Time As A Weapon: Ackman's Perspective On The US-China Trade War

Table of Contents

Ackman's Investment Thesis During the Trade War

Bill Ackman's investment strategy during the height of the US-China trade war was predicated on a careful assessment of the long-term implications of the conflict. He didn't simply react to short-term market fluctuations; instead, he sought to anticipate the evolving landscape and position his portfolio accordingly. His approach showcased his expertise in market timing and risk assessment, reflecting his deep understanding of the complexities of global macroeconomics.

- Specific investment decisions: Ackman likely shifted his portfolio away from companies heavily reliant on trade with China, anticipating potential disruptions and tariff impacts. He might have favored companies with diversified supply chains or those poised to benefit from reshoring initiatives.

- Companies invested in/avoided: While precise details of his portfolio during this period might not be publicly available, we can infer that he avoided companies heavily exposed to Chinese markets or those facing significant tariff increases. Conversely, he might have invested in companies that could capitalize on the shift in global trade dynamics.

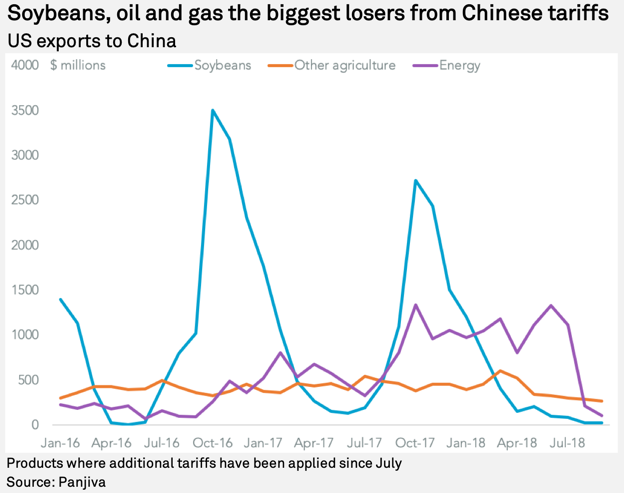

- Analysis of tariff impact: Ackman's analysis likely focused on the differential impact of tariffs on various sectors. He would have identified sectors particularly vulnerable to tariffs and those that might experience increased demand due to shifting trade flows. This granular approach allowed for a more nuanced investment strategy.

This deep dive into sector-specific impacts underpins Ackman's reputation for meticulous portfolio management and trade war investment strategy.

The "Time" Element in Ackman's Analysis

Ackman's perspective highlighted the strategic use of "time" by both the US and China during the trade war. He likely recognized that the conflict wasn't just about immediate tariff impacts but also about long-term economic positioning and power dynamics.

- Delays, negotiations, and escalations: The fluctuating timeline of negotiations, punctuated by periods of escalation and de-escalation, profoundly affected market dynamics. Ackman likely used these periods to re-evaluate his investment positions and adapt to the shifting geopolitical landscape.

- China's long-term planning vs. US short-term cycles: Ackman's analysis likely incorporated insights into China's long-term economic planning, contrasting this with the US's shorter-term political cycles. This understanding of differing strategic time horizons was pivotal in his decision-making process.

- Predictions about duration and outcome: While specific predictions are hard to verify, it's reasonable to assume that Ackman considered various scenarios for the trade war's duration and outcome, factoring these possibilities into his investment choices and risk mitigation strategies. This demonstrates an advanced approach to strategic timing and economic warfare strategy.

The Impact of Geopolitical Uncertainty on Investment Decisions

Geopolitical uncertainty, a defining characteristic of the US-China trade war, heavily influenced Ackman's investment choices. Navigating this turbulence required sophisticated risk management techniques.

- Risk mitigation examples: To mitigate risk, Ackman likely employed diversification strategies, hedging instruments, and a cautious approach to leverage. He would have constantly assessed the evolving geopolitical landscape and its potential implications for his portfolio.

