Trade Conflicts And Their Impact On America's Global Financial Position Under Trump

Table of Contents

Increased Tariffs and Their Economic Ripple Effects

The hallmark of the Trump administration's trade policy was the imposition of substantial tariffs on imported goods. This seemingly simple act had far-reaching and complex economic ripple effects.

Impact on Consumer Prices

Tariffs directly increased the prices of imported goods, impacting inflation and consumer spending. This effect was felt across various sectors.

- Increased costs for everyday goods: Tariffs on goods like steel, aluminum, and consumer electronics directly translated into higher prices at the retail level.

- Statistical data: Studies showed a noticeable increase in the Consumer Price Index (CPI) following the imposition of tariffs, particularly impacting lower and middle-income households disproportionately.

- Impact on different income brackets: Lower-income households, who spend a larger percentage of their income on essential goods, were particularly vulnerable to price increases driven by tariffs.

Effects on US Businesses

The impact of tariffs on American businesses was multifaceted, affecting both importers and exporters.

- Challenges for importers: Businesses reliant on imported materials or components faced increased production costs, leading to reduced profitability or price increases for consumers.

- Impact on specific industries: The agricultural sector, for example, experienced significant hardship due to retaliatory tariffs imposed by China, impacting exports of soybeans and other agricultural products.

- Job losses and gains: While some sectors experienced job losses due to reduced competitiveness, others benefited from increased domestic demand for certain goods, creating a complex employment picture.

- Supply chain disruptions: Tariffs and trade disputes led to significant disruptions in global supply chains, increasing uncertainty and costs for businesses.

Retaliatory Tariffs and Reduced Exports

The imposition of tariffs by the US inevitably led to retaliatory measures from other countries. This significantly impacted American exports.

- Loss of market share: Retaliatory tariffs made American goods less competitive in foreign markets, leading to a loss of market share and export revenue.

- Affected sectors: Industries like agriculture, manufacturing, and technology experienced substantial declines in exports, impacting their profitability and growth.

- Decreased export revenue: The overall decline in US exports contributed to a widening trade deficit and impacted overall economic growth.

Shifting Global Trade Relationships and Alliances

Trade conflicts under the Trump administration significantly strained relationships with key trading partners and impacted the role of the US in international organizations.

Strained Relationships with Major Trading Partners

The confrontational approach to trade led to heightened tensions and damaged relationships with key allies.

- Trade disputes with China: The trade war with China was the most significant, resulting in multiple rounds of tariff increases and counter-tariffs.

- Renegotiated trade agreements: The USMCA (United States-Mexico-Canada Agreement), replacing NAFTA, reflected a shift in trade policy priorities and a focus on bilateral agreements.

- Tensions with the European Union: Disputes over steel and aluminum tariffs led to retaliatory measures from the EU, further exacerbating trade tensions.

Impact on International Organizations

The Trump administration's approach challenged the role and authority of international trade organizations.

- Challenges to the WTO: The US frequently challenged the authority of the World Trade Organization (WTO), undermining its effectiveness in resolving trade disputes.

- Consequences for multilateralism: The focus on bilateral agreements over multilateral institutions weakened the global trading system and the principles of free trade.

The Impact on the US National Debt and Budget Deficit

The trade conflicts initiated under the Trump administration had a significant impact on the US national debt and budget deficit.

Costs of Trade Wars

Trade disputes incurred substantial financial costs for the US government and the economy.

- Lost revenue: Tariffs, while generating some revenue, were outweighed by the economic losses stemming from reduced trade and investment.

- Government subsidies: The government provided subsidies to some sectors affected by tariffs, adding to budgetary burdens.

- Legal battles: Trade disputes often involved costly legal battles, further straining government resources.

Impact on Foreign Investment

Trade uncertainty created by the trade conflicts negatively impacted foreign direct investment (FDI) in the United States.

- Decreased FDI inflow: Uncertainty about future trade policies discouraged foreign investment, hampering economic growth.

- Investor confidence: The unpredictable nature of trade policy significantly lowered investor confidence, leading to capital flight.

Long-Term Consequences for the US Economy

The long-term consequences of the trade conflicts initiated during the Trump administration remain a subject of ongoing debate and analysis.

Competitiveness and Innovation

Trade conflicts may have had a negative impact on US competitiveness in global markets.

- Reduced efficiency: Protectionist measures can reduce the pressure to increase efficiency, hindering innovation and competitiveness.

- Impact on technological advancements: Reduced access to global markets and collaboration can stifle technological advancements and innovation.

