Today's Personal Loan Interest Rates: Compare & Save

Table of Contents

Understanding Current Personal Loan Interest Rates

The current average personal loan interest rate range is quite broad, typically fluctuating between 6% and 36% APR (Annual Percentage Rate). Several key factors significantly influence the specific interest rate you'll receive. Your credit score is the most impactful, followed by the loan amount and the loan term.

-

Credit Score Impact:

- Excellent Credit (750+): Rates often fall in the lower range (6%-12%).

- Good Credit (700-749): Rates typically range from 8%-18%.

- Fair Credit (650-699): Expect rates between 15%-25%.

- Poor Credit (Below 650): Rates can be significantly higher, reaching 25% or even 36% or more. It might be difficult to secure a loan at all.

-

Loan Amount: Larger loan amounts often come with slightly higher interest rates due to increased risk for the lender. Smaller loans may also have higher rates because of the higher administrative cost involved relative to the loan amount.

-

Loan Term: Shorter loan terms generally have lower interest rates than longer terms, but require larger monthly payments. Longer terms reduce monthly payments but ultimately increase the total interest paid over the life of the loan.

-

Loan Type: Secured personal loans (backed by collateral) typically have lower interest rates than unsecured personal loans.

| Credit Score | Loan Amount ($) | Loan Term (Years) | Average APR Range (%) |

|---|---|---|---|

| 750+ | 5,000 | 3 | 6-9 |

| 700-749 | 10,000 | 5 | 8-15 |

| 650-699 | 15,000 | 3 | 15-22 |

| Below 650 | 5,000 | 5 | 25-36+ |

Note: These are average ranges; actual rates may vary depending on the lender and individual circumstances.

Factors Affecting Your Personal Loan Interest Rate

Beyond your credit score, several other factors significantly influence the interest rate you'll qualify for. Lenders use a complex algorithm to assess risk, and these factors play a crucial role.

-

Debt-to-Income Ratio (DTI): A high DTI (the percentage of your monthly income dedicated to debt payments) indicates higher risk, leading to potentially higher interest rates.

-

Employment History & Stability: A consistent and stable employment history demonstrates lower risk, improving your chances of securing a favorable rate.

-

Lender's Risk Assessment: Each lender has its own criteria and risk assessment models. Some lenders may be more lenient than others.

-

Type of Personal Loan (Secured vs. Unsecured): As mentioned previously, secured loans, because they have collateral, generally attract lower interest rates.

