The Trade War's Impact On Crypto: One Cryptocurrency That Could Thrive

Table of Contents

How Trade Wars Disrupt Traditional Markets and Investment Strategies

Trade wars create significant uncertainty in traditional markets like stocks and bonds. Imposed tariffs and retaliatory measures disrupt global supply chains, impacting businesses and investor confidence. This uncertainty leads investors to seek safer havens, often resulting in a flight to safety. Gold, for instance, typically sees increased demand during periods of geopolitical instability. The increased volatility and decreased liquidity that characterize trade wars further exacerbate the situation, making traditional investment strategies less effective.

- Increased market uncertainty leads to decreased investment. Investors become hesitant to commit capital when the future is unclear.

- Safe-haven assets like gold often see increased demand. Investors seek assets perceived as stable during times of turmoil.

- Trade wars can disrupt supply chains and impact global trade. This leads to higher prices for goods and services and potential shortages.

Cryptocurrencies as a Hedge Against Geopolitical Instability?

Given the instability caused by trade wars, some investors see cryptocurrencies as a potential hedge. The decentralized nature of cryptocurrencies, independent of traditional financial systems and government control, makes them an attractive alternative investment during times of geopolitical uncertainty. Their lack of reliance on centralized authorities offers a degree of insulation from the direct effects of trade disputes. This has led some to speculate that cryptocurrencies, particularly those emphasizing privacy, could see increased adoption as traditional markets falter.

- Decentralized nature reduces vulnerability to government actions. Cryptocurrencies are not subject to the same regulatory pressures as traditional assets.

- Potential for increased adoption as traditional markets suffer. Investors might seek alternative assets outside the immediate impact of trade wars.

- Increased demand for privacy-focused cryptocurrencies. Concerns about government surveillance and capital controls could drive adoption.

Bitcoin: A Potential Winner in the Trade War

Bitcoin, the original cryptocurrency, possesses several characteristics that make it a potential beneficiary of trade war uncertainty. Its inherent scarcity – with a maximum supply of 21 million coins – creates a deflationary pressure that can be attractive during times of inflation or currency devaluation often associated with trade wars. Its decentralized nature, discussed earlier, offers protection from government interference. Moreover, Bitcoin's established market dominance and wide adoption make it a relatively stable and liquid choice compared to many other cryptocurrencies.

- Scarcity: The limited supply of Bitcoin makes it a potentially valuable store of value in uncertain economic times.

- Decentralization: Its independence from central banks and governments is a significant advantage during periods of geopolitical risk.

- Established Market Dominance: Bitcoin's established position in the cryptocurrency market provides liquidity and relative stability.

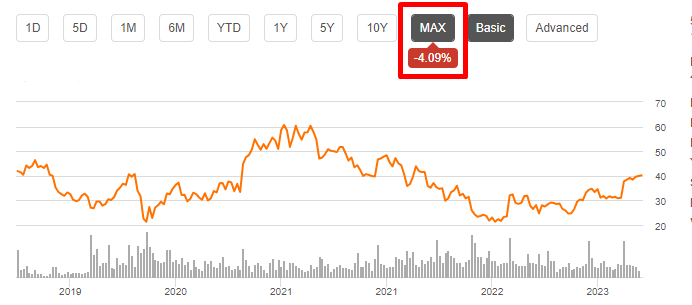

Technical Analysis Supporting Bitcoin's Potential

While detailed technical analysis requires expertise, certain indicators can be observed. For example, during past periods of global uncertainty, Bitcoin has shown a tendency to appreciate in value as investors seek alternative assets. (Note: It is crucial to consult with a financial advisor before making any investment decisions.) Analyzing historical price charts can offer further insights, although past performance is not indicative of future results. Consider consulting reputable charting tools for in-depth analysis.

Conclusion: Navigating the Trade War's Impact on Crypto – Investing in the Future

Trade wars significantly impact traditional markets, creating uncertainty and prompting investors to seek alternatives. Cryptocurrencies, particularly those with decentralized structures, offer a potential hedge against this instability. Bitcoin, with its scarcity, decentralization, and established market position, stands out as a cryptocurrency that could thrive amidst trade war uncertainty. Learn more about Bitcoin and its potential to thrive amidst global trade uncertainties. Consider adding Bitcoin to your crypto portfolio as a hedge against trade war volatility. Explore the benefits of investing in Bitcoin during this period of global uncertainty. Remember to conduct thorough research and consider consulting with a financial advisor before making any investment decisions.

Featured Posts

-

Posible Regreso De Neymar A La Seleccion Brasilena Para Enfrentar A Argentina

May 08, 2025

Posible Regreso De Neymar A La Seleccion Brasilena Para Enfrentar A Argentina

May 08, 2025 -

Lahore School Timetable Changes Psl 2024 Considerations

May 08, 2025

Lahore School Timetable Changes Psl 2024 Considerations

May 08, 2025 -

Ethereum Price Breakout Is 2 000 The Next Target

May 08, 2025

Ethereum Price Breakout Is 2 000 The Next Target

May 08, 2025 -

Uber Technologies Uber Investment Potential And Risks

May 08, 2025

Uber Technologies Uber Investment Potential And Risks

May 08, 2025 -

Brasileirao Arrascaeta Decisivo Flamengo Derrota Gremio Com Dois Gols

May 08, 2025

Brasileirao Arrascaeta Decisivo Flamengo Derrota Gremio Com Dois Gols

May 08, 2025