Global Economic Uncertainty

The increased protectionism during this period contributed to increased global economic uncertainty.

- Risk of global trade wars: The actions of the US emboldened other countries to pursue protectionist measures, increasing the risk of widespread trade wars.

- Decreased global trade volume: Protectionist policies, when adopted globally, contribute to reduced trade volumes and slower economic growth.

Conclusion

The Trump administration's trade conflicts had a profound and multifaceted impact on America's global financial position. Increased tariffs led to higher consumer prices, strained relationships with key trading partners, and increased the national debt. The long-term consequences, including potential damage to US competitiveness and global economic stability, continue to unfold. The key takeaways highlight the significant costs of protectionist policies and the importance of considering the broader implications of such actions. We urge further research and discussion on the long-term implications of trade conflicts and their effects on global economic stability, urging readers to critically consider the future of international trade relations in light of these events.

Featured Posts

-

New Ev Technology Partnership Saudi Aramco And Byd Collaborate

Apr 22, 2025

New Ev Technology Partnership Saudi Aramco And Byd Collaborate

Apr 22, 2025 -

Understanding Stock Market Valuations Bof As Rationale For Investor Confidence

Apr 22, 2025

Understanding Stock Market Valuations Bof As Rationale For Investor Confidence

Apr 22, 2025 -

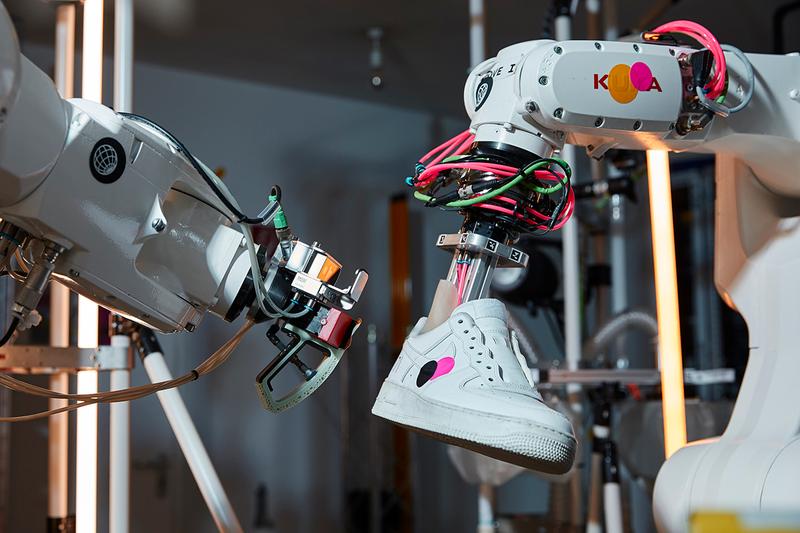

The Hurdles Of Robotic Nike Shoe Assembly

Apr 22, 2025

The Hurdles Of Robotic Nike Shoe Assembly

Apr 22, 2025 -

Assessing The Impact Of Trumps Trade Offensive On Us Financial Primacy

Apr 22, 2025

Assessing The Impact Of Trumps Trade Offensive On Us Financial Primacy

Apr 22, 2025 -

Citizens Take A Stand Anti Trump Protests Across America

Apr 22, 2025

Citizens Take A Stand Anti Trump Protests Across America

Apr 22, 2025

Latest Posts

-

Payton Pritchard Elevates Playoff Game Key To Celtics Game 1 Victory

May 12, 2025

Payton Pritchard Elevates Playoff Game Key To Celtics Game 1 Victory

May 12, 2025 -

La Sentence De Dals Ines Reg Et La Controverse De L Ouverture D Elle

May 12, 2025

La Sentence De Dals Ines Reg Et La Controverse De L Ouverture D Elle

May 12, 2025 -

Payton Pritchards New Converse Shoe Deal A Look Inside

May 12, 2025

Payton Pritchards New Converse Shoe Deal A Look Inside

May 12, 2025 -

Nba Award Boston Celtics Guard Declines Campaign

May 12, 2025

Nba Award Boston Celtics Guard Declines Campaign

May 12, 2025 -

L Autruche De Mask Singer 2025 Une Identite Choquante Revelee Chantal Ladesou Et Laurent Ruquier Surpris

May 12, 2025

L Autruche De Mask Singer 2025 Une Identite Choquante Revelee Chantal Ladesou Et Laurent Ruquier Surpris

May 12, 2025