Trump's Tax Bill Faces Unexpected Republican Headwinds

Table of Contents

Internal Divisions Within the Republican Party

The Republican party, far from being a unified front, is fractured into various factions with conflicting ideologies and priorities. This internal strife is playing out dramatically in the debate over Trump's tax bill. The struggle highlights the tension between fiscal conservatives concerned about the national debt, libertarian Republicans focused on minimizing government intervention, and more establishment Republicans prioritizing corporate interests. This intra-party conflict is creating significant headwinds for the proposed legislation.

-

Tea Party Republicans: This faction is known for its strong emphasis on fiscal conservatism and limited government spending. Many Tea Party members express concern that the proposed tax cuts, particularly for corporations, will exacerbate the national debt without delivering sufficient benefits to ordinary Americans. They are demanding stricter spending controls and a more fiscally responsible approach to tax reform.

-

Establishment Republicans: This group, while generally supportive of tax cuts, is divided on the specifics of the bill. Some worry about the potential political fallout from unpopular provisions, while others are pushing for amendments to ensure the bill benefits their corporate donors and constituents.

-

Specific Opposition: Senators such as [insert names of Republican senators who have publicly opposed parts of the bill] have openly voiced their concerns, highlighting the deep divisions within the party and making passage uncertain. Their public statements represent a significant challenge to the President's agenda and demonstrate the fracturing of Republican unity. Proposed amendments attempting to bridge the divide are constantly being debated and negotiated.

Concerns Regarding the National Debt and Fiscal Responsibility

A major source of Republican opposition stems from concerns about the bill's potential impact on the national debt and long-term economic stability. Critics argue that the significant tax cuts, coupled with increased spending, will lead to a dramatic surge in the national debt, placing a heavy burden on future generations.

-

Projected Debt Increases: Independent analyses project [insert data on projected debt increase from reputable sources] increase in the national debt over the next decade if the bill is passed without significant modifications. This figure has fueled concerns among fiscally conservative Republicans.

-

Expert Opinions: Prominent economists, such as [insert names and affiliations of economists who have voiced concerns], have warned about the potential negative consequences of the bill's fiscal impact, further strengthening the arguments of dissenting Republicans.

-

Alternative Proposals: Some Republicans are proposing alternative approaches to tax reform that emphasize fiscal responsibility and prioritize targeted tax cuts for specific demographics or sectors, instead of broad-based cuts that might inflate the national debt.

The Role of Lobbying and Special Interest Groups

The intense lobbying efforts surrounding the tax bill highlight the significant influence of special interest groups and corporate power in shaping political outcomes. Various sectors and industries are actively working to shape the bill to their advantage, leading to accusations of influence peddling and conflicts of interest.

-

Key Lobbying Groups: Groups representing [mention specific industries and their lobbying efforts], are heavily involved, seeking to secure favorable tax provisions for their members. This active lobbying effort underscores the complexity of the legislative process and its susceptibility to special interests.

-

Potential Quid Pro Quo: Concerns have been raised regarding potential quid pro quo arrangements between lawmakers and lobbying groups, further fueling the debate and creating skepticism regarding the bill's fairness and transparency.

-

Lack of Transparency: The lack of complete transparency in some lobbying activities surrounding the bill raises concerns about the extent of corporate influence on the legislative process.

Public Opinion and Political Fallout

Public opinion polls reveal a mixed reaction to the proposed tax bill, with [insert relevant poll data and sources]. This uncertainty about public support is contributing to the hesitancy of some Republicans, who fear negative electoral consequences in the upcoming midterm elections. The unexpected Republican headwinds are casting a shadow over the President's approval ratings, and the political fallout could be significant.

-

Impact on Midterm Elections: The controversy surrounding the bill could negatively affect Republican candidates in the midterm elections, potentially leading to losses in Congress. Voters may punish the party for perceived fiscal irresponsibility or for being too responsive to corporate interests.

-

Long-Term Political Consequences: The failure to pass the tax bill, or its passage in a significantly altered form, could have profound long-term political consequences for the Republican party, damaging its credibility and ability to govern effectively. It could also impact future legislative initiatives.

