To Buy Or Not To Buy Palantir Stock Before May 5th: Analyst Opinions And Predictions

Table of Contents

Current Market Sentiment Towards Palantir Stock

Keywords: Palantir stock price, Palantir market sentiment, PLTR stock forecast.

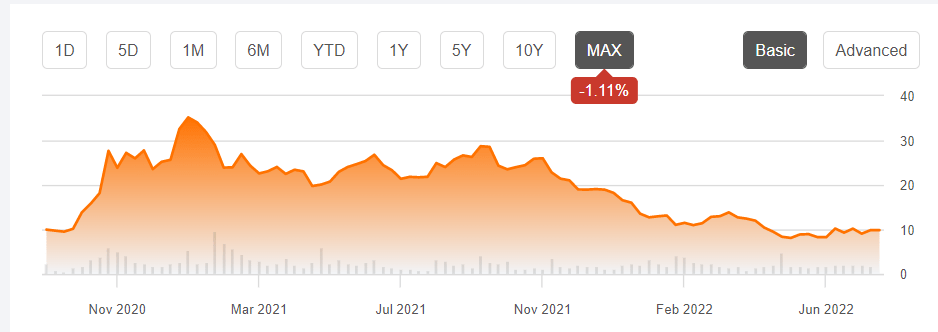

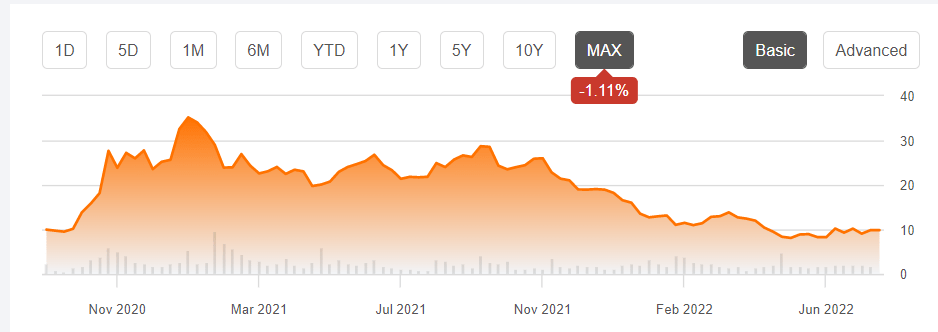

Palantir's stock price has experienced a period of volatility recently. While the stock has shown periods of growth, fueled by positive news regarding contract wins and technological advancements, it has also faced periods of decline, influenced by broader market trends and investor concerns. Understanding the current market sentiment is crucial before deciding whether to buy Palantir stock before May 5th.

- Recent Stock Performance: The stock has seen fluctuations in recent months. For example, it might have shown a 10% increase following a major contract announcement, but then experienced a 5% drop due to broader market corrections. Specific price points and dates should be included here for accurate representation. (Note: Replace these example percentages and descriptions with actual data at the time of publication).

- Influencing Factors: Several factors impact current market sentiment. Geopolitical events, particularly those involving major Palantir clients in government and defense, can significantly impact the stock price. Furthermore, the company's success in securing new contracts, especially large government contracts, directly influences investor confidence. Competition within the data analytics sector also plays a role.

- Significant News: Any significant news, such as new product launches, strategic partnerships, or regulatory changes, can dramatically affect Palantir stock. It's crucial to monitor news sources closely for any developments leading up to May 5th.

- Short Interest: A high level of short interest can indicate that some investors bet against Palantir's future performance. Understanding the level of short interest and its potential impact on the stock price following the earnings report is vital for informed decision-making.

Analyst Ratings and Price Targets for Palantir

Keywords: Palantir analyst rating, Palantir price target, Palantir stock forecast, Palantir valuation.

Analyst opinions on Palantir stock vary significantly. Understanding the range of predictions and their rationale is critical for a comprehensive assessment.

- Analyst Ratings Summary: Leading financial institutions have issued a range of ratings, including "buy," "hold," and "sell" recommendations. It is vital to identify which institutions hold which ratings and what their reasoning is. For example, Morgan Stanley might have a "buy" rating with a high price target, while another institution might have a "hold" rating with a more conservative target. (Insert specific examples of real analyst ratings and their justifications here. Always cite the source of this information.)

