The Power Of Simplicity: A Proven Dividend Investing Strategy

Table of Contents

Understanding the Fundamentals of Dividend Investing

Dividend investing involves purchasing stocks in companies that regularly pay out a portion of their profits to shareholders as dividends. This passive income stream can be a significant component of your overall investment returns. Understanding key terms is crucial for success.

Keywords: Dividend stocks, dividend yield, dividend payout ratio, dividend reinvestment plan (DRIP)

-

What are Dividends? Dividends are payments made by a company to its shareholders, typically from its profits. These payments represent a share of the company's success and are a tangible benefit of stock ownership.

-

Dividend Yield: This is the annual dividend per share divided by the stock's price. It represents the percentage return an investor receives based on the current market price. A higher yield doesn't automatically mean a better investment, as it could signal underlying financial issues. Analyzing dividend yield in conjunction with other metrics is crucial.

-

Dividend Payout Ratio: This is the percentage of a company's earnings paid out as dividends. A healthy payout ratio generally falls between 30% and 60%. A ratio too high could indicate the company is overpaying dividends and might not be sustainable in the long term. A low ratio may suggest the company is retaining a larger portion of earnings for growth.

-

Dividend Reinvestment Plans (DRIPs): Many companies offer DRIPs, allowing investors to automatically reinvest their dividends to purchase more shares. This powerful tool accelerates wealth creation through the magic of compounding.

-

Identifying Financially Healthy Companies: Before investing, research companies with a proven track record of consistent dividend payments and strong financial performance. Look for companies with stable earnings, low debt, and a history of increasing dividends. Avoid companies with erratic dividend payments or those facing significant financial challenges.

Building a Simple, Diversified Portfolio

Diversification is key to mitigating risk in any investment strategy. A diversified portfolio spreads your investments across different sectors, market caps, and asset classes, reducing your exposure to losses in any single area.

Keywords: Portfolio diversification, asset allocation, low-cost index funds, ETFs, stock picking

-

Diversification Strategies: You can diversify using various methods. Investing in a broad-market index fund or ETF is a simple approach that provides immediate diversification across hundreds or thousands of companies. Alternatively, you can build a portfolio of carefully selected individual dividend-paying stocks across different sectors (e.g., technology, healthcare, consumer staples). However, this requires more research and active management.

-

Low-Cost Index Funds and ETFs: These investment vehicles offer broad market exposure at a fraction of the cost of actively managed funds. They are a great option for beginners or those who prefer a simpler, hands-off approach.

-

Stock Picking: For a more hands-on approach, research and select individual dividend-paying stocks. Focus on companies with a history of consistent dividend increases, strong financials, and a sustainable business model. Thorough due diligence is crucial when selecting individual stocks.

-

Simplicity is Key: A simple portfolio is easier to manage and monitor. Don't overcomplicate your investment strategy. Focus on quality companies and a well-diversified approach.

Implementing a Long-Term, Buy-and-Hold Strategy

Patience and discipline are paramount in dividend investing. A long-term buy-and-hold strategy allows you to ride out market fluctuations and benefit from the power of compounding.

Keywords: Buy-and-hold strategy, long-term investing, patience, emotional discipline, market volatility

-

The Power of Compounding: Compounding is the process of earning returns on your initial investment and reinvesting those returns to generate further returns. Over time, this effect significantly accelerates your wealth growth.

-

Long-Term Perspective: Dividend investing is a long-term game. Short-term market fluctuations are inevitable, and reacting emotionally to them can lead to poor investment decisions. Focus on your long-term financial goals and stick to your plan.

-

Emotional Discipline: Market volatility is a normal part of investing. Avoid impulsive decisions based on fear or greed. Stick to your investment strategy and stay disciplined.

-

Strategic Rebalancing: Periodically review your portfolio and rebalance it to maintain your desired asset allocation. This involves selling some of your higher-performing assets and buying more of your lower-performing assets to bring your portfolio back into balance.

Reinvesting Dividends for Accelerated Growth

Reinvesting dividends is a crucial element of maximizing returns in a simple dividend investing strategy. This allows you to buy more shares, accelerating the compounding effect.

Keywords: Dividend reinvestment, compound interest, wealth building, financial freedom

-

Accelerated Growth: Reinvesting dividends, through a DRIP or manually, allows your returns to generate even more returns over time. This is the power of compound interest in action.

-

DRIPs Simplified: DRIPs automatically reinvest your dividends, eliminating the need for manual reinvestment. This is a highly convenient and effective way to accelerate your wealth-building journey.

