Trump's Trade Wars: A Threat To US Financial Supremacy?

Table of Contents

The United States has long held a position of unparalleled financial power, its influence shaping global markets and economies. However, the Trump administration's aggressive trade policies, often characterized as "Trump's Trade Wars," introduced a significant period of uncertainty and disruption. This article will examine the multifaceted impact of these policies, exploring whether they ultimately threatened or strengthened US financial supremacy. We will delve into the ramifications for global trade, US businesses, geopolitical alliances, and ultimately, the long-term health of the US economy's dominant position.

2. Main Points:

H2: The Tariffs and Their Ripple Effects on Global Trade

The hallmark of Trump's trade policy was the imposition of substantial tariffs on imported goods from various countries. These tariffs, intended to protect domestic industries and reduce the US trade deficit, targeted sectors such as steel, aluminum, and consumer goods from China.

- Specific examples: High tariffs were levied on steel and aluminum imports from Canada, Mexico, and the European Union. China faced tariffs on a wide range of products, escalating trade tensions significantly.

- Impact on prices and supply chains: Tariffs increased the cost of imported goods, leading to higher prices for consumers and businesses. Global supply chains were disrupted as companies scrambled to adjust to the new trade landscape. This impacted everything from manufacturing costs to the availability of goods.

- Retaliatory tariffs: Other countries responded by imposing their own tariffs on US goods, leading to a tit-for-tat escalation that further harmed global trade. This created a cycle of protectionism, hindering free trade and economic growth.

- Economic consequences: The consequences included job losses in export-oriented industries, increased inflation due to higher import prices, and reduced consumer choice due to limited availability of certain goods. Empirical studies demonstrate correlations between trade wars and economic slowdowns.

H2: Impact on US Businesses and the Stock Market

The uncertainty generated by Trump's trade wars significantly impacted US businesses and the stock market. The constant threat of new tariffs created an unpredictable environment, making it difficult for businesses to plan for the future.

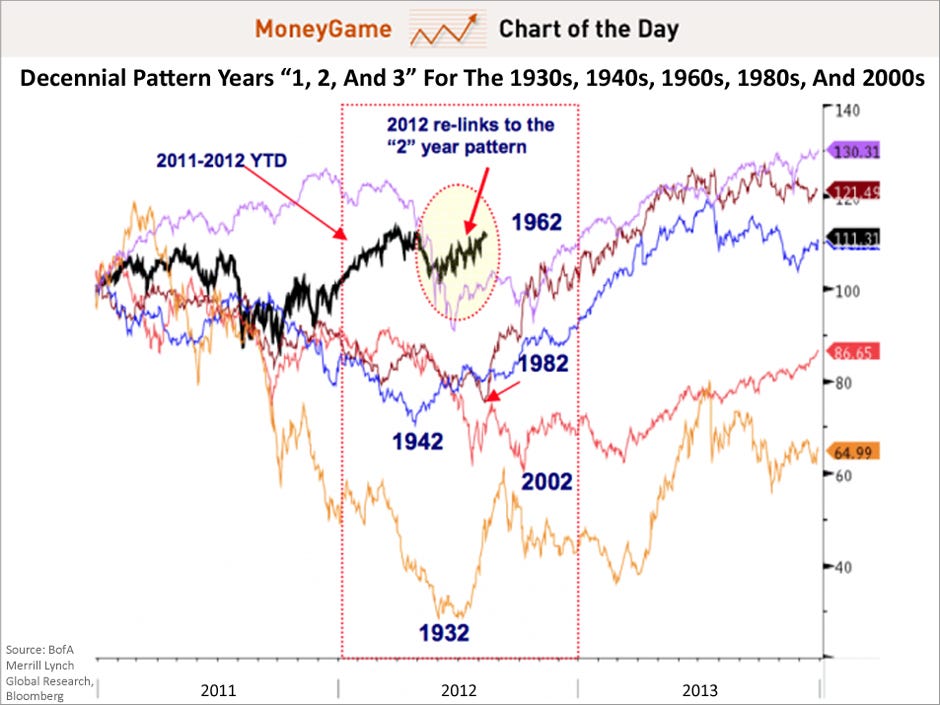

- Stock market volatility: Periods of heightened trade tensions coincided with significant stock market volatility, reflecting investor concerns about the economic outlook. Uncertainty around trade policy often triggers sharp market fluctuations.

- Impact on specific companies: Companies heavily reliant on imports or exports were particularly vulnerable. Some experienced significant profit losses, while others adapted by relocating production or diversifying their supply chains.

- Investor sentiment: Investor confidence plummeted during periods of intense trade disputes, leading to reduced investment and slower economic growth. Market sentiment is a crucial indicator of investor confidence and future prospects.