-

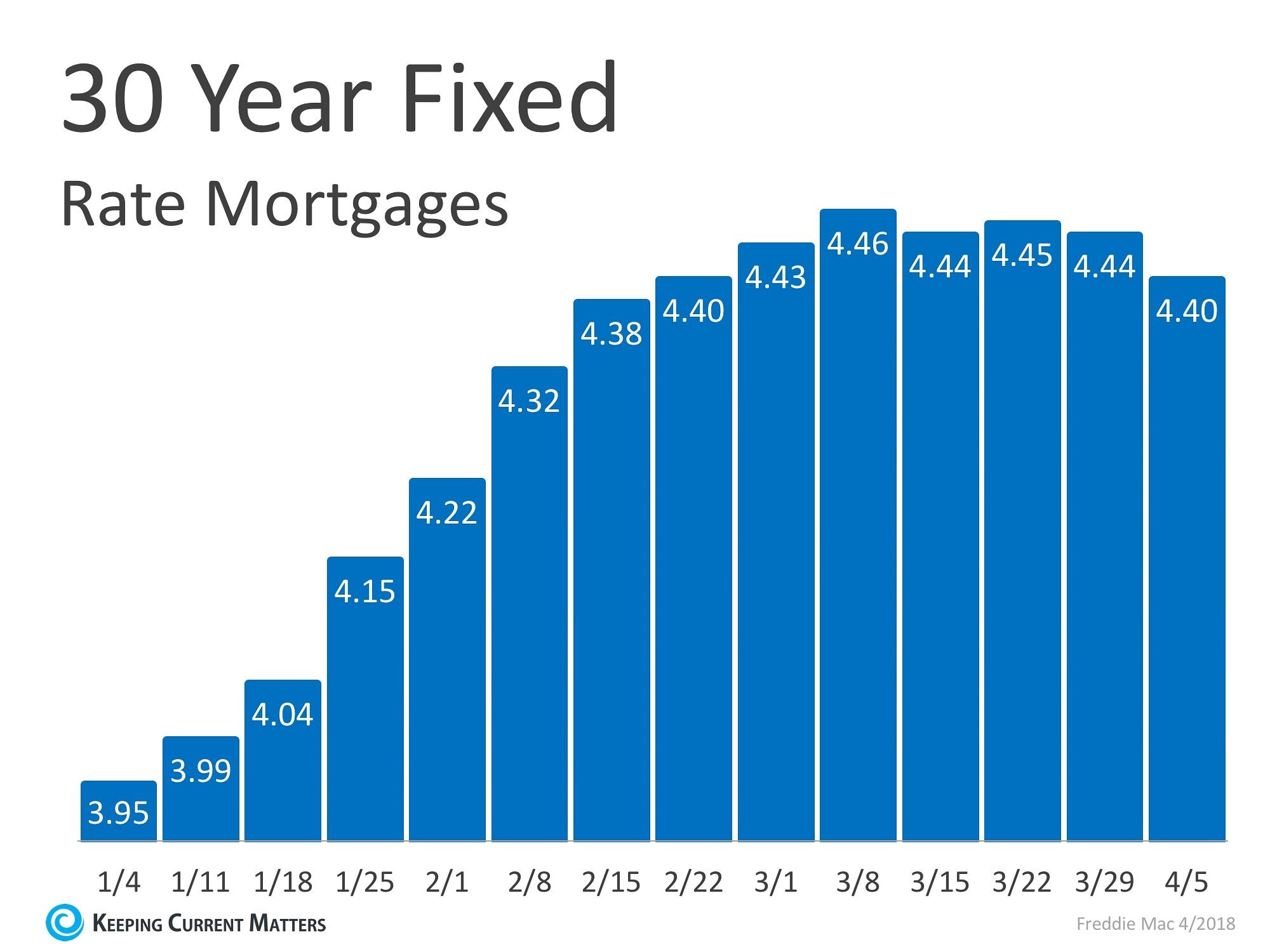

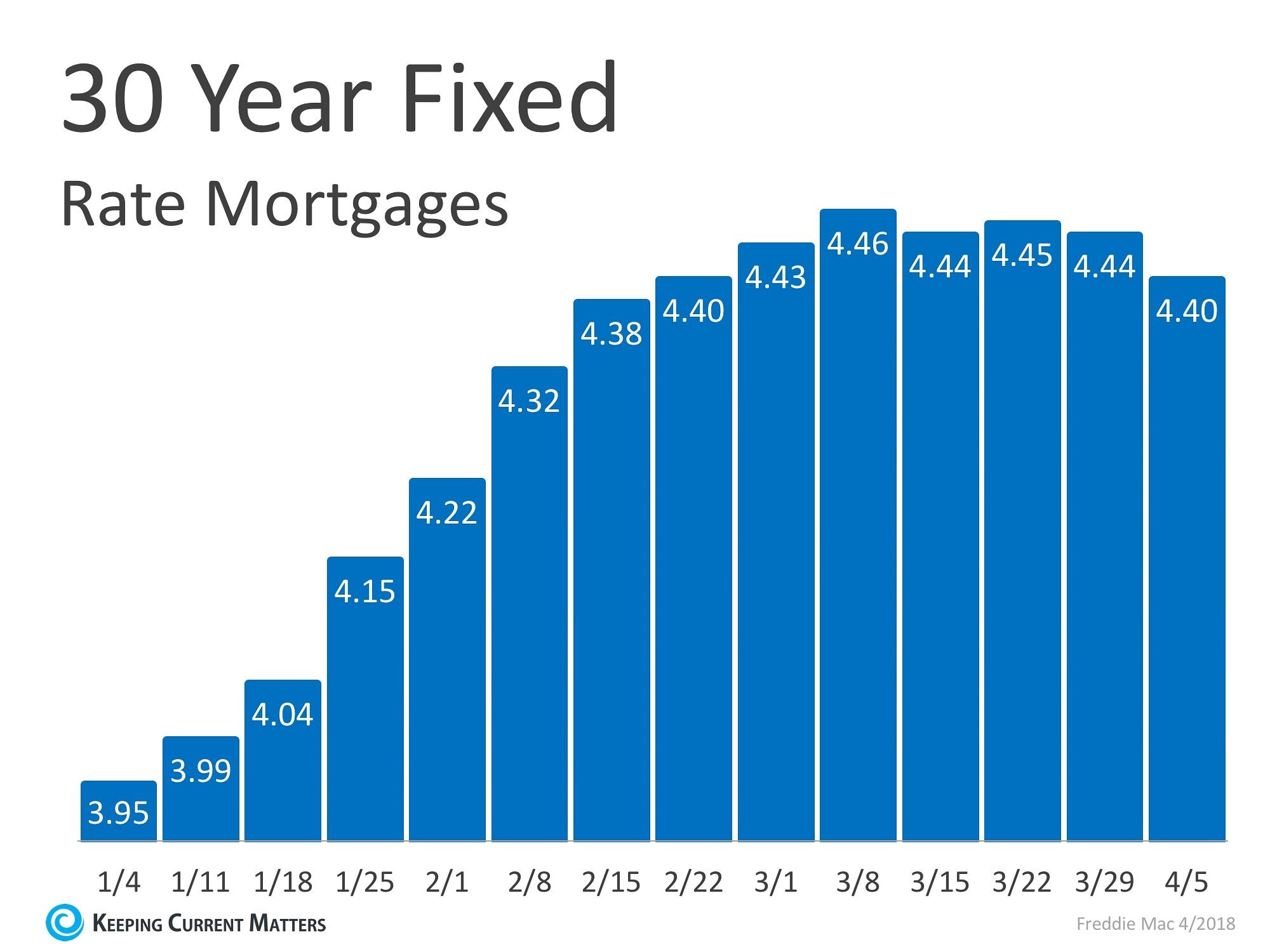

Current Economic Conditions: Broader economic conditions and prevailing interest rates in the market can influence the rates offered by lenders.

How to Compare Personal Loan Interest Rates Effectively

Finding the best personal loan rate involves actively comparing offers from different lenders. Don't settle for the first offer you receive.

-

Online Loan Comparison Tools: Several websites offer tools to compare rates from various lenders simultaneously.

-

Multiple Lenders: Check rates from banks, credit unions, and online lenders to maximize your chances of finding the best deal.

-

APR (Annual Percentage Rate): Focus on the APR, not just the interest rate. The APR includes all fees and charges, providing a true picture of the loan's total cost.

-

Fine Print: Carefully read the terms and conditions to understand all fees, including origination fees, late payment fees, and prepayment penalties.

-

Pre-qualification vs. Formal Application: Pre-qualification checks your eligibility without impacting your credit score, while a formal application requires a hard credit check.

Tips to Get the Lowest Personal Loan Interest Rate

Getting the best personal loan rate involves proactive steps.

-

Improve Your Credit Score: Before applying, work on improving your credit score through responsible credit management.

-

Negotiate with Lenders: Don't hesitate to negotiate with lenders for a lower rate, especially if you have a strong credit profile and multiple offers.

-

Shop Around: Compare offers from multiple lenders to leverage competition and secure a better deal.

-

Consider Secured Loans: If eligible, consider a secured loan to potentially access lower interest rates.

-

Large Down Payment: Making a larger down payment (if applicable) can reduce the loan amount and potentially lower your interest costs.

Conclusion

