Trump Tax Plan Unveiled: Key Details From House Republicans

Table of Contents

Individual Income Tax Changes under the Trump Tax Plan

The Trump Tax Plan proposes significant changes to the individual income tax system, impacting taxpayers across various income brackets. These changes aim to simplify the tax code while delivering tax relief to many Americans.

Lower Tax Rates

The plan proposes a significant reduction in individual income tax rates. While the exact rates varied depending on the specific version of the plan, a common feature was a simplification of the bracket system with fewer, lower rates.

- Hypothetical Example: The highest bracket might be reduced from 37% to 35%, while other brackets would see proportionally lower rates. These lower rates would lead to greater disposable income for many individuals.

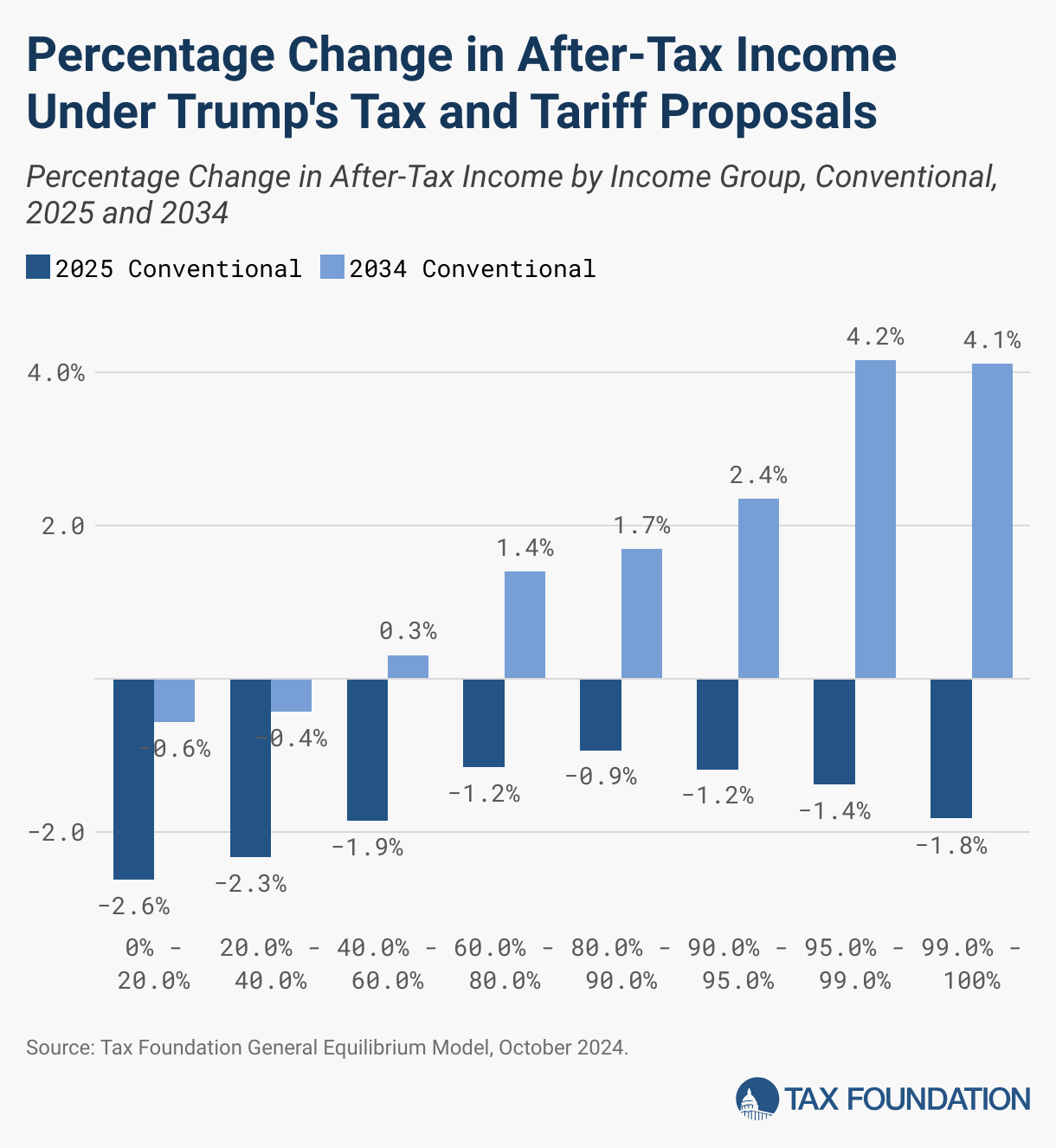

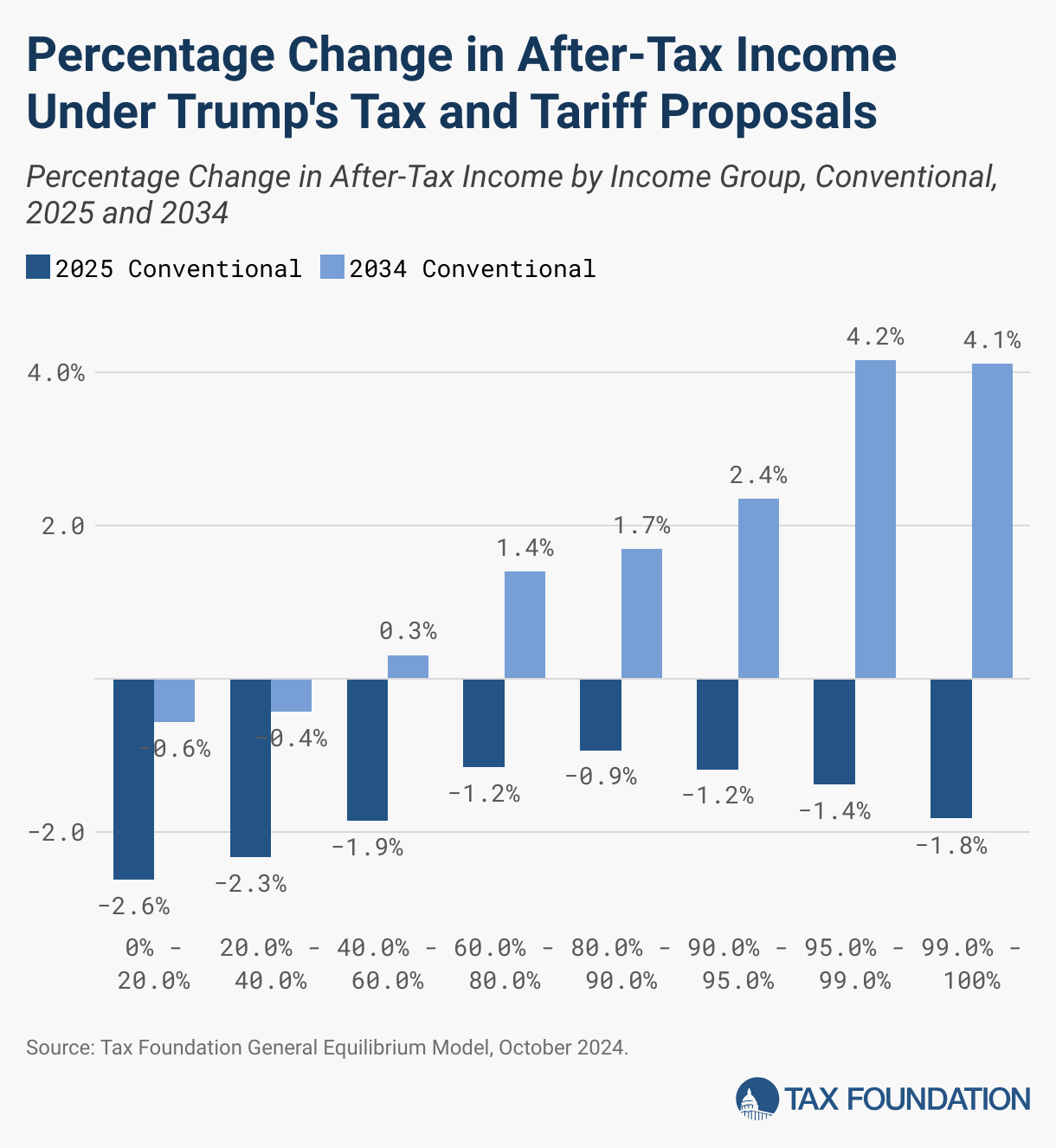

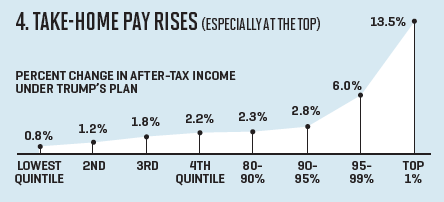

- Impact on Different Income Levels: Higher earners would generally see a larger percentage reduction in their tax liability, although the absolute dollar amount of savings would vary greatly depending on income level. Lower-income taxpayers might see smaller percentage reductions but still benefit from a simplified tax code and potential increases in deductions.

- Impact on Tax Revenue: The long-term effect on tax revenue is a subject of ongoing debate. Proponents argue that lower rates will stimulate economic growth, ultimately leading to increased tax revenue. Critics, however, express concerns about potential revenue shortfalls.

Standard Deduction and Child Tax Credit

The Trump Tax Plan also proposed increases to the standard deduction and enhancements to the child tax credit. These measures aimed to provide further tax relief for families and individuals.

- Proposed Increases: The standard deduction would be significantly increased, potentially doubling or more for certain filers. This means more taxpayers could benefit from using the standard deduction instead of itemizing.

