Trump's Tariffs Trigger 2% Drop In Amsterdam Stock Exchange

Table of Contents

Direct Impact of Tariffs on Dutch Businesses

The direct impact of Trump's tariffs on Dutch businesses is multifaceted and significant. Several key Dutch export sectors are heavily reliant on US trade, making them particularly vulnerable to increased tariff barriers. This includes, but isn't limited to, agricultural products like flowers and dairy, and specific manufacturing industries.

-

Agriculture: Dutch agricultural exports to the US face higher tariffs, directly impacting farmers' profits and potentially leading to reduced production. The competitive disadvantage created by these tariffs is substantial, potentially leading to job losses and reduced revenue for the sector.

-

Manufacturing: Specific manufacturing sectors in the Netherlands, particularly those exporting high-value products to the US, experience reduced competitiveness due to increased tariff costs. This forces them to either absorb the costs, impacting profitability, or raise prices, potentially leading to lower demand.

-

Retaliatory Tariffs: The EU's response to US tariffs could include retaliatory measures, further impacting Dutch businesses with exports to the US. This escalation of trade tensions creates uncertainty and hampers future trade plans. The potential for retaliatory tariffs from the EU targeting US businesses should also be considered a contributing factor to the overall market volatility.

Quantifying the potential losses requires a detailed sector-by-sector analysis, but initial estimates suggest millions of euros in lost revenue for affected Dutch companies. The impact on employment, investment, and future business plans is substantial and continues to unfold.

Wider Economic Consequences for the Netherlands

The consequences of Trump's tariffs extend beyond specific sectors, impacting the Dutch economy as a whole. The reduction in exports and the increased uncertainty about future trade relations have already dampened investor confidence.

-

Dutch GDP: Reduced exports and decreased investment, both direct and indirect consequences of the tariffs, are likely to negatively affect Dutch GDP growth in the short and potentially the long term. Economic forecasts need to be reevaluated in light of these significant trade barriers.

-

Investor Confidence and FDI: Uncertainty surrounding trade policy discourages foreign direct investment (FDI) in the Netherlands. Investors are hesitant to commit capital in an environment characterized by trade war-related volatility.

-

Knock-on Effects: The negative impact on export-oriented sectors has a ripple effect throughout the Dutch economy. Related industries and service providers experience a decrease in demand, creating a domino effect across numerous sectors.

-

European Union Impact: The Netherlands, as a member of the European Union, is affected by the EU's overall response to the US tariffs. The broader economic implications for the EU and its relationship with the US add further complexity to the situation. The consequences of these tariffs are clearly visible beyond national borders.

The overall impact on the Netherlands' economic stability and future growth prospects is a serious concern, necessitating proactive measures to mitigate the effects of trade policy uncertainty.

Market Reactions and Volatility

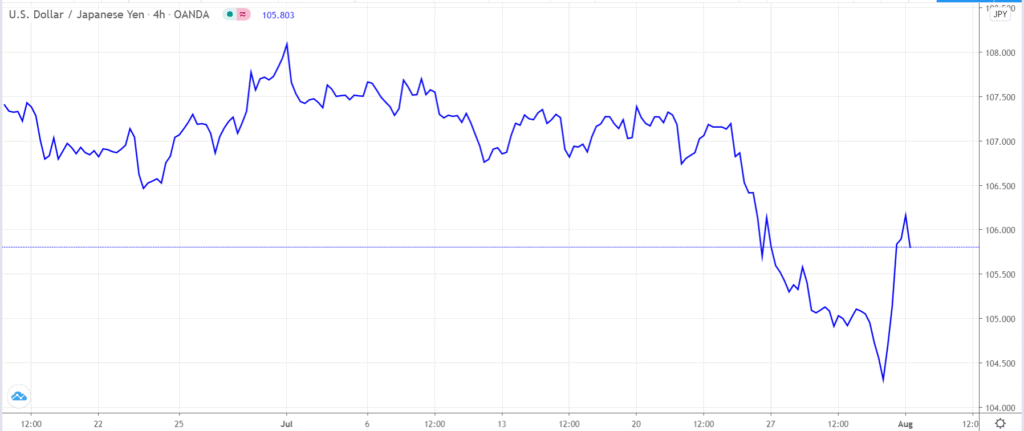

The announcement of the tariffs triggered an immediate and noticeable reaction in the Amsterdam Stock Exchange. The 2% drop in the AEX index reflects a clear loss of investor confidence and heightened market volatility.

