Factors such as global economic slowdown and unforeseen changes in consumer behavior influenced tax revenue collection, complicating efforts to accurately assess the plan's impact.

The Role of Increased Borrowing

Analyzing the Deficit Increase

The tax cuts resulted in a significant increase in the federal budget deficit. To finance the shortfall caused by reduced tax revenues, the government had to increase its borrowing. This is illustrated clearly in the following chart (insert chart here showing increase in national debt post-2017). The rising national debt poses significant long-term challenges, including increased interest payments and potential constraints on future government spending.

- National debt increase and its implications: The national debt soared following the implementation of the GOP tax plan, reaching unprecedented levels. This increase has implications for future generations who will inherit this debt and its associated interest burden.

- Long-term sustainability of increased borrowing: The continued reliance on borrowing to finance the deficit raises concerns about the long-term sustainability of the nation's fiscal position. Without significant changes to spending or revenue policies, the debt-to-GDP ratio is projected to continue rising.

- Comparison of current debt to historical levels: The current level of national debt represents a significant departure from historical norms, raising questions about the potential economic and political consequences.

Economic Growth Arguments: Fact or Fiction?

Supply-Side Economics and the GOP Tax Plan

The GOP tax plan was largely predicated on supply-side economics, which posits that tax cuts incentivize investment and production, leading to increased economic activity and ultimately, higher tax revenues. The plan aimed to trigger this effect by lowering corporate and individual tax rates. However, the degree to which this theory materialized in practice is a subject of ongoing debate.

- Evidence for and against increased economic activity: While some indicators, such as GDP growth, showed modest increases in the short term, the long-term impact on economic growth remains uncertain and heavily debated amongst economists.

- Analysis of job creation and investment levels following the tax cuts: Job creation and investment levels did not reach the levels initially projected by supporters of the tax plan.

- Criticisms of the supply-side approach: Critics argue that supply-side economics has not consistently delivered on its promises and that the benefits of tax cuts often disproportionately accrue to the wealthy, failing to "trickle down" to the broader economy.

Alternative Analyses and Expert Opinions

Independent Assessments of the GOP Tax Plan's Impact

The impact of the GOP tax plan on the deficit has been analyzed extensively by independent organizations and economists. These assessments offer diverse perspectives, highlighting the complexity of the issue.

- Findings from the Congressional Budget Office (CBO) or similar organizations: The CBO and other independent organizations have consistently projected significant increases in the national debt as a result of the tax cuts, often differing considerably from the initial projections of the administration.

- Differing opinions among economists on the plan's long-term effects: Economists hold varying opinions on the long-term economic consequences of the tax cuts, reflecting the complexity of economic modeling and the difficulty in predicting future economic conditions.

- Links to reputable sources for readers to explore further: (Include links to CBO reports, academic papers, and articles from reputable news sources).

Conclusion

The impact of the GOP tax plan and the deficit is far more complex than initially portrayed. The initial projections of increased revenue dramatically failed to materialize, leading to a substantial increase in the national debt and raising concerns about long-term fiscal sustainability. While proponents point to modest short-term economic growth, the extent to which this offsets the revenue loss remains highly debatable. The discrepancy between initial projections and the actual outcomes emphasizes the challenges in predicting the complex interplay between tax policy and economic growth. Understanding the complex relationship between the GOP tax plan and the deficit requires ongoing analysis and informed debate. Stay informed about the ongoing impact of the GOP tax plan and the deficit by engaging with credible sources and diverse perspectives.

Featured Posts

-

Usmc Tomahawk Missile Army Explores Drone Truck Deployment

May 20, 2025

Usmc Tomahawk Missile Army Explores Drone Truck Deployment

May 20, 2025 -

Miami Hedge Fund Manager Deportation Immigration Fraud Allegations

May 20, 2025

Miami Hedge Fund Manager Deportation Immigration Fraud Allegations

May 20, 2025 -

Hollywood Shut Down Writers And Actors Strike Impacts Film And Television

May 20, 2025

Hollywood Shut Down Writers And Actors Strike Impacts Film And Television

May 20, 2025 -

Le Meurtre D Aramburu Nouvelles Revelations Sur Les Suspects D Extreme Droite

May 20, 2025

Le Meurtre D Aramburu Nouvelles Revelations Sur Les Suspects D Extreme Droite

May 20, 2025 -

Millions Could Be Owed Hmrc Refunds Check Your Payslip Now

May 20, 2025

Millions Could Be Owed Hmrc Refunds Check Your Payslip Now

May 20, 2025

Latest Posts

-

Trumps Tariffs Gretzkys Loyalty Canadas Hockey Icon Caught In A Political Crossfire

May 20, 2025

Trumps Tariffs Gretzkys Loyalty Canadas Hockey Icon Caught In A Political Crossfire

May 20, 2025 -

Paulina Gretzky Channels Iconic Soprano Style In Leopard Print Dress

May 20, 2025

Paulina Gretzky Channels Iconic Soprano Style In Leopard Print Dress

May 20, 2025 -

Paulina Gretzky As A Soprano Stunning Leopard Dress Photos

May 20, 2025

Paulina Gretzky As A Soprano Stunning Leopard Dress Photos

May 20, 2025 -

Paulina Gretzkys Leopard Dress Channels A Sopranos Elegance Photos

May 20, 2025

Paulina Gretzkys Leopard Dress Channels A Sopranos Elegance Photos

May 20, 2025 -

Paulina Gretzky Job Family And Life With Dustin Johnson

May 20, 2025

Paulina Gretzky Job Family And Life With Dustin Johnson

May 20, 2025