Conclusion

Trump's tax bill is facing unprecedented challenges, primarily due to unexpected and significant resistance from within the Republican party. Internal divisions, concerns about fiscal responsibility, the influence of lobbying, and uncertain public opinion are all contributing to the political gridlock. This situation underscores the complexities of governing and the challenges of navigating conflicting interests within a political party. Follow the unfolding drama surrounding Trump's tax bill and stay updated on the latest developments in this contentious tax reform debate to fully understand the political headwinds facing this crucial piece of legislation.

Featured Posts

-

Falcons Dcs Son Issues Apology For Shedeur Sanders Prank Call

Apr 29, 2025

Falcons Dcs Son Issues Apology For Shedeur Sanders Prank Call

Apr 29, 2025 -

The Russian Militarys Actions A Growing Threat To European Stability

Apr 29, 2025

The Russian Militarys Actions A Growing Threat To European Stability

Apr 29, 2025 -

Seven Tech Giants Lose 2 5 Trillion 2024 Market Value Decline

Apr 29, 2025

Seven Tech Giants Lose 2 5 Trillion 2024 Market Value Decline

Apr 29, 2025 -

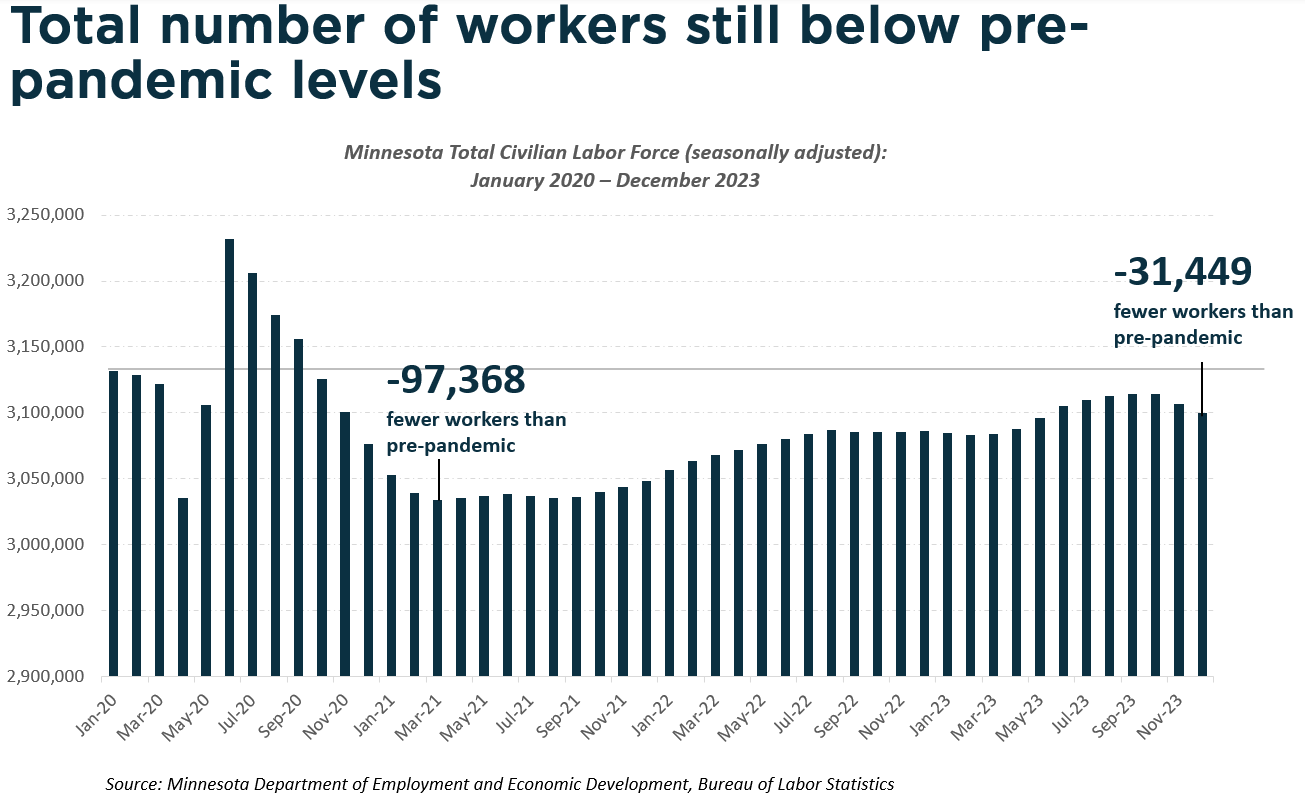

Study Reveals Positive Shift In Minnesota Immigrant Employment

Apr 29, 2025

Study Reveals Positive Shift In Minnesota Immigrant Employment

Apr 29, 2025 -

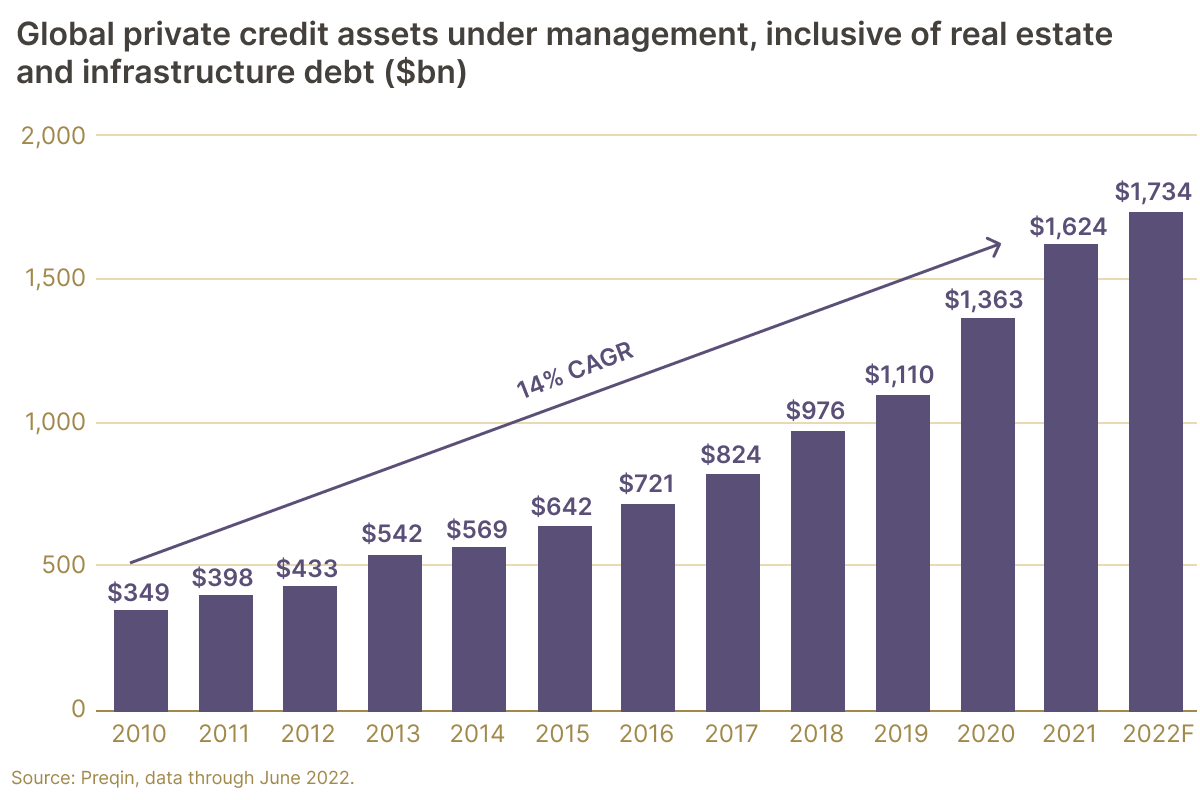

5 Key Dos And Don Ts Succeeding In The Private Credit Market

Apr 29, 2025

5 Key Dos And Don Ts Succeeding In The Private Credit Market

Apr 29, 2025

Latest Posts

-