Finding the best personal loan interest rate requires careful comparison shopping and understanding the factors influencing rates. By considering your credit score, debt-to-income ratio, and exploring multiple lenders, you can significantly reduce the total cost of your loan. Start comparing today's personal loan interest rates using our resources and find the best deal for your financial needs! Don't overpay – secure a low-interest personal loan and start saving money today. Use our comparison tools (link to a hypothetical comparison tool) to find the perfect personal loan with the lowest interest rate for you.

Featured Posts

-

Ipswich Towns Week In Review Mc Kenna Shines Phillips And Cajuste Struggle

May 28, 2025

Ipswich Towns Week In Review Mc Kenna Shines Phillips And Cajuste Struggle

May 28, 2025 -

Pacers Injury Report Mathurin Downgraded For Kings Game

May 28, 2025

Pacers Injury Report Mathurin Downgraded For Kings Game

May 28, 2025 -

Cuaca Jawa Barat 23 April 2024 Bandung Diprediksi Hujan Hingga Sore

May 28, 2025

Cuaca Jawa Barat 23 April 2024 Bandung Diprediksi Hujan Hingga Sore

May 28, 2025 -

Red Devils Sell Another Forward Not Part Of Amorims Vision

May 28, 2025

Red Devils Sell Another Forward Not Part Of Amorims Vision

May 28, 2025 -

Offre Limitee Galaxy S25 Ultra 1 To A 1294 90 E

May 28, 2025

Offre Limitee Galaxy S25 Ultra 1 To A 1294 90 E

May 28, 2025

Latest Posts

-

The Future Of Manila Bay A Look At Its Continued Vitality

May 30, 2025

The Future Of Manila Bay A Look At Its Continued Vitality

May 30, 2025 -

Toxic Algae Blooms Off California Extent And Effects On Marine Life

May 30, 2025

Toxic Algae Blooms Off California Extent And Effects On Marine Life

May 30, 2025 -

Citizen Scientists Exploring The Mysteries Within Whidbey Clams

May 30, 2025

Citizen Scientists Exploring The Mysteries Within Whidbey Clams

May 30, 2025 -

Manila Bays Health How Long Can Its Vibrancy Last

May 30, 2025

Manila Bays Health How Long Can Its Vibrancy Last

May 30, 2025 -

Californias Coastal Crisis The Devastating Effects Of Toxic Algae Blooms

May 30, 2025

Californias Coastal Crisis The Devastating Effects Of Toxic Algae Blooms

May 30, 2025