The Trade War's Impact: Predicting Crypto Market Winners And Losers

Table of Contents

H2: Safe-Haven Cryptos: Flourishing Amidst Uncertainty

Trade wars often create economic uncertainty, driving investors towards assets perceived as safe havens. In the crypto world, certain assets stand to benefit from this flight to safety.

H3: Bitcoin's Role as a Hedge Against Economic Instability:

Bitcoin, a decentralized digital asset, has increasingly been viewed as a hedge against economic instability. Its inherent resistance to government control and inflation makes it an attractive option during periods of geopolitical turmoil. Increased global uncertainty stemming from trade wars could significantly drive investors towards Bitcoin, seeking a store of value outside traditional financial systems.

- Historical Correlation: Historically, Bitcoin's price has shown some correlation with periods of heightened geopolitical uncertainty. For instance, during periods of heightened US-China trade tensions, we've seen increased Bitcoin adoption.

- Decentralization as a Key Factor: Bitcoin's decentralized nature makes it less susceptible to the direct impact of trade wars compared to assets tied to specific countries or economies.

H3: Altcoins Benefiting from Trade War Volatility:

While Bitcoin often leads the way, certain altcoins could also see increased demand during trade wars. Investors seeking diversification might turn to:

- Privacy Coins: Coins prioritizing user anonymity (e.g., Monero, Zcash) could see increased adoption as individuals seek to protect their assets from potential government scrutiny or economic instability.

- Stablecoins: Stablecoins pegged to fiat currencies (e.g., USD Coin, Tether) offer stability during market downturns, acting as a safe harbor in a volatile environment. Their value remains relatively stable irrespective of the trade war's impact on other crypto assets.

- Example: During previous periods of economic uncertainty, privacy coins saw a surge in trading volume as investors looked for ways to protect their assets from market fluctuations.

H2: Cryptos Vulnerable to Trade War Fallout

Not all cryptocurrencies are created equal, and some are inherently more vulnerable to the negative fallout of trade wars.

H3: Cryptos Heavily Tied to Traditional Markets:

Certain cryptocurrencies are closely linked to the performance of traditional markets. For example:

- Security Tokens: Tokens representing equity in a company are directly impacted by stock market performance. A trade war that negatively affects the stock market could also drag down the price of these security tokens.

- Exchange Tokens: Tokens native to specific cryptocurrency exchanges can suffer if trading volume declines due to decreased market confidence.

H3: Regionally-Specific Cryptos:

Cryptocurrencies with strong ties to specific countries or regions heavily impacted by trade wars are particularly susceptible.

- National Cryptocurrencies: A cryptocurrency primarily used within a nation heavily affected by trade tariffs could experience reduced adoption and price volatility.

- Geographical Dependence: Cryptos built on projects or companies operating predominantly in trade-war-affected regions are naturally vulnerable to economic downturns in those areas.

H2: Opportunities for Decentralized Finance (DeFi) in a Trade War Scenario

The decentralized finance (DeFi) ecosystem presents intriguing possibilities during trade wars.

H3: DeFi's Potential for Circumventing Traditional Financial Systems:

DeFi platforms offer an alternative to traditional banking and financial systems. This could be increasingly attractive during periods of trade war disruption, where cross-border transactions may become more difficult or expensive.

- Increased Accessibility: DeFi's open and accessible nature allows individuals in trade-war-affected regions to participate in financial activities without relying on traditional, potentially sanctioned, institutions.

- Reduced Reliance on Centralized Systems: DeFi reduces reliance on centralized intermediaries, making it more resilient to sanctions or disruptions affecting traditional financial systems.

H3: Risks Associated with DeFi During Global Uncertainty:

Despite the potential benefits, it's crucial to acknowledge the inherent risks of DeFi.

- Smart Contract Vulnerabilities: Exploits or bugs in smart contracts could be exacerbated during periods of market stress, leading to significant losses.

- Regulatory Uncertainty: The evolving regulatory landscape surrounding DeFi adds further complexity and uncertainty during times of global economic upheaval.

