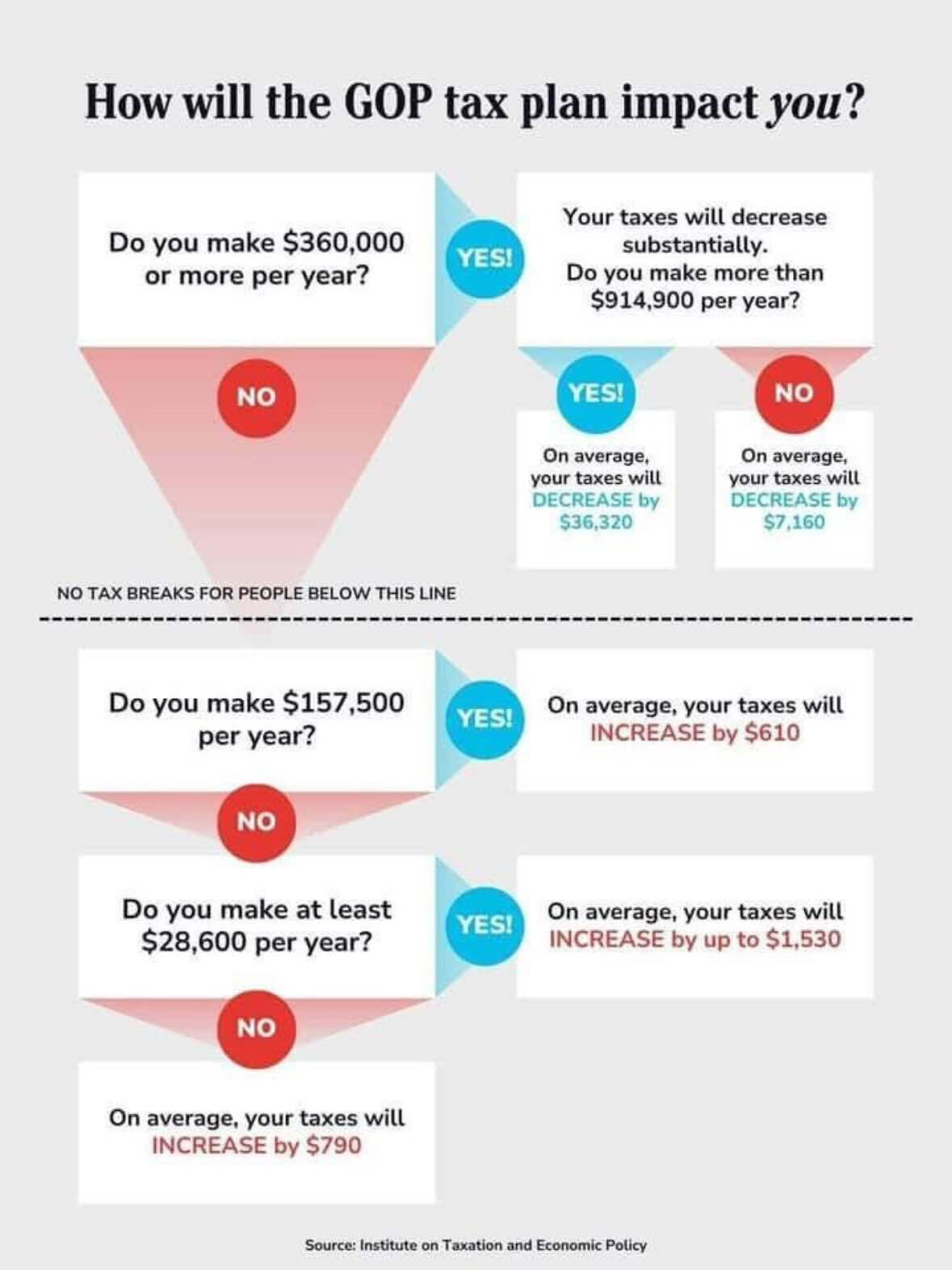

The Stark Math On The GOP Tax Plan: Deficit Impact Analysis

Table of Contents

Projected Revenue Losses Under the GOP Tax Plan

Proposed GOP tax cuts are projected to significantly decrease government revenue. Analyzing these projections requires careful consideration of the methodologies employed, primarily the difference between static and dynamic scoring. Static scoring simply estimates revenue loss based on existing tax rates and behavior, while dynamic scoring attempts to account for changes in economic activity spurred by the tax cuts. However, dynamic scoring relies on complex economic models with inherent limitations and assumptions that can significantly impact the results.

-

Specific Tax Cuts and Estimated Revenue Losses: For example, a reduction in the corporate tax rate from 21% to, say, 15%, could lead to a substantial decrease in corporate tax revenue, potentially hundreds of billions of dollars annually. Similarly, individual income tax cuts would decrease individual tax revenue. Precise figures depend heavily on the specific details of each proposal.

-

Assumptions Underlying Revenue Projections: Projections often assume specific economic growth rates triggered by the tax cuts. Higher growth rates lead to higher projected revenues, even with lower tax rates, based on the idea of increased economic activity generating more taxable income. However, these growth rates are often debated and subject to significant uncertainty.

-

Comparing Economic Models: Different economic models, each with different assumptions about economic behavior, produce varying revenue projections. This highlights the inherent uncertainty in predicting the exact fiscal impact.

-

Potential for Revenue Loss to Exceed Projections: It’s crucial to acknowledge the potential for revenue loss to significantly exceed projections. Unforeseen economic downturns or behavioral changes could exacerbate the negative impact on government revenue.