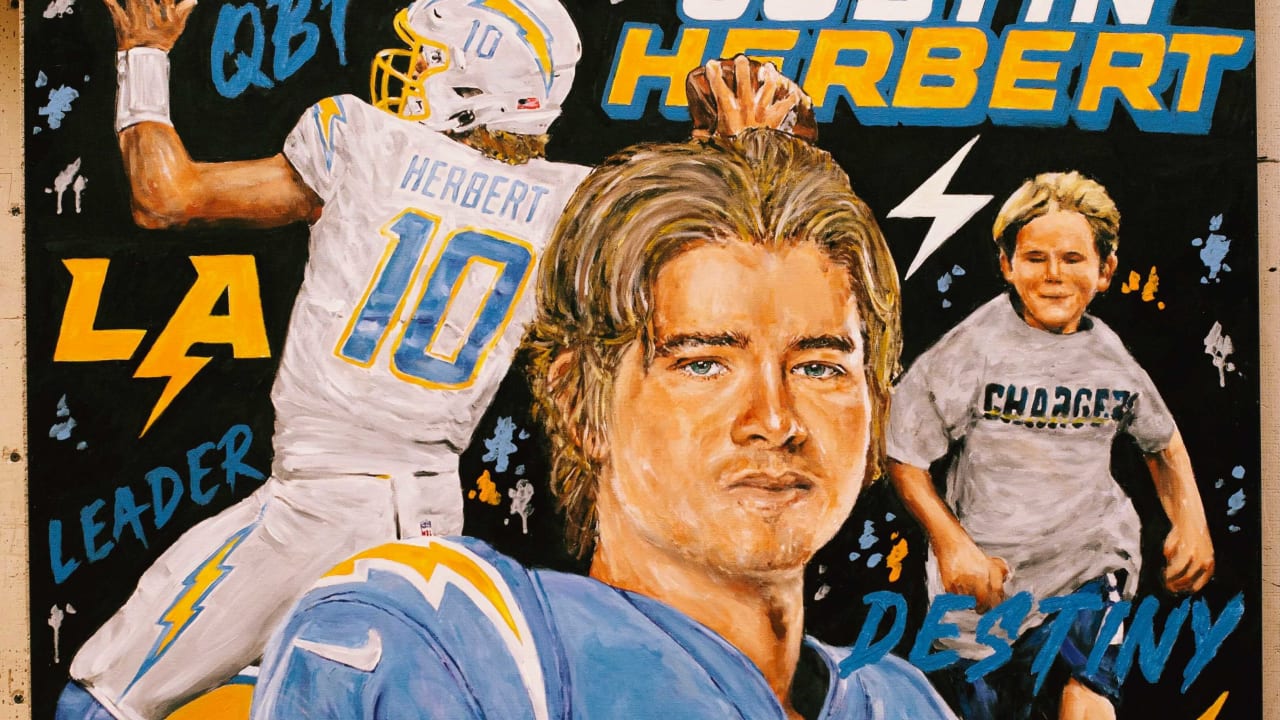

Justin Herbert Leads Chargers To Brazil For 2025 Season Opener

Apr 29, 2025

Justin Herbert Leads Chargers To Brazil For 2025 Season Opener

Apr 29, 2025 -

Novak Djokovics Upset Straight Sets Loss To Tabilo At Monte Carlo Masters 2025

Apr 29, 2025

Novak Djokovics Upset Straight Sets Loss To Tabilo At Monte Carlo Masters 2025

Apr 29, 2025 -

Ramiro Helmeyer A Blaugrana Heartbeat

Apr 29, 2025

Ramiro Helmeyer A Blaugrana Heartbeat

Apr 29, 2025 -

Chargers To Kick Off 2025 Season In Brazil Justin Herberts Role

Apr 29, 2025

Chargers To Kick Off 2025 Season In Brazil Justin Herberts Role

Apr 29, 2025 -

Alberto Ardila Olivares Una Apuesta Segura Para Marcar Goles

Apr 29, 2025

Alberto Ardila Olivares Una Apuesta Segura Para Marcar Goles

Apr 29, 2025