Trump's Economic Plans And Bitcoin: A $100,000 Price Prediction For BTC

Table of Contents

Trump's Economic Policies and Their Impact on Inflation

Trump's economic philosophy, characterized by fiscal expansion and a protectionist trade stance, could have profound implications for Bitcoin. Understanding these potential impacts is crucial to assessing the plausibility of a $100,000 Bitcoin price prediction.

H3: Fiscal Expansion and its effect on the US Dollar:

A Trump administration is likely to prioritize increased government spending and potentially further rounds of quantitative easing (QE). This could lead to:

- Increased Inflation: Significant government spending without corresponding increases in productivity often results in higher inflation.

- Weakening US Dollar: The potential increase in the national debt and inflationary pressures could weaken the value of the US dollar.

- Bitcoin as an Inflation Hedge: In times of high inflation, investors often seek assets that retain their value or even appreciate. Bitcoin, with its limited supply, could be seen as an effective hedge against inflation, driving up demand and price.

H3: Trade Protectionism and its Global Economic Consequences:

Trump's focus on trade protectionism, including the imposition of tariffs and trade wars, could create global economic uncertainty. This instability can, in turn, affect Bitcoin's value:

- Global Market Volatility: Trade disputes disrupt supply chains, impact international trade, and trigger volatility in global markets.

- Safe Haven Asset Demand: During times of economic and political turmoil, investors often flock to assets perceived as safe havens, such as gold and, increasingly, Bitcoin.

- Bitcoin Volatility: While serving as a safe haven, Bitcoin itself is inherently volatile. The uncertainty caused by Trump's trade policies could exacerbate this volatility, leading to both sharp rises and falls in price.

The Uncertainty Factor and Bitcoin's Safe-Haven Status

Uncertainty is a powerful driver of market behavior. Trump's economic policies, often unpredictable and controversial, inject a significant level of uncertainty into the global economic landscape. This uncertainty plays directly into Bitcoin's potential price surge.

H3: Political Uncertainty and its effect on investor behavior:

- Risk-Off Sentiment: When political and economic uncertainty reigns, investors often adopt a “risk-off” strategy, moving away from riskier assets and towards perceived safe havens.

- Flight to Safety: Bitcoin, despite its own inherent volatility, can be seen as a safe haven compared to traditional assets during periods of high uncertainty. This “flight to safety” can boost demand and price.

- Bitcoin Investment: Increased demand during periods of political instability can significantly impact Bitcoin's price.

H3: Regulatory Landscape and its influence on Bitcoin Adoption:

Trump's potential regulatory approach toward cryptocurrencies would heavily influence Bitcoin's trajectory. A less interventionist approach could facilitate wider adoption:

- Cryptocurrency Regulation: A more lenient regulatory environment could stimulate greater institutional investment and mainstream adoption of Bitcoin.

- Bitcoin Adoption: Increased institutional and retail adoption is a major factor driving price appreciation. A favorable regulatory climate under a Trump administration could accelerate this.

- SEC and CFTC Influence: The stance of regulatory bodies like the SEC and CFTC on cryptocurrencies significantly impacts investor confidence and market participation.

The $100,000 Bitcoin Price Prediction: Realistic or Overly Optimistic?

The $100,000 Bitcoin price prediction is ambitious, but several factors could contribute to its realization, while also facing considerable obstacles.

H3: Analyzing factors contributing to the prediction:

- Increased Institutional Adoption: Growing interest from institutional investors, like hedge funds and asset managers, steadily increases Bitcoin's legitimacy and demand.

