The Uncertain Future Of Trump's Tax Reform

Table of Contents

Economic Impact and Projected Deficits

Trump's Tax Reform significantly lowered the corporate tax rate from 35% to 21%, while also making adjustments to individual tax brackets and standard deductions. Proponents argued this would stimulate economic growth through increased investment and job creation. However, critics warned of potentially unsustainable increases in the national debt. The projected long-term effects remain a point of contention.

- Increased National Debt: The Congressional Budget Office (CBO) projected significant increases in the national debt due to the tax cuts, with estimates reaching trillions of dollars over the next decade. These figures are crucial for understanding the long-term fiscal implications of Trump's Tax Reform.

- GDP Growth: While GDP growth did increase in the years immediately following the tax cuts, determining a direct causal link remains difficult. Economists offer differing opinions on the extent to which the tax cuts contributed to this growth, with some attributing it to other factors like existing economic momentum. Analyzing pre- and post-reform GDP growth data is crucial to reach a comprehensive conclusion.

- Differing Economic Viewpoints: The effectiveness of Trump's Tax Reform in stimulating economic growth remains a subject of ongoing debate among economists. Some argue the cuts spurred investment and job creation, leading to increased productivity. Others contend the benefits were minimal, largely benefiting corporations and the wealthy, and ultimately exacerbating income inequality.

Political Landscape and Potential Rollbacks

The political landscape surrounding Trump's Tax Reform is highly dynamic. Changes in presidential administrations and shifts in congressional power could significantly impact the future of the tax code. Potential scenarios range from minor adjustments to complete repeal of certain provisions.

- Political Statements: Statements from current and future political leaders regarding tax reform will play a crucial role in shaping the future of Trump's Tax Reform. Different political parties hold varying perspectives on taxation, influencing the likelihood of adjustments or complete overhauls.

- Legislative Challenges: The current tax code faces potential legislative challenges, with ongoing debates about tax fairness and the need for revenue generation. These debates could lead to amendments or a complete restructuring of the tax system.

- Public Opinion: Public opinion polls consistently reveal a divided populace regarding Trump's Tax Reform. Understanding public sentiment on taxation is essential to predicting future legislative changes.

Legal Challenges and Ongoing Litigation

Trump's Tax Reform has faced several legal challenges, questioning the constitutionality of certain provisions. The outcomes of these legal battles could have significant implications for the long-term effectiveness and implementation of the tax law.

- Relevant Court Cases: A detailed examination of ongoing court cases is crucial to understanding the potential ramifications. Successful challenges could lead to the invalidation or modification of specific parts of the tax code.

- Potential Outcomes: The potential outcomes of these legal battles range from minor adjustments to significant alterations or even the partial or full repeal of certain tax provisions. This uncertainty significantly impacts the long-term viability of the current tax structure.

- Expert Opinions: Legal experts offer varying opinions on the likelihood of significant changes to Trump's Tax Reform resulting from ongoing litigation. Understanding these expert analyses provides further clarity on the potential future of the tax law.

Long-Term Sustainability and Future Projections

The long-term sustainability of Trump's Tax Reform hinges on several factors, including projected budget deficits and economic forecasts. Addressing these concerns requires careful consideration of future tax policy adjustments.

- Long-Term Effects Models: Economic models forecasting the long-term effects of Trump's Tax Reform provide valuable insights into the sustainability of the current system. These models incorporate various economic scenarios and project potential outcomes under different assumptions.

- Budgetary Adjustments: To address concerns about the increasing national debt, future adjustments to the tax code might be necessary. This could involve raising taxes in certain areas, introducing new taxes, or significantly altering existing provisions.

- Alternative Tax Reform Proposals: Alternative tax reform proposals are regularly debated, offering different approaches to tax policy. Analyzing these proposals helps understand the potential direction of future tax legislation and the eventual replacement or modification of Trump's Tax Reform.

The Uncertain Future of Trump's Tax Reform – A Call to Action

The future of Trump's Tax Reform remains highly uncertain. The economic impact, political landscape, legal challenges, and long-term sustainability all contribute to this uncertainty. Understanding these factors is crucial for informed participation in the ongoing debate about tax policy. Stay informed about upcoming legislative changes and engage in the public discourse to shape the future of tax policy in the United States. For further reading and resources on tax policy, visit [link to relevant resources].

Featured Posts

-

Tikkie Gebruiken Een Gids Voor Nederlandse Bankieren

May 22, 2025

Tikkie Gebruiken Een Gids Voor Nederlandse Bankieren

May 22, 2025 -

Gender Reveal Peppa Pigs Parents Announce Babys Sex

May 22, 2025

Gender Reveal Peppa Pigs Parents Announce Babys Sex

May 22, 2025 -

The Missing Girl Hoax A Viral Reddit Storys Unexpected Journey To The Big Screen

May 22, 2025

The Missing Girl Hoax A Viral Reddit Storys Unexpected Journey To The Big Screen

May 22, 2025 -

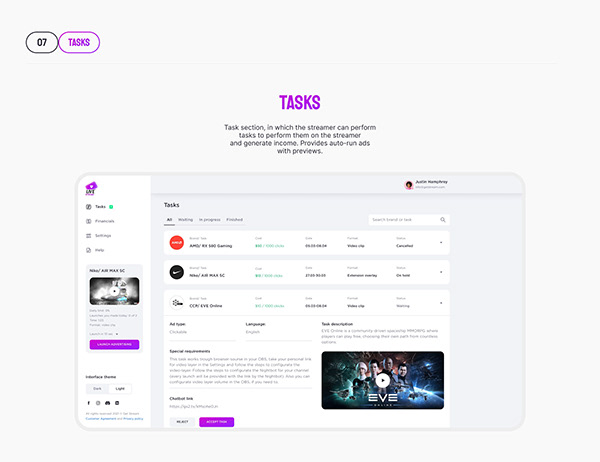

How Streamer Monetization Impacts The Viewer Experience

May 22, 2025

How Streamer Monetization Impacts The Viewer Experience

May 22, 2025 -

Project Finance Secured Freepoint Eco Systems And Ing Collaboration

May 22, 2025

Project Finance Secured Freepoint Eco Systems And Ing Collaboration

May 22, 2025

Latest Posts

-

Why Did Core Weave Inc Crwv Stock Climb On Tuesday A Detailed Analysis

May 22, 2025

Why Did Core Weave Inc Crwv Stock Climb On Tuesday A Detailed Analysis

May 22, 2025 -

Core Weave Crwv Stock Market Performance Explaining Todays Surge

May 22, 2025

Core Weave Crwv Stock Market Performance Explaining Todays Surge

May 22, 2025 -

Understanding Core Weaves Crwv Significant Stock Increase Last Week

May 22, 2025

Understanding Core Weaves Crwv Significant Stock Increase Last Week

May 22, 2025 -

Understanding Core Weave Inc S Crwv Tuesday Stock Price Increase

May 22, 2025

Understanding Core Weave Inc S Crwv Tuesday Stock Price Increase

May 22, 2025 -

Core Weave Crwv Stock Jump Understanding Wednesdays Market Movement

May 22, 2025

Core Weave Crwv Stock Jump Understanding Wednesdays Market Movement

May 22, 2025