- Impact of unpredictable policy changes: Ackman's understanding of the impact of unpredictable policy changes on market stability would have played a significant role. His investment choices reflect an awareness of the need to adapt to rapidly shifting political realities.

- Leveraging information asymmetry and geopolitical intelligence: Ackman's success likely stemmed in part from his access to information and his ability to interpret geopolitical intelligence to inform his investment decisions. This ability to decipher the implications of geopolitical events enabled more informed decisions.

Lessons Learned from Ackman's Approach

Investors can glean several valuable lessons from Ackman's approach to navigating the US-China trade war:

- Importance of long-term strategic thinking: Ackman's approach emphasizes the need for long-term strategic thinking, as opposed to short-term reactive strategies. Understanding the long-term ramifications of geopolitical events is crucial for successful investment.

- Value of understanding geopolitical factors: This illustrates the importance of understanding geopolitical factors and their profound impact on market behavior. Incorporating geopolitical analysis into investment decisions is paramount.

- Identifying and mitigating risks: The experience highlights the need to identify and mitigate risks associated with global trade tensions. A proactive approach to risk management is essential for weathering geopolitical storms.

Conclusion

Bill Ackman's perspective on the US-China trade war underscores the crucial role of "time" as a strategic weapon in global economic conflicts. His emphasis on long-term strategic thinking, a deep understanding of geopolitical risk, and meticulous risk management provided a framework for navigating the uncertainties of this complex situation. His success reveals the value of integrating geopolitical analysis into investment decisions and the importance of understanding how geopolitical events and the passage of time can profoundly influence market dynamics. Learning from Ackman’s approach to utilizing "time as a weapon" in the face of global trade tensions can help investors develop robust investment strategies that account for geopolitical risks and thrive in today's volatile global marketplace. Learn more about effective strategies for navigating the complexities of global trade conflicts and build a portfolio resilient to geopolitical risk. Understand how to harness "time as a weapon" in your own investment approach.

