The Impact Of Buffett's Succession On Berkshire Hathaway's Apple Holdings

Table of Contents

Changes in Investment Philosophy Post-Buffett

The transition of leadership at Berkshire Hathaway raises important questions about the future direction of its investment philosophy. Will the new leadership team, spearheaded by Greg Abel and Ajit Jain, maintain the core tenets established by Warren Buffett, or will we witness a significant shift in investment strategy?

Departure from Value Investing Principles?

Buffett's legendary success is largely attributed to his unwavering commitment to value investing. This approach focuses on identifying undervalued companies with strong fundamentals and long-term growth potential. Will Abel and Jain adhere to this principle, or might they embrace a more growth-oriented strategy, potentially altering Berkshire Hathaway's approach to its Apple holdings?

- Analysis of Greg Abel's and Ajit Jain's investment approaches: A detailed examination of their past investment decisions and public statements will be crucial in understanding their potential future direction. Do their approaches align with Buffett's value-focused methodology, or do they suggest a possible divergence?

- Potential diversification away from Apple: Berkshire Hathaway's substantial Apple stake represents a significant concentration of assets. The new leadership might choose to diversify the portfolio, reducing the reliance on a single company, regardless of its strength.

- Comparison of past Berkshire Hathaway investment decisions with current market trends: Analyzing past investment choices alongside current market dynamics will provide insight into potential future strategies. Are there emerging trends—such as the rise of AI or the metaverse—that might influence the new leadership's investment decisions?

The Role of Technology in Berkshire Hathaway's Future

Berkshire Hathaway's significant Apple investment underscores the growing importance of technology in the company's portfolio. How will the succession affect Berkshire's overall approach to technology investments?

- Examination of Berkshire Hathaway's current technology portfolio beyond Apple: A thorough review of Berkshire's existing tech holdings will reveal its current exposure to the sector and potential preferences.

- Assessment of potential future tech investments: Considering the rapid pace of technological innovation, understanding the future investment strategy is vital. Will the new leadership aggressively pursue new tech opportunities or maintain a more cautious stance?

- Discussion of the expertise within the new leadership regarding technology: Assessing the technological expertise within the new leadership team will help predict their comfort level and strategic approach to tech investments. Do they possess the knowledge and experience to navigate the complexities of the tech landscape?

Managing Berkshire Hathaway's Apple Stake

Berkshire Hathaway's massive Apple investment is a central aspect of its portfolio. How the new leadership manages this stake will have far-reaching implications.

Maintaining or Reducing the Apple Position

One of the most critical decisions facing the new leadership will be whether to maintain, increase, or reduce Berkshire Hathaway's significant Apple holdings.

- Analysis of Apple's future growth potential: Apple's continued success is a key factor in this decision. Projections of future growth and market dominance will influence the leadership's strategy.

- Discussion of potential risks associated with maintaining such a large position in a single company: Concentrating assets in a single company, however successful, carries inherent risks. Diversification might be seen as a prudent strategy to mitigate these risks.

- Examination of alternative investment opportunities for Berkshire Hathaway: The availability of attractive alternative investment opportunities will play a significant role in determining the future size of the Apple stake. Will compelling alternatives lead to a reduction in the Apple holdings?

Active vs. Passive Management of Apple Shares

Berkshire Hathaway has traditionally taken a passive approach to its investments. However, the sheer size of its Apple stake could prompt a shift towards more active involvement.

- Exploration of the possibility of Berkshire Hathaway gaining a board seat at Apple: This would allow for greater influence on Apple's strategic direction.

- Discussion of the potential benefits and drawbacks of increased involvement: Greater involvement offers benefits but could also lead to conflicts of interest or increased scrutiny.

- Comparison with other significant Berkshire Hathaway investments: How the new leadership manages the Apple stake might be informed by their experience managing other significant holdings in the Berkshire Hathaway portfolio.

Market Reactions and Investor Sentiment

The change in leadership at Berkshire Hathaway, and its implications for the Apple investment, will undoubtedly impact market sentiment and investor behavior.

Impact on Berkshire Hathaway's Stock Price

The market's reaction to the leadership transition and its impact on the Apple stake will significantly affect Berkshire Hathaway's stock price.

