The Norwegian Sovereign Wealth Fund's Response To Trump's Trade Policies Under Nicolai Tangen

Table of Contents

The Impact of Trump's Trade Policies on Global Markets

Trump's trade policies, characterized by significant tariffs and trade wars, significantly destabilized global economic stability. His administration initiated trade disputes with numerous countries, disrupting established trade relationships and creating uncertainty for businesses worldwide. Sectors such as energy and technology, significant components of the NSWF's portfolio, were particularly affected. The consequences were far-reaching:

- Increased market volatility: Tariffs and trade disputes led to increased uncertainty, causing significant fluctuations in global stock markets.

- Uncertainty in supply chains: Disruptions to global trade flows created significant challenges for businesses reliant on complex international supply chains.

- Potential devaluation of certain currencies: Trade wars often lead to currency fluctuations as countries adjust their economic policies in response.

- Shift in global trade patterns: Trump's policies forced companies to reassess their global strategies, potentially leading to a reshaping of international trade relationships.

Keywords: Global trade, tariffs, trade wars, market volatility, economic impact, supply chain disruption.

Nicolai Tangen's Leadership and the NSWF's Investment Strategy

Nicolai Tangen, a seasoned investment professional, brought a unique perspective to managing the NSWF. His approach emphasizes long-term value creation and responsible investing. The NSWF's overall investment philosophy prioritizes:

- Diversification across asset classes: Spreading investments across various asset classes (equities, bonds, real estate, etc.) to mitigate risk.

- Focus on long-term value creation: A patient, long-term investment approach, prioritizing sustainable growth over short-term gains.

- ESG (Environmental, Social, and Governance) considerations: Integrating ESG factors into investment decisions, reflecting a commitment to responsible and sustainable investing.

- Active vs. passive investment approaches: Employing a mix of active and passive management strategies depending on the specific asset class and market conditions.

While the core investment strategy remained consistent, the specific allocation and risk management approaches likely adapted to address the increased uncertainty resulting from Trump's trade policies.

Keywords: Investment strategy, risk management, portfolio diversification, ESG investing, long-term investment, active management.

Specific Responses of the NSWF to Trump's Trade Actions

The NSWF's response to Trump's trade actions likely involved subtle yet significant adjustments to its investment portfolio. While specific details of internal strategy are not publicly available due to confidentiality reasons, we can infer likely responses:

- Adjustments to sector allocations: The fund may have reduced its exposure to sectors heavily impacted by tariffs, such as certain manufacturing or agricultural businesses.

- Geographic diversification: Investments may have been shifted away from regions experiencing significant trade disputes or economic instability.

- Increased hedging strategies: The fund might have implemented more hedging strategies to protect against currency fluctuations and other market risks associated with trade wars.

Further research into publicly available data on the NSWF's portfolio composition during this period could reveal more precise examples of these adjustments.

Keywords: Investment adjustments, sector allocation, geographic diversification, risk mitigation, hedging strategies.

The Long-Term Effects on the NSWF's Performance

The long-term impact of Trump's trade policies on the NSWF's overall returns is a complex issue requiring further analysis and data. The effectiveness of the adjustments made in response to the increased market volatility and uncertainty will only become fully apparent over time. However, the experience provides valuable lessons regarding the importance of robust risk management and adaptive investment strategies in the face of significant geopolitical uncertainty. Analyzing the NSWF's performance during and after this period will offer important insights into effective strategies for navigating global economic shocks.

Keywords: Investment performance, risk mitigation effectiveness, long-term returns, lessons learned, economic uncertainty.

Conclusion: Navigating Uncertainty: The Norwegian Sovereign Wealth Fund under Nicolai Tangen

The Norwegian Sovereign Wealth Fund, under Nicolai Tangen's leadership, successfully navigated the challenging economic landscape created by Trump's trade policies. While specific details of their response remain partially undisclosed, the fund's commitment to diversification, long-term investment, and robust risk management likely played a crucial role in mitigating potential negative impacts. The NSWF's experience highlights the importance of adaptive investment strategies in a world increasingly characterized by geopolitical uncertainty. Further research into the NSWF's investment strategies, and the impact of global economic events on sovereign wealth funds more broadly, is encouraged. Keywords: Norwegian Sovereign Wealth Fund, global investment, economic policy, risk management.