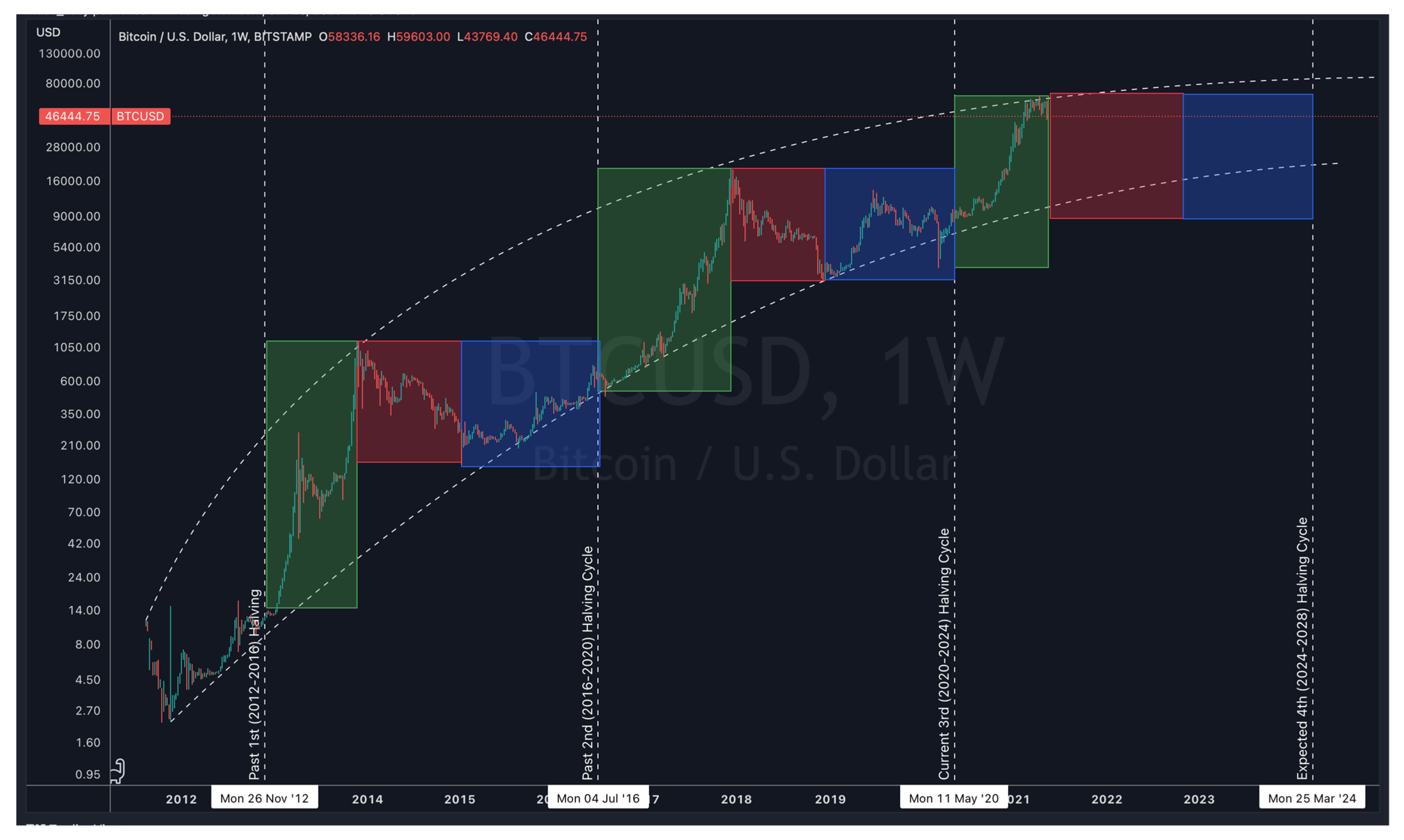

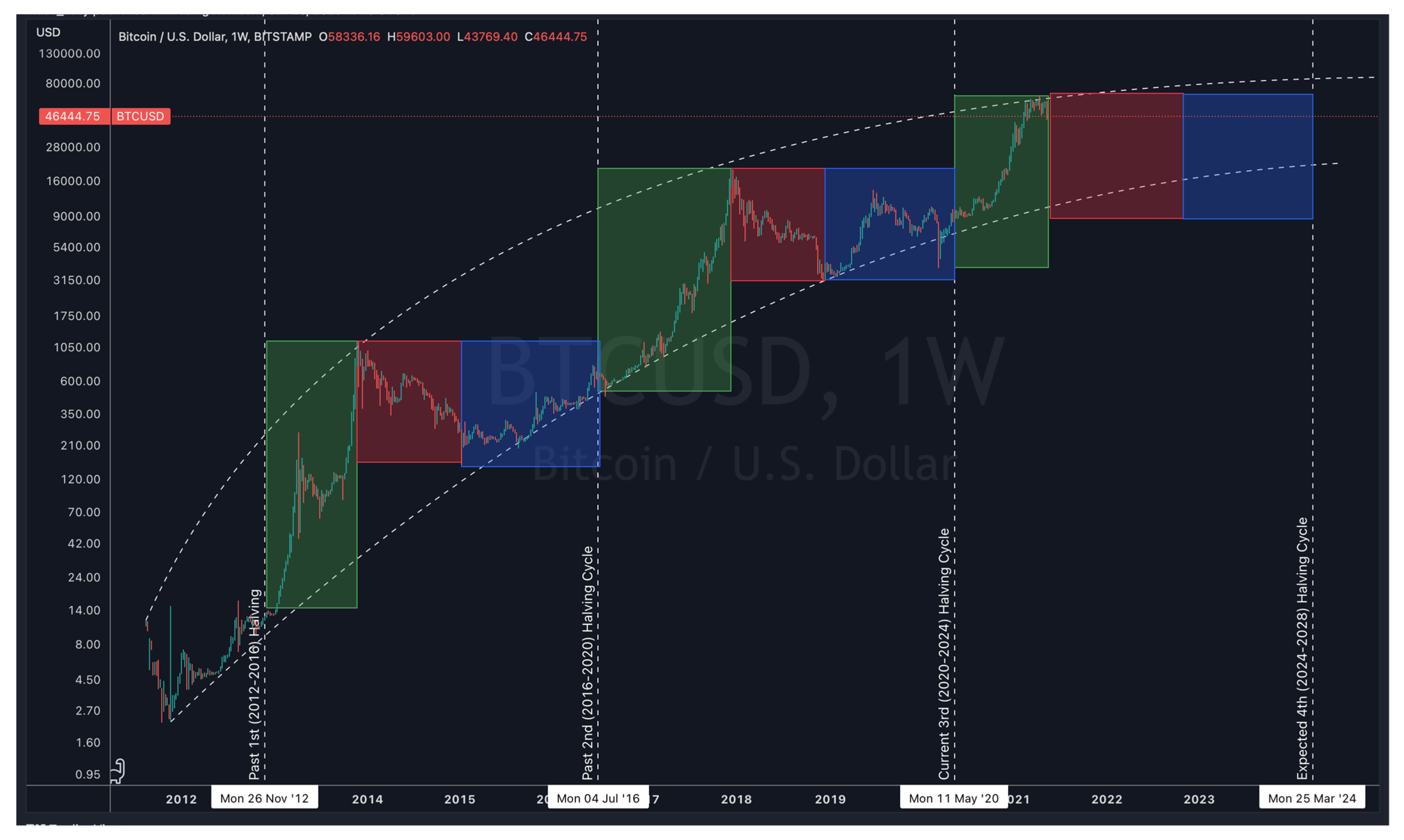

- Growing Scarcity of Bitcoin: Bitcoin's fixed supply of 21 million coins creates inherent scarcity. As demand increases, scarcity drives up the price.

- Macroeconomic Shifts: Significant macroeconomic events, such as runaway inflation or a weakening US dollar (as discussed above), could boost Bitcoin’s appeal as a hedge and drive its price upwards.

H3: Potential roadblocks and challenges:

