Trump's Tariffs Hit Amsterdam Stock Exchange: A 2% Decline

Table of Contents

The Immediate Impact of Trump's Tariffs on the AEX

The announcement of specific tariffs triggered an almost immediate 2% drop in the AEX. This direct correlation highlights the vulnerability of European markets to shifts in US trade policy. Data from the Euronext Amsterdam, the operator of the AEX, showed a sharp sell-off across various sectors immediately following the news.

-

Specific sectors most affected: The technology and automotive sectors were particularly hard hit, reflecting the targeted nature of some of Trump's tariffs. Companies heavily reliant on US markets or using US-sourced components suffered the most.

-

Examples of individual companies experiencing significant losses: [Insert examples of specific companies listed on the AEX and their percentage losses. Cite reputable financial news sources]. This demonstrated the immediate and tangible impact of Trump's tariffs on individual businesses.

-

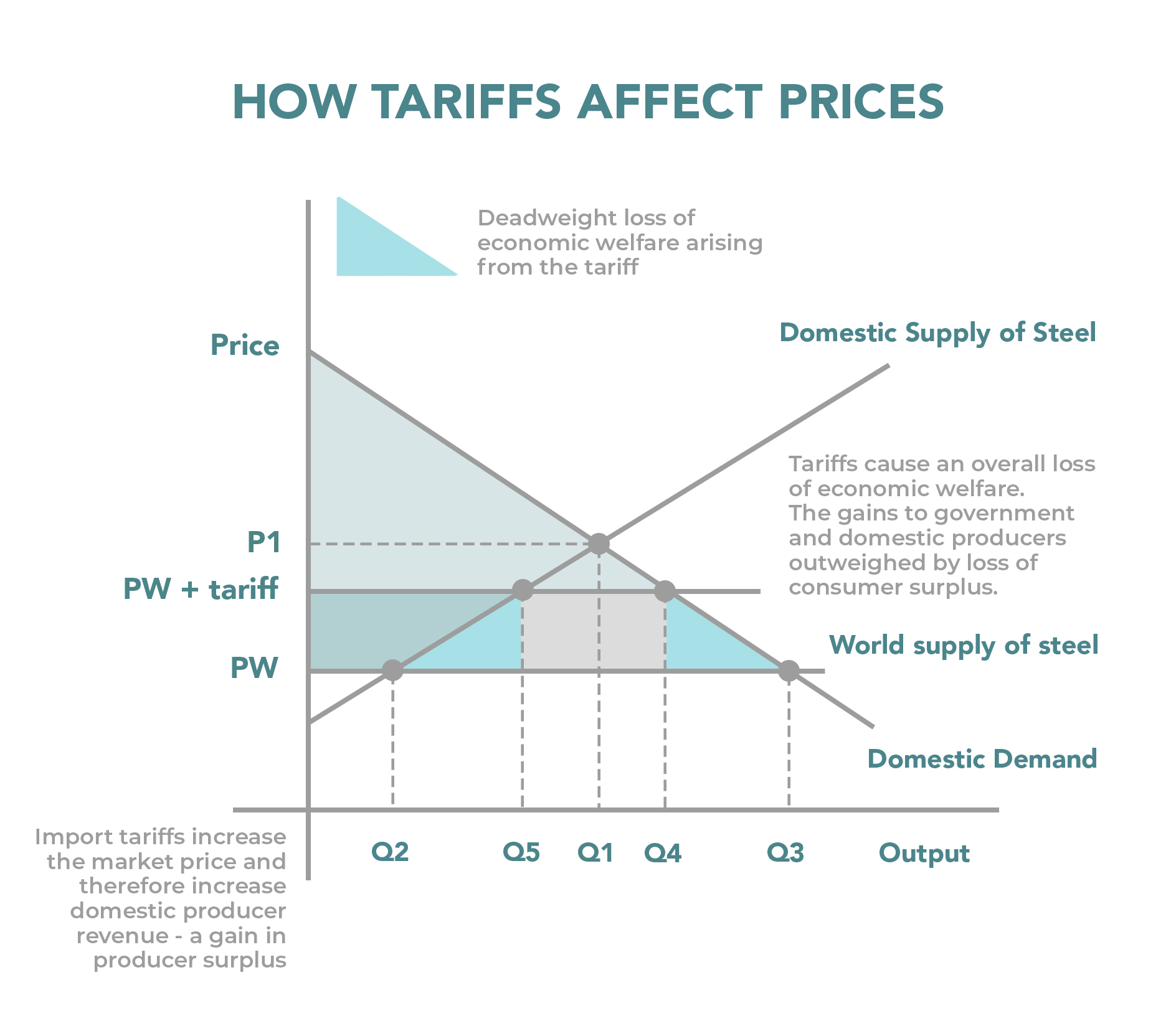

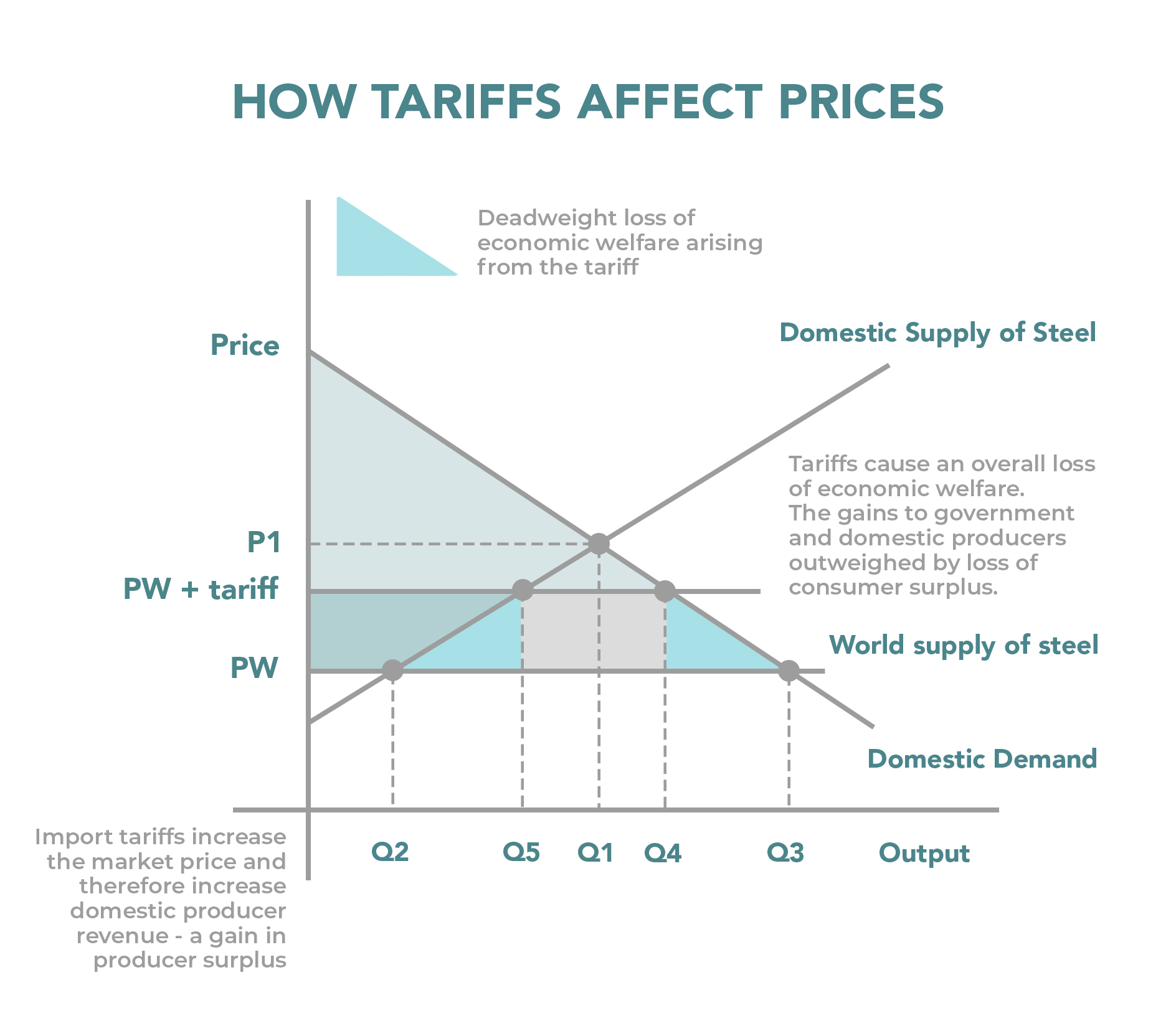

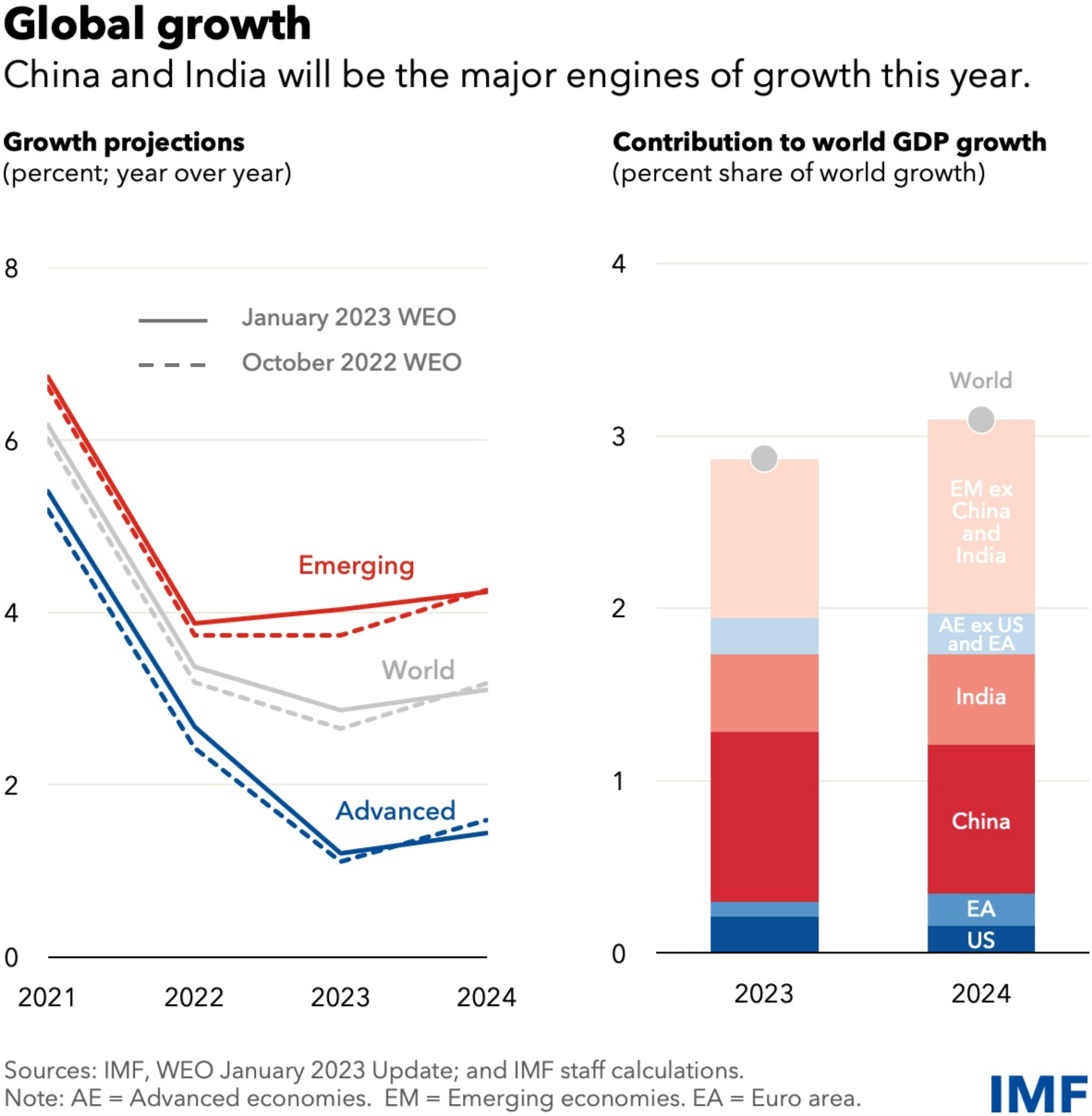

Graphs or charts visualizing the immediate market reaction: [Insert a graph or chart visually showing the AEX's decline following the tariff announcement. Clearly label the axes and cite the source of the data]. This visual representation will further emphasize the immediate impact.

Underlying Economic Factors Exacerbating the Decline

While Trump's tariffs were the immediate trigger, broader economic anxieties amplified the AEX's decline. The escalating global trade war created an atmosphere of uncertainty, affecting investor confidence worldwide.