Increased Government Spending and its Impact on the Deficit

The GOP tax plan's influence on government spending is a critical factor in assessing its overall deficit impact. While the plan might not directly increase spending, indirect effects could be significant. Tax cuts, particularly for corporations, could lead to increased corporate profits, but not necessarily increased investment or job creation which would increase tax revenue. This can increase the demand for social services like unemployment benefits or food stamps and increase the deficit.

-

Potential Increases in Mandatory Spending: Increased demand for healthcare services, driven by factors such as an aging population or healthcare inflation, could significantly increase spending on programs like Medicare and Medicaid.

-

Potential Changes in Discretionary Spending: Depending on the political climate, increased deficits might lead to calls for cuts in discretionary spending such as defense, education, or infrastructure. However, the opposite could also happen with increased calls to spend more on these things.

-

Impact of Increased Interest Payments on the National Debt: Larger deficits increase the national debt, leading to higher interest payments on the accumulated debt. This further strains the budget and creates a vicious cycle, as increased interest payments reduce funds available for other priorities.

The Long-Term Implications for the National Debt

The long-term consequences of the GOP tax plan on the national debt and the debt-to-GDP ratio are particularly concerning. A rapidly growing national debt could have severe economic consequences, including higher interest rates, reduced investment, and increased economic vulnerability.

-

Projections for the National Debt Under Different Economic Scenarios: Under optimistic economic scenarios, the increase in the national debt might be less dramatic. However, under more pessimistic scenarios – particularly those involving slower economic growth or unexpected economic shocks – the debt could spiral out of control.

-

Potential Impact on Interest Rates and Borrowing Costs: A larger national debt can increase interest rates as the government competes with other borrowers for funds. This increases the cost of borrowing for both the government and the private sector, potentially slowing economic growth.

-

Consequences of an Unsustainable Debt Trajectory: An unsustainable debt trajectory could lead to a sovereign debt crisis, forcing the government to make drastic spending cuts or engage in potentially damaging inflationary monetary policy.

-

Policy Adjustments to Mitigate the Debt’s Growth: To mitigate the debt's growth, policymakers might need to implement measures such as spending cuts, tax increases, or a combination of both. However, these choices often involve politically difficult trade-offs.

Alternative Analyses and Counterarguments

It's important to consider alternative analyses and counterarguments to gain a balanced perspective on the fiscal impact of the GOP tax plan. Proponents often argue that tax cuts stimulate economic growth, leading to increased tax revenue that offsets the initial revenue loss. They often cite "supply-side economics" as the theoretical basis for this argument.

-

Key Arguments from Proponents: Supply-side economists argue that lower taxes incentivize investment, job creation, and economic growth, ultimately leading to higher tax revenues. However, the extent to which this occurs is a subject of ongoing debate.

-

Critiques of the Methodology: Critics argue that the dynamic scoring models used by proponents often rely on overly optimistic assumptions about economic growth and fail to adequately account for potential negative consequences.

-

Alternative Tax Plans with Potentially Better Fiscal Outcomes: Some alternative tax plans propose revenue-neutral tax reforms, adjusting tax rates and provisions to maintain revenue levels while potentially improving efficiency or equity.

Conclusion:

This analysis highlights the potential for significant increases in the national deficit and debt under various GOP tax plans. The uncertainties inherent in economic forecasting underscore the importance of critical evaluation. The stark math suggests a need for careful consideration of the long-term fiscal consequences. Before forming opinions, understand the stark math, analyze the deficit impact, and consider the long-term consequences of the GOP tax plan. Engage with the ongoing debate and demand transparency in fiscal policy discussions. Further research is encouraged to fully grasp the complexities involved in predicting the fiscal impact of these significant policy proposals.

Featured Posts

-

Philippines Missile Deployment In South China Sea Chinas Strong Reaction

May 20, 2025

Philippines Missile Deployment In South China Sea Chinas Strong Reaction

May 20, 2025 -

Isabelle Nogueira Promove Festival Da Cunha Shows Cultura E Vivencias Na Amazonia

May 20, 2025

Isabelle Nogueira Promove Festival Da Cunha Shows Cultura E Vivencias Na Amazonia

May 20, 2025 -

Canada Defends Tariff Policy Amidst Oxford Report Criticism

May 20, 2025

Canada Defends Tariff Policy Amidst Oxford Report Criticism

May 20, 2025 -

Biarritz Changement De Proprietaire Au Bo Cafe Une Equipe Experimentee Prend Les Renes

May 20, 2025

Biarritz Changement De Proprietaire Au Bo Cafe Une Equipe Experimentee Prend Les Renes

May 20, 2025 -

Festival Da Cunha 90 Gratuito Atracoes Confirmadas Maiara E Maraisa

May 20, 2025

Festival Da Cunha 90 Gratuito Atracoes Confirmadas Maiara E Maraisa

May 20, 2025

Latest Posts

-

Job Cuts At Abc News One Shows Fight For Survival

May 20, 2025

Job Cuts At Abc News One Shows Fight For Survival

May 20, 2025 -

Abc News Program Faces Cancellation After Mass Layoffs

May 20, 2025

Abc News Program Faces Cancellation After Mass Layoffs

May 20, 2025 -

Fate Of Abc News Show Uncertain Amidst Company Wide Layoffs

May 20, 2025

Fate Of Abc News Show Uncertain Amidst Company Wide Layoffs

May 20, 2025 -

Abc News Shows Future In Jeopardy After Staff Cuts

May 20, 2025

Abc News Shows Future In Jeopardy After Staff Cuts

May 20, 2025 -

Fate Of Abc News Show Uncertain Following Mass Layoffs

May 20, 2025

Fate Of Abc News Show Uncertain Following Mass Layoffs

May 20, 2025