The Unexpected Canadian Heir To Warren Buffett's Legacy

Table of Contents

The Canadian Investor's Background and Early Influences

Our protagonist, Anya Sharma, hails from a small town in Alberta, Canada. Her early life wasn't steeped in Wall Street glamour; rather, it was grounded in the practical values of hard work and financial prudence instilled by her parents, both small business owners. This upbringing fostered a keen understanding of the realities of the Canadian economy and the importance of responsible financial management.

- Early exposure to finance: Anya's early involvement in her family's businesses provided invaluable hands-on experience, exposing her to budgeting, financial planning, and the intricacies of running a profitable enterprise. These formative years were crucial in shaping her future investment philosophy.

- Mentorship and influence: Although she didn't have direct mentorship from a prominent figure in the finance world, Anya's fascination with Warren Buffett and the principles of value investing guided her approach. She devoured books on Benjamin Graham and meticulously studied Berkshire Hathaway's investment portfolio.

- Formative experiences: Early investment successes and setbacks in the Canadian stock market taught Anya the importance of patience, thorough due diligence, and risk management. These lessons, learned firsthand, became the cornerstone of her investment strategy. She learned to identify undervalued assets within the Canadian economy, a skill that would later define her success.

Echoes of Buffett's Value Investing Philosophy

Anya Sharma's investment strategy is a compelling case study in the enduring power of value investing. This approach, popularized by Warren Buffett and rooted in the teachings of Benjamin Graham, focuses on identifying undervalued companies with strong fundamentals and holding them for the long term.

- Intrinsic value focus: Like Buffett, Anya meticulously analyzes the intrinsic value of a company, going beyond market sentiment to assess its underlying worth. This process involves thorough due diligence, analyzing financial statements, and understanding the company’s competitive landscape.

- Long-term perspective: Anya embraces the long-term perspective that is characteristic of Buffett's investment style, avoiding short-term market fluctuations and focusing on the company’s long-term growth potential. Her portfolio showcases holdings held for several years, mirroring Buffett's patient investment approach.

- Successful investments: Anya's portfolio boasts successful investments in several Canadian companies whose stock prices significantly outperformed the market over the long term. These investments showcase her ability to identify undervalued gems within the Canadian stock market, similar to Buffett's uncanny knack for spotting underappreciated companies in the US and beyond. Examples include investments in Canadian infrastructure and renewable energy companies, demonstrating her keen eye for long-term growth sectors.

Unique Canadian Perspectives and Market Opportunities

Anya's Canadian background significantly influences her investment approach. She leverages her deep understanding of the Canadian economy, its regulatory environment, and the unique opportunities within the Canadian stock market.

- Canadian market expertise: Anya demonstrates a profound understanding of the Canadian business landscape, identifying promising companies often overlooked by international investors. She specifically focuses on sectors such as technology, healthcare, and resource extraction that benefit from the Canadian economic context.

- North American and Global Diversification: While specializing in the Canadian market, Anya doesn't limit herself geographically. Her portfolio includes a diversified range of North American and even global investments, balancing her specialization with responsible diversification to mitigate risk.

- Economic trend analysis: Anya's approach isn't simply about identifying individual companies. She analyses larger economic trends within Canada and globally, positioning her investments strategically to capitalize on long-term growth trajectories. This macroeconomic view complements her micro-level analysis of individual firms.

Lessons Learned and Future Implications

Anya Sharma's success story offers valuable lessons for aspiring investors:

- Patience and discipline: Long-term investing requires patience and discipline, resisting the urge to react to short-term market volatility.

- Thorough due diligence: Meticulous research and a deep understanding of a company's fundamentals are paramount.

- Diversification: Spread your investments across various sectors and geographies to minimize risk.

Anya's future focus likely involves navigating the evolving landscape of the Canadian and global economies, adapting her strategy to new market conditions, and continuing to identify undervalued growth opportunities. Her success highlights the potential for individuals to achieve remarkable financial success by focusing on long-term value creation, mirroring the approach of legendary investors like Warren Buffett, but with a distinctly Canadian flavor. Her impact on the Canadian investment landscape, and potentially the global one, is only beginning.