-

Weakening Euro against the dollar: The weakening Euro against the dollar further exacerbated the situation, making imports more expensive and reducing the competitiveness of European exports, including those from the Netherlands.

-

Concerns about global economic slowdown: The trade war fueled concerns about a potential global economic slowdown, leading investors to seek safer havens and reduce risk exposure. This risk aversion contributed to the sell-off in the AEX.

-

Uncertainty about future trade relations: The unpredictability of Trump's trade policies created significant uncertainty, making it difficult for businesses to plan for the future and discouraging investment. This uncertainty is a key factor in market volatility.

The Role of Investor Sentiment and Market Volatility

Investor sentiment played a crucial role in the market downturn. The announcement of Trump's tariffs fueled negative sentiment, leading to a wave of selling.

-

Analysis of investor reactions and trading patterns: [Include details on trading volume and investor behavior following the announcement, citing relevant financial news articles or analysis]. This analysis will show the psychological impact on market behavior.

-

Mention of any related news stories that fueled negative sentiment: [Mention any related news stories that contributed to the negative sentiment, such as analysts’ predictions or statements from business leaders]. This provides context to the investor reaction.

-

Explanation of the psychological impact of uncertainty on market behavior: The unpredictability of Trump's trade policies significantly impacted investor confidence, leading to a risk-off sentiment and a sharp decline in the AEX. Fear and uncertainty are powerful drivers in market behavior.

Long-Term Implications of Trump's Tariffs on the Netherlands

The long-term implications of Trump's tariffs on the Dutch economy are significant and potentially far-reaching. The immediate market reaction is just the beginning.

-

Potential for job losses in affected sectors: Sectors heavily reliant on exports to the US or using US-sourced materials may experience job losses due to reduced competitiveness and decreased demand.

-

Impact on Dutch exports and international trade: Dutch exports could face reduced competitiveness in international markets due to increased costs and reduced demand. This could have a negative impact on the overall Dutch economy.

-

Government responses and potential mitigation strategies: The Dutch government may need to implement strategies to mitigate the negative effects of Trump's tariffs, such as providing support to affected industries or exploring alternative trade partnerships.

Analyzing the Ripple Effect: Trump's Tariffs and the Amsterdam Stock Exchange

In conclusion, the 2% drop in the AEX following the announcement of Trump's tariffs was a significant event showcasing the global interconnectedness of markets. The decline was a direct result of the tariffs themselves, amplified by broader economic concerns, negative investor sentiment, and market volatility. The long-term implications for the Netherlands and the global economy remain uncertain, requiring careful monitoring and strategic responses. To stay informed about the ongoing impact of Trump's trade policies, including their effect on the AEX and global markets, continue to follow reputable financial news sources and economic analysis. Understanding the evolving impact of Trump's tariffs is crucial for informed investment decisions and economic planning.

Featured Posts

-

Market Analysis 8 Stock Increase On Euronext Amsterdam After Trumps Tariff Decision

May 24, 2025

Market Analysis 8 Stock Increase On Euronext Amsterdam After Trumps Tariff Decision