Featured Posts

-

Analyzing Nicolai Tangens Investment Strategy During The Trump Tariff Era

May 05, 2025

Analyzing Nicolai Tangens Investment Strategy During The Trump Tariff Era

May 05, 2025 -

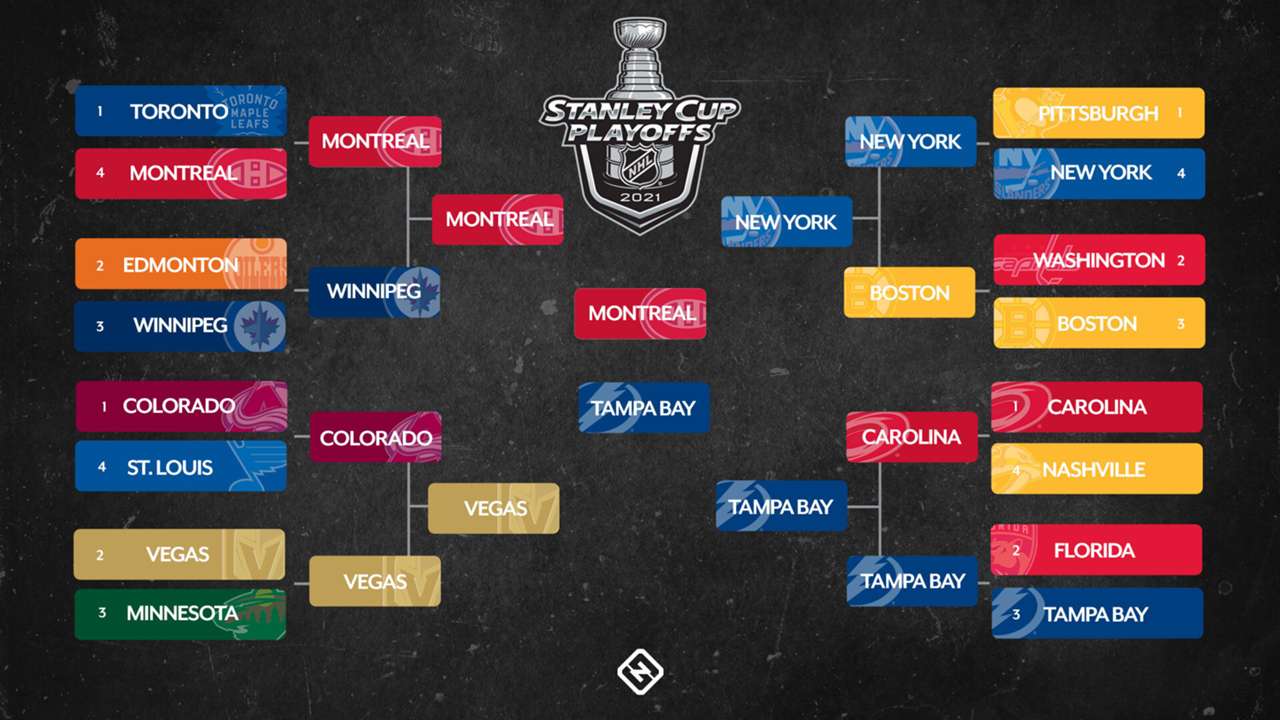

Nhl Playoffs First Round A Complete Guide

May 05, 2025

Nhl Playoffs First Round A Complete Guide

May 05, 2025 -

Gold Price Dips Two Consecutive Weekly Losses In 2025

May 05, 2025

Gold Price Dips Two Consecutive Weekly Losses In 2025

May 05, 2025 -

Capitals Announce 2025 Playoffs Initiatives A Vanda Pharmaceuticals Partnership

May 05, 2025

Capitals Announce 2025 Playoffs Initiatives A Vanda Pharmaceuticals Partnership

May 05, 2025 -

Sesame Street And Laugh In Star Ruth Buzzi Dies At 88

May 05, 2025

Sesame Street And Laugh In Star Ruth Buzzi Dies At 88

May 05, 2025

Latest Posts

-

Bryce Mitchell And Jean Silva Heated Exchange At Ufc 314 Presser

May 05, 2025

Bryce Mitchell And Jean Silva Heated Exchange At Ufc 314 Presser

May 05, 2025 -

Ufc 314 Mitchell Silva Press Conference Marked By Accusation Of Profanity

May 05, 2025

Ufc 314 Mitchell Silva Press Conference Marked By Accusation Of Profanity

May 05, 2025 -

Predicting The Ufc 314 Co Main Event Chandler Vs Pimblett Fight Analysis

May 05, 2025

Predicting The Ufc 314 Co Main Event Chandler Vs Pimblett Fight Analysis

May 05, 2025 -

Ufc 314 Co Main Event Analysis Betting Predictions For Chandler Vs Pimblett

May 05, 2025

Ufc 314 Co Main Event Analysis Betting Predictions For Chandler Vs Pimblett

May 05, 2025 -

Poirier Retires Pimbletts Reaction And Analysis

May 05, 2025

Poirier Retires Pimbletts Reaction And Analysis

May 05, 2025