Conclusion

Anya Sharma's journey is a compelling illustration of the power of value investing, demonstrating that the principles of Warren Buffett can be successfully applied in diverse markets. Her success, rooted in a deep understanding of the Canadian economy and a steadfast commitment to value investing principles, offers a powerful example for aspiring investors globally. She is truly an unexpected Canadian heir to Warren Buffett's legacy, proving that consistent application of sound investment principles can lead to remarkable results regardless of background or location. Learn from the unexpected Canadian heir to Warren Buffett's legacy and discover the power of value investing for yourself! [Link to further reading on value investing and the Canadian stock market]

Featured Posts

-

Us Attorney Generals Fox News Presence Context And Implications

May 09, 2025

Us Attorney Generals Fox News Presence Context And Implications

May 09, 2025 -

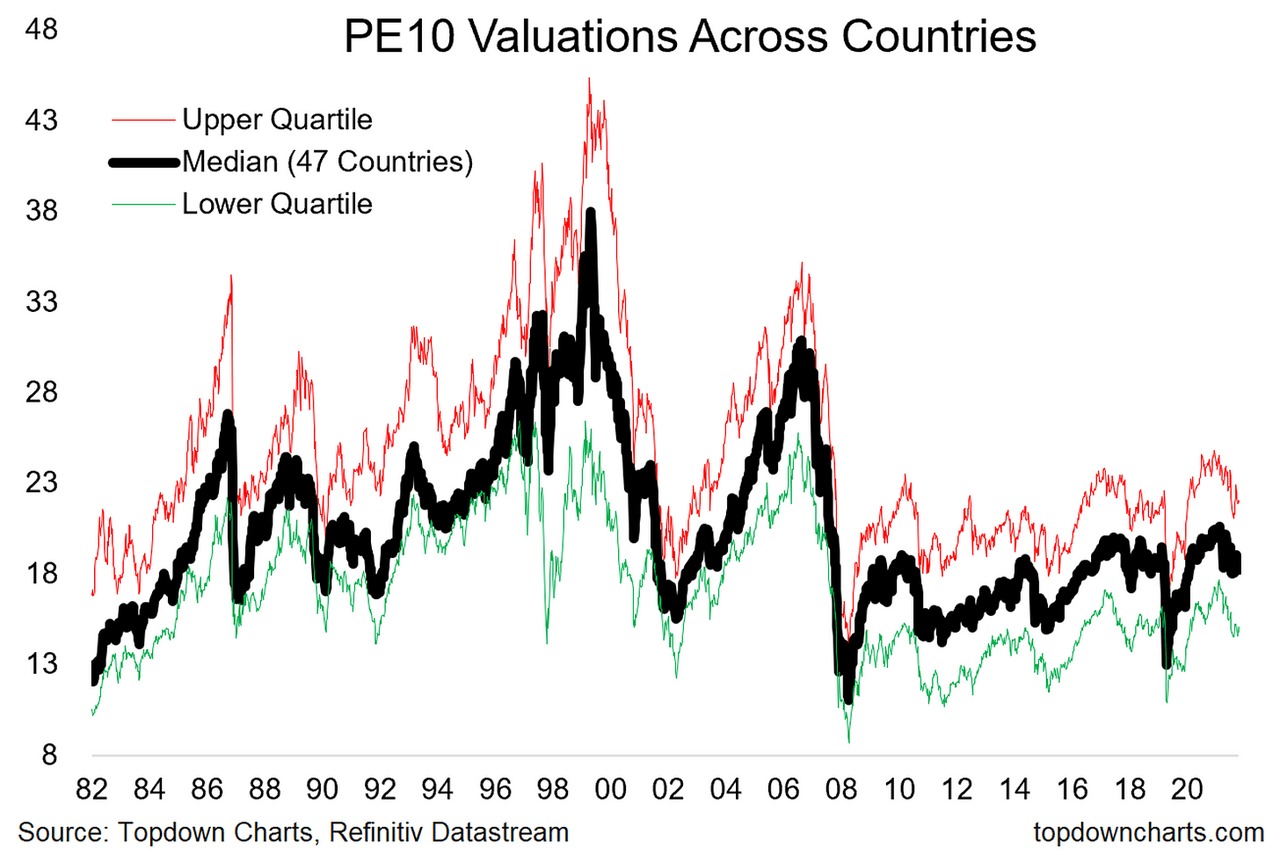

Bof As Take Are High Stock Market Valuations A Reason To Worry

May 09, 2025

Bof As Take Are High Stock Market Valuations A Reason To Worry

May 09, 2025 -

Indian Stock Market Update Sensex And Nifty Daily Performance Report

May 09, 2025

Indian Stock Market Update Sensex And Nifty Daily Performance Report

May 09, 2025 -

Madeleine Mc Cann Disappearance A 23 Year Olds Dna Test And Its Implications

May 09, 2025

Madeleine Mc Cann Disappearance A 23 Year Olds Dna Test And Its Implications

May 09, 2025 -

Senate Democrats Accuse Pam Bondi Of Hiding Epstein Records

May 09, 2025

Senate Democrats Accuse Pam Bondi Of Hiding Epstein Records

May 09, 2025