U.S. Economy Contracts: 0.2% Decline Due To Spending Weakness And Tariffs

Table of Contents

Spending Weakness: A Key Driver of Economic Contraction

A major contributor to the recent U.S. economy contracts is the noticeable weakness in spending, impacting both consumers and businesses. This slowdown reflects a broader trend of decreased economic activity.

Consumer Spending Slowdown

Consumer confidence, a crucial indicator of economic health, has plummeted in recent months. This decrease in confidence directly translates to reduced consumer spending, a cornerstone of U.S. economic growth. Statistics reveal a decline in retail sales and durable goods orders, further supporting this trend. Factors such as persistent inflation, rising interest rates, and increased household debt have significantly impacted consumer behavior, leading to a more cautious approach to spending.

- Decline in discretionary spending: Consumers are cutting back on non-essential purchases, opting instead to prioritize necessities.

- Increased savings rate: A higher savings rate reflects a growing sense of economic insecurity among consumers.

- Impact of rising interest rates: Increased borrowing costs make large purchases like homes and cars less affordable.

Business Investment Decline

Uncertainty surrounding the economic outlook has also led to a significant reduction in business investment. Companies are hesitant to commit to expansion plans, new hires, and capital expenditures due to concerns about future profitability and demand. Trade wars, persistent inflation, and supply chain disruptions are among the major factors influencing these cautious business decisions.

- Reduced hiring and expansion plans: Businesses are delaying or canceling expansion projects and reducing hiring.

- Increased caution in investment decisions: Uncertainty makes businesses reluctant to invest in new equipment and technologies.

- Impact of supply chain disruptions: Ongoing supply chain issues contribute to higher costs and uncertainty.

The Impact of Tariffs on the U.S. Economy

The imposition of tariffs, particularly during recent trade wars, has played a significant role in the contraction of the U.S. economy. These trade barriers have far-reaching consequences, impacting both consumers and businesses.

Trade Wars and Their Economic Consequences

Tariffs directly contribute to higher prices for imported goods, increasing the cost of living for consumers and the cost of production for businesses. Specific industries heavily reliant on imports have been disproportionately affected. For instance, the steel and aluminum industries experienced significant price increases following the imposition of tariffs, leading to job losses and reduced competitiveness.

- Increased import costs: Tariffs increase the price of imported goods, making them less competitive.

- Reduced competitiveness of U.S. businesses: Higher input costs make U.S. businesses less competitive in the global market.

- Retaliatory tariffs from other countries: Tariffs often provoke retaliatory measures from other countries, further harming trade.

Supply Chain Disruptions and Inflationary Pressures

Tariffs also contribute to supply chain disruptions, exacerbating inflationary pressures. The imposition of tariffs can lead to shortages of certain goods, driving up prices and creating uncertainty for businesses. This further contributes to decreased consumer spending and reduced business investment, perpetuating a cycle of economic contraction.

- Increased production costs: Disruptions to supply chains increase the cost of production for businesses.

- Shortages of goods: Tariffs can lead to shortages of certain goods, driving up prices.

- Contribution to overall inflation: Supply chain disruptions and increased import costs contribute to higher inflation.

Other Contributing Factors to the Economic Contraction

Beyond spending weakness and tariffs, several other factors contributed to the recent U.S. economy contracts.

Geopolitical Uncertainty and Global Economic Slowdown

Global events and a slowing global economy have also impacted the U.S. economy. International trade and investment are sensitive to geopolitical instability, and any disruption in global markets can have ripple effects on the U.S.

- Impact of global conflicts: Geopolitical tensions can disrupt supply chains and reduce investor confidence.

- Slowdown in global economic growth: A slowdown in global growth reduces demand for U.S. exports.

- Uncertainty in the international markets: Uncertainty in global markets can lead to reduced investment and economic activity.

Monetary Policy and Interest Rate Hikes

The Federal Reserve's efforts to combat inflation through interest rate hikes have also contributed to the economic slowdown. While intended to control inflation, higher interest rates increase borrowing costs for businesses and consumers, impacting investment and spending.

- Impact on borrowing costs: Higher interest rates make it more expensive for businesses and consumers to borrow money.

- Effect on investment and spending: Increased borrowing costs can reduce investment and consumer spending.

- Attempt to control inflation: The Federal Reserve's actions are aimed at curbing inflation, but they also have a cooling effect on the economy.