- Federal Reserve response: The Federal Reserve, tasked with maintaining economic stability, responded to these economic challenges by adjusting monetary policy, often lowering interest rates to stimulate growth. However, this was not always sufficient to offset the negative effects of the trade wars.

H2: Shifting Global Alliances and Geopolitical Implications

Trump's trade policies had profound geopolitical implications, altering relationships with key trading partners and impacting international organizations.

- Strengthening and weakening of alliances: While some alliances were strengthened through renegotiated trade deals, others were severely strained by protectionist measures. This led to a complex reshaping of global power dynamics.

- Impact on the WTO: The Trump administration's challenges to the World Trade Organization (WTO) raised concerns about the future of multilateral trade cooperation. The very foundation of the international trading system was challenged.

- Increased geopolitical tensions: Trade disputes often spilled over into broader geopolitical tensions, exacerbating existing conflicts and creating new ones. Trade is often intertwined with political and security agendas.

- Long-term consequences for US influence: The actions taken during this period significantly impacted the long-term influence of the US in shaping global trade rules and norms. This has implications for the global trading system, US influence, and the relative competitiveness of American corporations.

H2: Alternative Perspectives: Did Trump's Trade Policies Ultimately Benefit US Financial Supremacy?

While the negative consequences of Trump's trade wars are widely documented, some argue that certain aspects might have inadvertently benefited US financial dominance.

- Increased domestic manufacturing: Proponents suggest that tariffs led to increased domestic manufacturing and job creation in some sectors, albeit at a potentially higher cost to consumers. This was seen as a goal of trade protectionism.

- Improvements in the trade balance: While the overall effect on the trade balance is debatable, some sectors did experience short-term improvements in their trade deficit. However, this often came at the expense of other sectors and global economic stability.

- Renegotiated trade deals: The administration renegotiated the North American Free Trade Agreement (NAFTA), creating the USMCA. While the overall impacts are complex and still being debated, this represented an attempt to reshape trade relationships to supposedly benefit the US more directly.

- Impact on specific industries: Some specific industries, such as agriculture, were significantly impacted by retaliatory tariffs from other countries. The agricultural sector faced immense challenges due to trade disputes.

3. Conclusion: Evaluating the Long-Term Effects of Trump's Trade Wars on US Financial Power

Trump's trade wars created significant economic uncertainty, impacting global trade, US businesses, and geopolitical alliances. While some argue that certain policies benefited specific sectors or led to renegotiated trade deals, the overall impact on US financial supremacy remains complex and heavily debated. The short-term gains in some sectors might have been offset by long-term damage to global trust, diminished international cooperation, and increased economic instability. The long-term consequences for the US's position in the global economy are still unfolding and warrant continued observation and analysis.

Call to Action: Continue the conversation about the lasting effects of Trump's trade wars and their influence on US financial supremacy. Understanding these complex dynamics is crucial for navigating the future of global trade and ensuring a stable and prosperous international economic order.

Featured Posts

-

White House Cocaine Investigation Secret Service Concludes Inquiry

Apr 22, 2025

White House Cocaine Investigation Secret Service Concludes Inquiry

Apr 22, 2025 -

Dismissing Valuation Concerns Bof As Analysis Of The Stock Market

Apr 22, 2025

Dismissing Valuation Concerns Bof As Analysis Of The Stock Market

Apr 22, 2025 -

Increased Student Fear Following Fsu Security Gap Despite Prompt Police Response

Apr 22, 2025

Increased Student Fear Following Fsu Security Gap Despite Prompt Police Response

Apr 22, 2025 -

Open Ais Chat Gpt Faces Ftc Probe What It Means

Apr 22, 2025

Open Ais Chat Gpt Faces Ftc Probe What It Means

Apr 22, 2025 -

The Countrys Hottest New Business Locations A Geographic Analysis

Apr 22, 2025

The Countrys Hottest New Business Locations A Geographic Analysis

Apr 22, 2025

Latest Posts

-

Lowrys Support For Mc Ilroy At The Masters

May 12, 2025

Lowrys Support For Mc Ilroy At The Masters

May 12, 2025 -

Planning Your Meeting With Shane Lowry

May 12, 2025

Planning Your Meeting With Shane Lowry

May 12, 2025 -

Friendship And Success Shane Lowrys Pride In Rory Mc Ilroy

May 12, 2025

Friendship And Success Shane Lowrys Pride In Rory Mc Ilroy

May 12, 2025 -

Shane Lowrys Feelings Mc Ilroys Masters 2024

May 12, 2025

Shane Lowrys Feelings Mc Ilroys Masters 2024

May 12, 2025 -

Realizing The Dream Meeting Shane Lowry

May 12, 2025

Realizing The Dream Meeting Shane Lowry

May 12, 2025