-

AEX Index Performance: The AEX index experienced a sharp decline following the announcement, reflecting the immediate market sensitivity to the news. Further analysis is needed to fully assess the sustained impact on the AEX.

-

Trading Volume and Volatility: Trading volume increased significantly in the aftermath of the tariff announcement, indicating heightened market activity and uncertainty. The increased volatility reflects the uncertainty surrounding future trade relations.

-

Investor Sentiment: Investor sentiment turned negative, reflecting concerns about reduced profitability for Dutch companies and the broader economic outlook. This negatively impacted stock prices across various sectors.

-

Correlation with Global Indices: The AEX index's reaction was largely in line with other major global stock indices, highlighting the global nature of the market response to Trump’s tariffs and demonstrating the interconnectedness of global finance. Further analysis is necessary to determine the specific correlations.

Charts and graphs illustrating the AEX index performance, trading volume, and volatility in the period following the tariff announcement would provide a more comprehensive visual representation of the market reactions.

Potential Long-Term Implications

The long-term implications of Trump's tariffs on the Dutch economy are potentially far-reaching. Prolonged trade protectionism presents challenges to sustainable economic growth and necessitates a strategic response.

-

Sustainable Economic Growth: The persistent uncertainty surrounding trade policy poses a risk to sustainable economic growth in the Netherlands. The long-term effects of reduced exports and decreased investment need careful consideration.

-

Export Market Diversification: The Netherlands needs to proactively diversify its export markets to reduce its reliance on the US. This involves exploring new trade partnerships and strengthening existing ones outside of the US market.

-

Economic Diversification: A focus on economic diversification within the Netherlands, moving beyond industries heavily reliant on US trade, is crucial for bolstering resilience to future trade shocks.

-

Geopolitical Risks: Escalating trade tensions increase geopolitical risks and introduce further uncertainty into the global economic landscape. This necessitates a proactive approach to managing risks and navigating the complex geopolitical environment.

Strategies to mitigate the long-term consequences include fostering innovation, investing in new technologies, and strengthening international trade partnerships beyond the US. Economic diversification is a key factor in navigating the uncertainty introduced by these tariffs.

Conclusion

Trump's tariffs have had a significant and immediate impact on the Amsterdam Stock Exchange, resulting in a noticeable 2% drop in the AEX index. This decline reflects the direct impact on Dutch businesses heavily reliant on US trade, wider economic consequences for the Netherlands, and heightened market volatility. The potential long-term implications include risks to sustainable economic growth and necessitate a proactive response focused on export diversification and economic resilience. Stay updated on the latest developments surrounding Trump's tariffs and their effect on the AEX, and learn more about the impact of trade wars on the Amsterdam Stock Exchange to understand the evolving economic landscape and prepare for potential future challenges.

Featured Posts

-

Porsche Macan Buying Guide Tips And Advice For Smart Buyers

May 24, 2025

Porsche Macan Buying Guide Tips And Advice For Smart Buyers

May 24, 2025 -

Skolko Let Personazham V Filme O Bednom Gusare Zamolvite Slovo Analiz Vozrasta Geroev

May 24, 2025

Skolko Let Personazham V Filme O Bednom Gusare Zamolvite Slovo Analiz Vozrasta Geroev

May 24, 2025 -

Dow Jones Index Cautious Climb Continues After Strong Pmi Data

May 24, 2025

Dow Jones Index Cautious Climb Continues After Strong Pmi Data

May 24, 2025 -

Snl Afterparty Lady Gaga And Michael Polanskys Hand In Hand Appearance

May 24, 2025

Snl Afterparty Lady Gaga And Michael Polanskys Hand In Hand Appearance

May 24, 2025 -

Kyle And Teddis Heated Confrontation With Their Dog Walker

May 24, 2025

Kyle And Teddis Heated Confrontation With Their Dog Walker

May 24, 2025

Latest Posts

-

Woody Allen Sexual Abuse Claims Re Examined Following Sean Penns Public Backing

May 24, 2025

Woody Allen Sexual Abuse Claims Re Examined Following Sean Penns Public Backing

May 24, 2025 -

The Sean Penn Dylan Farrow Woody Allen Controversy A Deeper Look

May 24, 2025

The Sean Penn Dylan Farrow Woody Allen Controversy A Deeper Look

May 24, 2025 -

Sean Penn Questions Dylan Farrows Accusations Against Woody Allen

May 24, 2025

Sean Penn Questions Dylan Farrows Accusations Against Woody Allen

May 24, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025 -

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025