Conclusion: Navigating the Contraction of the U.S. Economy

The 0.2% decline in the U.S. economy is a complex issue stemming from a confluence of factors. Spending weakness, driven by decreased consumer confidence and reduced business investment, plays a significant role. Furthermore, the impact of tariffs on import costs, supply chains, and inflation cannot be overlooked. Understanding these interwoven factors is crucial for accurate economic forecasting and effective policymaking. To stay informed about developments affecting the U.S. economy and to navigate the complexities of the current economic situation, follow reputable sources for updates on the U.S. economy contracts and seek out further analysis from leading economists and financial institutions. Staying informed is key to navigating this period of economic contraction.

Featured Posts

-

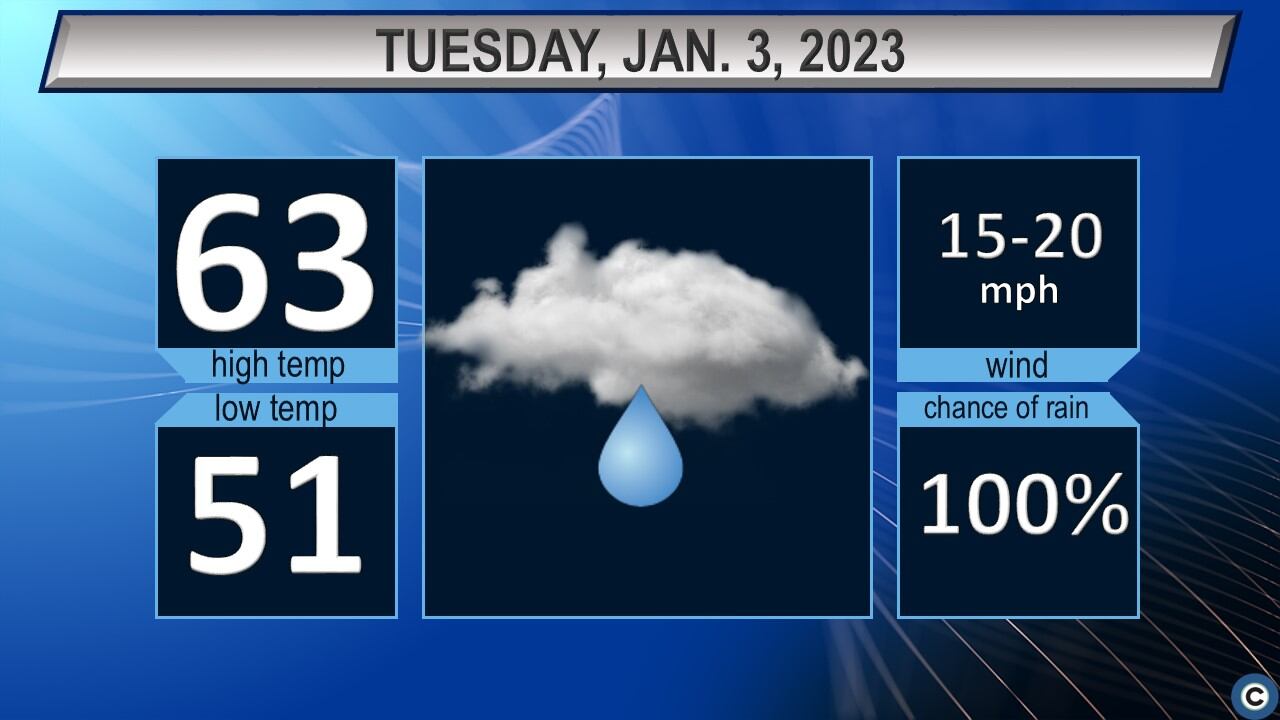

Northeast Ohio Tuesday Forecast Sunny And Dry

May 31, 2025

Northeast Ohio Tuesday Forecast Sunny And Dry

May 31, 2025 -

Building The Good Life Practical Steps For Lasting Well Being

May 31, 2025

Building The Good Life Practical Steps For Lasting Well Being

May 31, 2025 -

The Good Life Practical Strategies For A Fulfilling Life

May 31, 2025

The Good Life Practical Strategies For A Fulfilling Life

May 31, 2025 -

Receta Facil De Empanadas De Jamon Y Queso Sin Horno

May 31, 2025

Receta Facil De Empanadas De Jamon Y Queso Sin Horno

May 31, 2025 -

Pacific Trade Flows How The Tariff Truce Affects Us China Relations

May 31, 2025

Pacific Trade Flows How The Tariff Truce Affects Us China Relations

May 31, 2025