Trump Tax Cuts: Key Provisions Of The House GOP Bill

Table of Contents

The Tax Cuts and Jobs Act of 2017, spearheaded by the Trump administration and the House GOP, significantly altered the US tax code. This landmark legislation, often referred to as the Trump tax cuts, reshaped the tax landscape for individuals and corporations alike. This article delves into the key provisions of this bill, examining its impact on different segments of the population and the economy. Understanding these provisions is crucial for navigating the changed tax landscape and for comprehending its long-term consequences.

Individual Income Tax Changes

The Trump tax cuts brought significant changes to individual income tax rates, deductions, and credits. These changes aimed to simplify the tax code and boost economic growth, although their effectiveness remains a subject of ongoing debate.

Lower Individual Tax Rates

The bill reduced individual income tax rates across the board. Here's a comparison of pre- and post-TCJA rates:

- Pre-TCJA (2017): Seven tax brackets ranging from 10% to 39.6%.

- Post-TCJA (2018-2025): Seven tax brackets, but with lower rates ranging from 10% to 37%.

These reductions, while seemingly beneficial, had a sunset provision. The lower rates were set to expire after 2025, leading to uncertainty for long-term financial planning. This temporary nature sparked considerable debate about the bill's long-term fiscal sustainability.

Standard Deduction and Personal Exemptions

The Trump tax cuts significantly increased the standard deduction while eliminating personal exemptions. This simplification aimed to streamline the filing process for many taxpayers.

- Increased Standard Deduction: This made itemizing less appealing for many, especially those with lower incomes.

- Elimination of Personal Exemptions: This change impacted families, particularly those with multiple dependents.

For example, a single filer's standard deduction nearly doubled. While this simplified tax preparation for some, it also reduced the tax benefits for those who previously itemized deductions.

Child Tax Credit

The Trump tax cuts expanded the Child Tax Credit (CTC). Key changes included:

- Increased Credit Amount: The maximum credit amount increased.

- Partial Refundability: A portion of the credit became refundable, benefiting low-income families.

- Age Limit: The age limit for qualifying children remained unchanged.

These modifications provided substantial tax relief to families with children, particularly those with lower incomes who could now claim a partial refund even if their tax liability was zero.

Corporate Tax Rate Reduction

One of the most dramatic changes introduced by the Trump tax cuts was the reduction of the corporate tax rate.

Reduction from 35% to 21%

This significant decrease from 35% to 21% was intended to boost business investment and stimulate economic growth. Proponents argued that lower taxes would encourage businesses to expand, create jobs, and increase wages.

- Increased Competitiveness: The lower rate was intended to make American businesses more competitive globally.

- Repatriation of Overseas Profits: The bill also included provisions designed to encourage the repatriation of profits held overseas by US corporations.

However, critics argued that the rate reduction disproportionately benefited large corporations and did little to stimulate job creation or wage growth. The actual impact on business investment and economic growth continues to be debated among economists.

Pass-Through Business Taxation

The Trump tax cuts also addressed taxation for pass-through businesses, such as sole proprietorships, partnerships, and S corporations.

Qualified Business Income (QBI) Deduction

The Qualified Business Income (QBI) deduction allowed eligible self-employed individuals and small business owners to deduct up to 20% of their qualified business income.

- Eligibility Criteria: The deduction had complex eligibility criteria and limitations based on taxable income.

- Impact on Small Businesses: The deduction aimed to provide tax relief for small business owners, but its complexity made it challenging to navigate.

The QBI deduction was a significant component of the Trump tax cuts, but its complexity often required professional tax assistance to maximize its benefits.

Other Key Provisions

The Trump tax cuts included several other notable changes:

- Estate Tax Changes: Increased the estate tax exemption.

- SALT Deduction Limitations: Placed limitations on the deduction of state and local taxes (SALT).

- Changes to Alternative Minimum Tax (AMT): Made adjustments to the AMT.

Conclusion

The Trump tax cuts, as embodied in the Tax Cuts and Jobs Act of 2017, significantly reshaped the US tax system. The bill lowered individual and corporate tax rates, altered deductions and credits, and introduced the QBI deduction for pass-through businesses. While proponents argued these changes stimulated economic growth and benefited taxpayers, critics highlighted concerns about its long-term fiscal implications and its unequal distribution of benefits. Understanding the complexities of the Trump tax cuts and their lasting impacts is crucial for both individuals and businesses. For detailed information and personalized guidance on how these changes affected your tax liability, consult a qualified tax professional.

