Trade War Fears Trigger 7% Drop In Amsterdam Stock Market Opening

Table of Contents

The Impact of Trade Wars on Global Markets

Trade wars, characterized by escalating tariffs and economic sanctions, create a climate of profound uncertainty that significantly impacts global stock markets. This uncertainty erodes investor confidence, leading to market volatility and potentially triggering significant market corrections. The psychological impact of negative trade news is substantial, often resulting in immediate sell-offs and a flight to safety.

- Disrupted Supply Chains: Tariffs and sanctions disrupt established global supply chains, increasing production costs and reducing the availability of goods. This directly affects company profits and investor expectations.

- Eroding Investor Confidence: Negative headlines about trade wars fuel fear and uncertainty, prompting investors to reduce their risk exposure by selling off assets. This creates a downward spiral, further depressing market values.

- Historical Precedents: History offers numerous examples of market downturns directly linked to trade disputes. The impact is often amplified by the interconnectedness of modern global markets.

Amsterdam Stock Market's Specific Vulnerabilities

The Amsterdam Stock Exchange (AEX), while generally robust, experienced a particularly sharp drop due to the Netherlands' significant reliance on international trade. The Dutch economy is highly export-oriented, making it especially vulnerable to disruptions caused by trade wars.

- High Dependence on International Trade: The Netherlands' economy is heavily dependent on global trade, with many Dutch businesses exporting a significant portion of their goods and services. Disruptions to these trade flows directly impact their profitability.

- Heavily Impacted Sectors: Sectors like technology and manufacturing, heavily represented on the AEX, are particularly vulnerable to trade wars due to their reliance on global supply chains and international markets.

- Domino Effect on European Markets: The downturn in the Amsterdam Stock Market could have a domino effect on other European markets, given the interconnected nature of the European Union's economy.

Investor Reactions and Strategies

The 7% drop triggered immediate and widespread investor reactions. Many investors reacted with panic selling, exacerbating the downturn. Others implemented hedging strategies to mitigate potential losses.

- Sell-offs and Panicked Selling: The initial reaction involved significant sell-offs as investors sought to protect their capital from further losses. This panicked selling further amplified the market decline.

- Hedging Strategies: Sophisticated investors employed various hedging strategies, including diversification across asset classes and the use of derivatives, to reduce their exposure to risk.

- Expert Advice: Financial experts are advising investors to maintain a long-term perspective, diversify their portfolios, and carefully assess their risk tolerance during this period of market volatility.

Potential Long-Term Consequences and Predictions

The 7% drop in the Amsterdam Stock Market raises concerns about potential long-term economic consequences, both for the Netherlands and the global economy. While predicting the future is impossible, various scenarios are being considered.

- Economic Slowdown: A prolonged period of trade uncertainty could lead to an economic slowdown, impacting both consumer and business confidence.

- Market Recovery Timelines: Predictions regarding market recovery vary, with some analysts predicting a relatively quick rebound while others anticipate a more protracted period of volatility.

- Long-Term Investment Strategies: Financial advisors are urging long-term investors to remain calm and avoid making rash decisions based on short-term market fluctuations.

Conclusion

The 7% drop in the Amsterdam Stock Market represents a significant event, directly linked to escalating trade war fears. This dramatic fall underscores the vulnerability of even strong economies to global trade tensions and highlights the crucial need for robust risk management strategies. The interconnectedness of global markets means the consequences extend far beyond the Netherlands, impacting investor confidence and economic stability worldwide. The potential for long-term economic slowdown necessitates careful monitoring of global trade relations and proactive adaptation by investors.

Call to Action: Stay informed about developments in the Amsterdam Stock Market and global trade relations. Seek further information on the impacts of trade wars and investment strategies during market volatility. Consult with a financial advisor for personalized guidance in navigating this period of economic uncertainty. Understanding the implications of trade war escalation is crucial for making informed decisions regarding your investments in the Amsterdam Stock Market and beyond.

Featured Posts

-

Indonesia Classic Art Week 2025 Featuring Porsche

May 24, 2025

Indonesia Classic Art Week 2025 Featuring Porsche

May 24, 2025 -

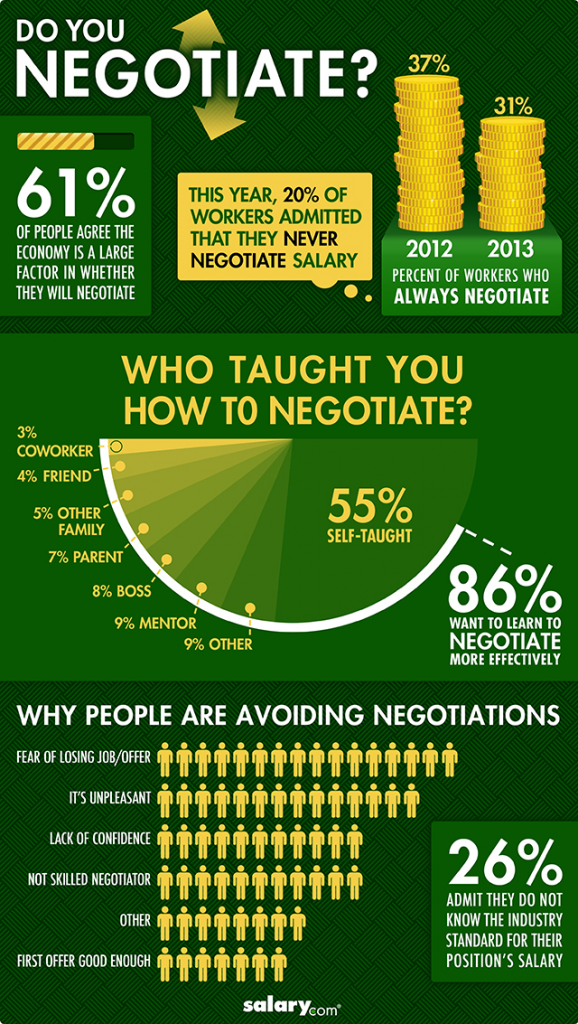

Is A Best And Final Job Offer Really Final Negotiation Strategies

May 24, 2025

Is A Best And Final Job Offer Really Final Negotiation Strategies

May 24, 2025 -

A Relaxing Escape To The Country Choosing The Right Location

May 24, 2025

A Relaxing Escape To The Country Choosing The Right Location

May 24, 2025 -

Analyzing Apple Stock Aapl Next Significant Price Points

May 24, 2025

Analyzing Apple Stock Aapl Next Significant Price Points

May 24, 2025 -

Apple Stock Suffers Setback Cook Announces 900 Million Tariff Hit

May 24, 2025

Apple Stock Suffers Setback Cook Announces 900 Million Tariff Hit

May 24, 2025

Latest Posts

-

Rumor Mill Open Ai And Jony Ives Ai Hardware Company

May 24, 2025

Rumor Mill Open Ai And Jony Ives Ai Hardware Company

May 24, 2025 -

Free Speech And Ai Examining The Case Of Character Ai

May 24, 2025

Free Speech And Ai Examining The Case Of Character Ai

May 24, 2025 -

Jony Ives Ai Company Potential Acquisition By Open Ai

May 24, 2025

Jony Ives Ai Company Potential Acquisition By Open Ai

May 24, 2025 -

Palestine Blocked Microsoft Email Restrictions Spark Employee Outrage

May 24, 2025

Palestine Blocked Microsoft Email Restrictions Spark Employee Outrage

May 24, 2025 -

The Legal Status Of Character Ai Chatbot Conversations

May 24, 2025

The Legal Status Of Character Ai Chatbot Conversations

May 24, 2025