Top 5 Commodity Market Charts To Watch Closely This Week

Table of Contents

Crude Oil Price Chart: Monitoring Geopolitical Instability and OPEC+ Decisions

Geopolitical instability and OPEC+ decisions are major drivers of crude oil prices. Analyzing the crude oil price chart requires a nuanced understanding of these factors. Effective crude oil price chart analysis involves considering both short-term volatility and long-term trends.

Geopolitical Risks

Ongoing conflicts and political tensions significantly impact global supply chains and subsequently, the crude oil price chart.

- Middle East Tensions: Instability in the Middle East, a major oil-producing region, can lead to supply disruptions and price spikes. Closely monitor news from this region for potential impacts on OPEC+ crude oil production.

- Eastern European Conflicts: The ongoing conflict in Eastern Europe continues to affect global energy markets, creating uncertainty and influencing the crude oil price chart analysis. Supply chain disruptions and sanctions contribute to price volatility.

- Geopolitical Risk Assessment: Utilizing geopolitical risk assessment tools and expert analyses is crucial for predicting potential impacts on the crude oil price chart.

OPEC+ Production Levels

OPEC+ (Organization of the Petroleum Exporting Countries and its allies) decisions directly influence global oil supply and, consequently, the crude oil price chart.

- OPEC+ Meetings: Pay close attention to the outcomes of OPEC+ meetings. Announcements regarding production quotas significantly affect the crude oil supply and demand dynamic, impacting the crude oil price chart.

- Production Quotas: Changes in production quotas, whether increases or decreases, have a direct and often immediate impact on the crude oil price chart. Analyzing historical data alongside current announcements is key for effective OPEC+ oil production chart interpretation.

- Oil Price Forecast: Consider incorporating various oil price forecasts into your analysis. However, remember that forecasts are not guarantees and should be viewed alongside other indicators reflected in the crude oil price chart.

Natural Gas Price Chart: Assessing Winter Demand and Storage Levels

The natural gas price chart is heavily influenced by winter demand and storage levels. Careful observation of these factors is vital for accurate price predictions.

Winter Demand Projections

Winter weather conditions significantly impact natural gas demand, directly influencing the natural gas price chart.

- Temperature Forecasts: Temperature forecasts are critical for predicting heating season demand. Colder-than-average temperatures typically lead to increased demand and higher prices, as reflected in the natural gas price chart.

- Heating Season Demand: The heating season represents the peak demand period for natural gas. Analyzing historical data from past heating seasons can provide valuable insights for predicting price movements in the natural gas price chart analysis.

Storage Levels and Supply

Current natural gas storage levels are crucial for assessing future price fluctuations and are clearly visible on the natural gas storage chart.

- Storage Levels: Low storage levels indicate a potential for supply shortages and price increases, while high levels suggest a more stable market. Monitoring storage levels is paramount for understanding the natural gas price volatility.

- Natural Gas Supply Outlook: Consider the overall natural gas supply outlook, including potential disruptions or increases in production. This impacts the natural gas price chart and the overall market stability.

Gold Price Chart: Tracking Inflation and Safe-Haven Demand

The gold price chart is a key indicator of investor sentiment toward inflation and economic uncertainty. Gold's role as an inflation hedge and safe-haven asset is well-established.

Inflationary Pressures

Inflation rates directly influence gold's appeal as an inflation hedge, significantly affecting the gold price chart.

- Central Bank Policies: Central bank policies, particularly interest rate decisions, greatly influence inflation expectations and, subsequently, the gold price chart. Higher inflation typically increases gold prices.

- Inflation Hedge Gold: Gold is frequently used as an inflation hedge because its value tends to rise as inflation increases. This is a crucial point to understand when analyzing the gold price chart analysis.

Safe-Haven Demand

Geopolitical uncertainty and market volatility drive safe-haven demand for gold, leading to price fluctuations reflected in the gold price chart.

- Economic Downturns: Concerns about economic downturns often increase investment in gold, pushing prices higher and affecting gold price chart trends. This is a key factor to consider during periods of market instability.

- Gold Investment Strategy: Understanding safe-haven demand is essential for developing a successful gold investment strategy. Analyzing the gold price chart trends in relation to global events is key.

Corn Price Chart: Examining Weather Patterns and Global Supply

The corn price chart is closely tied to weather patterns and the global balance of supply and demand.

Weather Conditions and Crop Yields

Weather significantly impacts corn production and global supply, impacting the corn price chart forecast.

- Climate-Related Events: Droughts, floods, and extreme temperatures can severely affect corn yields, creating volatility in the corn price chart. Monitoring weather patterns in major corn-producing regions is crucial.

Global Supply and Demand

Global corn supply and demand dynamics play a significant role in shaping the corn price chart.