Featured Posts

-

The Hobbit The Battle Of The Five Armies Behind The Scenes And Production

May 13, 2025

The Hobbit The Battle Of The Five Armies Behind The Scenes And Production

May 13, 2025 -

Record High Temperatures In La And Orange Counties Extreme Heat Warning

May 13, 2025

Record High Temperatures In La And Orange Counties Extreme Heat Warning

May 13, 2025 -

Indore Sizzles At 40 C Loo Alert Issued Health Advisory In Effect

May 13, 2025

Indore Sizzles At 40 C Loo Alert Issued Health Advisory In Effect

May 13, 2025 -

Bek Timnas Indonesia Jay Idzes Main Penuh Saat Venezia Imbangi Atalanta

May 13, 2025

Bek Timnas Indonesia Jay Idzes Main Penuh Saat Venezia Imbangi Atalanta

May 13, 2025 -

Record High Temperatures La And Orange County Heatwave

May 13, 2025

Record High Temperatures La And Orange County Heatwave

May 13, 2025

Latest Posts

-

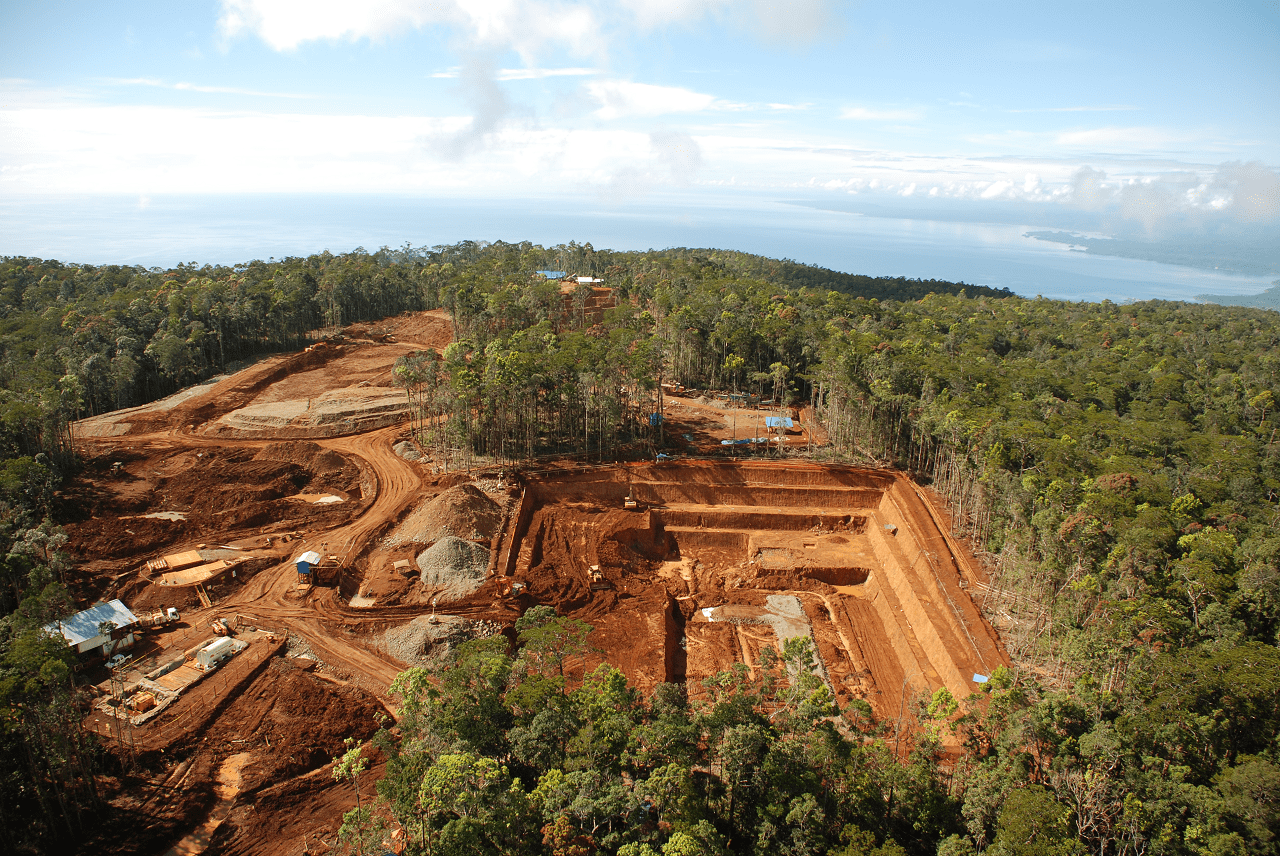

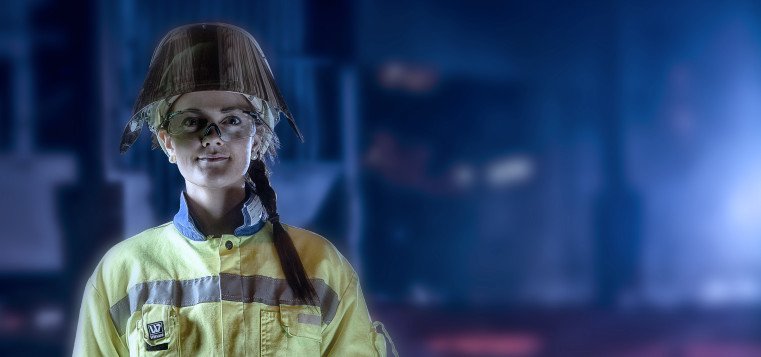

Indonesias Mining Sector Eramet And Danantara Forge Strategic Alliance

May 14, 2025

Indonesias Mining Sector Eramet And Danantara Forge Strategic Alliance

May 14, 2025 -

Best Sports Show On Hulu A Must Watch While You Wait For Ted Lasso Season 4

May 14, 2025

Best Sports Show On Hulu A Must Watch While You Wait For Ted Lasso Season 4

May 14, 2025 -

Downstream Investment Eramet And Danantara Partner For Future Growth

May 14, 2025

Downstream Investment Eramet And Danantara Partner For Future Growth

May 14, 2025 -

Ted Lasso Season 4 Wait Watch This 100 Rotten Tomatoes Rated Sports Show On Hulu

May 14, 2025

Ted Lasso Season 4 Wait Watch This 100 Rotten Tomatoes Rated Sports Show On Hulu

May 14, 2025 -

Ted Lasso Season 4 Officially In The Works Apple Tv And The Wga

May 14, 2025

Ted Lasso Season 4 Officially In The Works Apple Tv And The Wga

May 14, 2025