- Price Targets: Analysts offer a range of price targets for the coming months. These targets often reflect differing views on Palantir's growth potential and the risks involved. A wider range of price targets suggests greater uncertainty about the stock's future. For example, one analyst might predict a price of $20 per share, while another might predict $15.

- Rationale Behind Opinions: The justification for these differing opinions is crucial. Some analysts might highlight Palantir's strong government contracts and potential for growth in the commercial sector as reasons for optimism, while others might express concerns about the company's profitability and competition.

- Rating Revisions: It's essential to note any recent revisions to analyst ratings or price targets. Changes leading up to May 5th could indicate shifting sentiment among financial analysts.

Key Factors to Consider Before Investing in Palantir

Keywords: Palantir risk factors, Palantir investment risks, Palantir due diligence, Palantir financial performance.

Before investing in Palantir, a thorough assessment of the company's financial health, competitive landscape, and inherent risks is essential.

- Financial Health: Analyze Palantir's financial performance, including revenue growth, profitability (or lack thereof), debt levels, and cash flow. A detailed examination of financial statements is critical for evaluating the company's financial strength.

- Competitive Advantages and Disadvantages: Assess Palantir's competitive position in the data analytics market. What are its unique selling propositions? How does it compare to competitors like AWS, Google Cloud, and Microsoft Azure? Understanding its strengths and weaknesses is paramount.

- Investment Risks: Investing in Palantir carries inherent risks. Market volatility can significantly impact the stock price. Competition from established tech giants presents a challenge. Regulatory hurdles and potential changes in government spending could also affect the company's future performance.

- Long-Term Growth Prospects: Evaluate Palantir's long-term growth prospects in both the government and commercial sectors. Its success in expanding its customer base and penetrating new markets will play a significant role in its future success.

Predicting Palantir's Stock Performance After May 5th Earnings

Keywords: Palantir earnings prediction, Palantir post-earnings reaction, Palantir stock outlook.

Predicting Palantir's stock performance following the May 5th earnings report involves a degree of speculation. While analysts provide expectations, the actual outcome could differ significantly.

- Potential Earnings Surprises: Analysts' expectations should be compared to the company’s past performance and current market conditions to assess the probability of positive or negative earnings surprises.

- Market Reactions: Consider how the market might react to different earnings outcomes. A positive surprise could lead to a significant price increase, while a negative surprise could result in a considerable drop.

- Overall Market Environment: Remember that the broader market environment will also affect Palantir's stock performance. A positive market environment could cushion the impact of a negative earnings report, while a negative market environment could amplify it.

- Uncertainty: It is crucial to acknowledge the inherent uncertainty in market predictions. No prediction is guaranteed, and unforeseen events can always impact the stock price.

Conclusion

This analysis of analyst opinions and predictions concerning Palantir stock before the May 5th earnings report reveals a mixed outlook. While some analysts are bullish on Palantir's potential, others express caution due to certain risk factors. The upcoming earnings report will be crucial in shaping future investor sentiment.

Call to Action: Ultimately, the decision of whether to buy or sell Palantir stock before May 5th depends on your individual risk tolerance and investment strategy. Thoroughly research Palantir and consider consulting a financial advisor before making any investment decisions related to Palantir stock. Remember, this is not financial advice. Conduct your own thorough due diligence before investing in Palantir PLTR stock.

Featured Posts

-

Simplified Dividend Investing Achieving High Returns

May 10, 2025

Simplified Dividend Investing Achieving High Returns

May 10, 2025 -

Planned Elizabeth Line Strikes Travel Advice For February And March

May 10, 2025

Planned Elizabeth Line Strikes Travel Advice For February And March

May 10, 2025 -

Sensex Soars 500 Points Nifty Above 18400 Adani Ports Eternal Industries Lead Market Movers

May 10, 2025

Sensex Soars 500 Points Nifty Above 18400 Adani Ports Eternal Industries Lead Market Movers

May 10, 2025 -

Will Nigel Farages Reform Party Deliver On Its Promises

May 10, 2025

Will Nigel Farages Reform Party Deliver On Its Promises

May 10, 2025 -

Luis Enriques Psg Transformation How They Won The Ligue 1 Title

May 10, 2025

Luis Enriques Psg Transformation How They Won The Ligue 1 Title

May 10, 2025