U.S. Federal Reserve Maintains Rates Due To Inflationary And Unemployment Pressures

Table of Contents

Persistent Inflationary Pressures

Inflation continues to be a major concern for the U.S. economy. The consumer price index (CPI), a key measure of inflation, remains elevated, significantly impacting consumers' purchasing power. Businesses, too, grapple with increased input costs, affecting profitability and investment decisions. This persistent inflation stems from several interconnected factors:

- Supply chain disruptions: Ongoing global supply chain bottlenecks continue to constrain the availability of goods, driving up prices.

- Increased energy prices: Soaring energy costs, fueled by geopolitical instability and increased demand, significantly contribute to overall inflation.

- Strong consumer demand: Robust consumer spending, while positive for economic growth, adds pressure on prices as demand outpaces supply.

- Wage growth: While higher wages benefit workers, they also contribute to inflationary pressures as businesses pass increased labor costs onto consumers.

The Fed's inflation target typically centers around 2%. The current inflation rate significantly deviates from this goal, necessitating careful consideration of monetary policy adjustments to curb rising prices without triggering a recession. Understanding the interplay between the inflation rate, the producer price index (PPI), and the intricacies of supply chain bottlenecks is crucial to analyzing the Fed's approach.

Unemployment Rates and the Labor Market

While inflation poses a significant challenge, the unemployment rate remains relatively low, reflecting a strong (though potentially cooling) labor market. However, this strength is not without its complexities. Key labor market indicators offer a mixed picture:

- Job growth numbers: Though job growth has slowed somewhat recently, it still indicates a generally healthy labor market.

- Unemployment claims: Initial jobless claims offer insights into the level of layoffs and overall employment stability.

- Labor participation rate: The labor force participation rate, indicating the percentage of the working-age population actively employed or seeking employment, provides context to the unemployment figures.

The relationship between interest rates and employment is inverse – higher interest rates tend to cool down the economy, potentially leading to job losses, while lower rates stimulate economic activity and job creation. The Fed must carefully consider this relationship when making interest rate decisions. Analyzing the unemployment rate, job growth, and labor market dynamics is crucial to understanding the Fed's decision-making process.

The Fed's Balancing Act: Interest Rate Decision and Rationale

In its recent announcement, the Federal Reserve decided to maintain interest rates at their current level. This decision reflects a delicate balancing act aimed at taming inflation without jeopardizing the gains made in the labor market and risking a recession. Raising interest rates too aggressively could stifle economic growth and lead to job losses, while keeping rates too low risks fueling further inflation.

The Fed's rationale centers on the trade-off between these two significant economic risks. They are carefully monitoring incoming economic data, including inflation indicators and labor market statistics, to inform future decisions. Their forward guidance suggests a data-dependent approach, implying that future interest rate adjustments will depend on the evolving economic landscape. The current strategy represents a calculated risk, aiming to achieve a “soft landing” – slowing economic growth enough to curb inflation without triggering a recession. Understanding the Federal Reserve's monetary policy and the potential impact of interest rate hikes or a potential recession risk is paramount to understanding their decision.

Alternative Economic Policy Considerations

It's important to note that monetary policy (controlled by the Fed) interacts with fiscal policy (government spending and taxation). Different members of the Federal Open Market Committee (FOMC) may hold differing views on the optimal approach, leading to internal debates about the most appropriate course of action. These internal discussions, though not always public, highlight the complexities inherent in managing a large and dynamic economy.

Conclusion: Analyzing the U.S. Federal Reserve's Continued Rate Hold

The Fed's decision to maintain interest rates reflects a considered response to the current complex economic environment. The central bank is attempting to navigate a challenging path, striving to balance the urgent need to curb inflation with the desire to preserve employment gains and avoid a recession. The situation remains fluid, and future adjustments to interest rates are likely, contingent on incoming economic data.

Stay updated on the latest developments from the U.S. Federal Reserve to understand the impact of these critical decisions on the U.S. economy and your financial well-being. Follow our coverage of future interest rate decisions and learn more about the intricate workings of monetary policy. For more in-depth information, visit the official Federal Reserve website: [Link to Federal Reserve Website].

Featured Posts

-

How Us Market Fluctuations Affect Elon Musks Billions

May 09, 2025

How Us Market Fluctuations Affect Elon Musks Billions

May 09, 2025 -

Harry Styles Devastated By Snl Impression His Honest Reaction

May 09, 2025

Harry Styles Devastated By Snl Impression His Honest Reaction

May 09, 2025 -

Daycare Debate Psychologist Sparks Controversy With Viral Podcast Claims

May 09, 2025

Daycare Debate Psychologist Sparks Controversy With Viral Podcast Claims

May 09, 2025 -

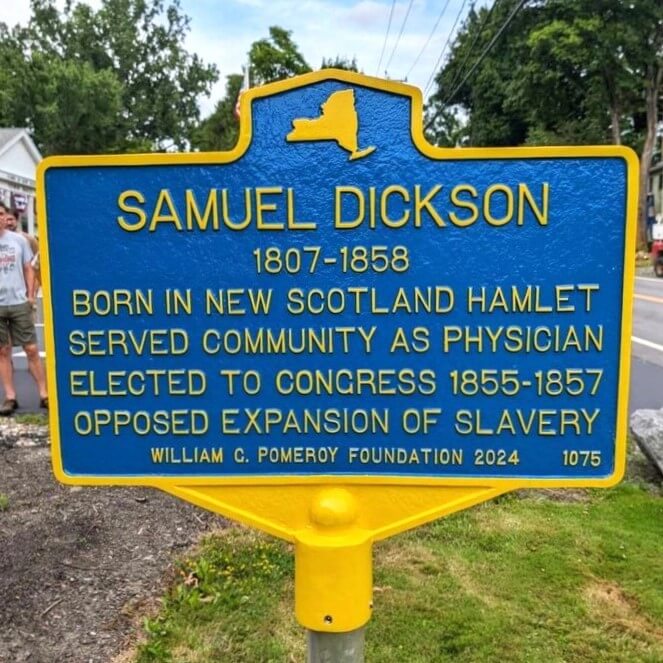

Samuel Dickson Industrialist And Pioneer Of The Canadian Lumber Industry

May 09, 2025

Samuel Dickson Industrialist And Pioneer Of The Canadian Lumber Industry

May 09, 2025 -

Edmonton Unlimiteds Global Tech Vision A New Strategy For Innovation

May 09, 2025

Edmonton Unlimiteds Global Tech Vision A New Strategy For Innovation

May 09, 2025