Featured Posts

-

Dip Dyed Ponytail Trend Ariana Grandes Swarovski Campaign Look

Apr 27, 2025

Dip Dyed Ponytail Trend Ariana Grandes Swarovski Campaign Look

Apr 27, 2025 -

Alejandro Tabilo Upsets Novak Djokovic In Straight Sets At Monte Carlo

Apr 27, 2025

Alejandro Tabilo Upsets Novak Djokovic In Straight Sets At Monte Carlo

Apr 27, 2025 -

Is Betting On Natural Disasters Like The La Wildfires A Sign Of The Times

Apr 27, 2025

Is Betting On Natural Disasters Like The La Wildfires A Sign Of The Times

Apr 27, 2025 -

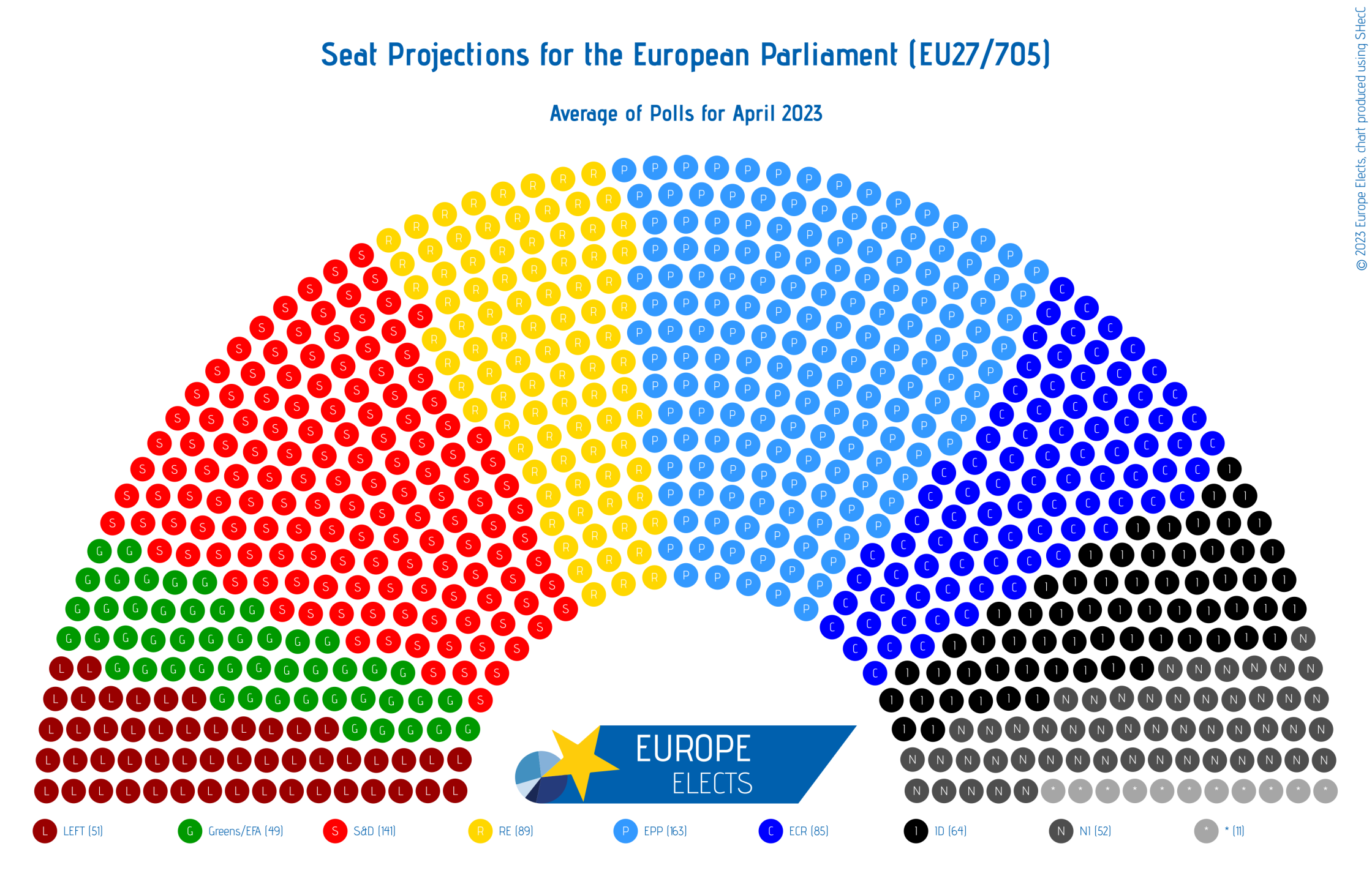

The Dax Index How Bundestag Elections Shape Market Trends

Apr 27, 2025

The Dax Index How Bundestag Elections Shape Market Trends

Apr 27, 2025 -

Analyzing Grand National Horse Fatalities Ahead Of The 2025 Event

Apr 27, 2025

Analyzing Grand National Horse Fatalities Ahead Of The 2025 Event

Apr 27, 2025

Latest Posts

-

Watch Blue Jays Vs Yankees Live Free Mlb Spring Training Stream March 7 2025

Apr 28, 2025

Watch Blue Jays Vs Yankees Live Free Mlb Spring Training Stream March 7 2025

Apr 28, 2025 -

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025 -

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025 -

Blue Jays Vs Yankees Spring Training Free Live Stream Time And Channel Info

Apr 28, 2025

Blue Jays Vs Yankees Spring Training Free Live Stream Time And Channel Info

Apr 28, 2025 -

Blue Jays Vs Yankees Live Stream March 7 2025 Watch Mlb Spring Training Free

Apr 28, 2025

Blue Jays Vs Yankees Live Stream March 7 2025 Watch Mlb Spring Training Free

Apr 28, 2025