Trump's Tariff Delay Sends Euronext Amsterdam Stocks Soaring 8%

Table of Contents

Understanding the Tariff Delay and its Impact

The Trump administration's announcement to delay the implementation of specific tariffs sent ripples across global markets. While the specifics of which tariffs were delayed and the exact timeframe weren't immediately clear, the delay itself provided significant relief to businesses and investors bracing for potential economic fallout. The original tariff threat had cast a long shadow over several key sectors, particularly those heavily reliant on trade with the US. The delay offered a crucial reprieve, allowing businesses to avoid immediate disruptions to supply chains and potentially devastating financial consequences.

- Types of goods impacted: The delayed tariffs initially targeted a range of goods, including [Insert specific examples of goods – e.g., steel, aluminum, agricultural products]. Further details on the specific HS codes affected are still emerging.

- Countries involved: The delay primarily affected trade relations between the US and [Insert specific countries – e.g., the European Union, China].

- Timeline: The original tariff announcement was made on [Date], and the subsequent delay was announced on [Date], with the new implementation date currently set for [Date – or "to be determined"].

Euronext Amsterdam's Response to the News

The news of the tariff delay triggered an immediate and dramatic reaction within the Euronext Amsterdam stock market. The 8% surge was a clear indication of the relief felt by investors. Specific sectors within the Euronext Amsterdam exchange, heavily exposed to US-EU trade, saw particularly significant gains. This sensitivity highlights the substantial influence of US trade policies on the Dutch economy and its stock market.

- Top-performing stocks: [Insert examples of top-performing stocks and their percentage gains – e.g., Company X (+12%), Company Y (+9%)].

- Percentage increases: The overall market increase of 8% was broad-based, although certain sectors (like [mention specific sector]) experienced even higher gains.

- Trading volume changes: Trading volume on Euronext Amsterdam experienced a significant spike following the announcement, indicating heightened investor activity. [Include specific data on volume changes if available].

Wider Global Market Implications of the Tariff Delay

The ripple effects of the Trump tariff delay extended far beyond Euronext Amsterdam. Global markets, initially wary of escalating trade tensions, breathed a collective sigh of relief. This temporary reprieve improved investor sentiment and injected a degree of optimism into an otherwise uncertain market. However, this is far from a long-term solution, and the underlying tensions remain.

- Reactions in other major stock markets: Other major stock markets, including [mention specific markets, e.g., the NYSE and FTSE 100], also experienced positive reactions, though perhaps less pronounced than in Amsterdam.

- Potential shifts in global trade patterns: While the delay offers temporary stability, the underlying uncertainties concerning US trade policies continue to cloud the future of global trade patterns.

- Role of investor sentiment: Investor sentiment played a crucial role in the market's response. The initial relief was palpable, but continued uncertainty regarding the future of US trade policy could quickly reverse this positive trend.

Analyzing the Future of US-EU Trade Relations

The tariff delay shouldn't be seen in isolation. It forms part of the ongoing, complex tapestry of US-EU trade relations, characterized by significant tensions and periodic periods of negotiation and conflict. This delay, while offering a respite, doesn't resolve the fundamental disagreements.

- Upcoming trade negotiations: Several upcoming trade negotiations and discussions between the US and EU are scheduled, the outcome of which will likely have a significant impact on the Euronext Amsterdam exchange and similar markets.

- Potential for further tariff actions: The threat of further tariff actions remains very real, and the potential for future imposition of such measures is a major source of ongoing uncertainty.

- Potential for a resolution to trade disputes: While the current situation offers a temporary reprieve, a long-term resolution to trade disputes between the US and the EU requires further negotiations and a significant shift in trade policy.

Conclusion: Navigating the Uncertainties of Trump's Tariff Policies on Euronext Amsterdam

The Trump administration's decision to delay certain tariffs had a significant and immediate impact on Euronext Amsterdam stocks, resulting in an impressive 8% surge. While this offers temporary relief, the broader global implications and the future of US-EU trade relations remain uncertain. The delay highlighted the considerable influence of US trade policies on global markets, particularly on exchanges like Euronext Amsterdam with significant exposure to US-EU trade. It’s crucial to stay informed about future developments concerning Trump's tariff policies and their effect on Euronext Amsterdam, carefully analyzing these developments and their implications for your investment strategies regarding Euronext Amsterdam stocks and related markets. Understanding the nuances of Trump tariffs and their potential impact is vital for effective investment decision-making in this dynamic global environment.

