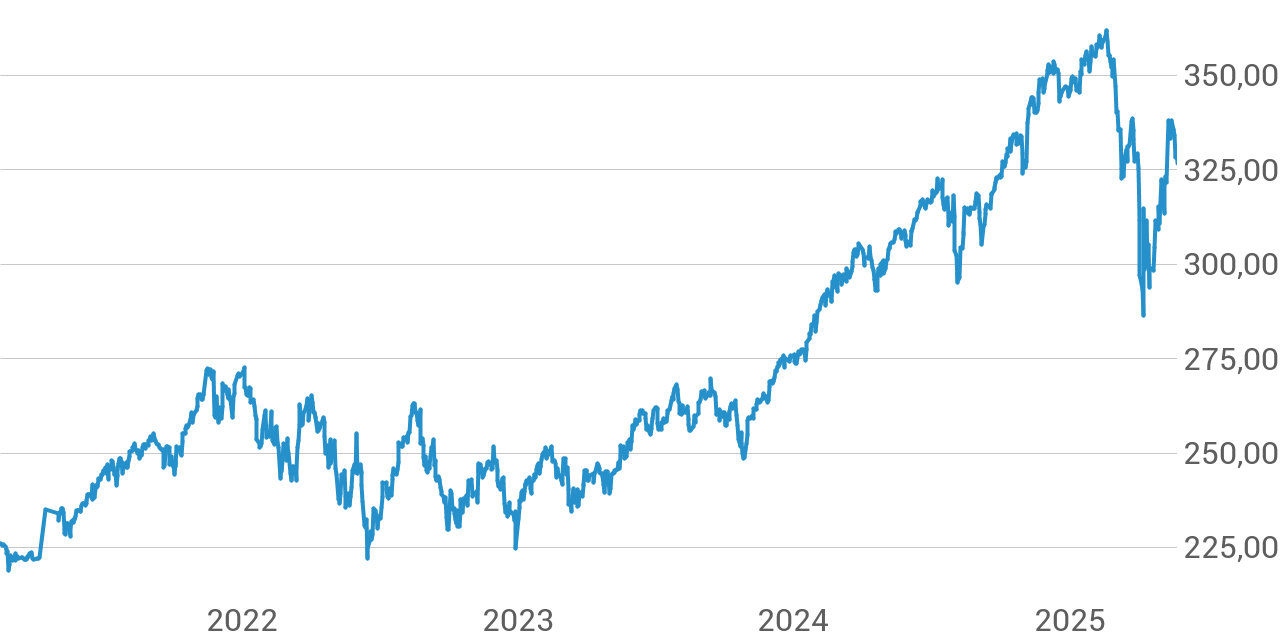

Tracking The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Accessing Real-Time and Historical Amundi Dow Jones Industrial Average UCITS ETF NAV Data

Obtaining accurate and up-to-date Amundi Dow Jones Industrial Average UCITS ETF NAV data is the first step to successful tracking. Several reliable sources provide this information, each offering different features and levels of detail.

The difference between real-time and delayed NAV data lies in the immediacy of the information. Real-time data reflects the current NAV, updated frequently throughout the trading day. Delayed data, however, is typically updated at the end of the trading day or with a time lag. Using a reliable source for your Amundi Dow Jones Industrial Average UCITS ETF NAV is crucial for accurate analysis.

Here are some key sources for accessing this data:

- Amundi's official website: The ETF provider's website is usually the most reliable source for official NAV data. Look for dedicated sections on ETF factsheets or pricing information.

- Major financial data providers (Bloomberg, Refinitiv): Professional-grade financial data terminals offer real-time NAV updates and historical data for in-depth analysis. These are typically subscription services.

- Your brokerage account platform: Most online brokerage accounts provide real-time or near real-time NAV quotes for the ETFs you hold within your portfolio. Check your account's features.

- Financial news websites: Many reputable financial news websites publish ETF NAV data, often with a slight delay.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors influence the daily fluctuations of the Amundi Dow Jones Industrial Average UCITS ETF NAV. Understanding these factors is crucial for interpreting NAV changes and making sound investment decisions.

- Dow Jones Industrial Average Index performance: The primary driver of the ETF's NAV is the performance of the underlying Dow Jones Industrial Average (DJIA) index. An increase in the DJIA generally leads to an increase in the ETF's NAV, and vice versa.

- Currency exchange rates (if applicable): If the ETF is denominated in a currency different from your base currency, fluctuations in exchange rates will impact the NAV you see in your local currency.

- ETF management fees and expenses: The ETF's expense ratio, which covers management fees and operating costs, gradually reduces the NAV over time. This is a small but ongoing deduction.

- Dividend distributions: When the underlying companies in the DJIA pay dividends, the ETF will distribute these dividends to its shareholders, which will typically result in a corresponding reduction in the NAV.

