The Impact Of Tariff Volatility On Recordati's M&A Strategy In Italy

Table of Contents

How Tariff Uncertainty Affects Recordati's Due Diligence Process

The unpredictable nature of tariffs dramatically increases the complexity and risk associated with Recordati's due diligence process. Evaluating potential acquisitions now requires a far more intricate and extensive analysis than before.

- Increased uncertainty in forecasting future profitability: Fluctuating tariffs make predicting a target company's future revenue streams exceptionally difficult. Any assumptions made during due diligence could be rendered inaccurate by sudden tariff changes, impacting projected returns.

- Need for more sophisticated modelling: Recordati's financial analysts must develop complex models incorporating multiple tariff scenarios. This requires significant additional time and resources, extending the due diligence timeline.

- Potential delays in deal closure: The need for comprehensive tariff risk assessment can lead to protracted negotiations and extensive contingency planning. This inevitably slows down the deal closure process, potentially causing missed opportunities.

- Higher due diligence costs: The increased complexity and time investment necessitate greater expenditure on specialized expertise and sophisticated analytical tools to effectively assess tariff-related risks.

Recordati's financial analysts must now meticulously factor in various tariff scenarios, analyzing their impact on a target company’s import/export activities, pricing power, and overall profitability. This detailed analysis significantly increases the time and resources dedicated to each potential acquisition, making the process both longer and more expensive.

The Impact of Tariffs on Recordati's Valuation of Target Companies

Tariff volatility significantly influences the perceived value of potential acquisition targets for Recordati. The effect can be substantial, leading to strategic shifts in acquisition strategies.

- Reduced valuations for companies heavily reliant on imported goods or exports: Companies with substantial import or export components face inherent risk due to tariff fluctuations. This directly impacts their profitability and consequently, their valuation in the eyes of Recordati.

- Increased negotiation leverage for Recordati: This reduced valuation provides Recordati with increased leverage during negotiations. They can potentially secure acquisitions at lower prices than would have been possible in a stable tariff environment.

- Potential for strategic acquisitions of companies facing tariff-related financial distress: Companies struggling under the weight of unexpected tariff increases may become attractive acquisition targets for Recordati, presenting opportunities for strategic acquisitions at discounted prices.

- Need for creative deal structuring: To mitigate tariff risks, Recordati may need to develop creative deal structures, such as contingent payments or earn-outs, to adjust the purchase price based on future tariff developments.

Tariffs directly impact a target company's profitability, forcing Recordati to carefully adjust its offers or even to reconsider certain acquisitions altogether. The increased uncertainty demands a more nuanced and cautious valuation approach.

Strategic Adjustments in Recordati's M&A Approach to Mitigate Tariff Risks

In response to tariff volatility, Recordati is likely adapting its M&A strategy to minimize exposure to these risks. This involves several key adjustments:

- Focus on acquisitions with diversified supply chains and export markets: Diversification mitigates the impact of tariffs on any single market or supplier. Companies with less geographically concentrated operations are inherently less vulnerable.

- Prioritization of domestic Italian companies: Acquiring Italian companies significantly reduces the exposure to international tariff fluctuations, simplifying risk assessment and reducing uncertainty.

- Increased collaboration with government agencies: Engaging with Italian government agencies to lobby for favorable trade policies can help create a more stable and predictable environment for future M&A activity.

- Investing in internal capabilities: Investing in internal expertise and resources dedicated to tariff risk management and analysis can improve the accuracy of valuations and reduce unforeseen complications during the due diligence phase.

Recordati might strategically shift its focus toward sectors less susceptible to tariff fluctuations or explore joint ventures to share risks and mitigate the impact of unpredictable tariff changes.

The Broader Impact on the Italian Pharmaceutical Market

The impact of tariff volatility extends beyond Recordati, affecting the entire Italian pharmaceutical market.

- Increased competition from companies in countries with more favorable trade policies: Companies in countries with more stable tariff environments gain a competitive advantage, potentially leading to increased market share in Italy.