Featured Posts

-

Nightcliff Shop Robbery Leads To Teens Arrest In Darwin

May 24, 2025

Nightcliff Shop Robbery Leads To Teens Arrest In Darwin

May 24, 2025 -

Kyle Walker Peters To Leeds Latest Transfer News

May 24, 2025

Kyle Walker Peters To Leeds Latest Transfer News

May 24, 2025 -

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Heavy Losses

May 24, 2025

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Heavy Losses

May 24, 2025 -

Apple Stock Performance Key Levels And Q2 Earnings Preview

May 24, 2025

Apple Stock Performance Key Levels And Q2 Earnings Preview

May 24, 2025 -

Porsche Classic Art Week Indonesia 2025 Seni Dan Otomotif Berpadu

May 24, 2025

Porsche Classic Art Week Indonesia 2025 Seni Dan Otomotif Berpadu

May 24, 2025

Latest Posts

-

Understanding Italys Updated Citizenship Law Great Grandparent Lineage

May 24, 2025

Understanding Italys Updated Citizenship Law Great Grandparent Lineage

May 24, 2025 -

Investigating The Impact Of Trump Administration Budget Cuts On Museums

May 24, 2025

Investigating The Impact Of Trump Administration Budget Cuts On Museums

May 24, 2025 -

Portable Chargers And Southwest Airlines Understanding The New Carry On Regulations

May 24, 2025

Portable Chargers And Southwest Airlines Understanding The New Carry On Regulations

May 24, 2025 -

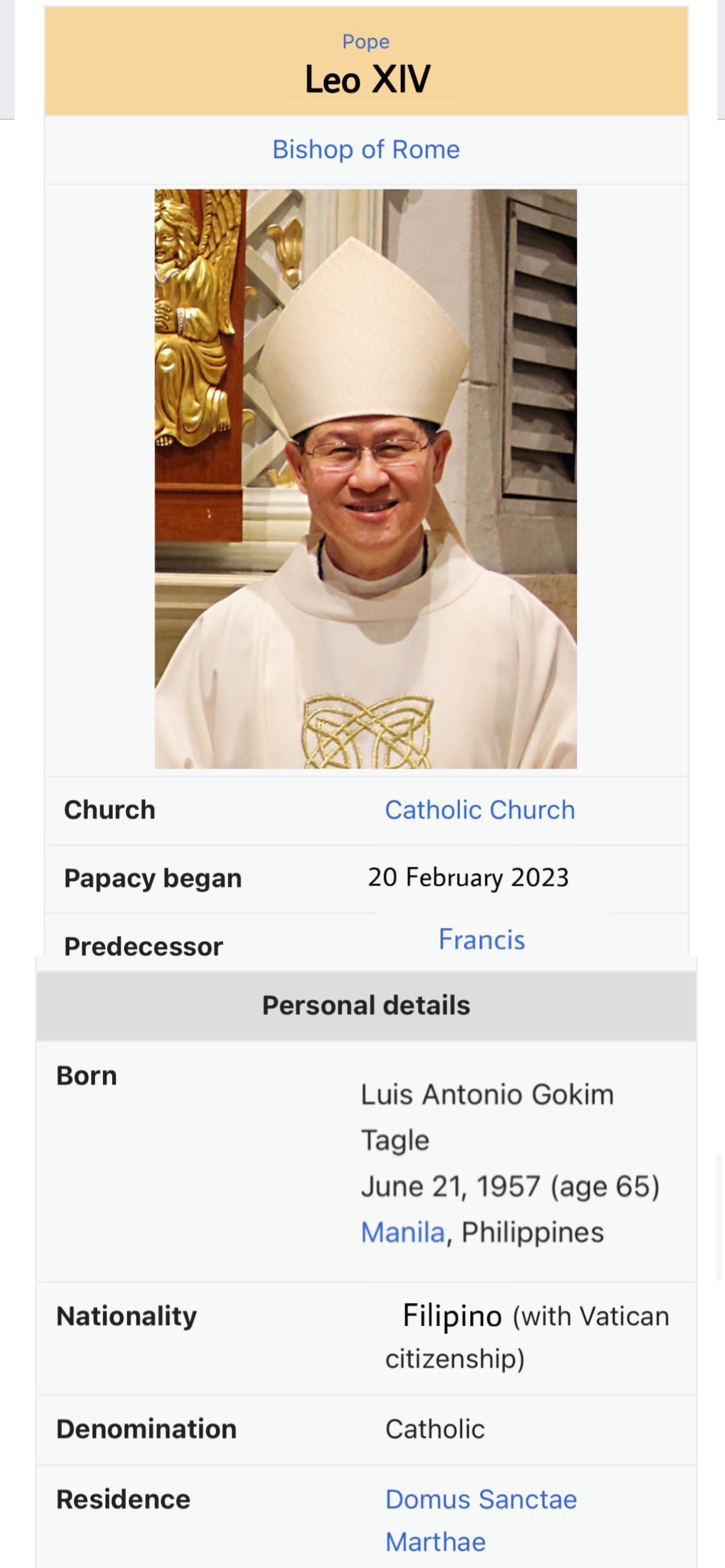

Viral Tik Tok A Young Womans Unexpected Encounter With Pope Leo

May 24, 2025

Viral Tik Tok A Young Womans Unexpected Encounter With Pope Leo

May 24, 2025 -

Negotiating Beyond The Best And Final Job Offer

May 24, 2025

Negotiating Beyond The Best And Final Job Offer

May 24, 2025