- Impact on Families with Children: The enhanced child tax credit would provide a larger tax break for families with children, reducing the overall tax burden.

- Limitations and Phase-Outs: Some versions of the plan included potential limitations or phase-outs for high-income earners to prevent excessive tax benefits.

Elimination or Modification of Certain Deductions

A key feature of the Trump Tax Plan involved the elimination or modification of certain itemized deductions.

- Deductions Affected: State and local tax (SALT) deductions were a prime target for elimination or significant limitations. Other itemized deductions might also face changes or restrictions.

- Rationale: The rationale behind these changes often centered on simplifying the tax code and promoting tax fairness. The elimination of certain deductions, proponents argued, would create a more equitable system.

- Impact on Taxpayers: Taxpayers who heavily rely on these deductions, particularly those in high-tax states, could face a significant increase in their tax liability.

Corporate Tax Rate Reductions in the Trump Tax Plan

The Trump Tax Plan also proposed significant reductions in the corporate tax rate. These changes were intended to boost business investment and economic growth.

Lower Corporate Tax Rate

The plan aimed for a substantial reduction in the corporate tax rate.

- Proposed Rate: The rate was initially 35%, then lowered to 21% under the Tax Cuts and Jobs Act of 2017. Further proposals aimed for even lower rates, depending on the specific version of the plan.

- Impact on Business Investment: Lower corporate tax rates were expected to encourage businesses to invest more in capital equipment, research and development, and job creation.

- Impact on Corporate Profits and Shareholder Returns: Lower taxes could lead to increased corporate profits and potentially higher shareholder returns.

International Tax Provisions

The Trump Tax Plan also contained provisions related to international taxation.

- Repatriation of Foreign Earnings: The plan addressed the repatriation of foreign earnings, encouraging companies to bring profits earned overseas back to the US.

- Foreign Tax Credit: Modifications to the foreign tax credit were also considered, aiming to simplify the system and reduce complexities for multinational corporations.

- Implications for Multinational Corporations: The changes to international taxation had significant implications for multinational corporations operating both domestically and internationally.

Economic Impacts of the Trump Tax Plan

The potential economic impacts of the Trump Tax Plan were a subject of extensive debate and analysis.

GDP Growth Projections

Proponents of the plan projected significant GDP growth as a result of the tax cuts.

- Sources: These projections often came from government reports, think tanks, and economic analyses conducted by supporters of the plan.

- Counterarguments: Critics argued that the projected GDP growth was overstated and that the actual impact would be much less significant, or even negative.

Potential Inflationary Pressures

The tax cuts raised concerns about potential inflationary pressures.

- Mechanisms: Increased consumer spending, fueled by lower taxes, could lead to increased demand and higher prices. Similarly, increased business investment could also contribute to inflation.

- Impact on Consumer Prices and Interest Rates: Higher inflation could lead to higher consumer prices and potentially higher interest rates.

National Debt Implications

The Trump Tax Plan had significant implications for the national debt.

- Changes in Government Revenue: Lower tax rates could lead to reduced government revenue.

- Proposed Spending Cuts or Offsets: Some versions of the plan included proposed spending cuts or other measures to offset the revenue loss, but these were often insufficient to fully compensate.

- Long-Term Fiscal Sustainability: The long-term fiscal sustainability of the plan was a major concern, with critics expressing worry about a further increase in the national debt.

Conclusion

The House Republican’s proposed "Trump Tax Plan" presented significant changes to the US tax code, impacting individuals and businesses. This plan, characterized by lower tax rates and alterations to deductions and credits, aimed to stimulate economic growth. However, it also carried risks related to inflation and the national debt. Understanding the complexities of the Trump Tax Plan requires careful consideration of both its potential benefits and its potential drawbacks. To stay informed on the latest developments regarding this Trump Tax Plan and its potential impact on your finances, continue to follow reputable news sources and seek professional tax advice. Understanding the potential effects of the Trump Tax Plan on your specific financial situation is crucial for effective financial planning.

Featured Posts

-

Padres Dominate Giants In Two Game Series

May 15, 2025

Padres Dominate Giants In Two Game Series

May 15, 2025 -

Ai In Therapy Balancing Benefits With Surveillance Risks

May 15, 2025

Ai In Therapy Balancing Benefits With Surveillance Risks

May 15, 2025 -

Analysis House Gop Releases Trump Tax Plan Details

May 15, 2025

Analysis House Gop Releases Trump Tax Plan Details

May 15, 2025 -

Dont Miss Out Cheap Boston Celtics Finals Gear

May 15, 2025

Dont Miss Out Cheap Boston Celtics Finals Gear

May 15, 2025 -

Tampa Bay Rays Complete Padres Sweep Thanks To Chandler Simpson

May 15, 2025

Tampa Bay Rays Complete Padres Sweep Thanks To Chandler Simpson

May 15, 2025