-

Long-Term Wealth Creation: Consistent dividend reinvestment is a cornerstone of long-term wealth creation. It transforms passive income into an engine for exponential growth.

-

Financial Freedom: Through diligent reinvestment, you steadily build a portfolio that can provide a significant source of passive income, paving the way for financial freedom.

Conclusion

This article has explored a simple yet powerful dividend investing strategy that focuses on building a diversified portfolio, employing a long-term buy-and-hold approach, and diligently reinvesting dividends. By understanding the fundamentals and adhering to these principles, you can unlock the potential of passive income and achieve your financial goals.

Call to Action: Ready to harness the power of simplicity and start your journey towards financial freedom with a proven dividend investing strategy? Begin your research today and take control of your financial future! Explore different dividend-paying stocks and ETFs to discover which best fits your investment goals. Remember, a simple dividend investing strategy can be your key to long-term success.

Featured Posts

-

Solve Nyt Strands Game 376 Hints And Answers For March 14th Friday

May 10, 2025

Solve Nyt Strands Game 376 Hints And Answers For March 14th Friday

May 10, 2025 -

Fresh Evidence Emerges In Wynne Evans Strictly Scandal A Path To Clearing His Name

May 10, 2025

Fresh Evidence Emerges In Wynne Evans Strictly Scandal A Path To Clearing His Name

May 10, 2025 -

Vegas Golden Knights Win Adin Hills Stellar Performance Shuts Down Blue Jackets

May 10, 2025

Vegas Golden Knights Win Adin Hills Stellar Performance Shuts Down Blue Jackets

May 10, 2025 -

Fatal Pedestrian Accident On Elizabeth City Road Police Investigation

May 10, 2025

Fatal Pedestrian Accident On Elizabeth City Road Police Investigation

May 10, 2025 -

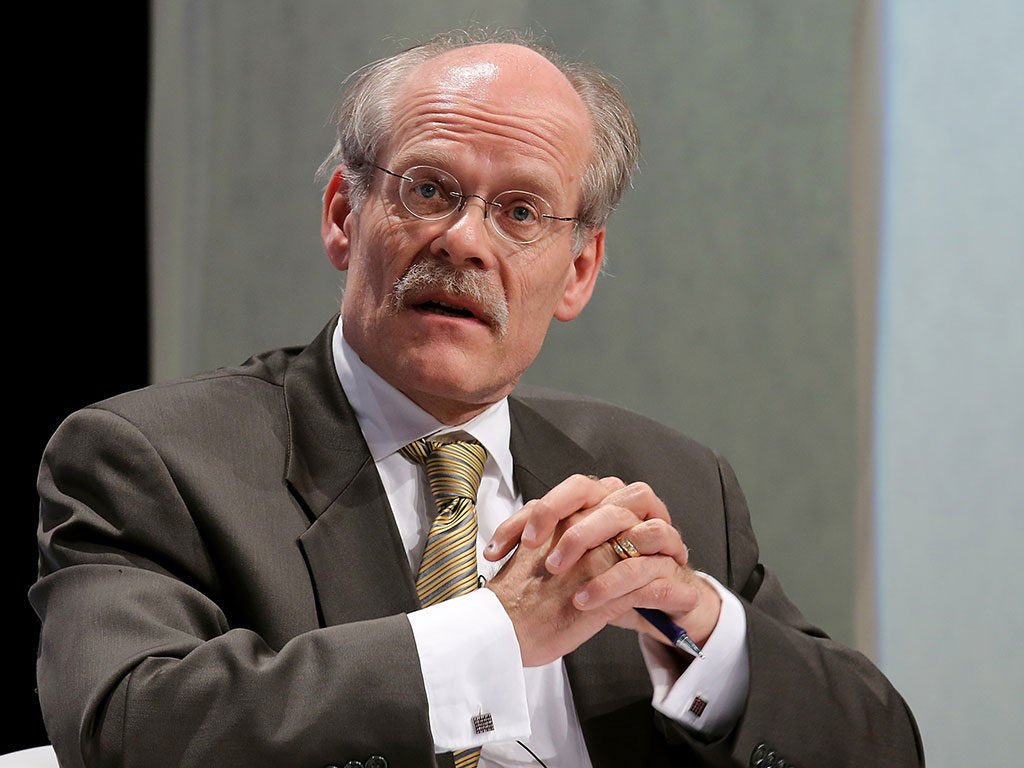

Thailands Central Bank Governor Search Economic Uncertainty And Tariffs

May 10, 2025

Thailands Central Bank Governor Search Economic Uncertainty And Tariffs

May 10, 2025