Utilizing Amundi Dow Jones Industrial Average UCITS ETF NAV for Investment Decisions

Tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV is not merely about observing numbers; it's a tool for making informed investment choices.

- Performance evaluation: By comparing the historical NAV data, you can easily assess the performance of your investment over time. This allows you to track your gains or losses.

- Buy/sell signals based on NAV trends: While not a standalone indicator, observing trends in the NAV, combined with other market analysis, can help identify potential buying or selling opportunities.

- Portfolio rebalancing based on NAV changes: Tracking NAV helps you ensure your portfolio remains aligned with your target asset allocation. Changes in the NAV of your Amundi Dow Jones Industrial Average UCITS ETF might trigger rebalancing decisions.

- Benchmarking against other ETFs: Comparing the NAV performance of this ETF against other similar ETFs in the same market segment aids in evaluating its relative performance and identifying potentially better alternatives.

Understanding the Differences Between NAV and Market Price

While the NAV is a crucial metric, it’s vital to understand the difference between the NAV and the market price of the Amundi Dow Jones Industrial Average UCITS ETF.

- Definition of Market Price: The market price is the price at which the ETF shares are currently trading on the exchange. This price fluctuates continuously throughout the trading day, influenced by supply and demand.

- Impact of supply and demand on market price: High demand can push the market price above the NAV (a premium), while low demand can push it below (a discount).

- Bid-ask spread explanation: The difference between the bid price (what buyers are willing to pay) and the ask price (what sellers are willing to accept) creates a bid-ask spread, further influencing the market price’s deviation from the NAV.

- Premium/discount to NAV: The difference between the market price and the NAV represents a premium or discount. A premium indicates that investors are willing to pay more than the net asset value, while a discount suggests the opposite. Understanding the reasons behind these premiums and discounts requires deeper market analysis. The NAV provides a more accurate representation of the underlying assets than the market price, particularly on less liquid trading days.

Conclusion: Mastering Amundi Dow Jones Industrial Average UCITS ETF NAV Tracking

Effectively tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV requires accessing reliable data sources like the Amundi website, brokerage platforms, or financial data providers. Remember to consider the factors influencing the NAV, including the performance of the Dow Jones Industrial Average, currency fluctuations, expense ratios, and dividend distributions. By understanding these factors and diligently tracking the NAV, you can enhance your performance evaluation, identify potential buy/sell signals, and make more informed decisions for portfolio rebalancing and benchmarking against competitors. Start tracking your Amundi Dow Jones Industrial Average UCITS ETF NAV today to optimize your investment strategies and gain a deeper understanding of your portfolio's performance. Understanding your Amundi Dow Jones Industrial Average UCITS ETF NAV is key to successful investing!

Featured Posts

-

Amundi Msci World Catholic Principles Ucits Etf A Guide To Its Net Asset Value

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf A Guide To Its Net Asset Value

May 24, 2025 -

Lyudi Lyubyat Schekotat Nervy Refleksiya Fedora Lavrova O Pavle I I Zhanre Trillera

May 24, 2025

Lyudi Lyubyat Schekotat Nervy Refleksiya Fedora Lavrova O Pavle I I Zhanre Trillera

May 24, 2025 -

Rayakan Seni Dan Otomotif Di Porsche Indonesia Classic Art Week 2025

May 24, 2025

Rayakan Seni Dan Otomotif Di Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

Escape To The Country Top Destinations For A Tranquil Getaway

May 24, 2025

Escape To The Country Top Destinations For A Tranquil Getaway

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc A Comprehensive Guide

May 24, 2025

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc A Comprehensive Guide

May 24, 2025

Latest Posts

-

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Heavy Losses

May 24, 2025

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Heavy Losses

May 24, 2025 -

Gryozy Lyubvi Ili Ilicha Otsenka Publikatsii V Gazete Trud

May 24, 2025

Gryozy Lyubvi Ili Ilicha Otsenka Publikatsii V Gazete Trud

May 24, 2025 -

Fedor Lavrov O Trillerakh I Imperatore Pavle I O Prirode Chelovecheskogo Interesa K Opasnosti

May 24, 2025

Fedor Lavrov O Trillerakh I Imperatore Pavle I O Prirode Chelovecheskogo Interesa K Opasnosti

May 24, 2025 -

Gryozy Lyubvi Ili Ilicha Gazeta Trud Kratkiy Analiz

May 24, 2025

Gryozy Lyubvi Ili Ilicha Gazeta Trud Kratkiy Analiz

May 24, 2025 -

Pavel I I Trillery Pochemu Lyudi Lyubyat Schekotat Nervy Vzglyad Fedora Lavrova

May 24, 2025

Pavel I I Trillery Pochemu Lyudi Lyubyat Schekotat Nervy Vzglyad Fedora Lavrova

May 24, 2025