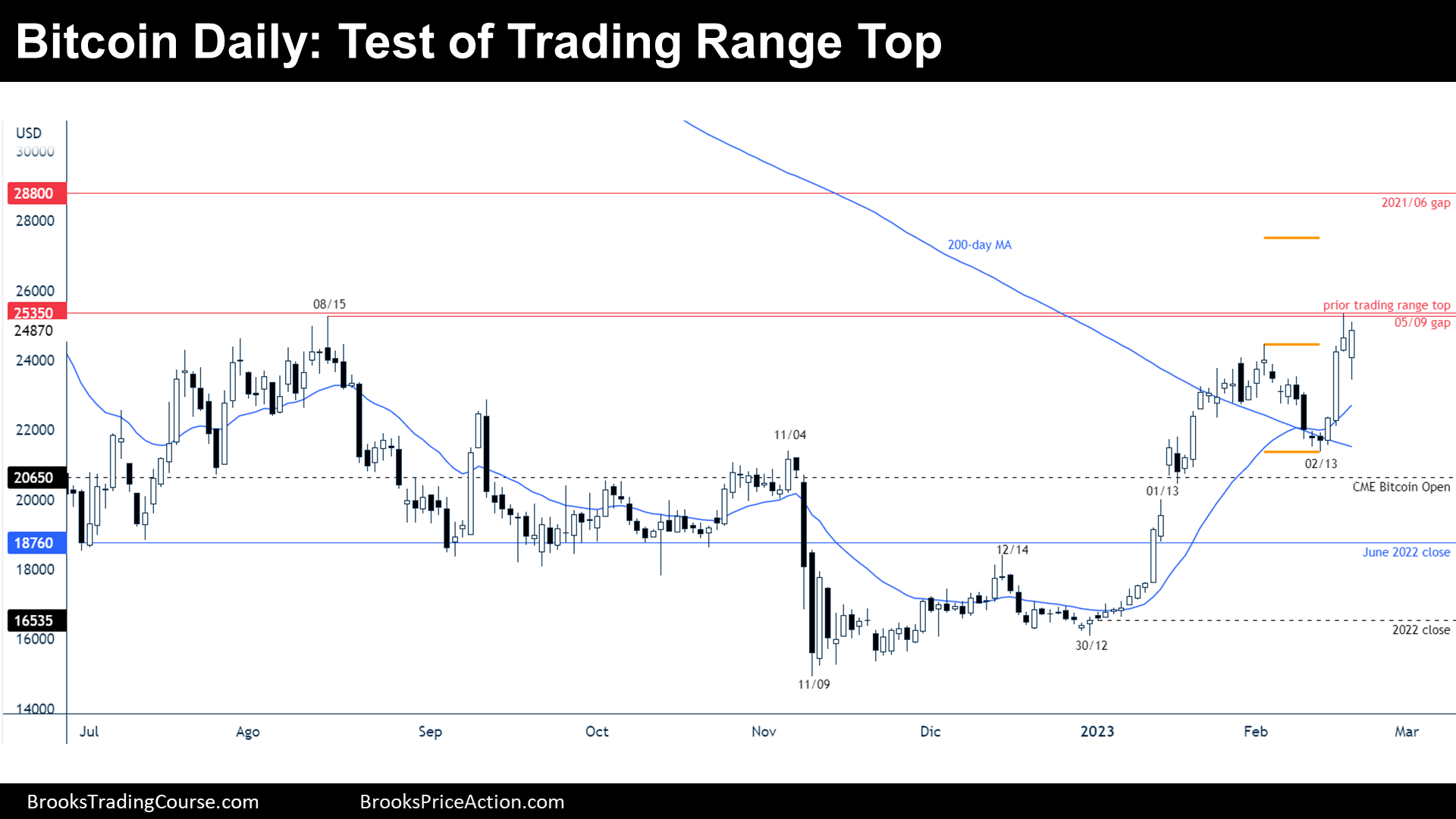

- Market Correction: Bitcoin's history includes periodic, significant price corrections. A major correction could set back the $100,000 goal considerably.

- Crypto Market Competition: The emergence of competing cryptocurrencies presents a challenge to Bitcoin's dominance and price.

- Regulatory Risks: Increased regulation, even if less interventionist than some feared, could stifle growth and price appreciation. Increased scrutiny could dampen investor enthusiasm.

Conclusion: Navigating the Uncertainties of Trump's Economic Plans and Bitcoin's Future

The potential impact of Trump's economic plans on Bitcoin's price is a complex issue with significant uncertainties. While his policies could create conditions leading to increased inflation, a weakening dollar, and greater demand for Bitcoin as a safe haven, several risks remain. The $100,000 Bitcoin price prediction, while bold, is not entirely impossible, contingent on a confluence of favorable events and a less disruptive regulatory environment. Are you ready to navigate the potential for a $100,000 Bitcoin under Trump's economic plans? Further research into macroeconomic trends, regulatory developments, and Bitcoin's inherent volatility is crucial for informed investment decisions in this dynamic space.

Featured Posts

-

Bitcoin Chart Analysis Entering A Rally Zone May 6 2024

May 08, 2025

Bitcoin Chart Analysis Entering A Rally Zone May 6 2024

May 08, 2025 -

Warfare 5 Films That Perfectly Blend Action And Emotion

May 08, 2025

Warfare 5 Films That Perfectly Blend Action And Emotion

May 08, 2025 -

Hdyth Jysws En Antqalh Lflamnghw Rd Alshmrany Fydyw

May 08, 2025

Hdyth Jysws En Antqalh Lflamnghw Rd Alshmrany Fydyw

May 08, 2025 -

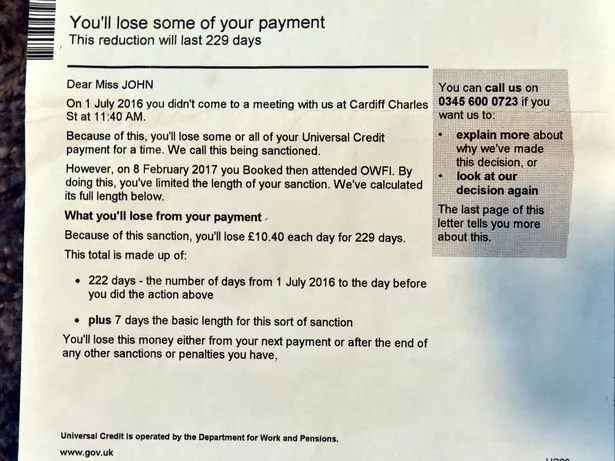

5 Billion Universal Credit Cuts Dwp Refund Details For April And May

May 08, 2025

5 Billion Universal Credit Cuts Dwp Refund Details For April And May

May 08, 2025 -

Am I Due A Universal Credit Refund From The Dwp

May 08, 2025

Am I Due A Universal Credit Refund From The Dwp

May 08, 2025