3. Conclusion:

In summary, while Bitcoin and certain altcoins like privacy coins and stablecoins may act as safe havens during trade wars, cryptocurrencies heavily tied to traditional markets or specific regions are likely to be more vulnerable. DeFi presents both opportunities and risks, offering potential alternatives to traditional finance but also carrying inherent vulnerabilities. The cryptocurrency market remains inherently unpredictable; however, by carefully considering these factors and conducting thorough research, you can improve your ability to navigate the impact of the trade war on your crypto portfolio. Understanding the winners and losers in the crypto market during trade wars is crucial for making informed investment decisions. Conduct your own research, stay informed about global economic events, and always practice sound risk management when navigating the complex world of cryptocurrency, especially during periods of global uncertainty. Remember that predicting future crypto market movements in relation to trade wars is challenging, and careful analysis is paramount.

Featured Posts

-

Madhyamik Pariksha Result 2025 Check Merit List Online

May 09, 2025

Madhyamik Pariksha Result 2025 Check Merit List Online

May 09, 2025 -

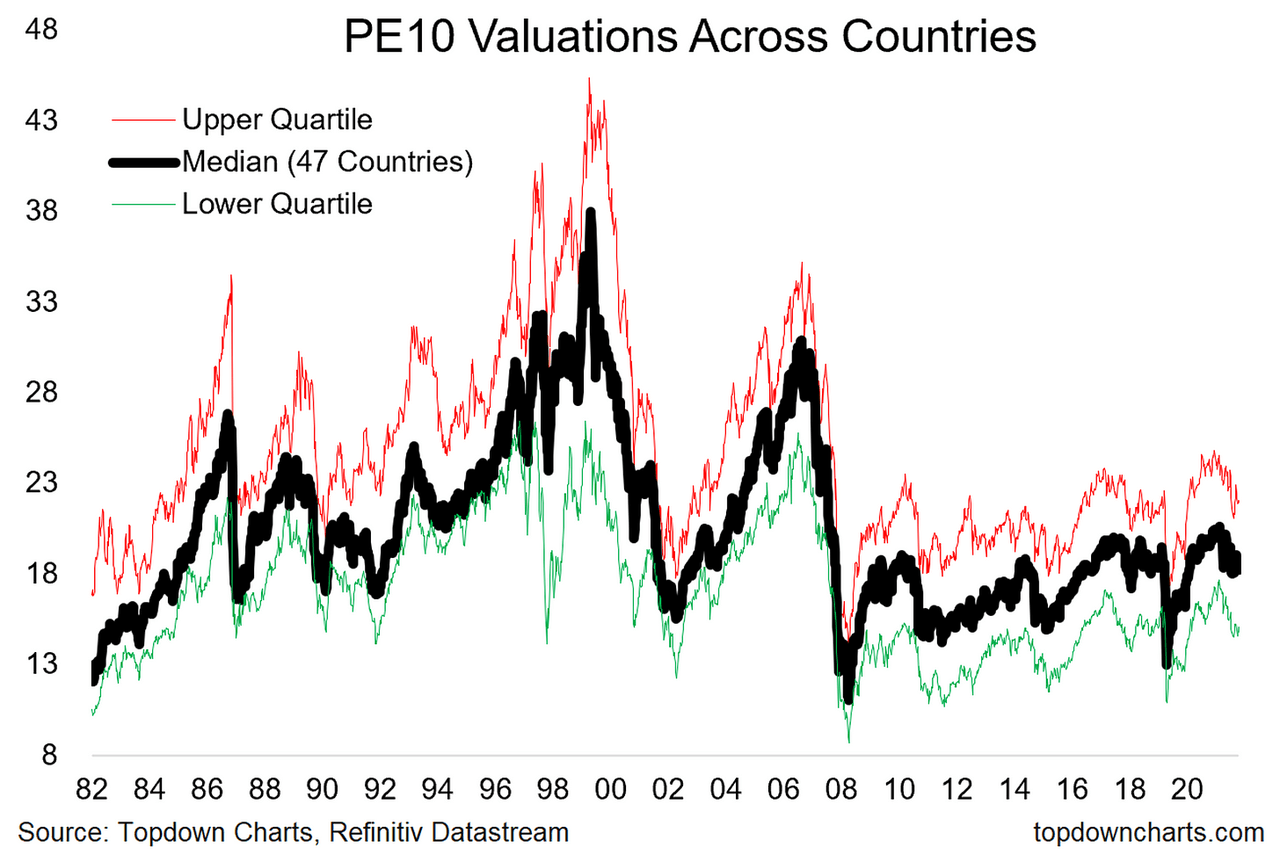

High Stock Market Valuations Bof As Analysis And Investor Reassurance

May 09, 2025

High Stock Market Valuations Bof As Analysis And Investor Reassurance

May 09, 2025 -

Farcical Misconduct Proceedings Nottingham Families Call For Delay

May 09, 2025

Farcical Misconduct Proceedings Nottingham Families Call For Delay

May 09, 2025 -

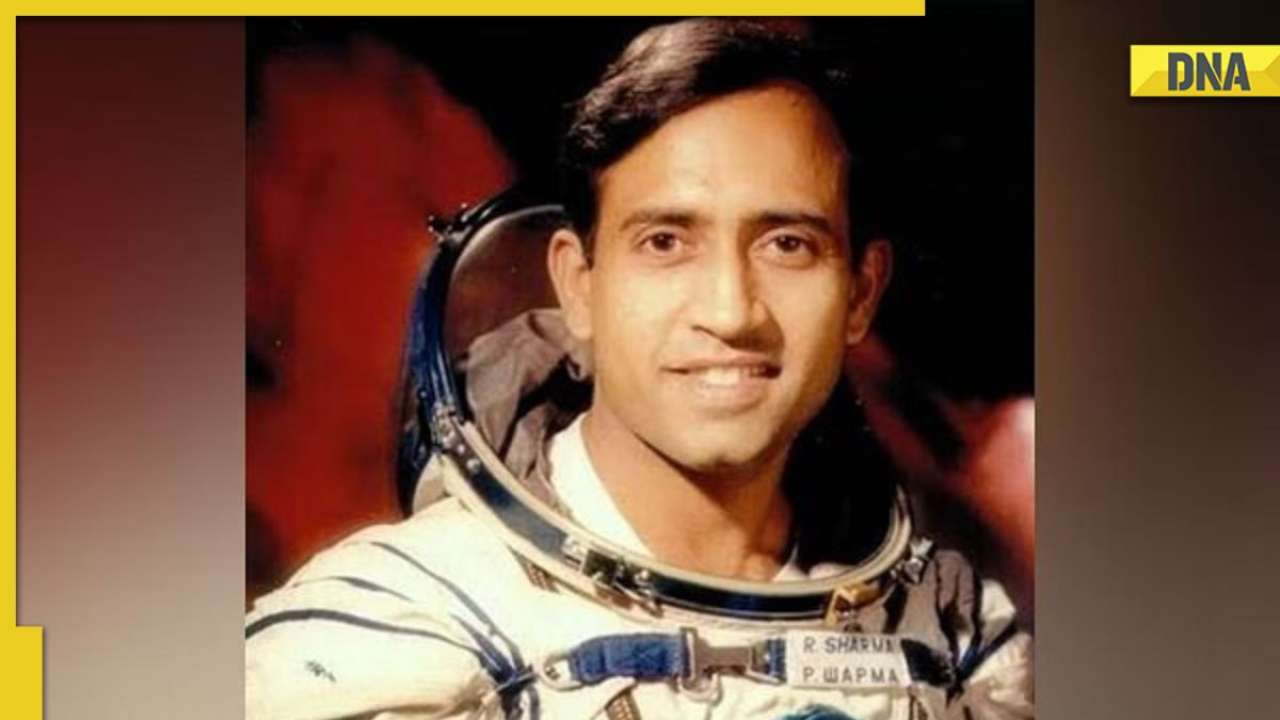

Rakesh Sharma Indias First Astronaut His Journey And Current Endeavors

May 09, 2025

Rakesh Sharma Indias First Astronaut His Journey And Current Endeavors

May 09, 2025 -

Attorney General Pam Bondi And The Epstein Files Controversy

May 09, 2025

Attorney General Pam Bondi And The Epstein Files Controversy

May 09, 2025