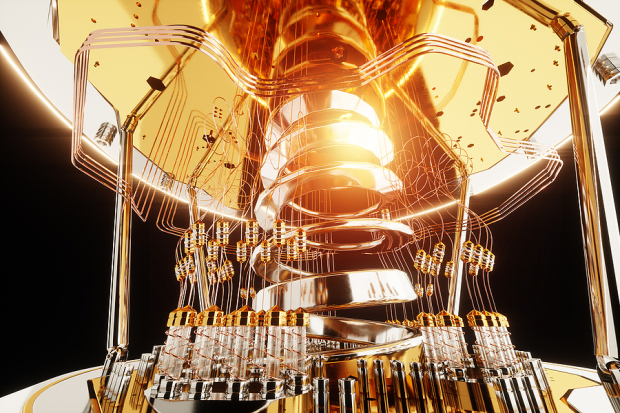

This AI Quantum Computing Stock: A Strong Reason To Buy On The Dip

Table of Contents

Company X's Leading Position in the AI Quantum Computing Market

Company X is a frontrunner in the burgeoning field of AI-powered quantum computing. Their innovative technology sets them apart from the competition, offering a unique blend of cutting-edge algorithms and sophisticated qubit technology. This leadership position is solidified by several key factors:

-

Specific patented technologies or breakthroughs: Company X holds several patents on crucial quantum annealing processes and error correction techniques, providing a significant competitive advantage. Their proprietary algorithms allow for faster and more efficient processing of complex data sets, surpassing the capabilities of classical computing.

-

Market share compared to competitors: While precise market share data in this nascent field is difficult to obtain, independent analyses suggest Company X holds a significant portion of the market dedicated to [specific niche, e.g., financial modeling applications of quantum computing].

-

Strategic partnerships and collaborations: Company X has forged strategic alliances with leading technology companies and research institutions, facilitating access to resources and expertise, accelerating innovation and market penetration.

-

Strong intellectual property portfolio: A robust IP portfolio protects Company X's groundbreaking technologies and provides a formidable barrier to entry for competitors. This strong intellectual property is crucial in this rapidly evolving field.

The combination of these factors establishes Company X as a key player in the quantum computing landscape, leveraging both quantum annealing and qubit technology to deliver superior performance in the competitive landscape. Their focus on AI algorithms further strengthens their position, highlighting the synergy between these two transformative technologies.

The Dip: A Buying Opportunity for Long-Term Investors

The recent dip in Company X's stock price can be attributed to several factors, including a broader market correction and some temporary setbacks in a specific project. However, this dip presents a compelling buying opportunity for long-term investors.

-

Analysis of current market conditions: The current market volatility is impacting many technology stocks, creating a temporary undervaluation of Company X's long-term potential.

-

Comparison to previous dips and subsequent recovery: Historical data shows that Company X has weathered similar dips in the past, followed by significant rebounds fueled by positive developments and continued innovation.

-

Technical analysis (if applicable and relevant): [Insert relevant technical analysis here, if applicable. For example: "Technical indicators suggest the stock is currently trading below its intrinsic value, representing a compelling entry point."]

-

Expert opinions supporting the buy recommendation: Several reputable financial analysts have issued buy recommendations for Company X, citing its strong fundamentals and future growth potential.

This dip isn't a reflection of the company's long-term viability; it's a temporary market fluctuation offering a chance to acquire shares at a discounted price before a potential resurgence. The buy the dip strategy is particularly relevant in this context given the company's strong growth projections.

The Synergistic Power of AI and Quantum Computing: Future Growth Potential

The convergence of AI and quantum computing is poised to revolutionize multiple industries. This synergy unlocks unprecedented computational power, enabling breakthroughs previously considered impossible. Company X is uniquely positioned to capitalize on this powerful combination:

-

Potential applications in various industries: Company X's technology has applications across various sectors, including drug discovery, financial modeling, materials science, and cryptography, creating multiple avenues for growth.

-

Future market projections and growth estimates for AI and quantum computing: Industry analysts predict exponential growth in both AI and quantum computing markets over the next decade, positioning Company X for substantial expansion.

-

Company X's roadmap for future innovation and product development: Company X's aggressive R&D efforts and ambitious roadmap ensure they remain at the forefront of innovation, continually expanding their capabilities and market reach.

Strong Financials and Positive Growth Projections

Company X boasts strong financials, including consistent revenue growth, increasing profitability, and a healthy balance sheet. [Insert relevant financial data here, such as revenue growth percentages, profit margins, and balance sheet ratios, supported by charts and graphs]. These figures, corroborated by reports from reputable financial institutions, underpin the investment thesis.

Managing Risk: A Balanced Perspective

Investing in a company in the relatively new and volatile quantum computing sector involves inherent risks. However, a balanced approach to risk management can mitigate potential downsides:

-

Diversification of investment portfolio: Spreading investments across different asset classes reduces overall portfolio risk.

-

Setting realistic investment goals and time horizons: Adopting a long-term investment strategy minimizes the impact of short-term market fluctuations.

-

Understanding the company's financial risks and potential challenges: Thorough due diligence and an understanding of the company's financial position are crucial for informed investing.

Conclusion: Should You Buy This AI Quantum Computing Stock?

Company X's leading position in the AI quantum computing market, coupled with its current undervaluation following a temporary dip, presents a compelling investment opportunity. The synergistic potential of AI and quantum computing, along with strong financials and positive growth projections, suggests substantial long-term growth. While risks exist, a balanced approach to risk management, coupled with thorough due diligence, can help investors capitalize on this promising sector. Consider conducting further research on Company X and its financial performance before making any investment decisions. This promising AI quantum computing stock could be a valuable addition to your portfolio. [Link to Company X's website and relevant financial reports].

Featured Posts

-

Analyzing The D Wave Quantum Qbts Stock Price Crash On Monday

May 20, 2025

Analyzing The D Wave Quantum Qbts Stock Price Crash On Monday

May 20, 2025 -

Analysis Abc News Layoffs And Their Effect On Programming

May 20, 2025

Analysis Abc News Layoffs And Their Effect On Programming

May 20, 2025 -

F1 Miami Gp Hamilton And Ferraris Tense Tea Break

May 20, 2025

F1 Miami Gp Hamilton And Ferraris Tense Tea Break

May 20, 2025 -

D Wave Quantum Qbts Stock Analyzing Todays Significant Gain

May 20, 2025

D Wave Quantum Qbts Stock Analyzing Todays Significant Gain

May 20, 2025 -

Nyt Mini Crossword Answers For March 24 2025

May 20, 2025

Nyt Mini Crossword Answers For March 24 2025

May 20, 2025

Latest Posts

-

Huuhkajat Kaksikko Kaellman Ja Hoskonen Palaavat Kotiin

May 20, 2025

Huuhkajat Kaksikko Kaellman Ja Hoskonen Palaavat Kotiin

May 20, 2025 -

Kaellman Ja Hoskonen Loppu Puolassa Mitae Seuraavaksi

May 20, 2025

Kaellman Ja Hoskonen Loppu Puolassa Mitae Seuraavaksi

May 20, 2025 -

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 20, 2025

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 20, 2025 -

Suomalaiset Jalkapalloilijat Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran

May 20, 2025

Suomalaiset Jalkapalloilijat Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran

May 20, 2025 -

Huuhkajat Kaellman Ja Hoskonen Siirtyvaet Pois Puolasta

May 20, 2025

Huuhkajat Kaellman Ja Hoskonen Siirtyvaet Pois Puolasta

May 20, 2025