- Analysis of investor confidence in the new leadership team: Investor confidence in Abel and Jain will be a crucial driver of the stock price. Will the market embrace the new leadership, or will there be uncertainty?

- Review of historical market reactions to major changes at Berkshire Hathaway: Past market reactions to significant events at Berkshire Hathaway will offer insights into potential future responses.

- Prediction of short-term and long-term effects on share price: A balanced assessment of both short-term volatility and long-term implications is necessary for a complete understanding.

Influence on Apple's Stock Price

Berkshire Hathaway's influence on Apple's stock price is undeniable. Any shift in their investment strategy could trigger a reaction in the Apple market.

- Assessment of the market's perception of Berkshire Hathaway's influence on Apple: The market's perception of Berkshire Hathaway's role will influence the impact of any changes to its holdings.

- Analysis of Apple's reliance on institutional investors like Berkshire Hathaway: Apple's dependence on large institutional investors like Berkshire Hathaway adds another layer to the analysis.

- Discussion of potential consequences of a reduction in Berkshire Hathaway's Apple holdings: A reduction in Berkshire Hathaway's stake might negatively impact Apple's stock price due to decreased investor confidence.

Conclusion

Warren Buffett's succession marks a pivotal moment for Berkshire Hathaway and its substantial investment in Apple. The future direction of this holding will significantly influence the company's overall performance and market valuation. While the new leadership team brings its own experience and expertise, the transition presents both opportunities and challenges. Understanding the potential impacts of Buffett's Succession on Berkshire Hathaway's Apple Holdings is crucial for investors and market analysts alike. Stay informed about the evolving dynamics and make well-informed decisions regarding your investment strategies. Further research into the individual investment philosophies of Greg Abel and Ajit Jain will offer valuable insights into the future of this substantial investment.

Featured Posts

-

130 Years After The Dreyfus Affair A New Push For Justice

May 24, 2025

130 Years After The Dreyfus Affair A New Push For Justice

May 24, 2025 -

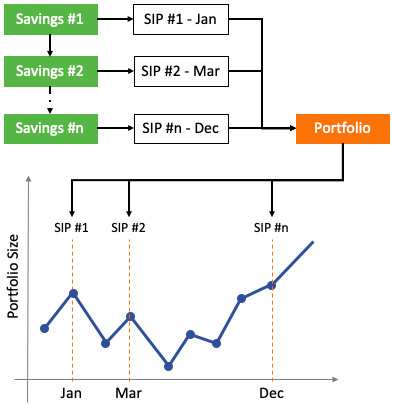

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025 -

Konchita Vurst Evrovidenie 2014 Zhizn Kaming Aut I Plany Na Buduschee

May 24, 2025

Konchita Vurst Evrovidenie 2014 Zhizn Kaming Aut I Plany Na Buduschee

May 24, 2025 -

Glastonbury 2025 Charli Xcx Neil Young And The Unmissable Acts

May 24, 2025

Glastonbury 2025 Charli Xcx Neil Young And The Unmissable Acts

May 24, 2025 -

Universals Epic 7 Billion Theme Park A New Era In The Disney Universal Rivalry

May 24, 2025

Universals Epic 7 Billion Theme Park A New Era In The Disney Universal Rivalry

May 24, 2025

Latest Posts

-

The Role Of Orbital Space Crystals In Advanced Pharmaceuticals

May 24, 2025

The Role Of Orbital Space Crystals In Advanced Pharmaceuticals

May 24, 2025 -

Improving Drug Development Through Orbital Space Crystal Research

May 24, 2025

Improving Drug Development Through Orbital Space Crystal Research

May 24, 2025 -

Space Crystals And The Future Of Pharmaceutical Innovation

May 24, 2025

Space Crystals And The Future Of Pharmaceutical Innovation

May 24, 2025 -

The Future Of Ai Open Ai And Jony Ives Collaboration

May 24, 2025

The Future Of Ai Open Ai And Jony Ives Collaboration

May 24, 2025 -

Harnessing Space Crystals For Enhanced Drug Development

May 24, 2025

Harnessing Space Crystals For Enhanced Drug Development

May 24, 2025