- Biofuel Production: The use of corn in biofuel production influences demand and price. Changes in biofuel mandates can affect the corn price chart.

- Global Corn Market: Analyzing global corn market trends, including export demand and import patterns, helps predict price movements as reflected in the corn supply and demand chart.

Copper Price Chart: Monitoring Global Economic Growth and Infrastructure Spending

The copper price chart serves as an indicator of global economic health and infrastructure investment.

Economic Growth Indicators

Copper demand is closely tied to global economic growth, making the copper price chart a valuable economic barometer.

- Manufacturing Activity: Strong manufacturing activity typically drives up copper demand, leading to higher prices. This relationship is clearly visible in the copper price chart analysis.

- Construction Projects: Increased construction projects, particularly large-scale infrastructure developments, boost copper demand and influence the copper price chart.

Infrastructure Investment

Government spending on infrastructure projects significantly impacts copper demand and the copper price chart outlook.

- Government Spending: Significant government investments in infrastructure often lead to a surge in copper demand, impacting the copper price chart. Monitoring government spending plans is essential.

Conclusion

Staying informed about crucial commodity market charts is critical for navigating the complexities of the commodity markets. By closely monitoring these top 5 commodity market charts, along with other relevant economic indicators, you can make more informed trading decisions and potentially mitigate risks. Keep an eye on these key commodity market charts throughout the week to stay ahead in the dynamic world of commodities trading. Remember to continuously analyze these commodity market charts for a comprehensive understanding of market trends.

Featured Posts

-

Essential Commodity Market Charts Your Weekly Watchlist

May 05, 2025

Essential Commodity Market Charts Your Weekly Watchlist

May 05, 2025 -

Gigi Hadid And Bradley Cooper Instagram Post Confirms Romance

May 05, 2025

Gigi Hadid And Bradley Cooper Instagram Post Confirms Romance

May 05, 2025 -

Snl 50th Anniversary Emma Stones Show Stopping Popcorn Dress

May 05, 2025

Snl 50th Anniversary Emma Stones Show Stopping Popcorn Dress

May 05, 2025 -

Knockout Win Fuels Rematch Call From Past Canelo Opponent

May 05, 2025

Knockout Win Fuels Rematch Call From Past Canelo Opponent

May 05, 2025 -

The Rise Of Disaster Betting Examining The Market For Wildfire Wagers In Los Angeles

May 05, 2025

The Rise Of Disaster Betting Examining The Market For Wildfire Wagers In Los Angeles

May 05, 2025

Latest Posts

-

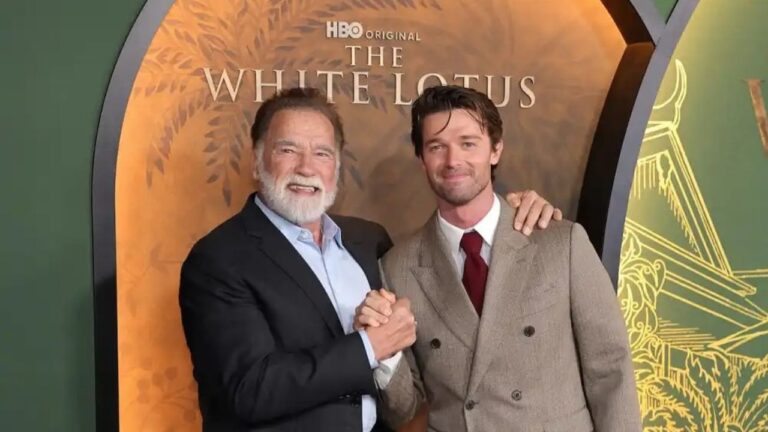

Nepotism Debate Patrick Schwarzeneggers White Lotus Casting Sparks Discussion

May 06, 2025

Nepotism Debate Patrick Schwarzeneggers White Lotus Casting Sparks Discussion

May 06, 2025 -

Chris Pratt On Patrick Schwarzeneggers Steamy White Lotus Moment

May 06, 2025

Chris Pratt On Patrick Schwarzeneggers Steamy White Lotus Moment

May 06, 2025 -

White Lotus Patrick Schwarzeneggers Response To Nepotism Accusations

May 06, 2025

White Lotus Patrick Schwarzeneggers Response To Nepotism Accusations

May 06, 2025 -

Patrick Schwarzenegger Addresses Nepotism Claims Regarding His White Lotus Role

May 06, 2025

Patrick Schwarzenegger Addresses Nepotism Claims Regarding His White Lotus Role

May 06, 2025 -

Patrick Schwarzenegger Joins Luca Guadagninos Upcoming Movie

May 06, 2025

Patrick Schwarzenegger Joins Luca Guadagninos Upcoming Movie

May 06, 2025