May 24, 2025 -

National Rallys Le Pen Demonstration A Disappointing Turnout

May 24, 2025

National Rallys Le Pen Demonstration A Disappointing Turnout

May 24, 2025 -

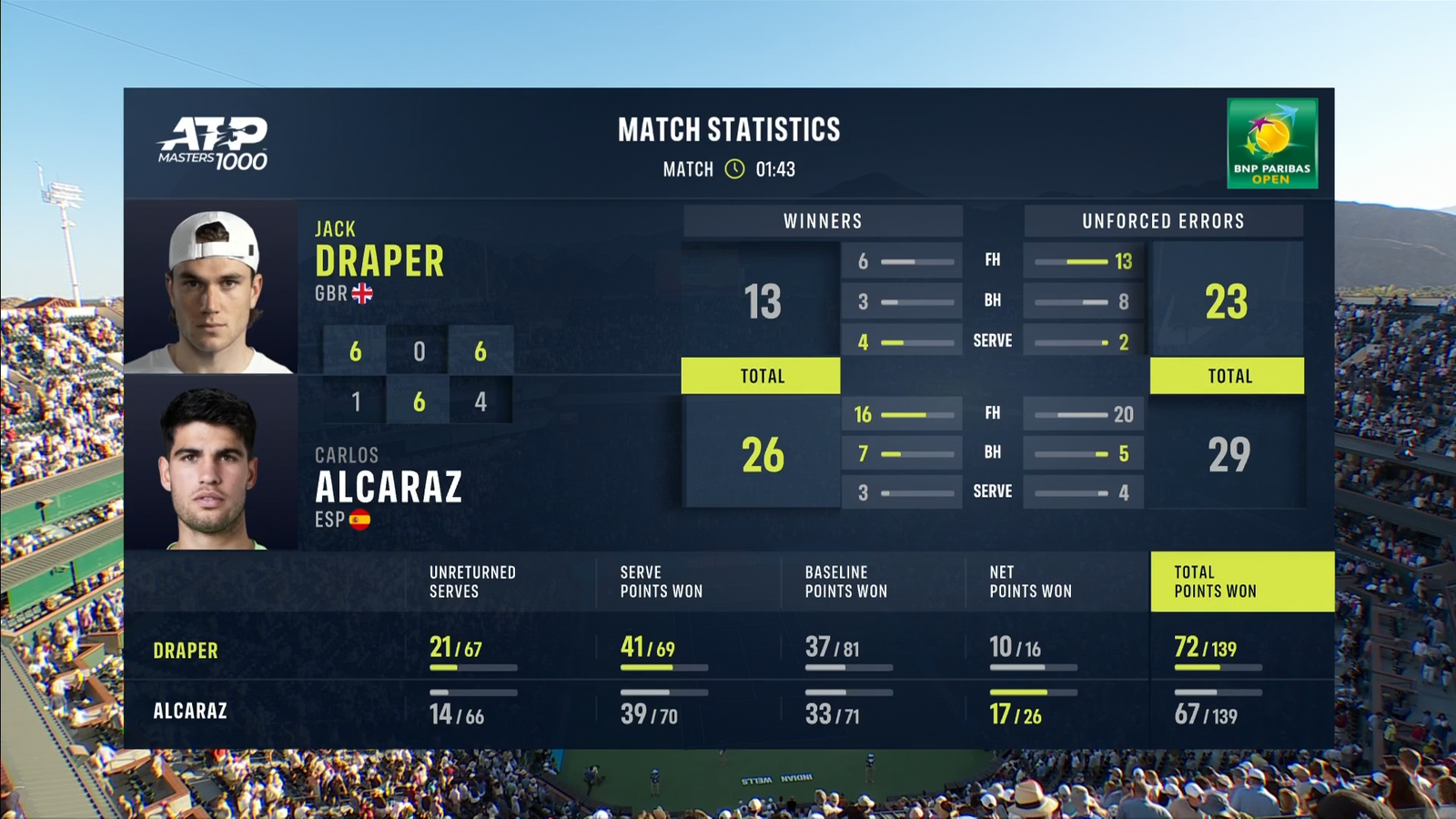

Atp Indian Wells Draper Wins First Masters 1000 Tournament

May 24, 2025

Atp Indian Wells Draper Wins First Masters 1000 Tournament

May 24, 2025 -

The Long Term Effects Of Trumps Cuts On Museum Programs And Community Engagement

May 24, 2025

The Long Term Effects Of Trumps Cuts On Museum Programs And Community Engagement

May 24, 2025 -

Sse Cuts Spending 3 Billion Reduction Amidst Economic Slowdown

May 24, 2025

Sse Cuts Spending 3 Billion Reduction Amidst Economic Slowdown

May 24, 2025

Latest Posts

-

Trumps Cuts To Museums A Look At The Lasting Consequences For Cultural Preservation

May 24, 2025

Trumps Cuts To Museums A Look At The Lasting Consequences For Cultural Preservation

May 24, 2025 -

Italian Citizenship New Rules For Claiming Rights Through Ancestry

May 24, 2025

Italian Citizenship New Rules For Claiming Rights Through Ancestry

May 24, 2025 -

Game Industry Cuts Accessibility Takes The Hit

May 24, 2025

Game Industry Cuts Accessibility Takes The Hit

May 24, 2025 -

Southwest Airlines New Restrictions On Portable Chargers In Carry On Luggage

May 24, 2025

Southwest Airlines New Restrictions On Portable Chargers In Carry On Luggage

May 24, 2025 -

Visualizing Risk A Statistical Analysis Of Airplane Safety Incidents

May 24, 2025

Visualizing Risk A Statistical Analysis Of Airplane Safety Incidents

May 24, 2025