- Potential for consolidation within the Italian pharmaceutical sector: Smaller companies facing increased financial pressure from tariffs may be forced to merge or be acquired by larger entities like Recordati, leading to market consolidation.

- Impact on research and development investments: Reduced profitability due to tariff uncertainty might lead to decreased investment in research and development, potentially hindering innovation within the Italian pharmaceutical industry.

- Changes in drug pricing and availability: Fluctuating tariffs can directly affect the price and availability of pharmaceuticals in Italy, impacting both consumers and the healthcare system.

The consequences of tariff volatility for the Italian pharmaceutical market are multifaceted, encompassing both opportunities and significant challenges for companies across the sector.

Conclusion

This analysis clearly demonstrates that tariff volatility & Recordati M&A strategy Italy are intrinsically linked. The unpredictable nature of tariffs forces Recordati to adopt a more cautious and strategic approach to mergers and acquisitions, impacting every stage from due diligence to valuation and deal structuring. The uncertainty necessitates a sophisticated risk management strategy and a proactive engagement with the evolving regulatory landscape. To stay informed about the latest developments and their implications for Recordati's M&A activities, continue monitoring updates on Tariff Volatility & Recordati M&A Strategy Italy.

Featured Posts

-

Bakambw Yewd Bqwt Qyadt Alkwnghw Aldymqratyt Fy Tsfyat Kas Alealm 2026

Apr 30, 2025

Bakambw Yewd Bqwt Qyadt Alkwnghw Aldymqratyt Fy Tsfyat Kas Alealm 2026

Apr 30, 2025 -

Der Architekt Des Scheiterns Und Die Deutsche Koalitionsbildung Eine Analyse

Apr 30, 2025

Der Architekt Des Scheiterns Und Die Deutsche Koalitionsbildung Eine Analyse

Apr 30, 2025 -

Iopc Challenges Chris Kaba Panorama Ofcom To Investigate Broadcasting Standards

Apr 30, 2025

Iopc Challenges Chris Kaba Panorama Ofcom To Investigate Broadcasting Standards

Apr 30, 2025 -

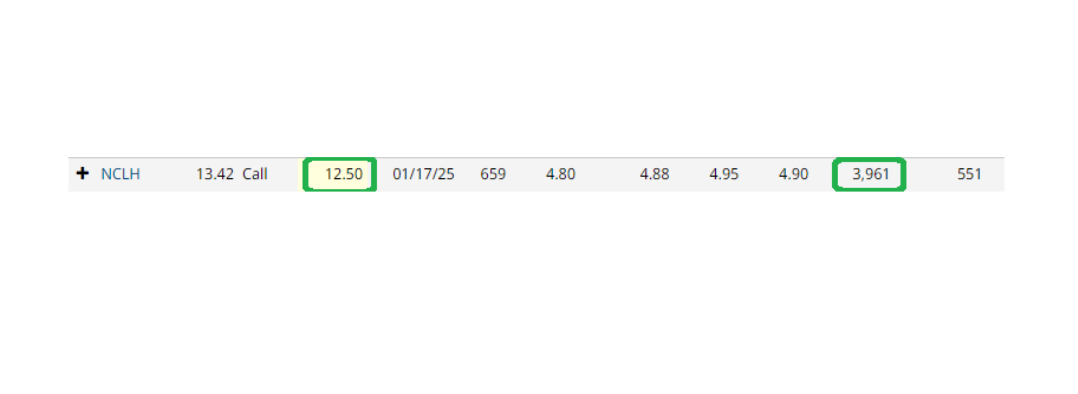

Analyzing Nclh Stock What Are Hedge Funds Doing

Apr 30, 2025

Analyzing Nclh Stock What Are Hedge Funds Doing

Apr 30, 2025 -

Noa Argamani On Times 2025 List Of 100 Most Influential People

Apr 30, 2025

Noa Argamani On Times 2025 List Of 100 Most Influential People

Apr 30, 2025